|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

- Bitcoin Futures (114)

- Charts & Indicators (307)

- Commodity Brokers (589)

- Commodity Trading (846)

- Corn Futures (64)

- Crude Oil (230)

- Currency Futures (102)

- Day Trading (658)

- Day Trading Webinar (61)

- E-Mini Futures (163)

- Economic Trading (166)

- Energy Futures (127)

- Financial Futures (178)

- Future Trading News (3,160)

- Future Trading Platform (327)

- Futures Broker (665)

- Futures Exchange (347)

- Futures Trading (1,266)

- futures trading education (446)

- Gold Futures (111)

- Grain Futures (101)

- Index Futures (271)

- Indices (233)

- Metal Futures (141)

- Nasdaq (79)

- Natural Gas (40)

- Options Trading (191)

- S&P 500 (145)

- Trading Guide (431)

- Trading Webinar (60)

- Trading Wheat Futures (45)

- Uncategorized (26)

- Weekly Newsletter (224)

Category: Day Trading

Here is a subject that a lot of people don’t understand at all. Day Trading can be risky. So, it is something that you should stay away from unless and until you are absolutely sure about what you are doing.

There are a number of items about Day Trading such as the minimum mantaince requirementand more that need to be taken into consideration. With the blogs and write-ups listed in this section, you can learn a great deal about day trading.

We at Cannon Trading can help you understand the different concepts of trading and present you with the latest information on the same. Our team of professional and smart people can help you in your day trading transactions and more. In order to understand day trading more clearly, we advise that you go through all the write-ups listed in this category archive on Day Trading.

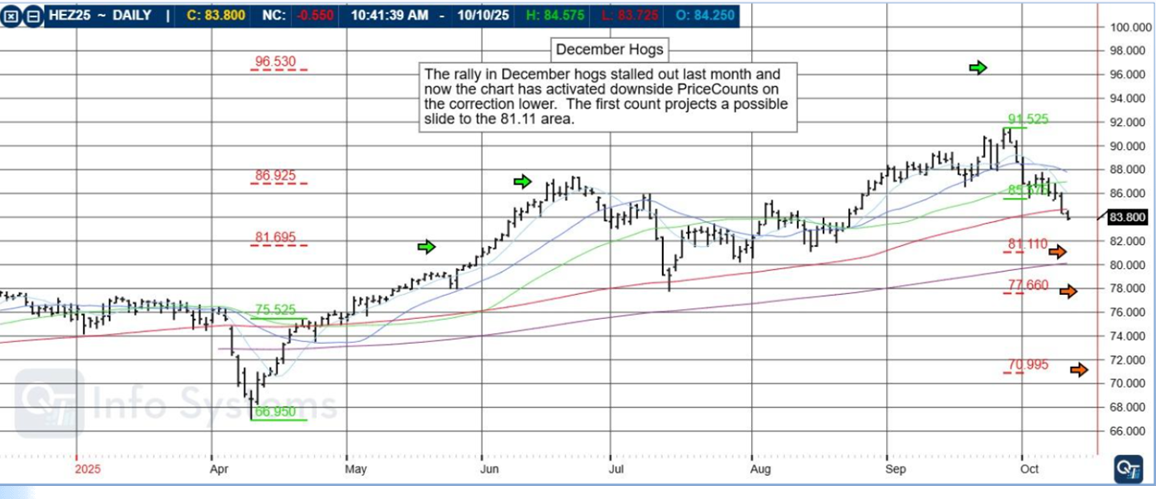

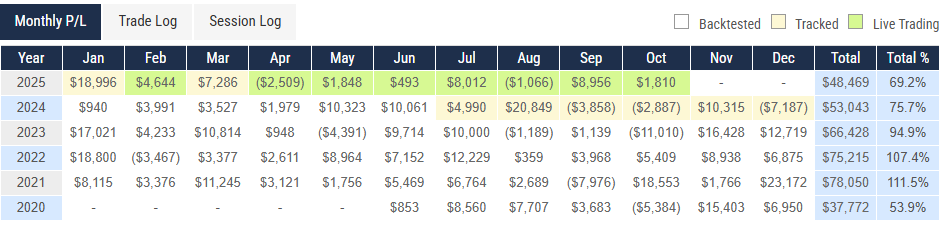

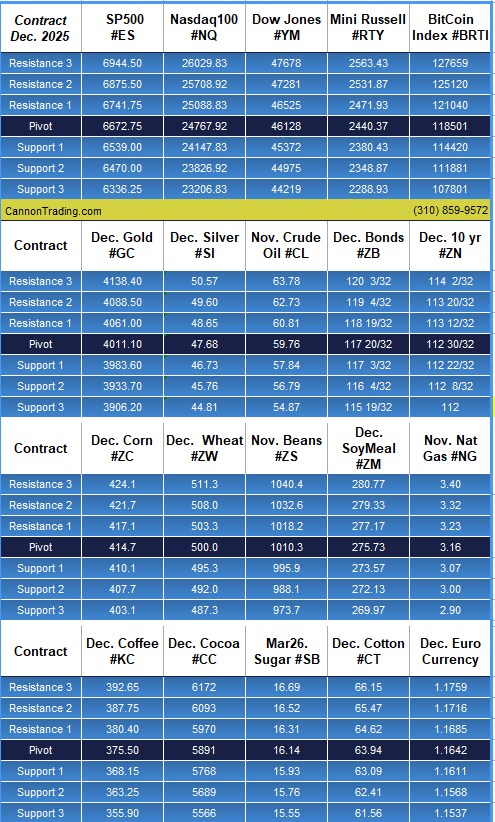

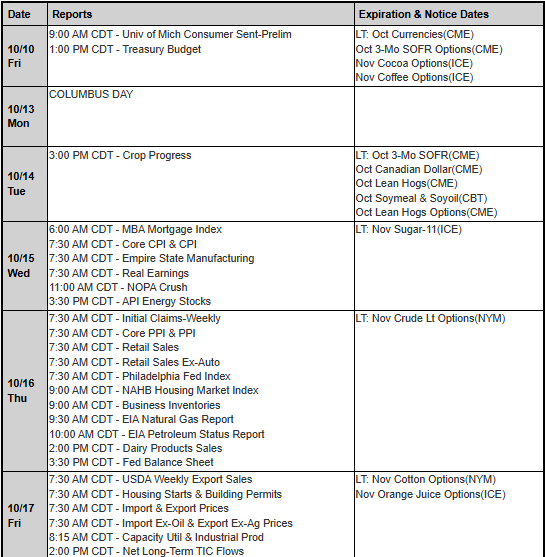

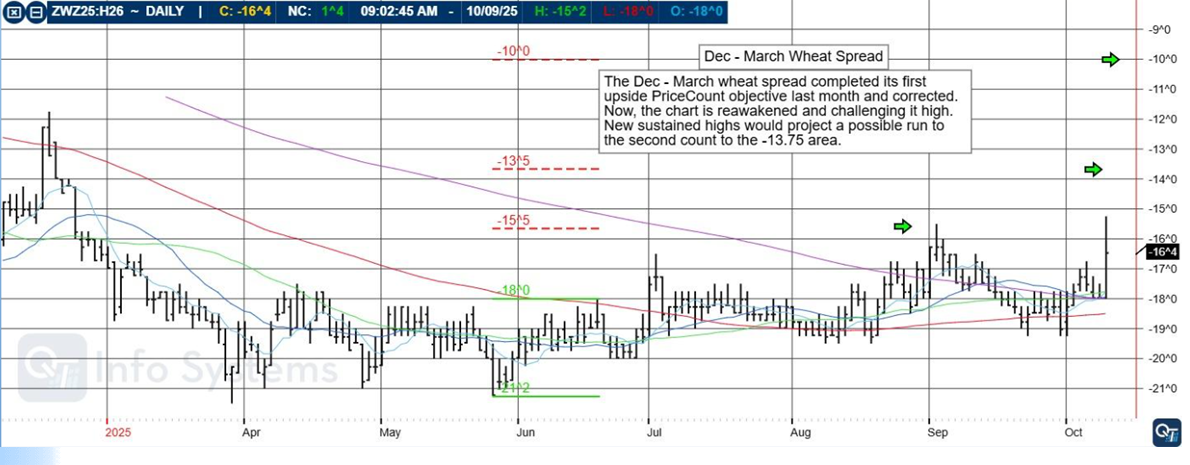

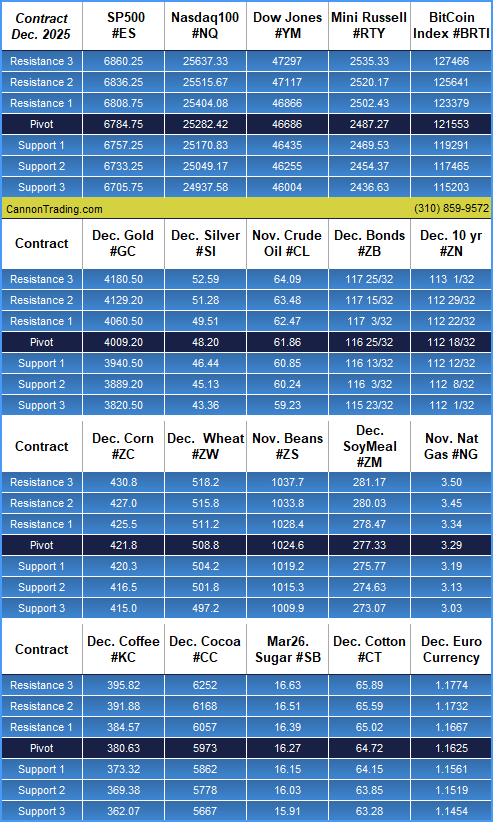

Spread Trading, December-March Wheat Spread, Levels, Reports; Your 4 Important Must-Knows for Trading Futures on October 10th, 2025

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||

|

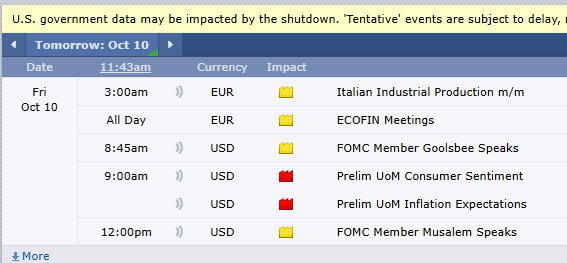

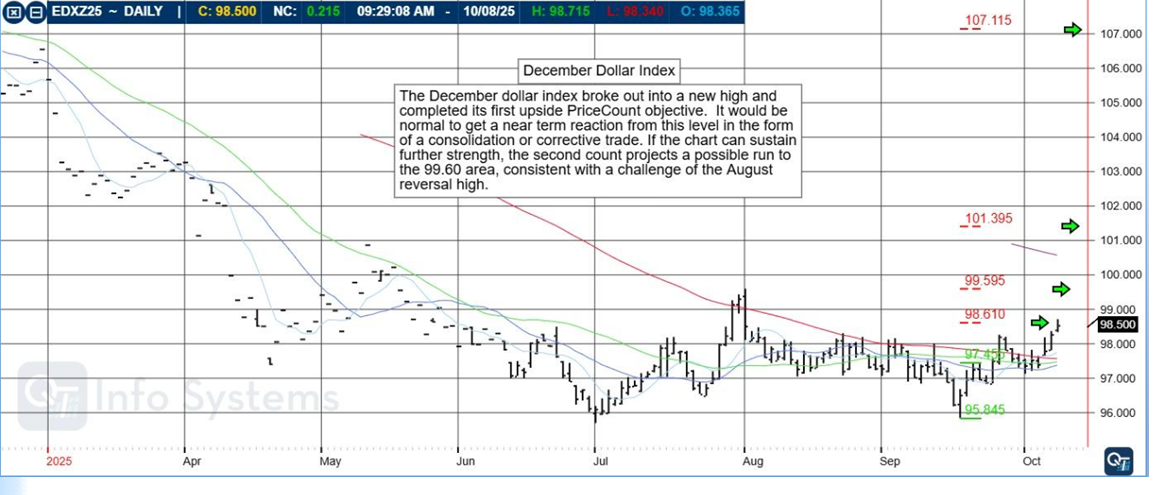

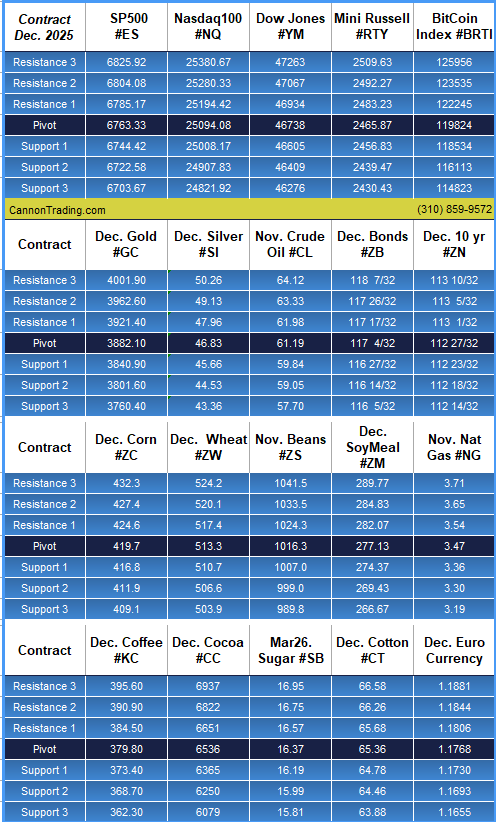

Crypto Trading, December Dollar Index, Levels, Reports; Your 4 Important Need-To-Knows for Trading Futures on October 9th, 2025

|

|

General: Crypto Trading Round-The-Clock

Big news. CME Group, the world’s largest derivatives marketplace, plans to offer customers round-the-clock trading for its cryptocurrency products next year.

The timetable anticipates 24/7 trading of futures and options starting in early 2026. Currently this will cover the CME Group’s main offerings in Bitcoin and Ethereum, but starting Oct. 13, they will be joined by Solana and XRP derivatives.

Trading in cryptocurrency derivatives has been growing steadily since CME first offered Bitcoin futures in 2017. Notional open interest, which represents the outstanding value of contracts, reached a record $39 billion in mid-September.

All-hours access lets investors respond to price swings in real time, which could add additional legitimacy and liquidity to these digital assets.

Stock Index Futures:

The Dec. E-mini S&P 500 and E-mini Nasdaq futures contracts traded to new all-time record highs intraday today. Volume has tended to be lighter on this the sixth day of the U.S. government shutdown.

Traders have been negligibly on edge at these highs with some uncertainty about the U.S. shutdown, the state of the jobs market and the delay of scheduled releases of U.S. government economic reports.

Looking elsewhere for clues on the U.S. jobs front, last week a report from global outplacement firm Challenger, Gray & Christmas indicated U.S. employers announced fewer layoffs in September but hiring plans so far this year were the lowest since 2009. It came a day after a weaker-than-expected ADP National Employment Report.

Metals:

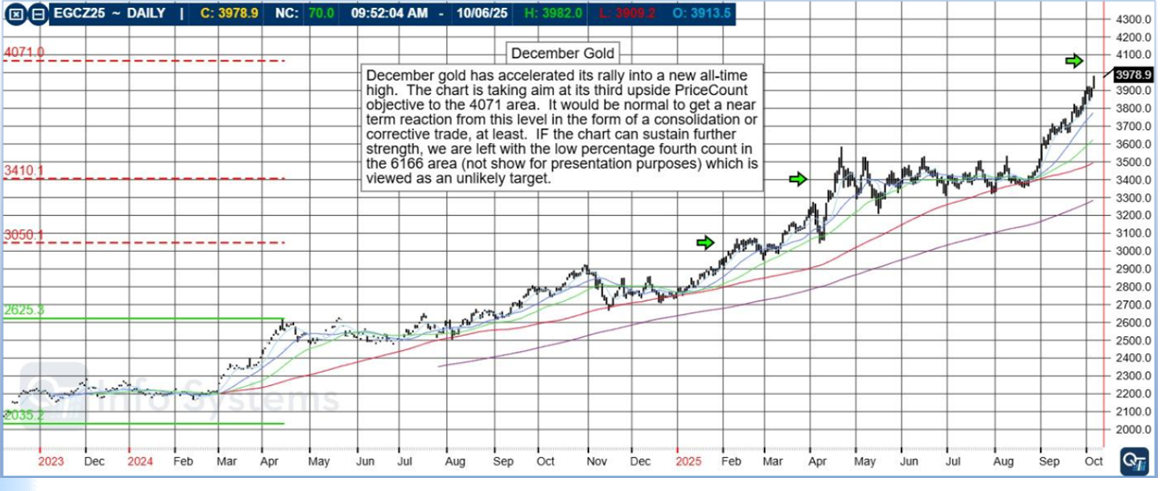

Dec. gold futures rose to new all-time highs for the sixth of seven trading sessions today, barreling through yesterday’s first move through $4,000 per ounce to trade intraday up to $4,081 per ounce, a $76.6 per ounce follow-through move.

Gold and silver futures have surged roughly 55% and 65% year to date, respectively, as expectations of Federal Reserve rate cuts have boosted the appeal of metals, which tend to perform better when interest rates are lower.

Energies:

Despite today’s report that U.S. crude oil inventories rose more than expected last week, crude oil futures oil futures staged a modest recovery today after last week’s decline to a 16-week low as the U.S. government shutdown fed worries about the global economy, while traders expected more oil supply to come on the market with the planned output boost announced by OPEC+ over the weekend.

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||

|

Trading Resources, December Silver, Levels, Reports; Your 4 Important Need-To-Knows for Trading Futures on October 8th, 2025

|

|

|

|

|

|

|

|

|

Want to feature our updated trading levels on your website? Simply paste a small code, and they’ll update automatically every day!

Click here for quick and easy instructions.

|

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

Silver Reaching New Heights, December Gold, Levels, Reports; Your Important Need-To-Know Facts for Trading Futures on October 7th, 2025

|

|

Silver Soars

By Andy Hecht – www.cqg.com

- A bullish trend since the 2020 low

- Silver rises to the highest price in fourteen years- The 2011 and 1980 highs are the upside targets

- Fundamentals support higher silver prices

- Gold supports rising silver prices

- Expect volatility and new highs as investment and speculative demand are critical

At the turn of this century, nearby COMEX silver futures prices were $5.413 per ounce. After trading as low as $4.02 in November 2001, silver prices began a slow ascent, reaching $49.82 a decade later, in April 2011. The 2011 peak was slightly below the record 1980 high at $50.32 per ounce.

Silver corrected from the 2011 high, but the price remained above the $10 level, trading to a low of $11.64 in March 2020 as the global pandemic weighed on prices across all asset classes. Silver quickly recovered, rising to over $20 four months later in July 2020.

In September 2025, silver futures are closing in on a challenge to the 2011 and 1980 peaks, and all signs indicate that those levels could soon become technical support rather than resistance.

A bullish trend since the 2020 low

The continuous COMEX silver futures contract reached a low of $11.74 per ounce in March 2020 as the global pandemic gripped markets across all asset classes.

Read the rest of the article along with charts and More!

Contact our trading desk today to learn how we can help you integrate silver and gold into your strategies.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

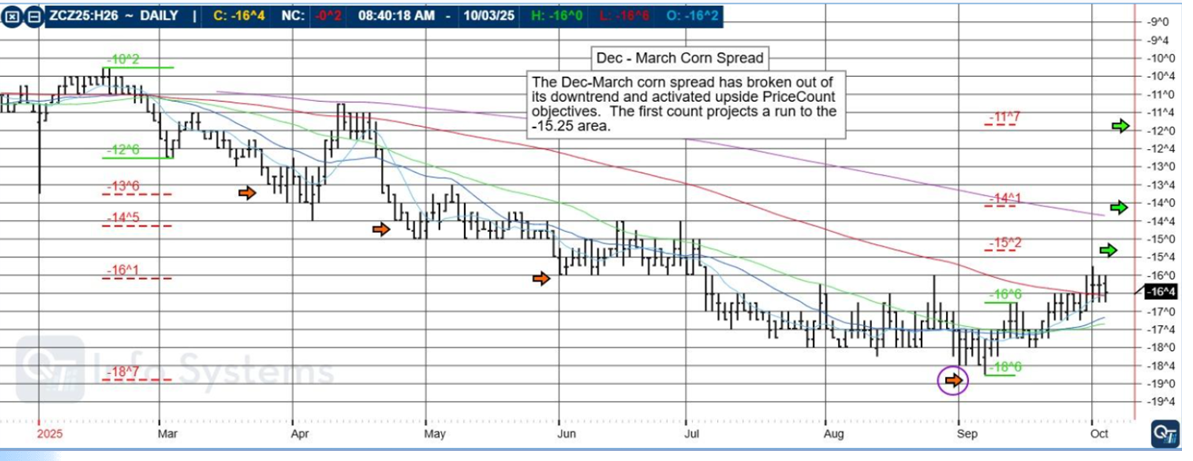

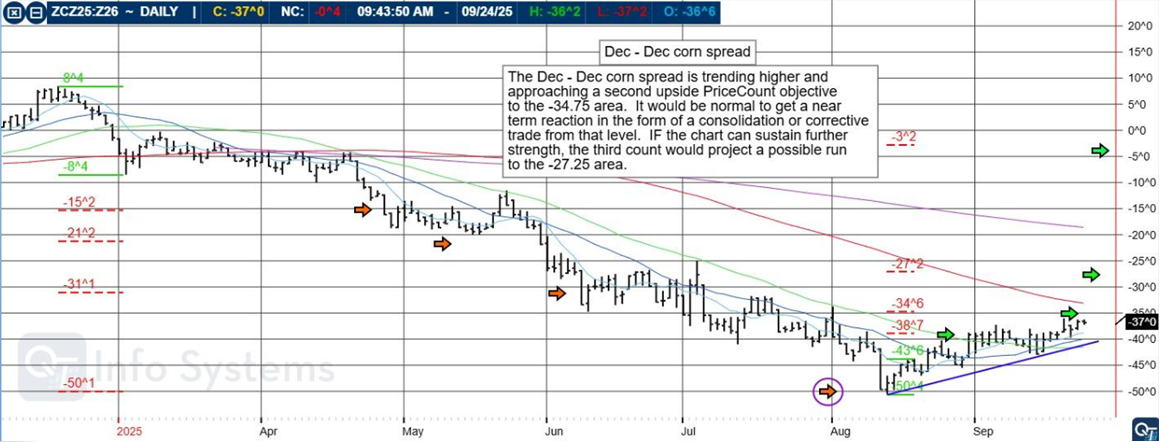

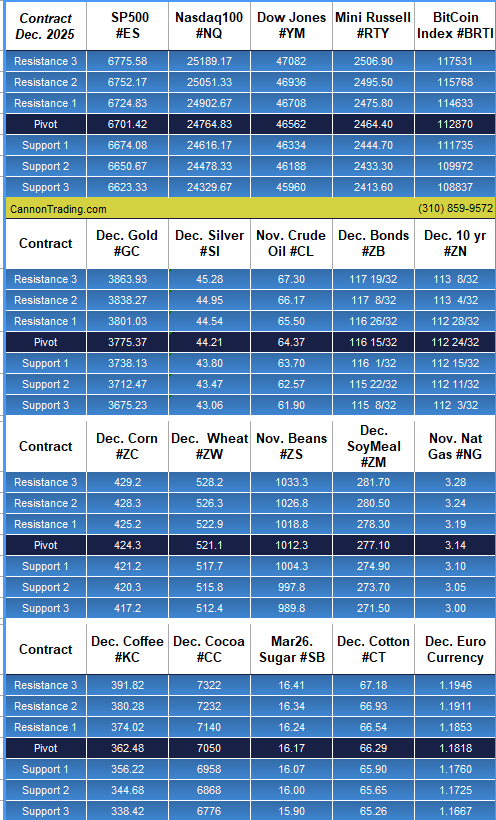

FOMC amid Government Shutdown, Metals, Dec/March Corn Spread, Levels, Reports; Your 4 Important Must-Knows for Trading Futures the Week of October 6th, 2025

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

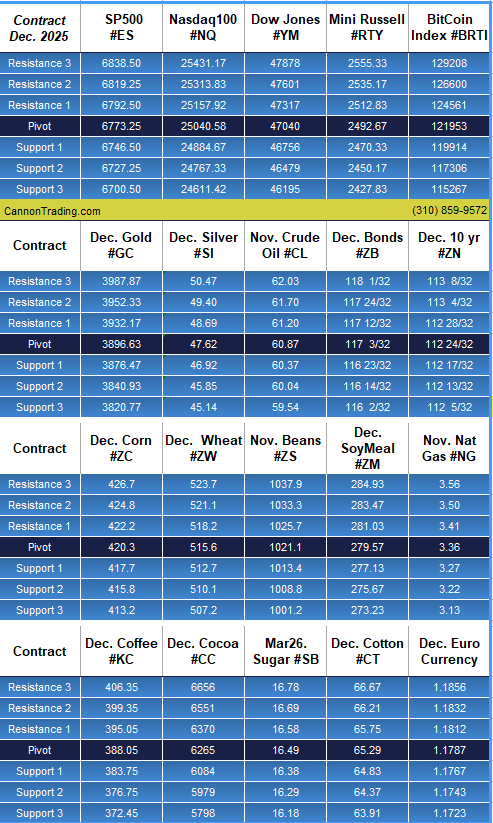

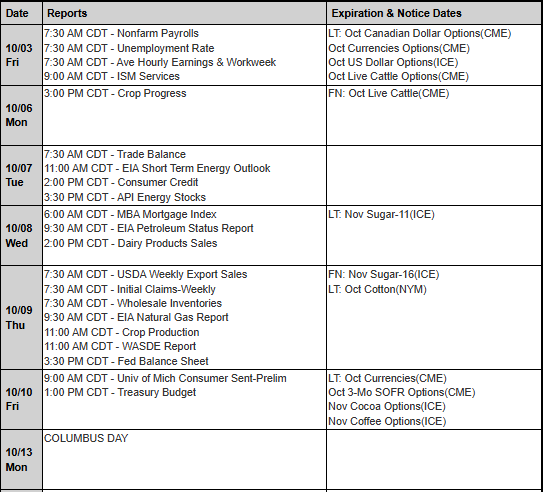

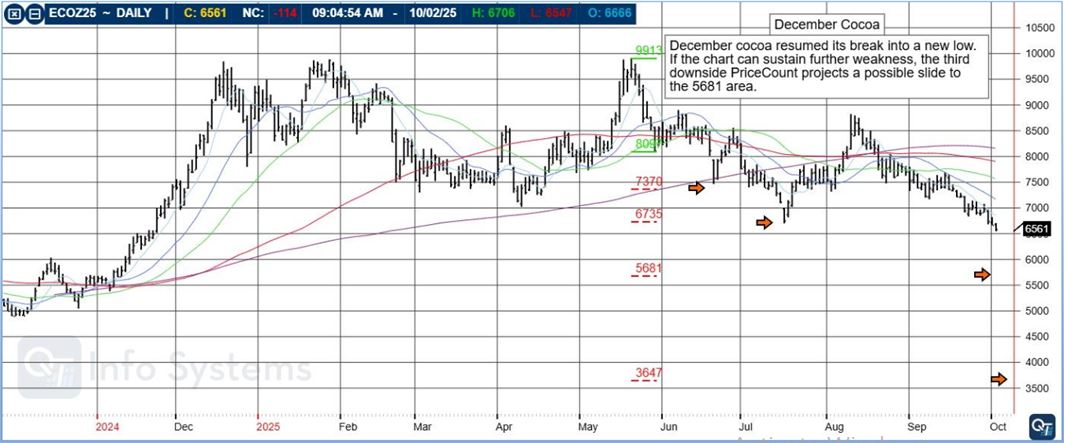

Trade and Risk Management, December Cocoa, Levels, Reports; Your 4 Important Must-Knows for Trading Futures on October 3rd, 2025

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

NFP next Friday, December Dollar Index, Levels, Reports; The Important Need-To-Knows for Trading Futures The Week of September 29th, 2025

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

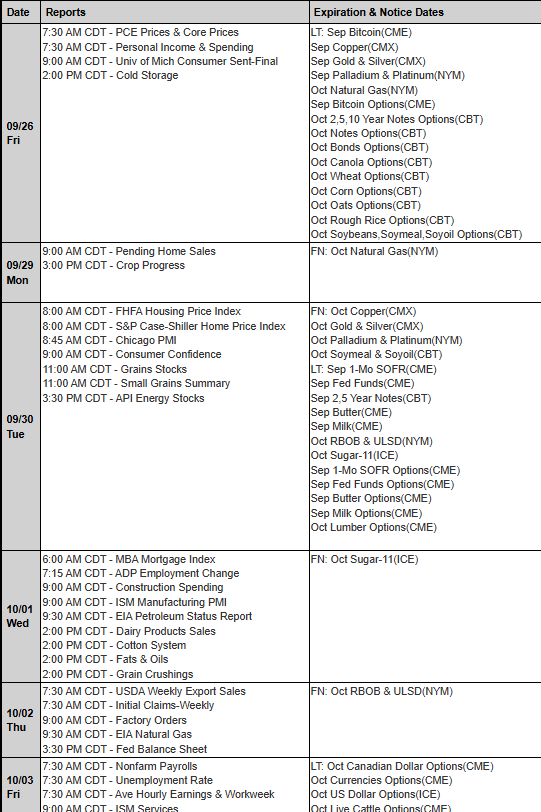

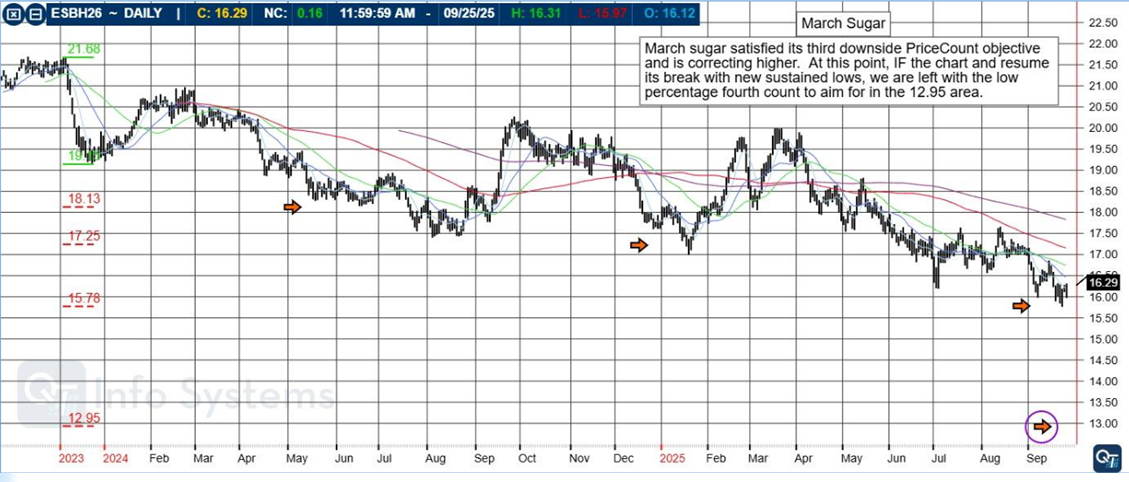

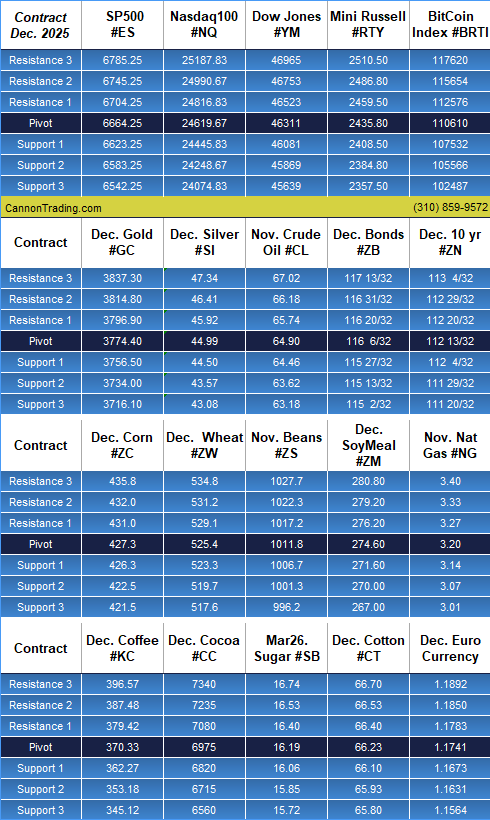

PCE: What to Know, What to Look For, March Sugar, Levels, Reports: The Important Parts of Trading Futures on September 26th, 2025

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

GDP: What It Is and What to Look for in the Upcoming Report; December Corn, Levels, Reports – The Important Facts to Keep in Mind When Trading Futures on September 25th, 2025

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010