Get Real Time updates and more on our private FB group!

How to Trade “Consolidation Patterns”

By John Thorpe, Senior Broker

There are a number of consolidation patterns: sideways ranges(rectangles), upward or downward sloping patterns or “flags” , triangular or Pennants. Today I have found on the Continuous Daily

Comex Gold chart to illustrate, several recent rectangle consolidation patterns. One recent rectangular consolidation with a false breakout followed by a confirmed breakout and one that is currently forming. A Consolidation rectangle pattern has clearly defined ranges defined by highs and lows that can be connected drawing horizontal lines.

The above chart reflects just this. There are three points of interest outside the two rectangles, on the first one from March to April there is an upside break out but on light volume, Rule #1.

Breakouts must occur on a closing basis on heavier than normal volume. You should not trade the breakout move on lighter volume. #2 wait for a retest of the previous resistance or support line. You will notice the high volume day after the breakout was on a failure of the retest. Good for you! a win, you didn’t fall for the breakout.

And #3, On April 29 had you worked a sell

GTC limit order at or around the retest level of 1917,1918,1919.00 (which you could have placed as early as April 25th) you would be short the breakout . Soon after, a new consolidation zone is created and we are still currently inside. You can see two bars outside the consolidation but NOT on a closing basis.

In Summary, look for one of these patterns which are some of the most common, Look for a high volume breakout and don’t get in until the market retests the previous support or resistance area, and try to manage your stop loss orders within the old consolidation areas!!

Important: Trading commodity futures and options involves a substantial risk of loss.

The recommendations contained in this letter are of opinion only and do not guarantee any profits.

Past performances are not necessarily indicative of future result

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

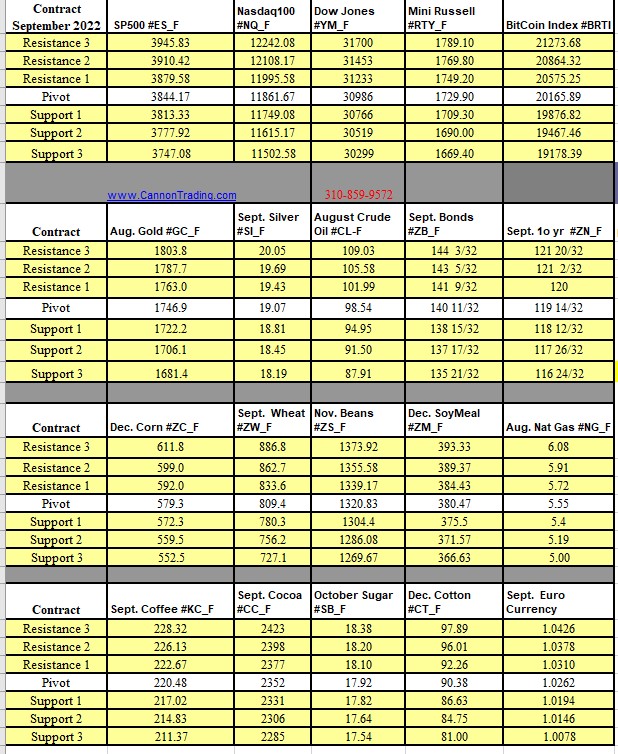

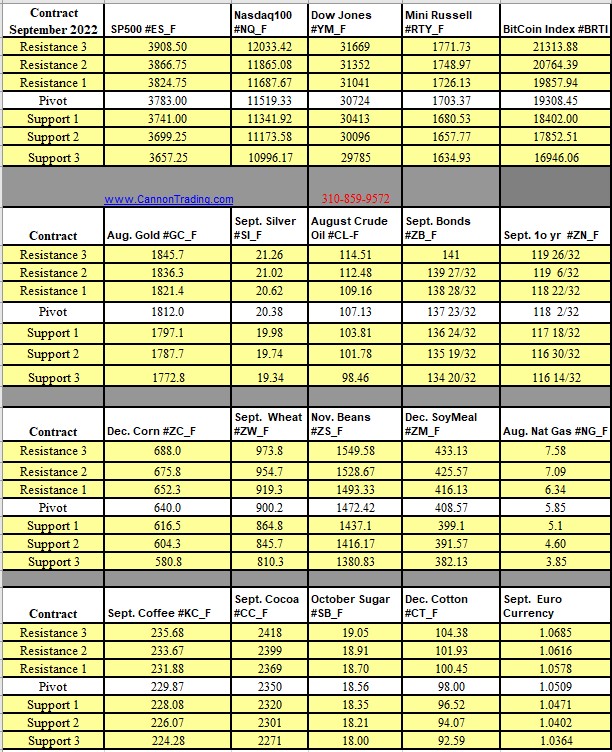

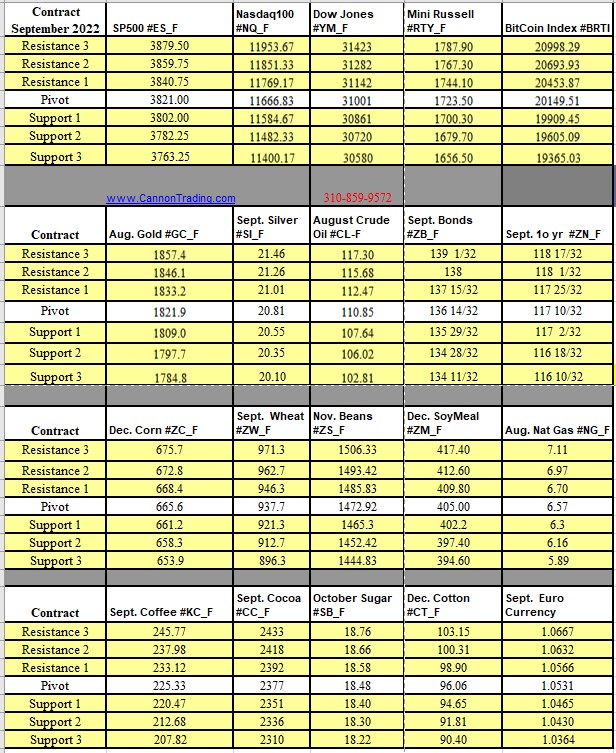

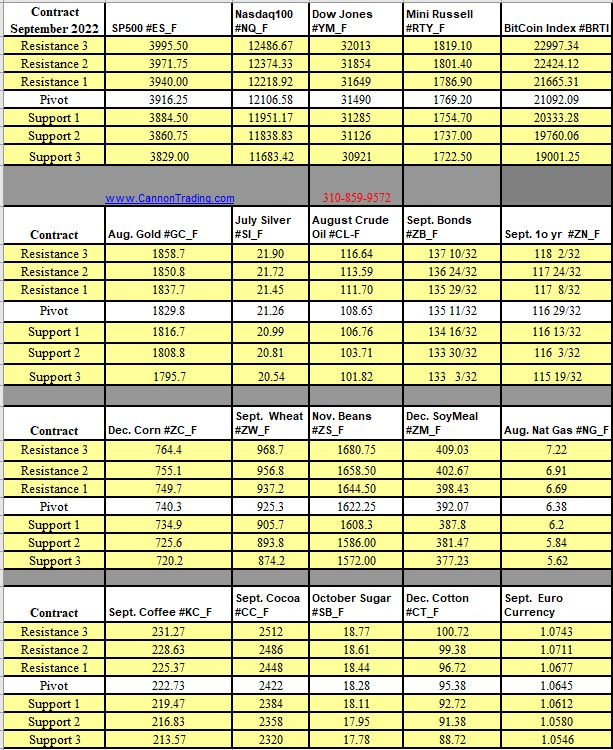

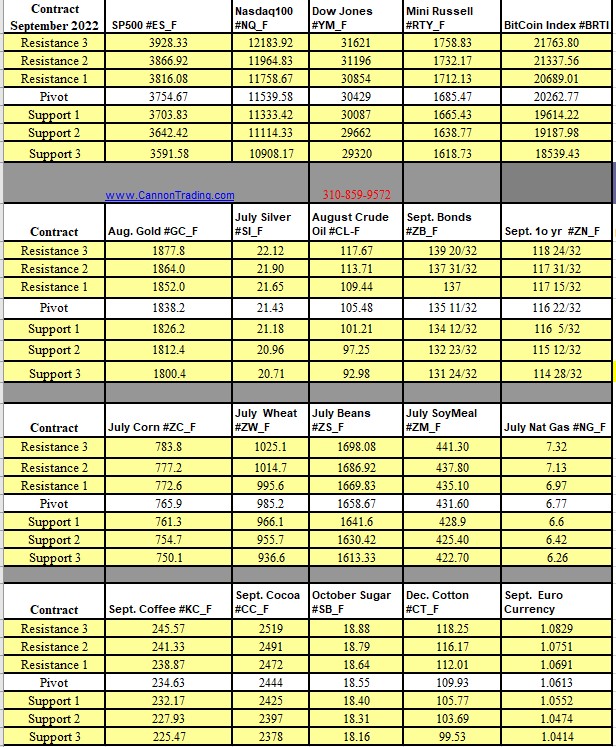

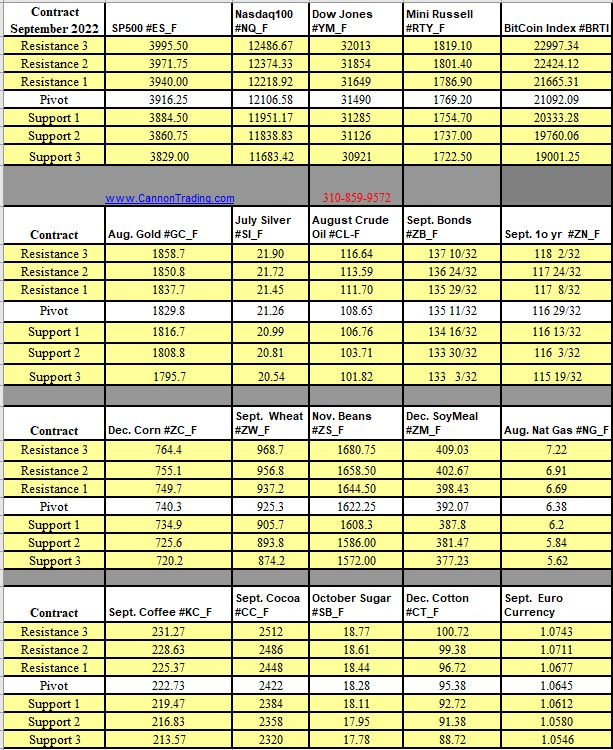

Futures Trading Levels

06-28-2022

Improve Your Trading Skills

Economic Reports, Source:

Forexfactory.com

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.