TradeTheNews.com Weekly Market Update: Strong tech earnings stoke optimism despite slow-moving US stimulus talks and COVID flare ups

Fri, 31 Jul 2020 16:06 PM EST

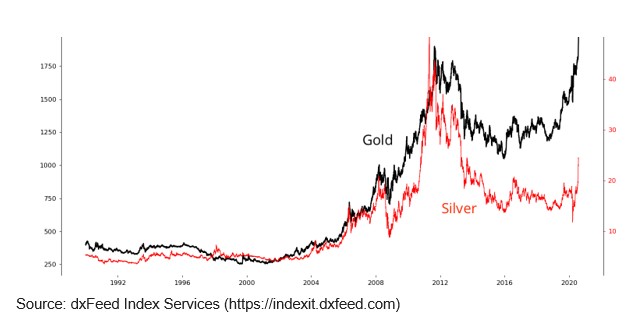

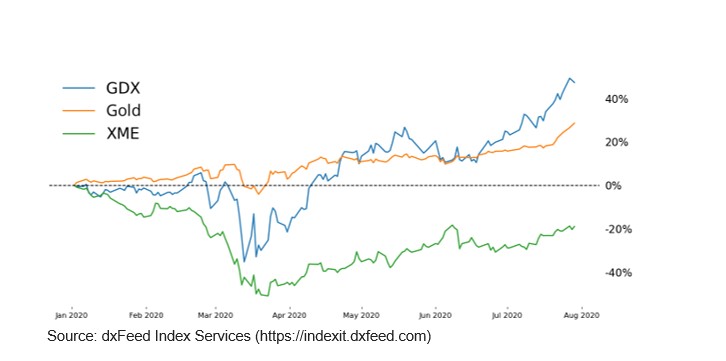

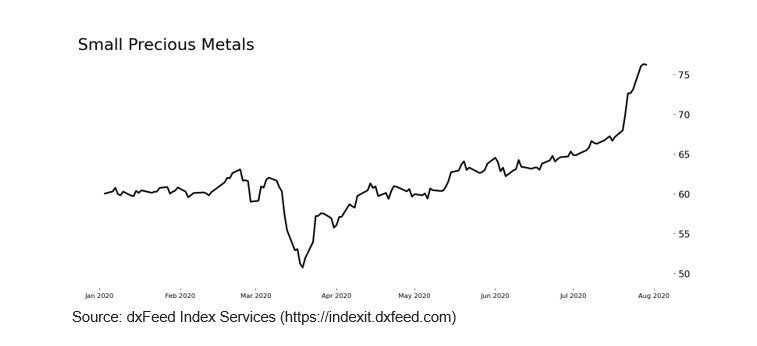

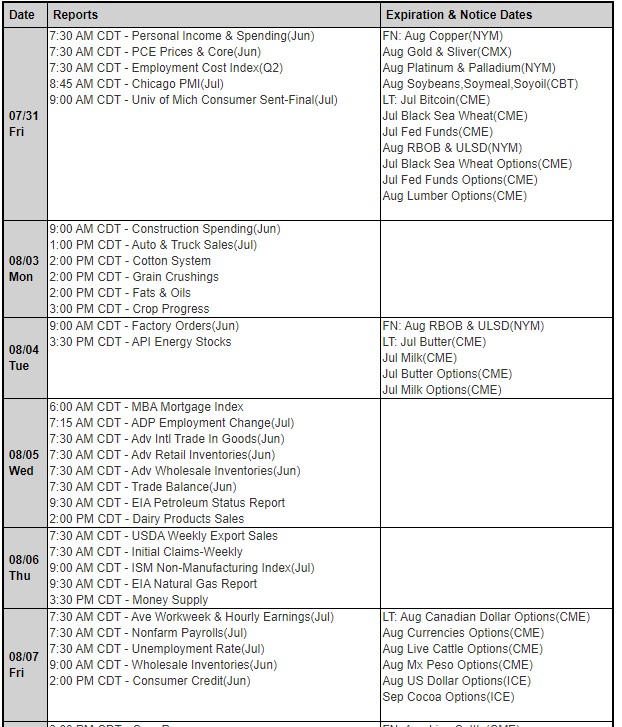

Investors had a litany of potential catalysts to navigate this week. Earnings season surged, while four high-profile US tech executives testified in front of a Senate panel the day before their firms reported astonishing quarterly numbers. The FOMC meeting concluded without and changes to policy, as expected. Chairman Powell explicitly expressed yet again that officials had no intention of even entertaining a discussion on raising rates anytime soon. There were some signs that US hotspots were seeing coronavirus infection rates start to slow, while other parts of the country, and various pockets outside the US were forced to confront resurgent Covid-19 numbers. Interest rates moved lower globally exacerbated by benign inflation readings in Europe and continued worries about the trajectory of the US economy. Adding to the unease was continued bickering in Washington D.C. Republican and Democratic leaders showed little inclination to find middle ground in the ongoing coronavirus stimulus talks. The US dollar continued to break lower while metals and bitcoin made new cycle highs. For the week, the S&P gained 1.7%, the DJIA lost 0.2%, and the Nasdaq surged 3.7%.

In corporate news this week, earnings season ramped into overdrive as reports from the big tech firms and over a third of the S&P 500 came in. Amazon blew away estimates again, guiding well above top-line consensus with improving margins, as spending flooded in from pandemic online shopping. Apple soared higher after posting its own monster third quarter and announcing a 4-for-1 stock split. Google shares fell after posting a decline in ad business and operating margin. Facebook advertising revenue topped expectations, as the social media giant continued to grow amid the pandemic and despite a boycott by many large advertisers. EBay beat on the top and bottom line and guided ahead of consensus as volumes spiked amid the pandemic spending influx. AMD posted an earnings beat and raised its revenue forecast as it gained semiconductor market share at the expense of Intel. Starbucks posted further coronavirus-induced losses but the coffee chain noted positive US SSS in July. McDonalds reported a weak quarter, posting a miss on EPS, though it, too, saw positive US comps in July. UPS notched a big beat on both its top and bottom line though it said it expects US Q3 demand growth to be lower sequentially. Exxon and Chevron results were disappointing, highlighting current difficulties in the oil patch environment. Enova announced it would acquire online lender OnDeck in a $90M deal, about 94% below its peak market valuation in 2015. Reports late in the week indicated Nvidia is in advanced talks to acquire Softbank’s semiconductor design company Arm for over $32B. On the regulatory front, a bipartisan duo of congressmen, Senators Blumenthal (D-CT) and Hawley (R-MO), called on the Department of Justice to probe Zoom and TikTok. And on Friday, the Trump administration was said to be preparing to order China’s ByteDance to sell its US TikTok operations.

TUES 7/28

MMM Reports Q2 $1.78 v $1.77e, Rev $7.18B v $7.27Be; On track for ~2B global respirators production

(US) Fed extends emergency lending programs by 3 months through Dec 31st to provide certainty to borrowers

*(US) JUL RICHMOND FED MANUFACTURING INDEX: 10 V 5E

*(US) JULY CONSUMER CONFIDENCE: 92.6 V 95.0E

(US) Dallas Fed July Texas Service Sector Outlook Survey: General Business Activity: -26.7 v +2.1 prior

EBAY Reports Q2 $1.08 v $1.06e, Rev $2.87B v $2.80Be

ONDK Enova to acquire OnDeck in $90M deal for $1.38/shr ($8M to be paid in cash)

SHOP Files $7.5B mixed securities shelf (7% of market cap)

LB Confirms to cut home office headcount by 15%; updates on progress in executing go-forward strategy; most Bath & Body Works and Victoria’s Secret stores in North America have reopened

WEDS 7/29

DBK.DE Reports Q2 Net -€77M v -€3.2B y/y, Pretax +€158M v -€946M y/y, Net Rev €6.29B v €6.20B y/y; Transformation is fully on track, raises FY20 Rev guidance

SAN.FR Reports Q2 Business EPS €1.28 v €1.31 y/y, Business Net €1.60B v €1.64B y/y, Rev €8.21B v €8.4Be; Raises Business EPS guidance

RIO.AU Reports H1 Underlying Net $4.75B v $4.3Be; underlying EBITDA $9.64B v $9.14Be; Rev $19.4B (consolidated sales) v $20.7B y/y; Affirms FY20 output guidance

RIO.AU CFO: China’s recovery is amazing, elsewhere is very weak – post earnings comments

GE Reports Q2 -$0.15 v -$0.14e, Rev $17.8B v $17.0Be; Sees positive Industrial FCF in FY21

SMG Reports Q3 $3.80 v $3.35e, Rev $1.49B v $1.32Be; Consumer purchases entering August are up 23% at our largest four retail partners and we’ve seen increases in every product category

BA Reports Q2 -$4.79 v -$2.93e, Rev $11.8B v $12.6Be; has close to $10B untapped credit

GM Reports Q2 -$0.50 v -$1.72e, Rev $16.8B v $20.5Be

R Reports Q2 -$0.95 v -$1.44e, Rev $1.90B v $2.00Be; now expects the recovery in the used vehicle market will be delayed beyond the company’s prior expectation of mid-2021

INTU Introduces QuickBooks Cash & Payments, a New Business Bank Account With a 1% Rate (Using GDOT Banking Lic)

(US) Nevada reports June casino gaming Rev $567M, -45.6% y/y; Las Vegas strip Rev $238.3M, -31.4% y/y

*(US) DOE CRUDE: -10.6M V -0.5ME; GASOLINE: +0.7M V -1.5ME; DISTILLATE: +0.5M V +0.5ME

DB1.DE Reports Q2 Net €288M v €288M y/y, adj EBITDA €483.1M v €482Me, Rev €778M v €724.8M y/y

005930.KR Reports Q2 Final (KRW) Net 5.5T v 5.18T y/y; Op 8.15T v 6.6T y/y (vs 8.10T prelim); Rev 52.97T v 56.13T y/y (vs 52.0T prelim)

*(US) FOMC LEAVES TARGET RANGE UNCHANGED BETWEEN 0.00-0.25%; AS EXPECTED; economy has picked up in recent months but still below pre-pandemic levels

THURS 7/30

AIR.FR Reports H1 Net -€1.9B v +€1.2B y/y, Adj EBIT -€945M* v +€2.5B y/y; Rev €18.9B v €20.27Be

RDSA.NL Reports Q2 -$2.33* v -$0.31e, Rev $32.5B v $91.8B y/y; Affirms dividend cut to $0.16/share [in line with announcement from April 30th]

BA.UK Reports H1 adj EPS 16.7p v 25.0p y/y, adj EBITA £895M v £999M y/y, Rev £9.87B v £9.42B y/y

066570.KR Reports final Q2 (KRW) Net 65.6B v 106B y/y; Op 495.4B v 652B y/y (493B prelim), Rev 12.8T v 15.6T y/y (12.8T prelim)

AZN.UK Reports Q2 Core EPS $0.96 v $0.93e, Rev $6.28B v $6.3Be

*(DE) GERMANY JULY NET UNEMPLOYMENT CHANGE: -18.0K V +41.0KE (1st decline in 4 months); UNEMPLOYMENT CLAIMS RATE: 6.4% V 6.5%E

*(DE) GERMANY Q2 PRELIMINARY GDP Q/Q: -10.1% V -9.0%E; Y/Y: -11.7% V -11.5%E (largest contraction since 1970)

*(EU) EURO ZONE JULY ECONOMIC CONFIDENCE: 82.3 V 81.4E

*(EU) EURO ZONE JUN UNEMPLOYMENT RATE: 7.8% V 7.7%E

JNJ Single dose of Johnson & Johnson COVID-19 vaccine candidate demonstrates robust protection in pre-clinical studies on non-human primates (NHPs) as demonstrated by ‘neutralizing antibodies’; Ad26.COV2.S Phase 3 trial to start in Sept to evaluate both one- and two-dose regimens of Ad26.COV2.S in parallel studies

UPS Reports Q2 $2.13 v $1.06e, Rev $20.5B v $17.3Be

PG Reports Q4 $1.16 v $1.01e, Rev $17.7B v $17.0Be

*(DE) GERMANY JULY PRELIMINARY CPI M/M: -0.5% V -0.3%E; Y/Y: -0.1% V +0.1%E

Z Launches nationwide strategic existing home selling partnership with D.R. Horton

*(US) Q2 ADVANCE GDP ANNUALIZED Q/Q: -32.9% (record decline) V -34.5%E; PERSONAL CONSUMPTION: -34.6% V -34.5%E

*(US) INITIAL JOBLESS CLAIMS: 1.43M V 1.45ME; CONTINUING CLAIMS: 17.02M V 16.20ME

*(US) Q2 ADVANCE GDP PRICE INDEX: -1.8% V 0.0%E; CORE PCE Q/Q: -1.1% V -0.9%E

(US) Pres Trump questions whether the election should be delayed until it can be done ‘properly, securely and safely’

ZM Sen Blumenthal (D-CT) and Sen Hawley (R-MO) call on Dept of Justice to probe Zoom and Tiktok – press

AMZN Reports Q2 $10.30 v $1.74e, Rev $88.9B v $81.6Be

GOOGL Reports Q2 $10.13 v $8.43e, Rev $31.6B (ex $6.7B of TAC) v $30.6Be

*(CN) CHINA JULY MANUFACTURING PMI (GOVT OFFICIAL): 51.1 V 50.8E (5th straight expansion)

FRI

NOKIA.FI Reports Q2 non- IFRS Net €316M v €258M y/y, Rev €5.1B v €5.24Be

*(FR) FRANCE Q2 PRELIMINARY GDP Q/Q: -13.8% V -15.2%E; Y/Y: -19.0% V -20.0%E

*(EU) EURO ZONE Q2 ADVANCE GDP Q/Q: -12.1% V -12.1%E; Y/Y: -15.0% V -14.5%E

*(EU) EURO ZONE JULY ADVANCE CPI ESTIMATE Y/Y: 0.4% V 0.2%E; CPI CORE Y/Y: 1.2% V 0.8%E

NVDA Reportedly in advanced talks to acquire Softbank chip company arm – press

CAT Reports Q2 $1.03 v $0.66e, Rev $10.0B v $9.20Be; Not providing FY20 outlook

*(US) JUN PERSONAL INCOME: -1.1% V -0.6%E; PERSONAL SPENDING: 5.6% V 5.2%E

*(US) JULY FINAL UNIVERSITY OF MICHIGAN CONFIDENCE: 72.5 V 72.9E

(US) Atlanta Fed GDPNow forecasts initial Q3 GDP growth at +11.9%

(US) NJ Gov Murphy: New Jersey transmission rate rises to 1.35; these numbers are ‘setting off alarms’

KSU PE firms reportedly discussing bid for KSU, could fetch $21B with debt – press