What to Look for as we Finish the Trading Week

By Mark O’Brien, Senior Broker

Energy:

After starting the year near $72 per barrel, by June, West Texas crude oil (Jan. ’23 futures contract) climbed to its highs above $108 per barrel. Today, Jan. crude oil traded to an intraday low of $71.75, a ±$36 per barrel (±$36,000) leap and fall.

Not to be out don’t, after breaching $10.00 per million British thermal units in early August, natural gas traded below $5.34 intraday yesterday, a whopping ±46% cut in the asset’s value and a ±$46,000 move for a single futures contract (Jan. ’23 futures contract).

Metals:

Albeit experiencing a slight correction this week so far, gold (Feb. ’23 futures contract) managed to hold nearly all of its ±$170 rally through $1,800 per ounce off its multi-year lows of early November near $1,635 per ounce – a ±$17,000 move in one month.

Announcements:

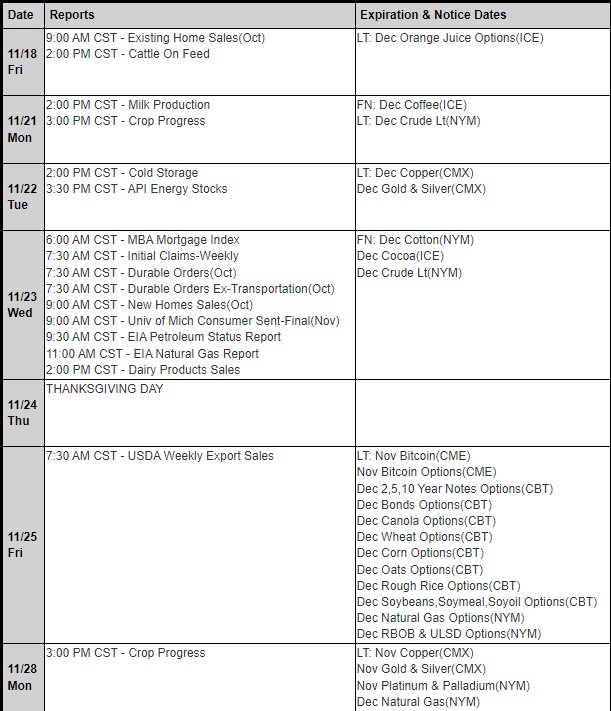

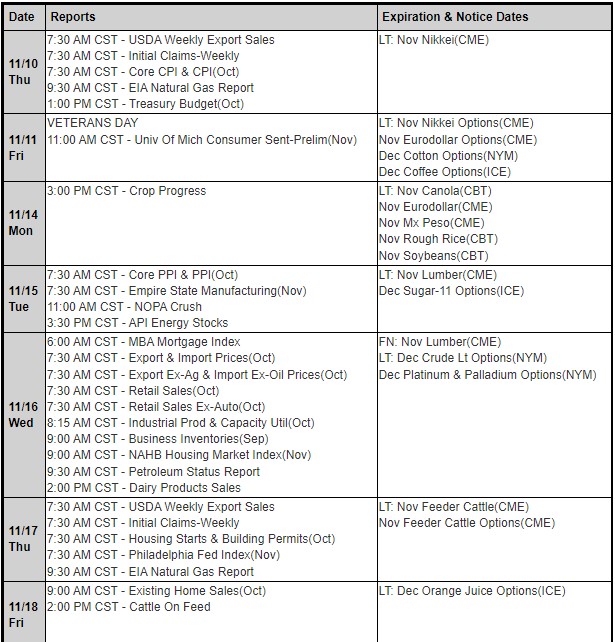

Keep an eye on the calendar for important U.S. government reports this Friday, starting with the Labor Department’s release of its Producer Price Index showing the cost of wholesale goods and services. The reading reflects what companies pay for supplies such as grains, fuel, metals, lumber, packaging and so forth. This is a key inflation gauge in the midst of four-decade high wholesale prices. Release time: 7:30 A.M., Central Time.

Also on Friday, the USDA will release its Crop Production Report along with its World Supply/Demand report (likely the more critical). It’s delivered at 11:00 A.M., Central Time.

A Cannon broker will be able to assist, provide feedback and answer any questions.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

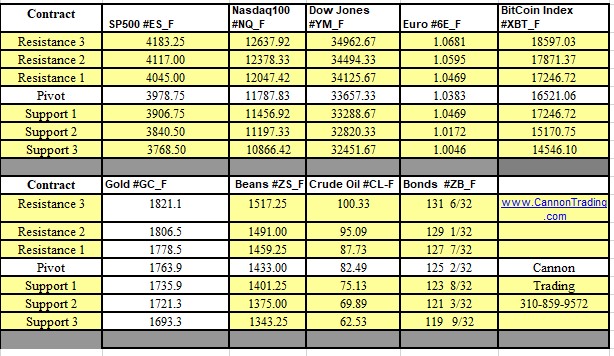

Futures Trading Levels

for 12-08-2022

Economic Reports, Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.