|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

- Bitcoin Futures (114)

- Charts & Indicators (306)

- Commodity Brokers (589)

- Commodity Trading (845)

- Corn Futures (64)

- Crude Oil (229)

- Currency Futures (102)

- Day Trading (658)

- Day Trading Webinar (61)

- E-Mini Futures (163)

- Economic Trading (166)

- Energy Futures (127)

- Financial Futures (178)

- Future Trading News (3,159)

- Future Trading Platform (326)

- Futures Broker (665)

- Futures Exchange (347)

- Futures Trading (1,265)

- futures trading education (446)

- Gold Futures (111)

- Grain Futures (101)

- Index Futures (271)

- Indices (233)

- Metal Futures (140)

- Nasdaq (79)

- Natural Gas (40)

- Options Trading (191)

- S&P 500 (145)

- Trading Guide (429)

- Trading Webinar (60)

- Trading Wheat Futures (45)

- Uncategorized (26)

- Weekly Newsletter (222)

Category: Future Trading News

As a high risk trading type, futures trading is not for someone who is faint-hearted. Though there are a number of different ways of investing in futures , it is important to stick to what you know. Treading into unknown waters is not something that you should do when dealing in futures.

From managing margins to ordering trades to doing market analysis and more if you want to, you can do that all by yourself – but you may betaking double the risk. Therefore, when trading in futures, it may be better to seek advice from a professional trader.

Professional trading experts at Cannon Trading can help you with your futures trading. We are also there to keep you updated with the latest on futures trading and market news. All the news and latest articles on futures trading are published on our site under the category Archive Futures Trading News, which you are currently browsing through. Read more and the latest here and keep updated.

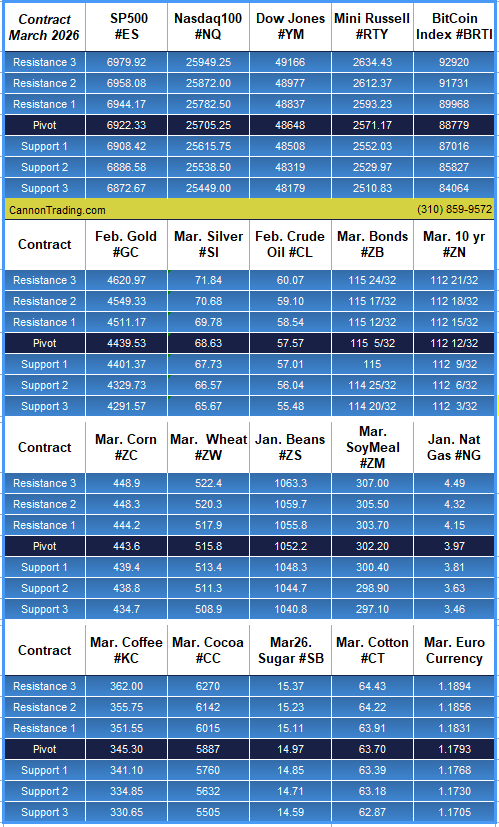

Christmas S&P 500 Trends, Santa Claus Rally Basics, July – Nov Bean Spread, Christmas Trading Schedule, Levels, Reports; Your 5 Important Can’t-Miss Need-To-Knows for Trading Futures on December 24th, 2025

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

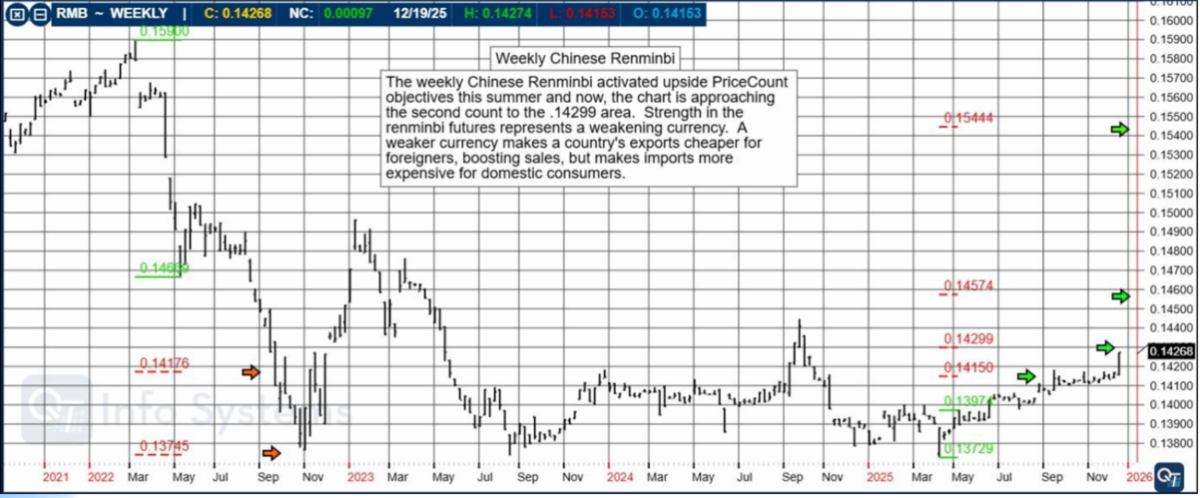

Happy Holidays from us to you! Weekly Chinese Renminbi, Levels, Reports; Your 4 Important Can’t-Miss Need-To-Knows for Trading Futures on December 23rd, 2025

|

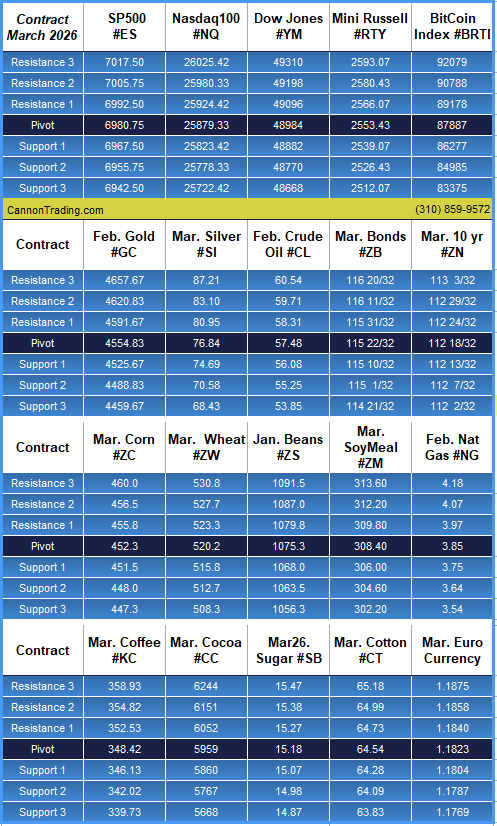

At-a-Glance Levels

| Instrument | S2 | S1 | Pivot | R1 | R2 | ||

|---|---|---|---|---|---|---|---|

Gold (GC)— Feb(#GC) |

4329.73 | 4401.37 | 4439.53 | 4511.17 | 4549.33 | ||

Silver (SI)— Mar. (#SI) |

66.57 | 67.73 | 68.63 | 69.78 | 70.68 | ||

Crude Oil (CL)— Jan (#CL) |

56.04 | 57.01 | 57.57 | 58.54 | 59.10 | ||

Mar. Bonds (ZB)— Mar (#ZB) |

114 25/32 | 115 | 115 5/32 | 115 12/32 | 115 17/32 |

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

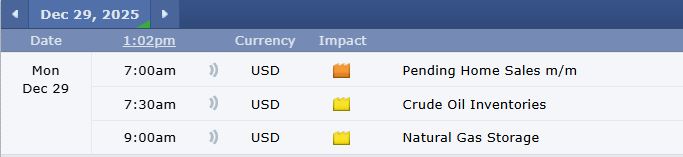

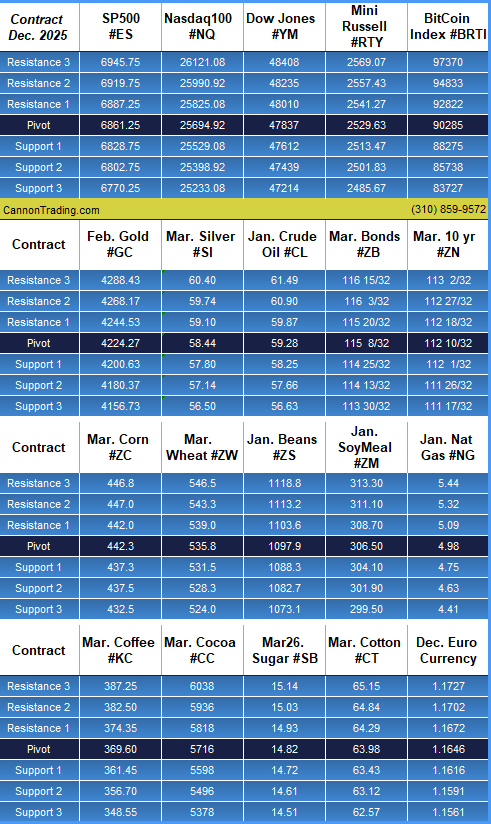

Christmas 2025 Trading Hours

Christmas 2025 Trading Hours

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

Triple Witching Friday, Automated Gold Algo Trading, Levels, Reports; Your 4 Important Need-To-Knows for Trading Futures on December 19th, 2025

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Futures Trading Blog

Blogs For Futures Trading

In the fast-paced, high-stakes world of modern finance, information is the currency that matters most. For retail and professional traders alike, the difference between a profitable week and a significant drawdown often hinges on access to timely, accurate, and actionable market analysis. This is where blogs for futures trading play a critical role. While the internet is flooded with generic financial advice, discerning traders know that few resources rival the depth, history, and reliability found in the ecosystem of Cannon Trading Company and its sister sites, E-Futures.com and E-Mini.com.

As pioneers who helped transition the industry from the shouting pits of the 20th century to the digital screens of the 21st, Cannon Trading has cultivated a reputation not just as a brokerage, but as a premier educational hub. This analysis explores how their decades of experience, commitment to transparent education, and integration of cutting-edge technology have cemented their status as leaders in the futures trading blog space.

The Evolution of a Pioneer: From the Pit to the Blogosphere

To understand why Cannon Trading’s content stands out among futures trading blogs, one must first understand their history. Founded in 1988, Cannon Trading established itself long before the “blog” was even a concept. They operated during an era where market information was gated, expensive, and slow. When the digital revolution arrived in the late 1990s, Cannon was among the first to pivot, launching online trading services in 1998.

This early adoption gave them a unique advantage. Unlike modern “influencer” blogs that often lack real-world trading experience, Cannon’s content is rooted in over 37 years of operational history. When their analysts write about market volatility or order flow, they are drawing on institutional knowledge that spans the 1987 crash, the Dot-com bubble, the 2008 financial crisis, and the post-pandemic inflation surge. This depth of experience is palpable in their daily market commentary, making their site a “must-read” futures trading blog for those seeking historical context alongside technical levels.

The Cannon Trading Blog: A Daily Essential for Traders

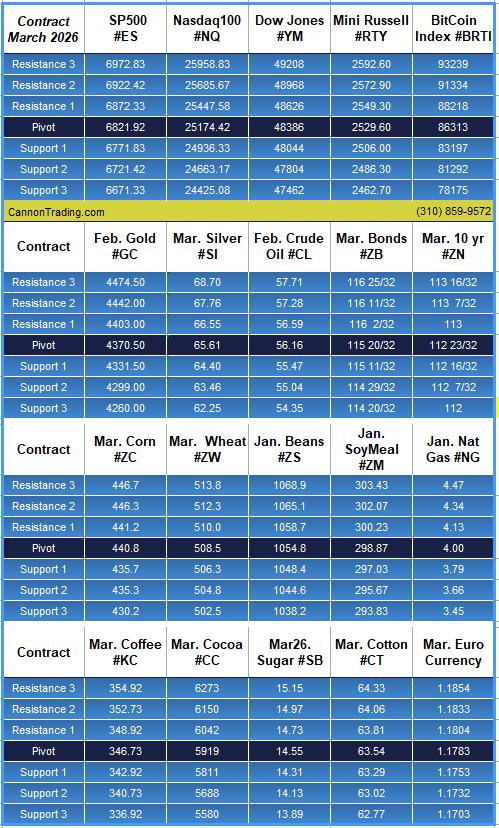

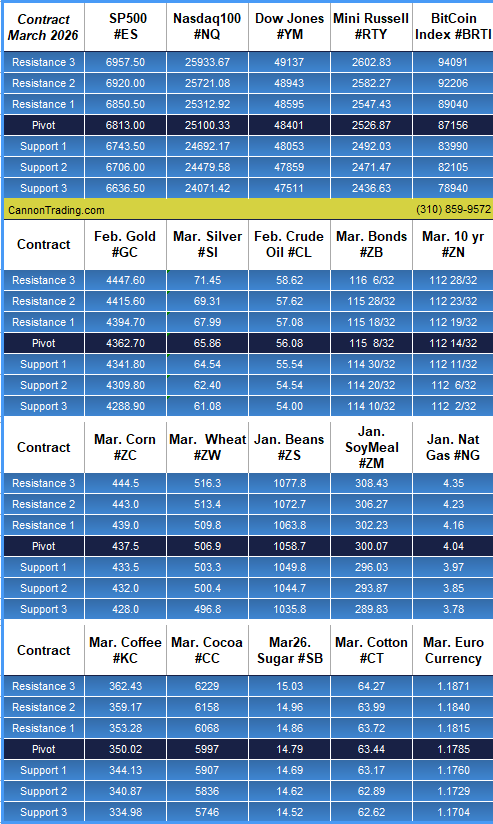

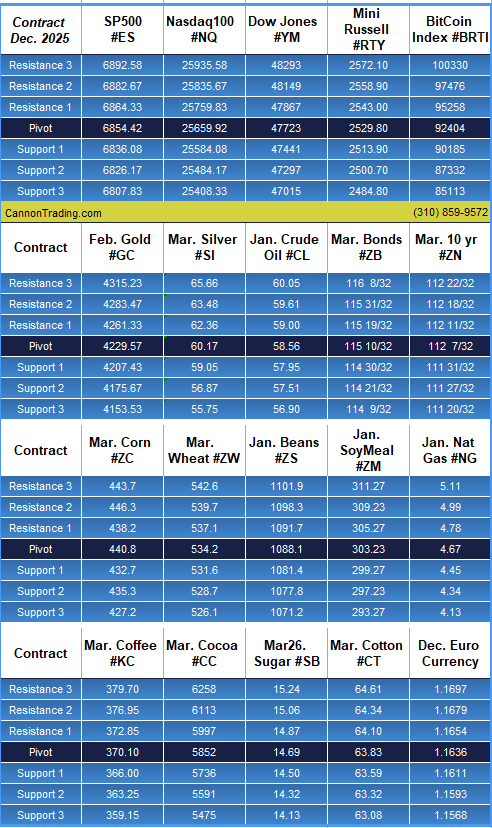

The core of Cannon’s educational offering lies in its primary blog. It distinguishes itself from other blogs for futures trading through its practical, trade-ready focus. While many competitors publish vague macroeconomic fluff, Cannon Trading focuses on “Daily Support & Resistance Levels.”

For active traders, these posts are invaluable. Every trading day, the blog provides specific price levels for major indices like the E-mini S&P 500, Nasdaq 100, and crude oil. These aren’t just computer-generated numbers; they are curated updates that help traders frame their day. A trader looking for futures trading blogs that offer actionable data will find Cannon’s approach refreshing. Instead of reading 1,000 words on why the market might move, they get a clear map of where buyers and sellers are likely to clash.

Furthermore, their “Weekly Newsletter” has become a staple in the industry. It often combines technical analysis with fundamental insights—such as the impact of new tariffs or Federal Reserve interest rate decisions—breaking down complex geopolitical events into clear trading scenarios. This ability to synthesize macro news with micro-market structure is a hallmark of a high-quality futures trading blog.

E-Futures.com: The Technical and Platform Authority

While Cannon Trading serves as the flagship, its sister company, E-Futures.com, offers a slightly different flavor of content that is equally vital. E-Futures has carved out a niche as a leader in platform education and technical tutorials.

In the world of online trading, the software is the trader’s weapon. If you do not know how to use your platform efficiently—how to set a trailing stop, how to configure a DOM (Depth of Market), or how to set up an OCO (One-Cancels-Other) order—you are at a severe disadvantage. E-Futures.com excels here. Their blog and resource sections often feature deep dives into platform capabilities, specifically for the “CannonX” platform powered by CQG.

Reviewing the futures trading blogs available today, few go into the granular detail that E-Futures does regarding execution. They understand that a great trade idea is useless if the execution is botched. By providing content that bridges the gap between strategy and software, E-Futures.com ensures its readers are not just knowledgeable about the market, but proficient in navigating it. This focus on “how-to” content complements the “what-to-trade” content found on the main Cannon site, creating a comprehensive educational loop.

E-Mini.com: Specialized Content for the Index Trader

The third pillar of this educational triumvirate is E-Mini.com. As the name suggests, this entity focuses heavily on the E-mini and Micro E-mini contracts. With the explosive popularity of the Micro E-mini S&P 500 (MES) and Micro E-mini Nasdaq (MNQ), a new wave of retail traders has entered the market. These traders need specific guidance on margins, contract specifications, and the nuances of leverage.

E-Mini.com serves as a specialized futures trading blog for this demographic. Their content demystifies the barrier to entry, explaining how smaller contract sizes allow for more precise risk management. Articles detailing “Day Trading Margins” and “Contract Specs” are crucial for newer traders who might be intimidated by the full-sized contracts. By segmenting this content onto a dedicated site, the Cannon group ensures that information is tailored and accessible, preventing new traders from being overwhelmed by institutional-level jargon found on other blogs for futures trading.

TrustPilot and the “Human” Element of Digital Blogging

One might ask: “Anyone can write a blog; how do I know this advice is trustworthy?” This is where the Cannon ecosystem truly separates itself from the pack. In an age of AI-generated content and anonymous financial gurus, Cannon Trading backs its futures trading blog with verified reputation.

A quick glance at TrustPilot reveals a near-perfect 4.9-star rating, a rarity in the brokerage world. What is fascinating is how these reviews often reference the educational support provided by the brokers. Reviewers frequently mention brokers by name—Ilan, Kimberly, Joe, Mark—citing how they helped explain a difficult market concept or walked them through a platform issue.

This relates directly to their blog strategy because the blog is essentially an extension of this personalized service. The articles are written or vetted by licensed Series 3 professionals, not freelance copywriters. When you read a piece on E-Futures.com about “The Risks of Over-Leverage,” it is backed by a firm that has spent 37 years helping clients manage that exact risk. This credibility is the currency that makes them a trusted futures trading blog. Readers know that the entity publishing this advice has a vested interest in their longevity and success, verified by hundreds of third-party reviews.

Smooth Trade Execution: The End Goal of Every Blog Post

Ultimately, the purpose of reading blogs for futures trading is to execute better trades. Cannon Trading and its sister companies understand this pipeline better than anyone. Their educational content is designed to lead directly to smooth trade execution.

When a trader reads about a “Key Resistance Level at 4500” on the Cannon blog, they need confidence that their broker can execute that trade instantly when the price hits. Cannon’s infrastructure, utilizing top-tier clearing relationships and robust platforms like CQG and Rithmic, ensures that the latency between “idea” and “execution” is minimal.

The blog educates the trader on where to click; the brokerage technology ensures the click counts. This synergy is often missing from independent futures trading blogs that act purely as publishers. Because Cannon, E-Futures, and E-Mini are brokerages first and publishers second, their content is inherently practical. They do not publish theoretical strategies that are impossible to execute due to slippage or liquidity issues. They publish what works, backed by the technology to make it happen.

A “Sister” Ecosystem: Why Three is Better Than One

The decision to maintain three distinct brands—Cannon Trading, E-Futures, and E-Mini—might seem redundant to an outsider, but it is a strategic masterstroke in the realm of futures trading blogs. It allows for specialization.

- Cannon Trading: The institutional voice. Focuses on macro trends, daily levels, and professional service.

- E-Futures: The technical voice. Focuses on platforms, software tutorials, and multi-asset diversity (grains, metals, energies).

- E-Mini: The retail voice. Focuses on accessibility, low margins, and index trading for the everyday trader.

This segmentation allows them to dominate the SEO landscape for blogs for futures trading. No matter what level of trader you are—a hedge fund manager hedging crude oil risk, or a retail trader scalping the Micro S&P—there is a specific site in their network speaking your language. This comprehensive coverage is why they remain leaders in the online futures blog space.

The Importance of SEO and Accessibility in Futures Education

In the digital age, accessibility is key. A futures trading blog is useless if traders cannot find it. Cannon Trading and its sister companies have optimized their content for modern search habits and LLM (Large Language Model) accessibility. Their articles use clear headers, bullet points for data (like margin requirements), and direct answers to complex questions.

This “Geo-agnostic” approach is vital. Futures trading is a global endeavor. A trader in London, Tokyo, or Sydney needs to access the same high-quality US market data as a trader in Chicago. Cannon’s blogs are designed to be globally accessible, providing time-zone relevant information (such as noting when reports are released in Eastern Time) and catering to a remote client base. Their rise as a trusted futures trading blog is partly due to this realization that the modern trading floor is digital and decentralized.

Personable Customer Service: The “Secret Sauce”

While this piece focuses on their blogs, one cannot decouple the content from the service. The reason Cannon Trading’s content resonates is the “personable customer service” ethos that underpins it.

Many futures trading blogs are dry and academic. Cannon’s content often feels like a conversation with a broker. They address common anxieties—fear of missing out (FOMO), the stress of margin calls, the discipline of waiting for a setup. This empathetic tone comes from their “Human Service Above Automation” philosophy. They know the psychological toll of trading because they have been on the phones with clients for three decades. This emotional intelligence makes their futures trading blog not just an analytical resource, but a psychological anchor for many traders.

The Gold Standard of Futures Blogging

In summary, Cannon Trading Company, along with E-Futures.com and E-Mini.com, has established a dynasty in the world of online trading education. They are not leaders simply because they have been around the longest, though their 1988 founding is significant. They are leaders because they have successfully translated that history into a digital format that empowers the modern trader.

Their ecosystem offers a masterclass in what blogs for futures trading should be: accurate, actionable, and backed by verified expertise. From the granular platform tutorials on E-Futures to the accessible entry-points on E-Mini, and the daily professional analysis on Cannon Trading, they cover every base.

For the trader seeking a reliable futures trading blog, the search often begins and ends here. The combination of positive TrustPilot reviews, decades of industry wisdom, personable service, and a seamless bridge between education and execution makes them the undisputed heavyweights of the sector. In a market defined by uncertainty, Cannon Trading provides the one thing traders need most: clarity.

FAQ: Futures Trading Blogs & Cannon Trading Services

Q: Why should I read blogs for futures trading instead of just watching news? A: Blogs for futures trading often provide more specific, actionable technical analysis than general financial news. For example, Cannon Trading’s blog provides specific support and resistance price levels for daily trading, whereas cable news typically covers broad economic trends that may not help with immediate trade execution.

Q: What makes Cannon Trading a trusted futures trading blog source? A: Cannon Trading is a licensed brokerage founded in 1988 with a clean regulatory record and a 4.9/5 rating on TrustPilot. Unlike anonymous financial bloggers, their content is produced by licensed professionals with decades of experience in the futures industry.

Q: Do E-Futures.com and E-Mini.com offer different content? A: Yes. While they are sister companies, their futures trading blogs focus on different niches. E-Futures often focuses on platform tutorials and technical software guides, while E-Mini focuses on index trading, micro contracts, and margin specifications for retail traders.

Q: Can I access these futures trading blogs from outside the United States? A: Absolutely. The content is optimized for global access. Whether you are trading from Europe, Asia, or South America, the futures trading blog content is relevant for anyone trading US-based futures markets like the CME Group products.

Q: How often is the Cannon Trading futures trading blog updated? A: Cannon Trading updates its blog daily with “Daily Support & Resistance Levels” and provides regular “Weekly Newsletters” and market commentary, ensuring traders have fresh data for every trading session.

Q: Does reading a futures trading blog guarantee profit? A: No. Futures trading involves substantial risk of loss and is not suitable for every investor. A futures trading blog is an educational tool to help inform your decisions, but past performance is not indicative of future results.

Q: How does the blog help with smooth trade execution? A: By providing clear technical levels and platform tutorials, the blogs help traders plan their trades in advance. Knowing exactly where to enter or exit (based on the blog’s analysis) and how to use the platform (based on E-Futures’ tutorials) leads to smoother, more confident trade execution.

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

CPI Delay Implications, March Wheat – Corn Spread, Levels, Reports; Your 4 Important Can’t-Miss Need-To-Knows for Trading Futures on December 18th, 2025

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

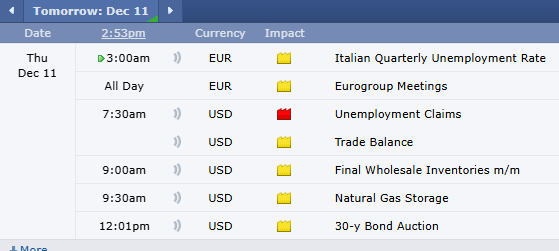

Interest Rate Cut, WEBINAR TOMORROW, January Soybeans, Levels, Reports; Your 5 Important Can’t-Miss Need-To-Knows for Trading Futures on December 11th, 2025

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

FOMC Day Strategy, NEW WEBINAR THURSDAY, Levels, Reports; Your 4 Important Can’t Miss Need-To-Knows for Trading Futures on December 10th, 2025

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

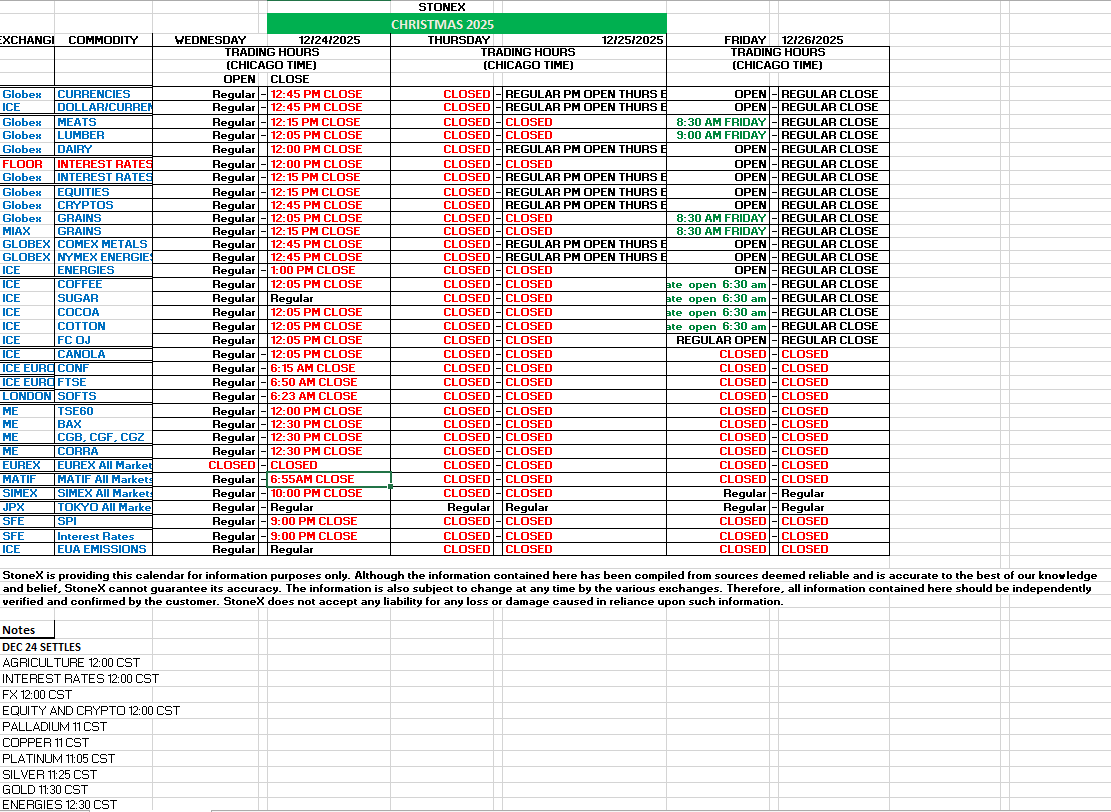

FOMC Announcement, Powell’s Speech Wednesday, Levels, Reports; Your 4 Quick but Important Can’t-Miss Need-To-Knows for Trading Futures on December 9th, 2025

|

At-a-Glance Levels

| Instrument | S2 | S1 | Pivot | R1 | R2 | ||

|---|---|---|---|---|---|---|---|

Gold (GC)— Feb(#GC) |

4180.37 | 4200.63 | 4224.27 | 4244.53 | 4268.17 | ||

Silver (SI)— Mar. (#SI) |

57.14 | 57.80 | 58.44 | 59.10 | 59.74 | ||

Crude Oil (CL)— Jan (#CL) |

57.66 | 58.25 | 59.28 | 59.87 | 60.90 | ||

Mar. Bonds (ZB)— Mar (#ZB) |

114 13/32 | 114 25/32 | 115 8/32 | 115 20/32 | 116 3/32 |

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010