The world of futures trading is vast, intricate, and, at times, obscured by layers of jargon and complexity. Among the most actively traded financial instruments in this domain are oil futures contracts, a crucial commodity derivative that influences global economies. Understanding these contracts—how they work, the potential risks, and their historical impacts—can make a critical difference for any futures trader seeking success.

What Are Oil Futures Contracts?

An oil futures contract is a legal agreement to buy or sell a specific amount of crude oil at a predetermined price at a future date. These contracts are standardized and traded on exchanges such as the CME Group’s New York Mercantile Exchange (NYMEX) and the Intercontinental Exchange (ICE). They allow producers and consumers to hedge against price fluctuations while providing opportunities for commodity brokerage firms and traders to speculate on oil price movements.

Oil futures come in various forms, including e-mini futures and micros futures, which allow for different contract sizes to cater to traders with varying risk appetites and capital.

10 Obscure Facts About Oil Futures Contracts That Traders Should Know

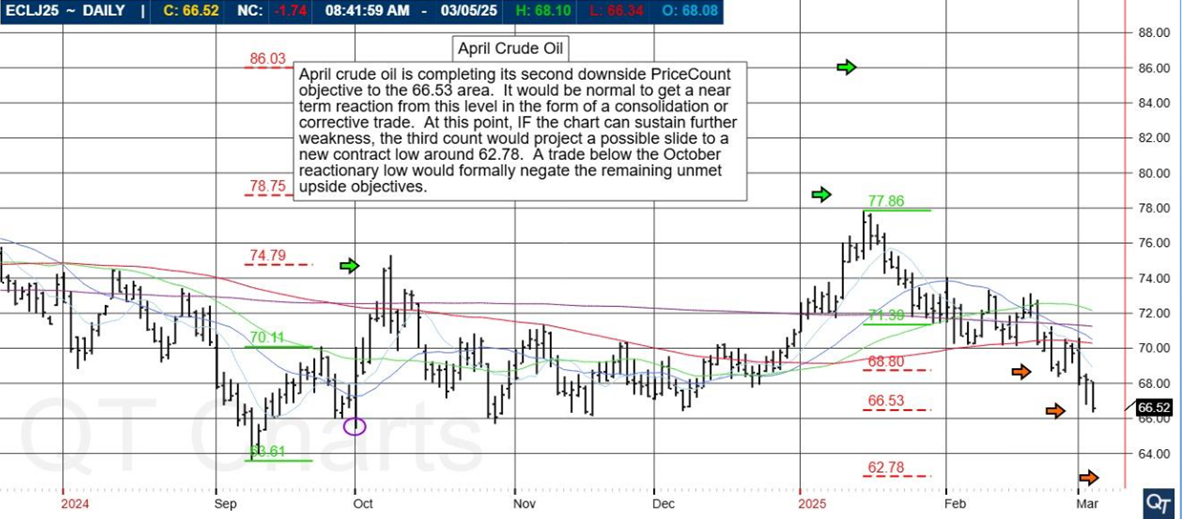

- The Market Has Negative Prices—And It Happened in 2020

- On April 20, 2020, West Texas Intermediate (WTI) crude oil futures for May delivery fell to -$37.63 per barrel. Due to an extreme storage shortage, holders of contracts were willing to pay others to take the contracts off their hands.

- Contango vs. Backwardation Can Make or Break a Trade

- In futures trading, a market in contango means that future prices are higher than spot prices, often due to storage costs. In backwardation, future prices are lower, typically due to high demand. Understanding these states helps traders plan their strategies effectively.

- ‘Crack Spread’ Trading Exploits Oil Product Refining Margins

- Futures traders use the “crack spread” strategy to hedge or profit from the difference between crude oil and refined products like gasoline or diesel. This spread reflects refinery margins and demand shifts.

- Oil Futures Contracts Expire Differently Than Stock Options

- Unlike stock options, which expire monthly, oil futures have contract rollovers that can create price volatility around expiry dates. If a trader doesn’t roll over before expiry, they may have to accept physical delivery.

- Oil Price Moves Don’t Always Correlate With Global Events Immediately

- While geopolitical events (like wars and OPEC decisions) impact oil, price reactions can be delayed due to hedging and algorithmic trading, making predictive trading challenging.

- Hedging by Airlines and Trucking Companies Influences Prices

- Large-scale fuel consumers like airlines hedge fuel costs using oil futures contracts, impacting market dynamics. For example, Southwest Airlines famously saved billions by hedging its jet fuel costs during the 2000s.

- The ‘Tanker Trade’ Can Affect Oil Futures Prices

- Oil traders sometimes buy physical crude oil and store it in tankers, waiting for higher prices in a contango market. This floating storage impacts oil futures market liquidity.

- Algorithmic Trading Dominates Oil Futures

- High-frequency trading (HFT) algorithms execute over 50% of futures trading volume, reacting to news, order flow, and price trends faster than human traders.

- Oil Futures Are Prone to Flash Crashes

- Sudden price collapses (flash crashes) can happen due to electronic trading malfunctions or massive stop-loss triggers. One example occurred in 2018 when oil prices dropped 7% in a matter of minutes.

- ‘The Widowmaker’—A Dangerous Spread Trade

- The natural gas futures spread trade between winter and summer contracts is nicknamed “The Widowmaker” because of its extreme volatility. Though unrelated to oil, it often moves in correlation, impacting oil-based hedging strategies.

Understanding the Risk Potential of Oil Futures Contracts

Like all futures trading, oil futures contracts come with significant risks:

- Leverage Risk: Futures contracts use leverage, meaning traders can control large positions with relatively small amounts of capital. However, leverage magnifies both gains and losses.

- Volatility Risk: Oil prices can swing wildly due to geopolitical events, natural disasters, or economic reports.

- Margin Calls: If a trader’s position moves against them, brokers may issue margin calls, requiring additional capital to maintain the position.

- Liquidity Risk: While oil futures are generally liquid, extreme events can lead to price gaps and limited exit opportunities.

- Regulatory Risk: Governments and regulatory bodies can impose new rules affecting oil trading. For example, position limits or increased margin requirements can change market conditions suddenly.

Case Studies: Real-Life Oil Futures Trading Lessons

Case Study 1: The 2020 Oil Price Crash

As mentioned earlier, WTI crude oil prices went negative in April 2020. Some traders who failed to roll over their contracts in time were forced to take delivery of oil, with no storage options available. The lesson: Always have an exit strategy before contract expiry.

Case Study 2: The 2008 Oil Price Surge and Crash

In 2008, crude oil surged to an all-time high of $147 per barrel, only to plummet to $33 by year-end. Many traders who went long near the peak suffered devastating losses. The takeaway? Markets can remain irrational longer than traders can stay solvent.

Case Study 3: How a Small Trader Profited from the Crack Spread

A trader noticed gasoline refining margins widening and strategically went long on gasoline futures while shorting crude oil. This classic crack spread trade yielded substantial profits as gasoline prices rose.

Why Cannon Trading Company is a Great Choice for Trading Oil Futures

For both new and experienced traders, having the right futures broker is essential. Cannon Trading Company stands out for several reasons:

- Wide Selection of Trading Platforms: Offering cutting-edge platforms like CQG, Rithmic, and Sierra Chart, Cannon Trading ensures traders have the best tools.

- TrustPilot 5-Star Ratings: With consistently high ratings, Cannon Trading has built a reputation for reliability and client satisfaction.

- Decades of Experience: Established in 1988, the firm has deep industry expertise in commodity brokerage and futures trading.

- Regulatory Excellence: Fully compliant with NFA and CFTC regulations, Cannon Trading provides a secure and transparent trading environment.

- Support for All Trader Levels: Whether trading e-mini futures, micros futures, or full-sized contracts, Cannon Trading accommodates all experience levels.

Trading oil futures contracts is a high-risk, high-reward endeavor requiring deep market knowledge. From forgotten trading techniques like the crack spread to modern risks such as algorithmic-driven volatility, futures traders must stay informed. Cannon Trading Company, with its best-in-class platforms, compliance, and experience, is an excellent choice for anyone looking to engage in future trading with confidence.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading