The Week Ahead: War, CPI, Minutes- watch your blindside

By Senior Broker, John Thorpe

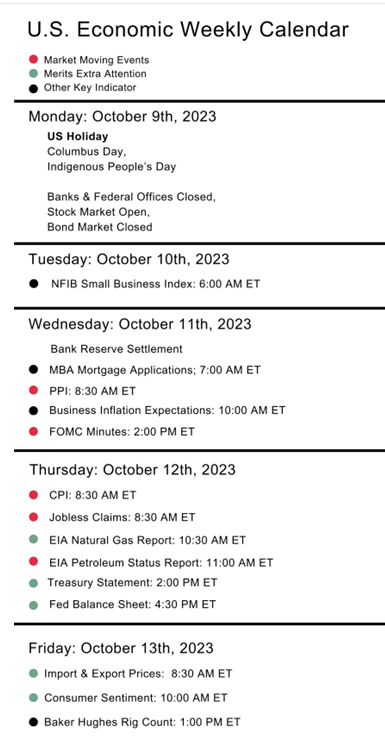

Today, due to the US Holiday, bond markets and US Government offices were closed, volatility in US stocks were muted.

The surprise attack on the State of Israel and official declaration of war over the weekend has the potential to be the main driver in the direction of the equity markets forcing the inflation, deficit, jobs narrative to take a back seat. . When the bond markets open, we will get a much better idea how much as gold did reflect a moderate flight to quality in today’s trade.

Here is a good piece from Fortune mag published over the weekend Attack on Israel: What investors, economists, and strategists are saying | Fortune it’s worth a scan.

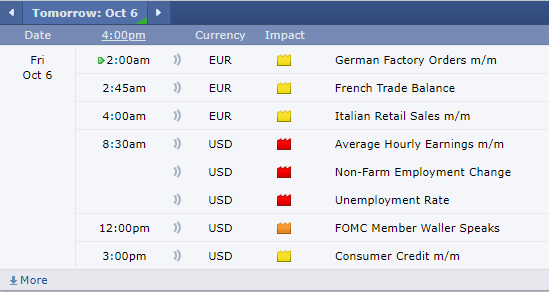

Data releases this week will include PPI, CPI , Fed Minutes to be the most impactful.

Wednesday @ 7:30 CDT Producer Price Index values will be released: Producer prices in September are expected to rise 0.3 percent on the month versus a 0.7 percent increase in August. The annual rate in September is seen at 1.7 percent versus August’s 1.6 percent increase. September’s ex-food ex-energy rate is seen rising 0.2 percent on the month and 2.1 percent on the year versus August’s 0.2 percent on the month and 2.2 percent yearly rise.

Also on this day, The Fed minutes will be released @ 1:00 PM CDT: Detailing the issues of debate and consensus among policymakers, the Federal Open Market Committee issues minutes of its latest meeting three weeks after the meeting.

Consumer Price Index CPI Thursday 7:30 am CDT Core prices in September are expected to hold steady at a monthly increase of 0.3 percent to match August’s 0.3 percent increase Overall prices are also expected to rise 0.3 percent on the month after August’s as-expected percent 0.6 increase which hit expectations. Annual rates, at 3.7 percent overall and 4.3 percent for the core in August, are expected 3.6 at 4.1 percent respectively.

Also on this Day and time, Jobless Claims : Jobless claims for the October 8 week are expected to come in at 209,000 versus 207,000 in the prior week.

For the Ag Sector we have the WASDE report, Thursday the 12th as well, this report is released @ 11:00 am CDT.

Watch your blindside and expect more volatility!

Plan your trade and trade your plan.

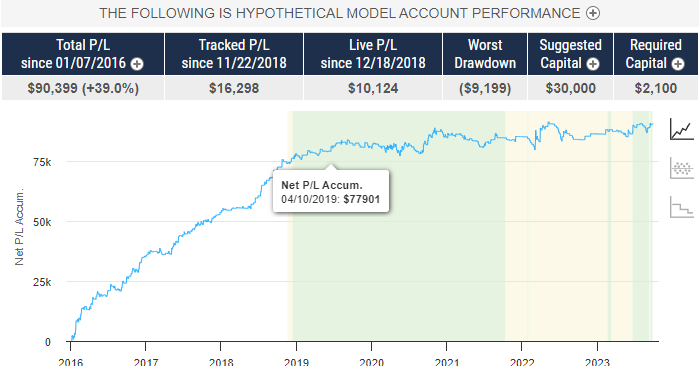

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

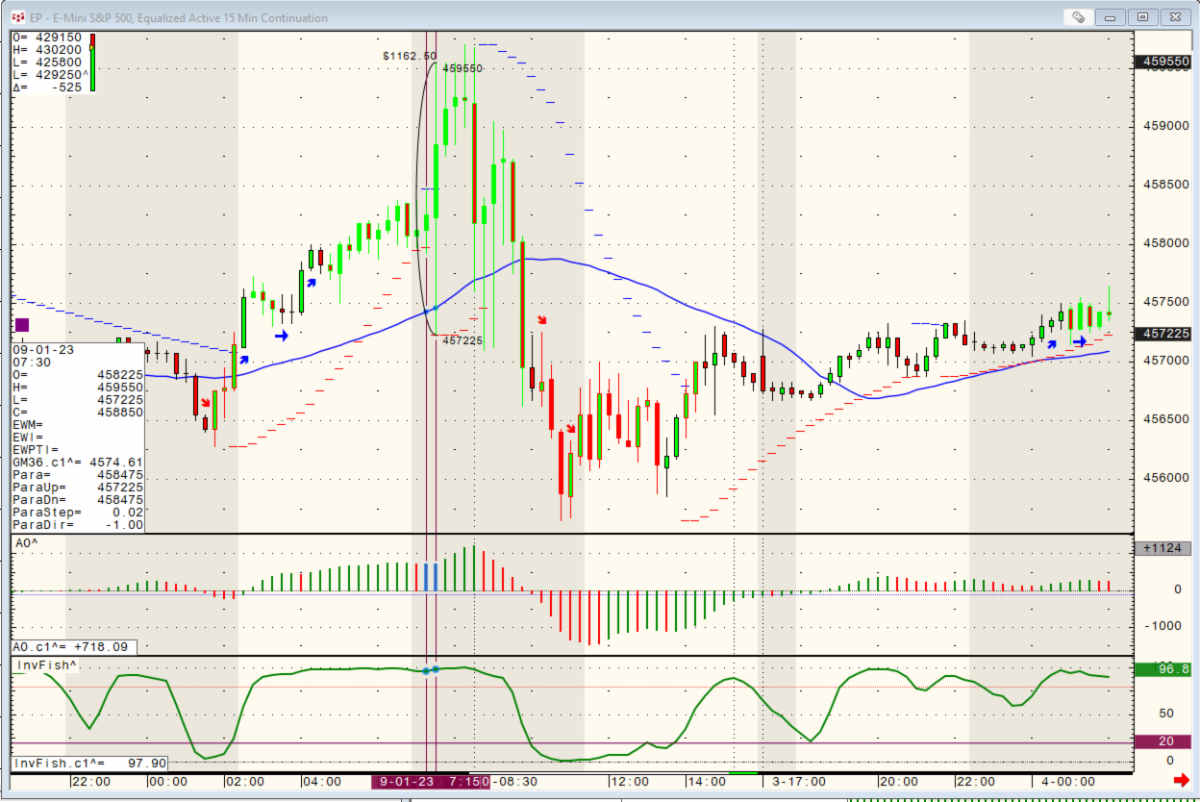

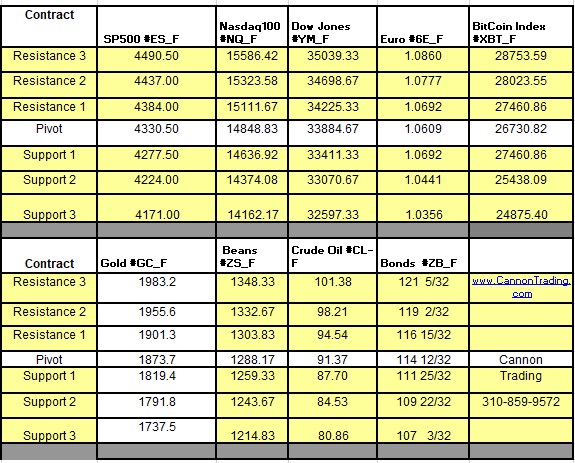

Futures Trading Levels

10-10-2023

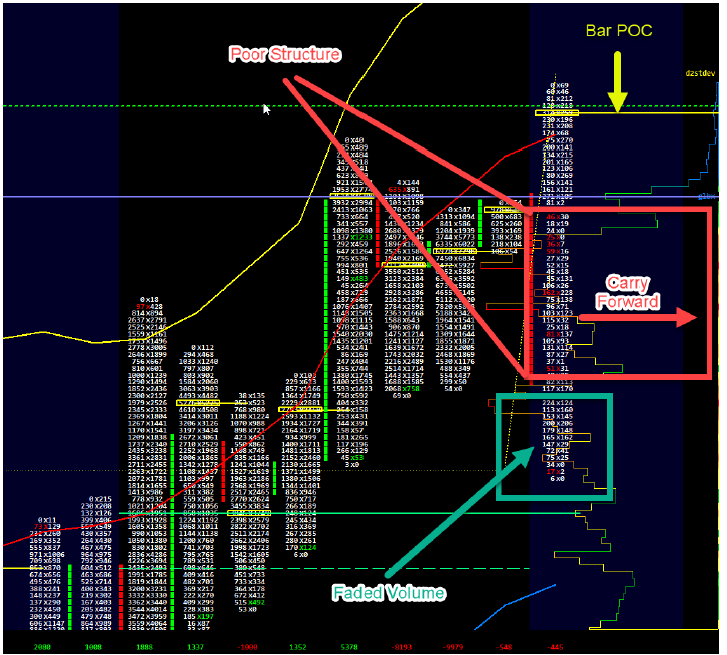

Download your FREE copy of Order Flow Essentials!

Improve Your Trading Skills

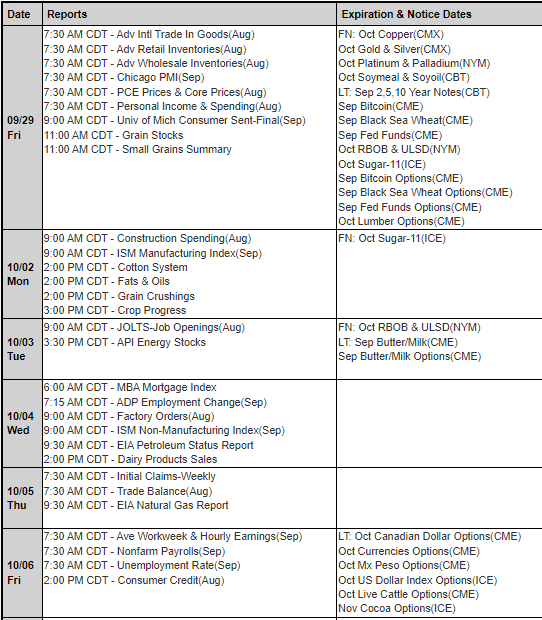

Economic Reports, Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.