In today’s fast-paced and highly competitive futures markets, traders demand tools that offer speed, reliability, and intelligent features. The CannonX powered by CQG trading platform is engineered to deliver just that. With cutting-edge technology at its core and a legacy of trusted brokerage services, the CannonX futures platform offers an unparalleled experience for futures traders—whether they’re managing personal portfolios or operating on an institutional scale.

Let’s explore how this robust futures trading platform benefits from CQG’s powerful infrastructure, how long it has served traders and brokers, what makes it stand apart from other solutions, and why partnering with Cannon Trading Company is a strategic decision for anyone serious about trading futures.

Try a FREE Demo!

CQG: The Engine Behind CannonX

CQG has long been synonymous with institutional-grade technology in the trading world. For over four decades, they’ve built platforms known for precision, performance, and stability. By integrating CQG’s capabilities into Cannon Trading’s offering, CannonX powered by CQG becomes a high-caliber futures trading platform accessible to a broader range of clients.

The CQG engine within CannonX ensures ultra-low-latency trade execution, robust market data feeds, and a suite of advanced analytical tools. CQG’s proven performance in delivering global market access means traders on the CannonX futures platform can rely on real-time price updates, secure order routing, and deep functionality across assets.

What Makes CannonX a Superior Futures Trading Platform?

The CannonX powered by CQG trading platform was designed with one goal in mind: to empower futures traders with tools that are fast, flexible, and dependable. Several unique advantages set CannonX apart from its peers in the futures platform space.

- Institutional-Grade Performance

While many platforms cater only to retail users, CannonX draws on CQG’s infrastructure to offer features typically reserved for hedge funds and prop desks. This institutional trading platform provides the resilience and performance required for high-volume futures trading under any market condition.

- Highly Configurable Workspace

Traders can fully customize the layout, indicators, trade windows, and alerts within the CannonX interface. From chart styles to trading strategies, the CannonX futures platform adapts to individual preferences, allowing traders to optimize performance and visibility.

- Advanced Risk Management

Built-in controls allow for robust oversight. Traders and brokers alike can set risk thresholds, position limits, and account alerts in real time—essential for ensuring compliance and capital protection on a professional futures trading platform.

- Superior Market Data and Visualizations

With CQG’s market data integrated directly into CannonX, traders gain a real-time edge. Market depth, volume profiles, and technical overlays are delivered seamlessly, making the platform ideal for technical analysts and execution-focused professionals alike.

Try a FREE Demo!

CannonX Through the Years: How Long Has It Been Available?

The CannonX powered by CQG trading platform has been serving the futures trading community for multiple years. Since its debut, it has earned credibility and trust among professional traders and brokers, thanks to consistent platform improvements and close attention to user feedback.

Unlike newer platforms that may still be in testing phases, CannonX is a mature and battle-tested futures platform that has weathered volatile markets and high-volume days. This longevity ensures both reliability and user confidence.

A Streamlined Trading Experience

A defining feature of the CannonX futures platform is its seamless trade execution process. Every element is optimized to remove friction, reduce errors, and accelerate action.

- One-Click Order Entry with DOM Ladder

The integrated Depth of Market (DOM) window provides a fast, visual way to enter, adjust, and cancel orders. Whether using limit, market, or stop types, trades are executed with just one click, a hallmark of elite futures trading platforms.

- Built-In Advanced Order Types

CannonX supports a variety of intelligent order types—like trailing stops, OCOs, and bracket orders—enabling users to automate portions of their strategy without third-party add-ons. These tools make it easier to implement complex trades within an institutional trading platform environment.

- Lightning-Fast Order Routing

Because CannonX powered by CQG connects traders directly to exchanges via CQG’s global network, orders are placed with minimal delay. This ultra-low-latency routing is essential in trading futures, where every tick counts.

- Cross-Device Functionality

CannonX doesn’t limit traders to a desktop setup. The platform works seamlessly across desktops, laptops, and mobile devices. Traders remain connected to the markets, executing trades and managing positions on the go—yet another benefit of a truly modern futures platform.

Try a FREE Demo!

Why Cannon Trading Company Is a Top Brokerage for Futures Traders

The platform is only one part of the equation. The brokerage behind the CannonX powered by CQG trading platform—Cannon Trading Company—brings a wealth of experience, reliability, and service to the table.

- Over Three Decades of Brokerage Excellence

Cannon Trading Company has been guiding clients through the futures markets since 1988. Their decades-long presence speaks to their stability and deep understanding of client needs in futures trading.

- Spotless Regulatory Record

With a clean record among regulatory bodies such as the NFA and CFTC, Cannon Trading stands out for its ethical and transparent business practices. This integrity reinforces their value as a trusted broker when trading futures.

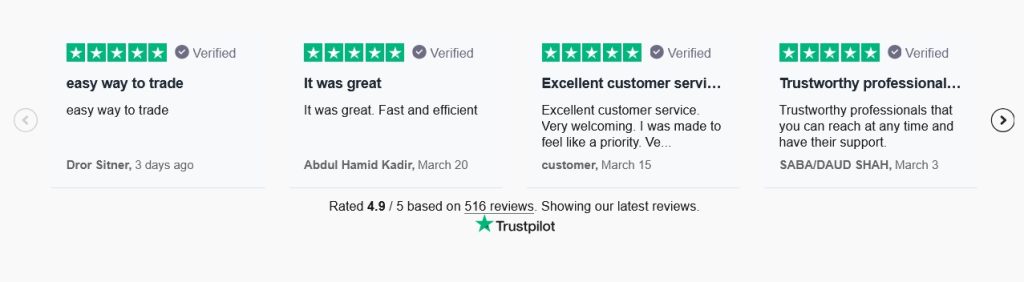

- Top-Tier Reputation on TrustPilot

The firm boasts an outstanding customer service record, reflected in its numerous 5-star reviews on TrustPilot. Clients repeatedly cite personalized support, timely responses, and comprehensive guidance as key strengths—benefits not easily found with every futures platform provider.

- Platform Variety and Expert Guidance

Beyond the CannonX futures platform, the brokerage offers access to a wide range of elite futures trading platforms, including R|Trader Pro, Bookmap, MotiveWave, and others. This flexibility allows traders to choose the tool that fits their strategy best, all under one brokerage account.

- Dedicated Support and Onboarding

Cannon Trading offers every client, regardless of experience level, direct access to human support. Whether it’s platform training or strategy discussion, they provide the kind of tailored service that’s rare in modern financial services.

Built for Everyone—Trusted by Pros

The beauty of the CannonX powered by CQG trading platform lies in its dual appeal. New traders appreciate the intuitive layout and responsive support, while seasoned pros tap into its deep order flow tools and low-latency routing.

The platform supports an environment where execution, analysis, and risk management occur within one cohesive framework—a key advantage for anyone engaged in trading futures at scale or across time zones.

The Smart Choice for Today’s Futures Traders

In a world where milliseconds and margin efficiency determine competitive edge, traders cannot afford to use outdated tools. The CannonX powered by CQG trading platform ensures that every trader—whether self-directed or institutional—is equipped with the tools to thrive in modern markets.

From its institutional backbone to its highly customizable interface, CannonX is more than just a futures trading platform—it’s a complete solution tailored to the demands of serious market participants.

Why CannonX and Cannon Trading Are a Perfect Pairing

If you’re searching for a platform that merges institutional-grade functionality with personalized service, look no further than the CannonX powered by CQG trading platform. Supported by Cannon Trading Company’s decades of experience, spotless reputation, and industry-leading customer service, this futures platform delivers unmatched performance and peace of mind.

Whether your focus is speed, customization, execution quality, or regulatory transparency, CannonX delivers on every front. It’s the perfect combination of innovative technology and brokerage expertise—a true competitive advantage for trading futures in 2025 and beyond.

Try a FREE Demo!

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading