By John Thorpe, Senior Broker

Over the course of the last 45 years, whether you own a small monopoly of commercial buildings or a condo on Oak street U.S.A. your investments are subjected to the actions of the Federal Reserve Bank.

The Federal Reserve Bank seeks to provide stability in the largest world economy through interest rate regulation. Its mandate is to use financial tools to satisfy two congressional mandates, 1: Full Employment and 2: Moderate Inflation to a 2% annualized rate; Move too far too fast in any direction with policy shifts and financial perils for all! may be in the offing. The economy could move too fast in the wrong direction or too fast in the right direction which can lead to an overheating and a bursting of an economic bubble. Look no further than Savings and Loan crisis in the 1980’s and 90’s, the Japanese housing market collapse in 1989 (Japan is currently still struggling with a zero interest rate environment 30 years later) the Dot Com bubble after Y2K and most recently , the housing market collapse, which began with the bankruptcy of Iceland, no one paid attention, then the bankruptcy of Ireland, again, no one paid attention, then the bankruptcy of Bear Stearns, some paid attention (what did any of these entities have to do with the value of our homes, we thought) then Lehman brothers collapsed in September of 2008 and everyone paid attention as our home prices collapsed.

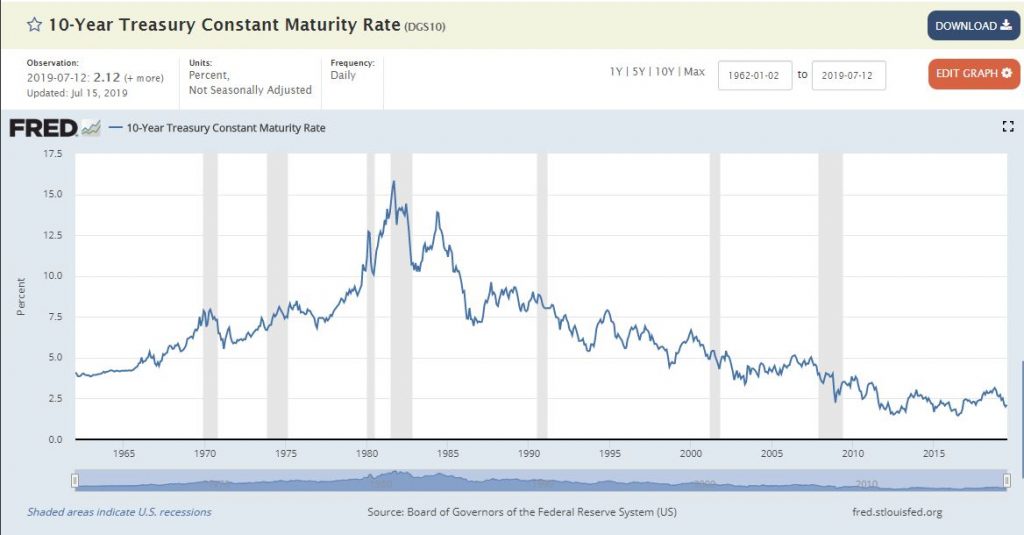

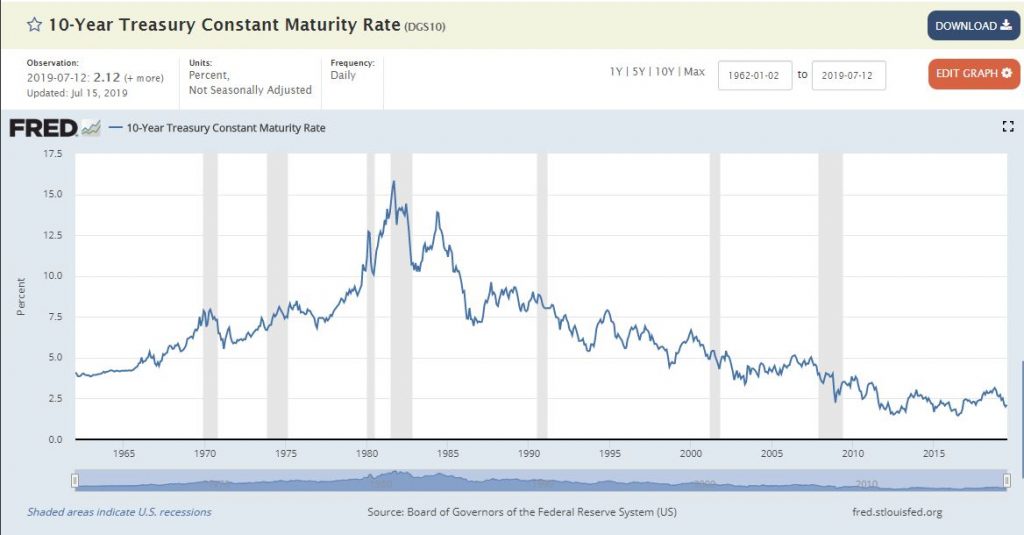

Use Google, DuckDuckGo, Bing or any of your favorite search engines and type in

10 yr. correlation with mortgage rates

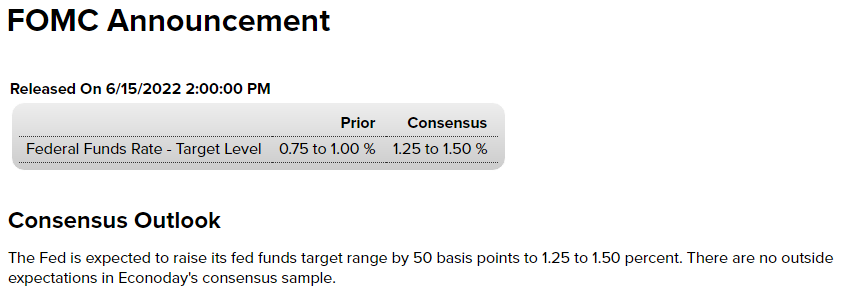

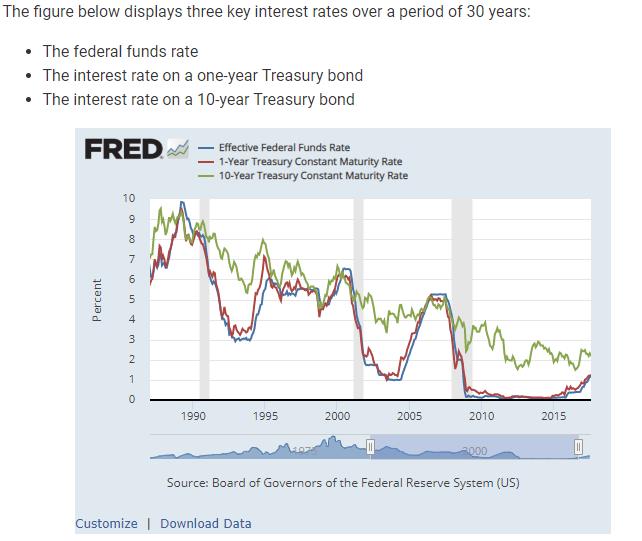

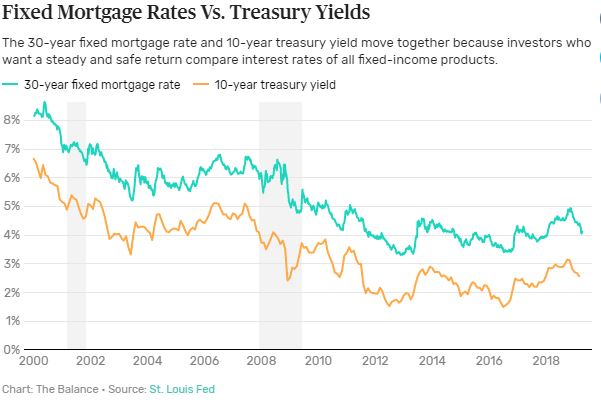

You will find search pages full of information about the importance of interest rate policy and its effect on mortgage rates, specifically the Fedfunds rate.

Whether you have a 30 yr fixed, a 15 yr fixed or a 5/1 ARM (usually capped after 5 years) you need to protect your largest investments by first understanding the tools available to the public to monitor these markets and second, knowing you can contact a professional to discuss the myriad of ways to hedge your real estate portfolio and be ready when you need to by utilizing the futures markets to protect your investments.

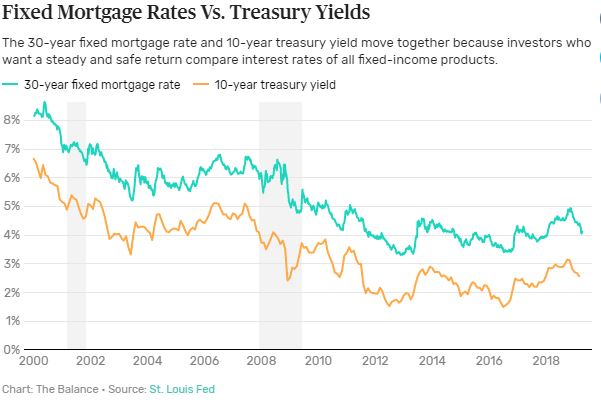

The hypothesis: Generally speakingand largely from region to region diversity, when interest rates go lower, home prices go higher. Lower interest rates lead to increases in the value of real assets. Mortgage rates are sensitive to changes in Fed Policy, the 10yr note being the reference financial instrument moves in response to market reactions to Fed policy shifts.

When interest rates go higher, a definite time lag exists in the long run may make home prices move lowerand real asset prices lower.

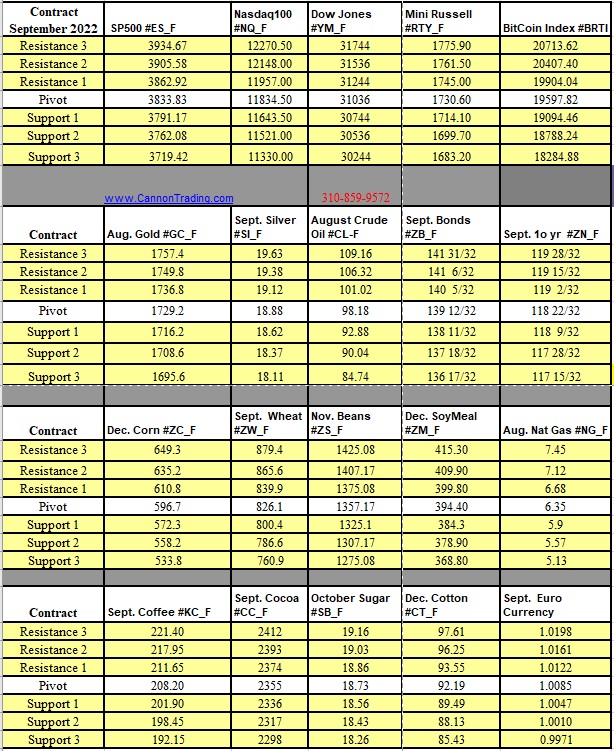

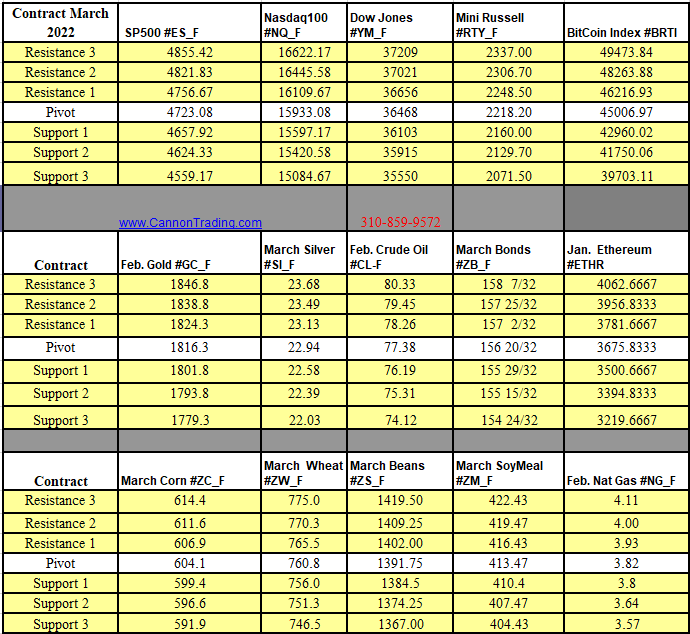

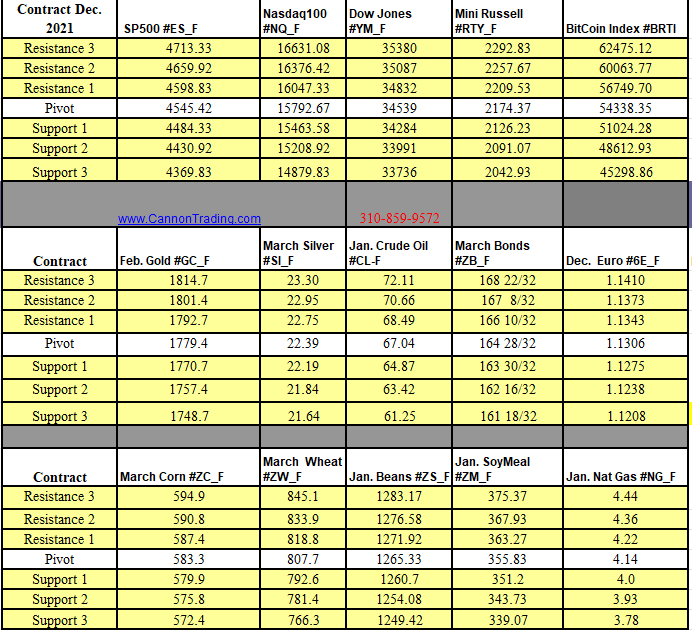

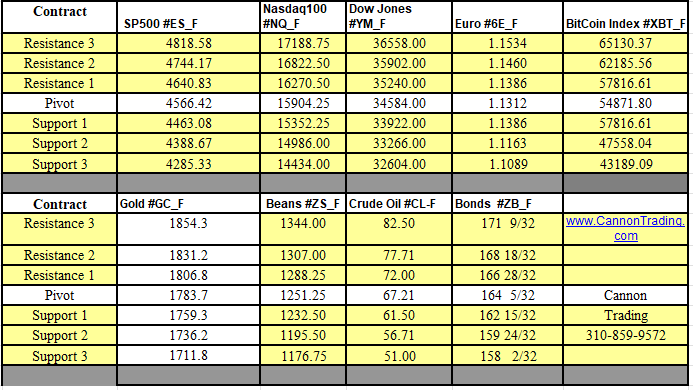

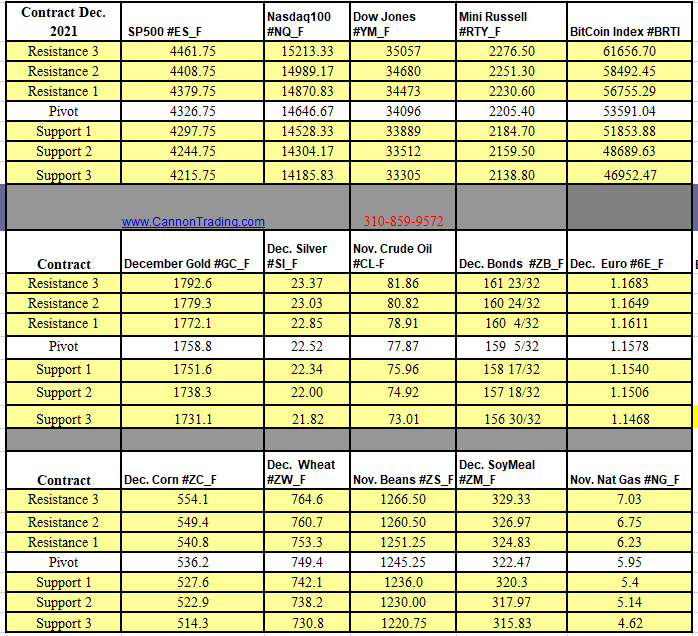

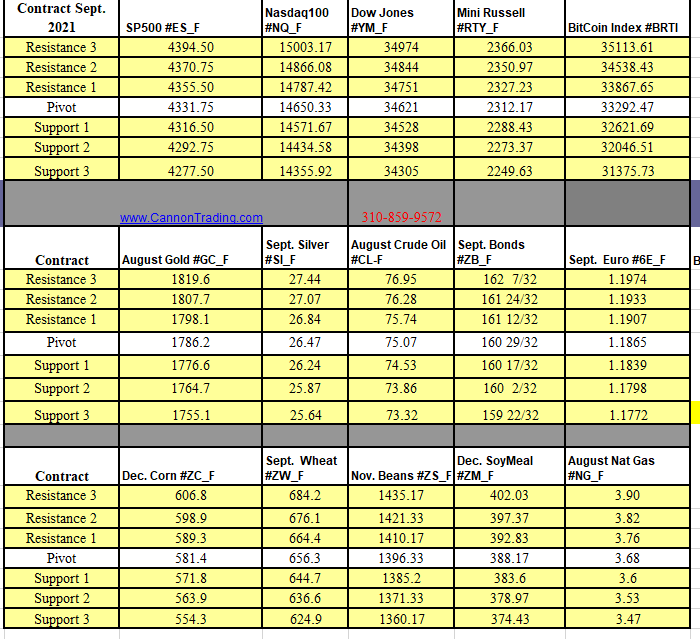

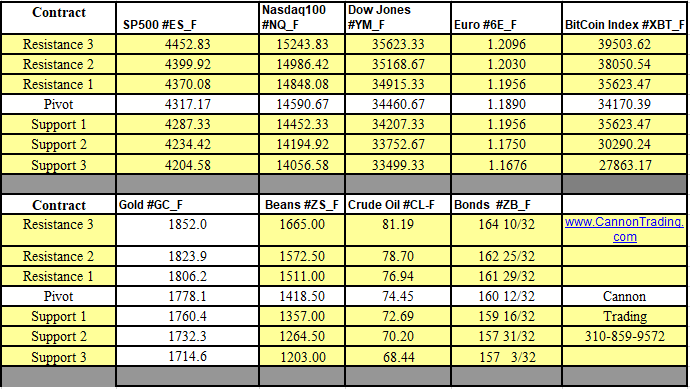

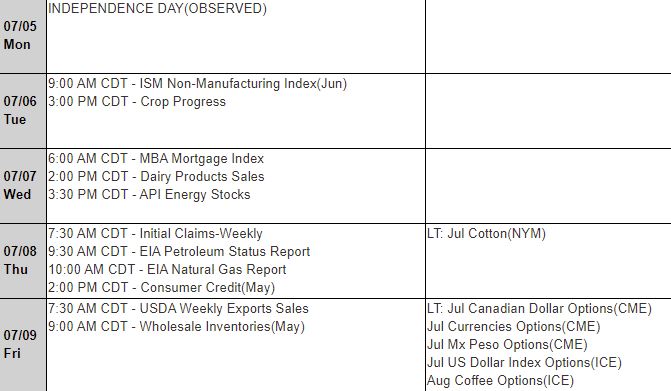

Watch futures market prices in the interest rate futures. Get comfortable watching the interest rate futures contracts.

I am by no means offering a pure hedge or even a short-term hedge in my analysis.

I believe what you will see and get a sense of the ebbs and flows of these markets from a visual perspective while you are learning about the base currency (US Dollar) valuation of real assets changing and thereby affecting not only the value of the real assets you hold but also the cost to maintain those assets. The interest rate futures markets give you the clearest picture of how policy equates to real rates for you, the mortgage holder. 10yr Note Futures prices and chart

Major trends that are a serious harbinger of future housing price changes are important to understand so you may act to preserve, maintain and profit from potential shifts in policy.

Between 2008 and 2012 during the last recession, a major fed policy tool used was a series of fed fund rate reductions (net effect is the cost of money becomes cheaper relative to real asset prices), these calculated moves lowered the interest rate on longer term debt obligations 10Yr. Note Futures Prices and Chart as well as all dollar denominated Treasuries.

As you can see, Mortgage rates, I mean the 10yr Treasury Note rates (Freudian slip, sorry), are still at or near all-time lows.

In Summary, Familiarizing yourself with the interrelationships among Mortgage rates, 10 year treasuries and fed fund policy shifts are an important starting point for a conversation with a professional about protecting your family’s biggest investment.

A Cannon Trading professional is available between 8:30am to 5:00pm Eastern to answer your questions Call Now

Disclaimer – Trading Futures, Options on Futuresand retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledgeand financial resources. You may lose all or more of your initial investment. Opinions, market dataand recommendations are subject to change at any time.