|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

- Bitcoin Futures (114)

- Charts & Indicators (307)

- Commodity Brokers (589)

- Commodity Trading (846)

- Corn Futures (64)

- Crude Oil (230)

- Currency Futures (102)

- Day Trading (658)

- Day Trading Webinar (61)

- E-Mini Futures (163)

- Economic Trading (166)

- Energy Futures (127)

- Financial Futures (178)

- Future Trading News (3,160)

- Future Trading Platform (327)

- Futures Broker (665)

- Futures Exchange (347)

- Futures Trading (1,266)

- futures trading education (446)

- Gold Futures (112)

- Grain Futures (101)

- Index Futures (271)

- Indices (233)

- Metal Futures (142)

- Nasdaq (79)

- Natural Gas (40)

- Options Trading (191)

- S&P 500 (145)

- Trading Guide (431)

- Trading Webinar (60)

- Trading Wheat Futures (45)

- Uncategorized (26)

- Weekly Newsletter (224)

Category: Day Trading

Here is a subject that a lot of people don’t understand at all. Day Trading can be risky. So, it is something that you should stay away from unless and until you are absolutely sure about what you are doing.

There are a number of items about Day Trading such as the minimum mantaince requirementand more that need to be taken into consideration. With the blogs and write-ups listed in this section, you can learn a great deal about day trading.

We at Cannon Trading can help you understand the different concepts of trading and present you with the latest information on the same. Our team of professional and smart people can help you in your day trading transactions and more. In order to understand day trading more clearly, we advise that you go through all the write-ups listed in this category archive on Day Trading.

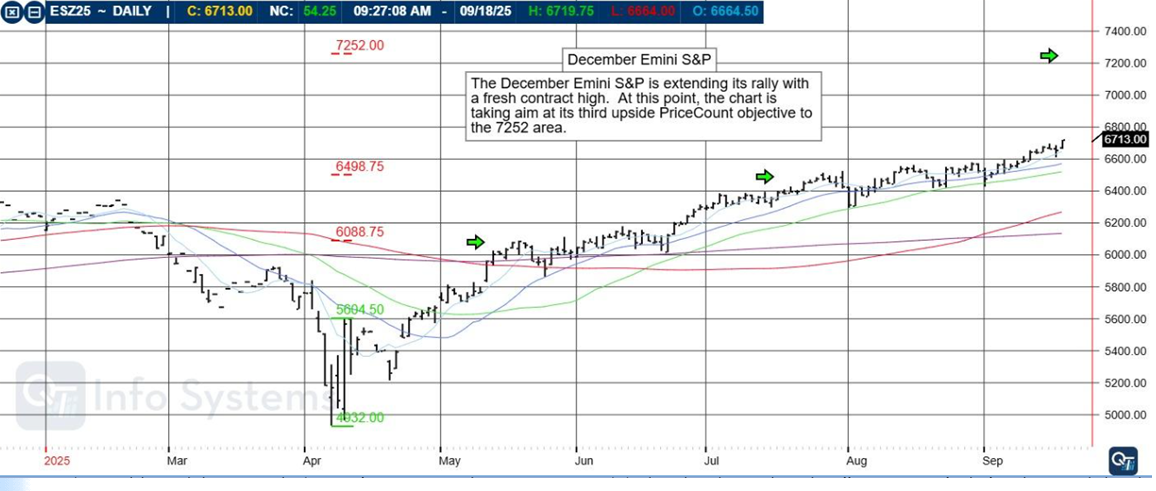

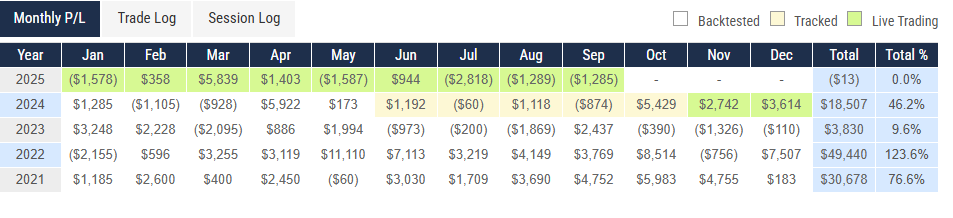

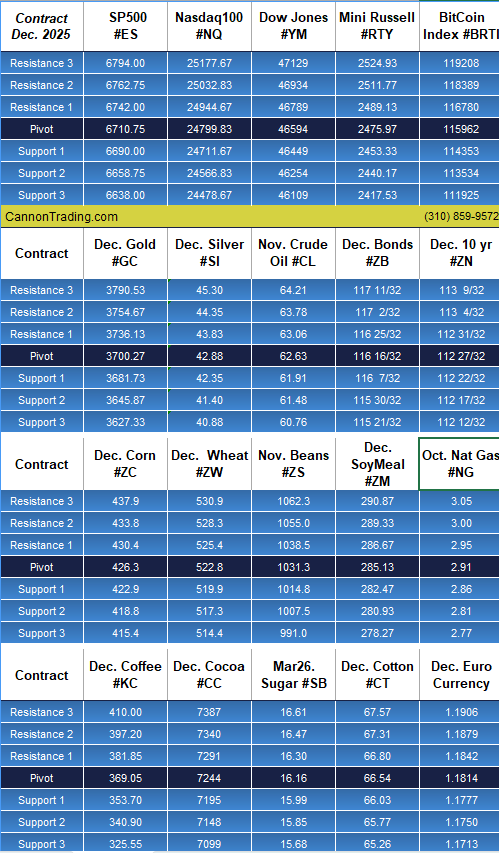

Interest Rate Cut, FOMC, Levels, Reports; Your 4 Important Must-Knows for Trading Futures on September 18th, 2025

|

Rolling Over to December, December Coffee, Levels, Reports; Your 4 Important Must-Knows for Trading Futures on September 16th, 2025

|

|

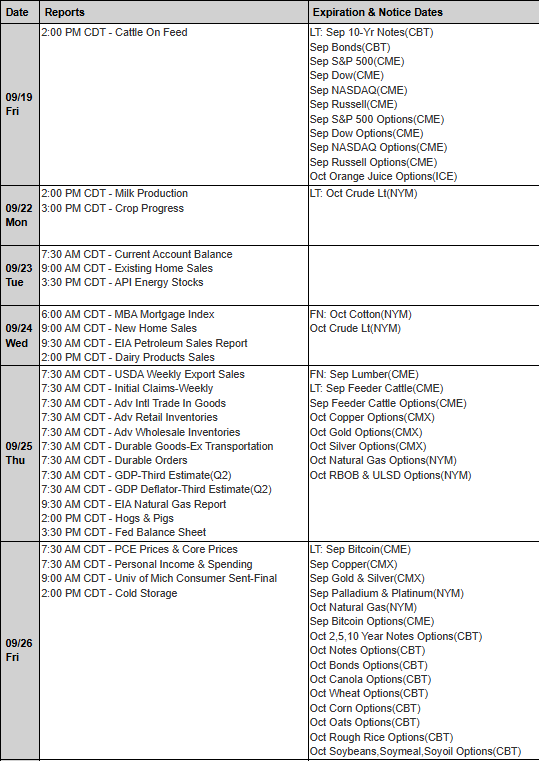

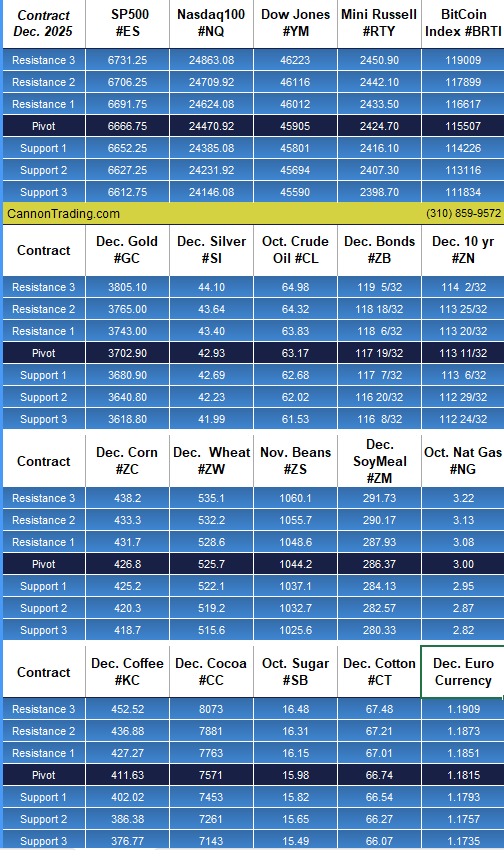

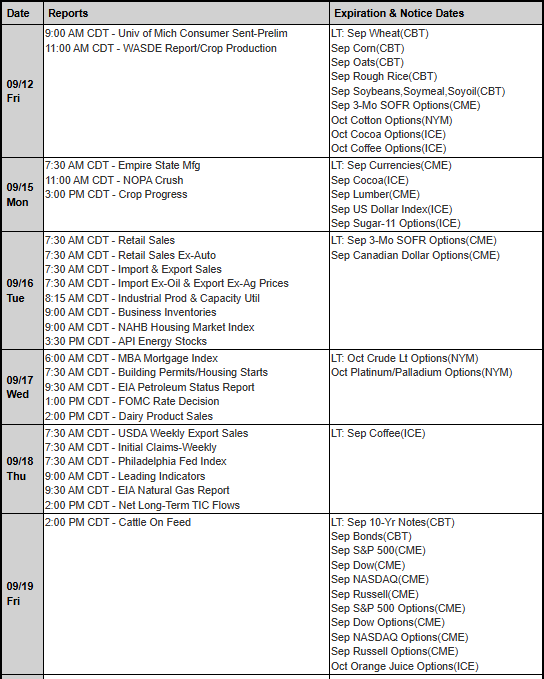

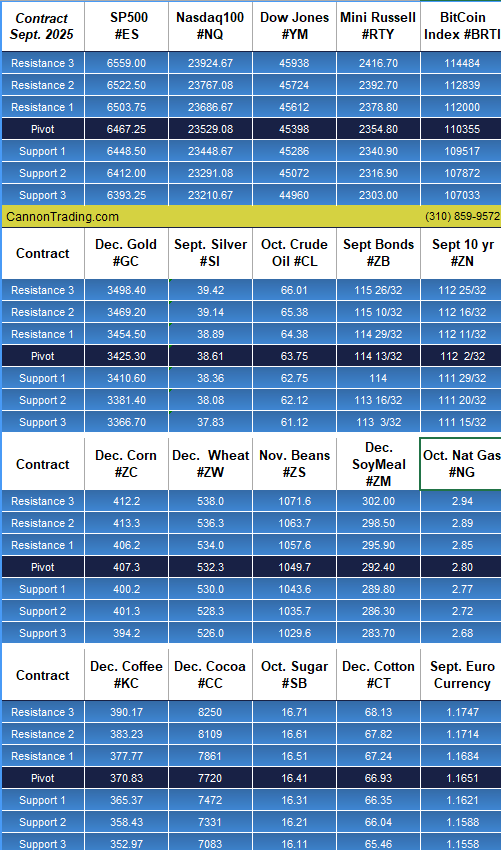

FOMC Rate Decision, December Corn, Sentinel Gold 15, Levels, Reports; Your 5 Important Must Knows for Trading Futures the Week of September 15th, 2025

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Trade Entry, October Hogs, Levels, Reports; Your Important Must-Knows for Trading Futures on September 12th, 2025

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

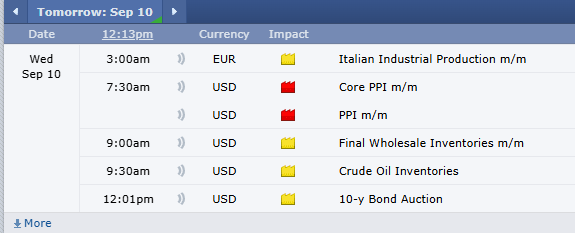

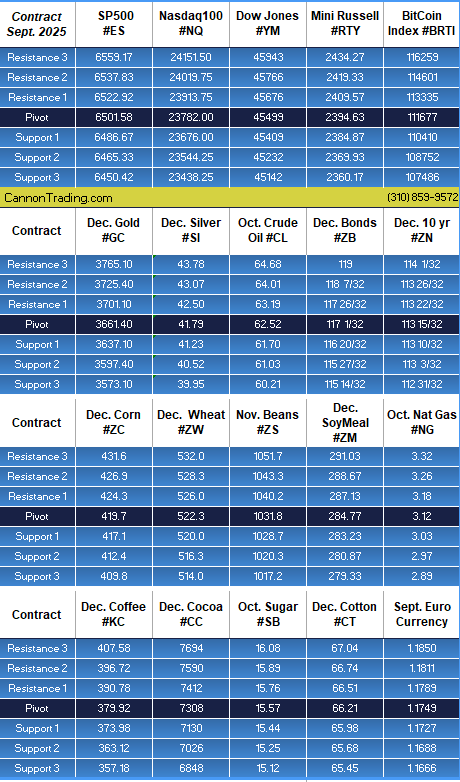

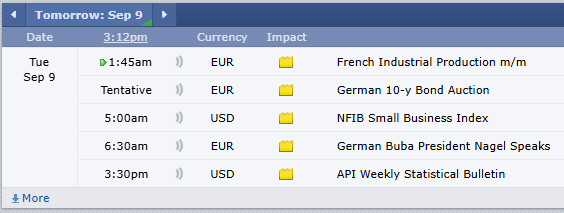

Cattle – Live & Feeder, Core PPI, Webinar TOMORROW MORNING!!! Levels, Reports; Your 5 Important Must-Knows for Trading Futures on Wednesday, September 10th, 2025

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

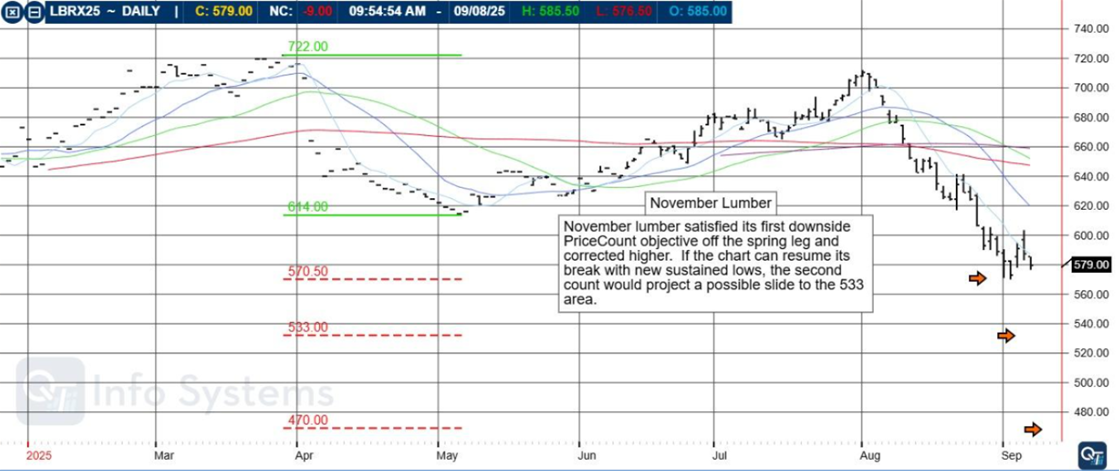

Webinar Wednesday – Decoding the Markets, November Lumber, Levels, Reports: Your 4 Important Must-Knows for Trading Futures on September 9th, 2025

|

|

|

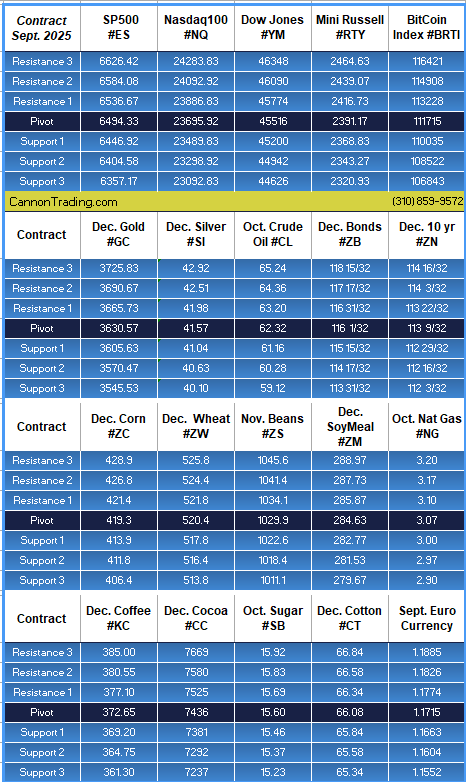

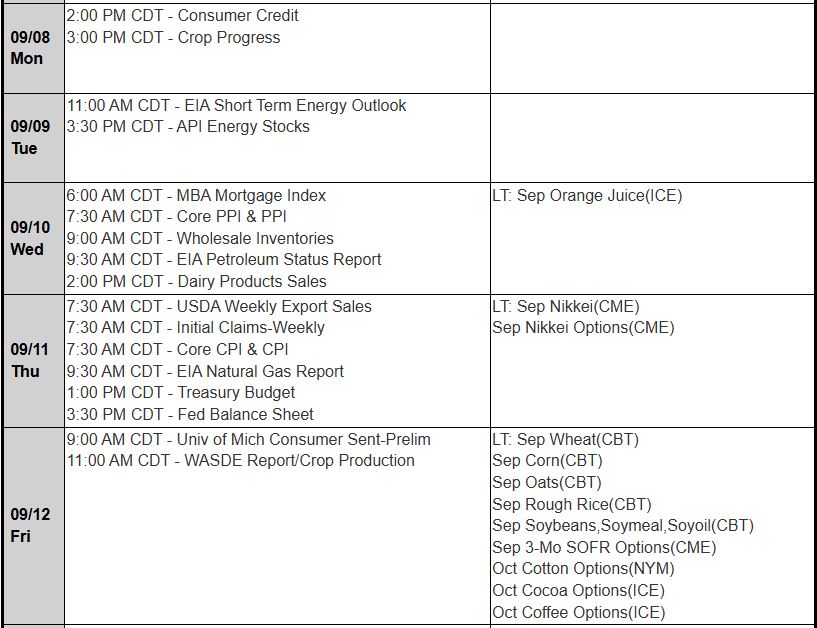

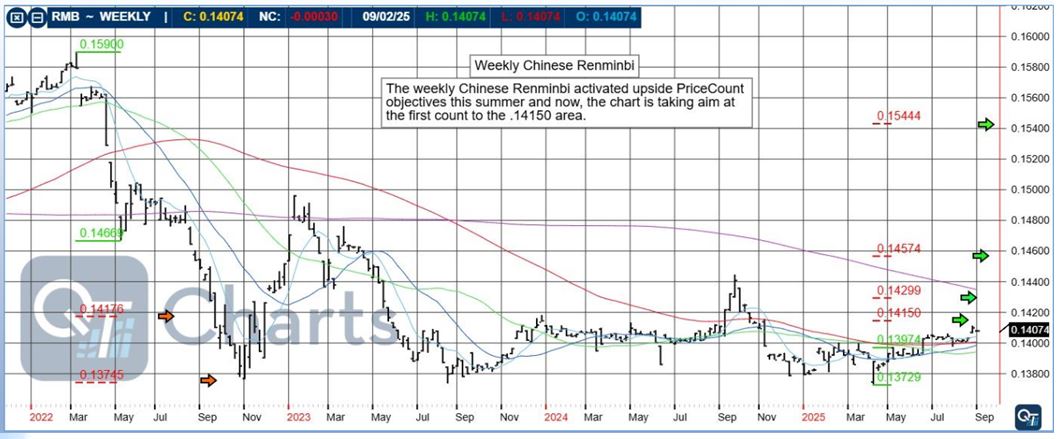

Fed Announcements, CPI, PPI, WASDE, Levels, Reports; Your 6 Important Must-Knows for Trading Futures the Week of September 8th, 2025

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Futures Brokers; Five Undeniable Traits of the Top Futures Brokers

Futures Brokers

The second half of 2025 presents traders with extraordinary opportunities in futures trading, but it also demands heightened responsibility, discipline, and insight. Volatility remains elevated across commodities, equities, cryptocurrencies, and interest-rate derivatives as central banks adjust policies amid a turbulent global economy. Traders are increasingly relying on their futures brokers not just for execution but also for guidance, risk management tools, and robust trading platforms.

Choosing the best futures brokers isn’t just about low commissions or fast executions—it’s about aligning yourself with a trusted partner who helps you navigate complexity with confidence. In this context, Cannon Trading Company stands out as one of the top-rated futures brokers USA, thanks to its decades of industry experience, an exemplary regulatory record, cutting-edge platform offerings, and hundreds of verified five-star ratings on TrustPilot.

In this article, we’ll explore:

- How traders can leverage their futures broker to ensure responsible trading in H2 2025.

- The evolving role of futures brokers in the age of AI-driven, high-speed markets.

- Why Cannon Trading Company is a leading ally for traders navigating today’s markets.

- The importance of technology, compliance, and education when trading futures responsibly.

Try a FREE Demo!

The Evolving Role of Futures Brokers in 2025

In 2025, the role of a futures broker has transformed from that of a simple trade executor to that of a comprehensive trading partner. Traditional brokers offered order execution and access to exchanges, but modern futures brokers are now:

- Risk Advisors – Helping traders understand leverage, margin requirements, and downside exposure.

- Platform Gatekeepers – Providing access to powerful futures options trading platforms like CQG, Rithmic, TradingView, MotiveWave, and Bookmap.

- Compliance Leaders – Ensuring traders meet federal regulations and exchange guidelines.

- Educators – Equipping traders with research, insights, and learning resources.

- Innovation Hubs – Integrating AI, analytics, and high-speed routing to support optimal trade decisions.

When working with the best futures brokers, traders aren’t just selecting a transactional service—they’re choosing a strategic partner capable of helping them make smarter, more responsible decisions when trading futures.

Why Responsible Futures Trading Matters in H2 2025

The second half of 2025 brings heightened uncertainty across asset classes:

- Interest Rates: Central banks are balancing inflation and slowing growth.

- Commodities: Energy and agricultural markets remain volatile amid supply chain disruptions.

- Equity Futures: The S&P 500 and Nasdaq futures show increased sensitivity to geopolitical developments.

- Digital Assets: Cryptocurrencies and micro ether futures continue attracting speculative interest.

These dynamics underscore the importance of disciplined strategies. Traders who over-leverage or ignore risk parameters face amplified losses. Responsible trading in this environment involves:

- Setting realistic position sizes.

- Using stop-loss orders effectively.

- Diversifying across asset classes.

- Leveraging analytics from futures options trading platforms.

- Working closely with a knowledgeable futures broker to stay informed and compliant.

The right futures brokers USA empower traders to adapt, manage risk, and maintain consistency amid shifting markets.

How Traders Can Leverage Their Futures Broker for Responsible Trading

- Access to Top-Tier Futures Trading Platforms

In H2 2025, execution speed and analytical capabilities matter more than ever. The best futures brokers provide traders with access to world-class futures options trading platforms, such as:

- CQG – Known for lightning-fast execution and institutional-grade charting.

- TradingView – Offers an intuitive interface and integrated social trading insights.

- Bookmap – Delivers granular order-flow visualization for scalpers and high-frequency traders.

- Rithmic/RTrader Pro – Ideal for algorithmic traders seeking low-latency connectivity.

- MotiveWave – Advanced Elliott Wave and Gann analysis tools for technical traders.

By leveraging these technologies, traders can better evaluate price action, manage positions, and implement advanced strategies responsibly.

- Guidance on Risk Management

A seasoned futures broker serves as an invaluable resource for risk mitigation. They help traders:

- Understand margin requirements for different contracts.

- Set maximum daily loss limits to prevent emotional overtrading.

- Implement trailing stops and hedge positions using futures options trading strategies.

- Diversify across multiple products to reduce portfolio volatility.

Traders working with experienced futures brokers USA gain a safety net against avoidable mistakes, enabling them to maintain longevity in volatile markets.

- Education and Market Research

The best futures brokers go beyond execution to deliver actionable intelligence. Educational resources include:

- Webinars on evolving futures markets and strategies.

- Real-time news feeds and economic event alerts.

- Analysis of open interest, volume, and sentiment data.

- Tutorials on futures broker options for hedging and speculation.

This combination of technology and education is essential for building a disciplined approach to trading futures responsibly.

- Personalized Support and Compliance Assistance

Unlike discount-only firms, full-service futures brokers like Cannon Trading Company offer personal guidance. In 2025, compliance remains critical as regulators tighten oversight to protect retail traders. A trusted futures broker helps ensure:

- Adherence to CFTC and NFA guidelines.

- Correct reporting of positions and margins.

- Proper understanding of leverage and exposure.

By acting as both a compliance resource and execution partner, a broker reduces legal and financial risks for traders.

Why Cannon Trading Company Stands Out

Decades of Experience

Founded in 1988, Cannon Trading Company has spent nearly four decades helping traders succeed in dynamic futures markets. This depth of experience gives the firm unparalleled insight into market cycles, trader psychology, and technological innovation.

Five-Star TrustPilot Ratings

With numerous verified 5 out of 5-star ratings on TrustPilot, Cannon Trading Company has earned a stellar reputation among traders worldwide. These reviews highlight exceptional customer service, transparent pricing, and fast execution.

Exemplary Regulatory Reputation

Cannon maintains spotless relationships with federal and independent regulators, including the CFTC and NFA. Their emphasis on compliance gives traders confidence that they’re working with one of the best futures brokers in the industry.

Wide Selection of Futures Trading Platforms

Unlike brokers tied to a single platform, Cannon offers a diverse suite of futures options trading platforms to match every trader’s style, including CQG, Rithmic, TradingView, and MotiveWave.

This flexibility empowers traders to choose the ideal tools for their strategy while enjoying expert support from Cannon’s team.

The Power of Futures Options with the Right Broker

An area where a skilled futures options broker shines is helping traders incorporate options into their strategies. Options on futures contracts enable traders to:

- Hedge against downside risks while holding long futures positions.

- Generate income through premium-selling strategies.

- Structure trades with asymmetric risk-reward profiles.

With Cannon Trading Company’s expertise, traders gain access to cutting-edge futures broker options and personalized guidance on how to integrate options into their portfolio responsibly.

Responsible Trading Strategies for H2 2025

To thrive in today’s markets, traders should combine advanced tools with discipline. Here are key strategies:

- Adopt a Risk-First Mindset

- Limit exposure per trade to a fixed percentage of account equity.

- Use volatility-based position sizing to account for fluctuating markets.

- Leverage Broker Research and Insights

- Utilize analytics and educational materials provided by futures brokers USA.

- Use Futures and Options Together

- Combine outright futures contracts with protective options to limit downside while keeping upside potential.

- Harness Automation Responsibly

- Use algorithmic features on futures options trading platforms but maintain manual oversight.

With a trusted futures broker like Cannon Trading Company, these strategies become easier to execute effectively.

The second half of 2025 will test traders’ discipline, adaptability, and strategy. Partnering with the best futures brokers—especially those with deep experience, regulatory excellence, and cutting-edge tools—is essential for success.

Cannon Trading Company continues to stand out as a premier choice among futures brokers USA, offering:

- Decades of expertise.

- Exceptional customer satisfaction with countless five-star TrustPilot reviews.

- A strong regulatory reputation.

- Access to elite futures options trading platforms for every trading style.

For traders looking to navigate complex markets responsibly, Cannon Trading Company is more than just a futures broker—it’s a strategic ally.

Try a FREE Demo!

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

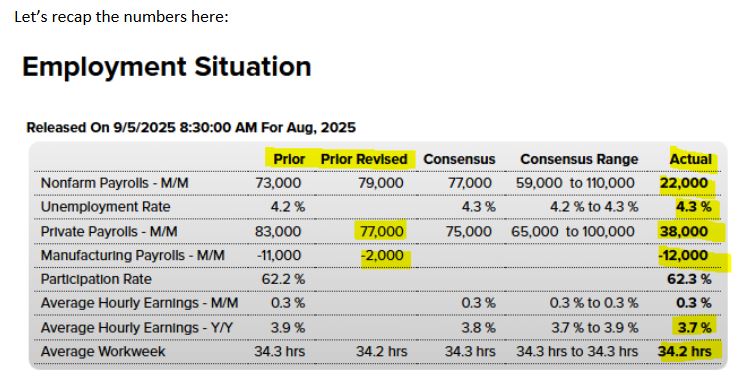

Labor Department Reports, Non Farm Payroll, ADP, Levels, Reports; Your 5 Important Must-Knows for Trading Futures on September 4th, 2025

|

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010