7 Shocking Pitfalls of Ignoring Class 3 Milk Futures in Your Trading Strategy

In the dynamic and multifaceted world of commodities trading, class 3 milk futures stand out as a unique and critical financial instrument. Designed primarily for dairy producers, processors, and traders, these futures contracts are integral to hedging against price volatility in the dairy market. As the global dairy industry evolves with increasing complexity, understanding the nuances of class 3 milk futures becomes imperative for traders, commodity brokers, and institutional investors. This paper explores the foundational aspects of class 3 milk futures, distinguishes them from other dairy-related futures, provides projections for the next three trimesters of 2025, and examines why Cannon Trading Company and its state-of-the-art platform, CannonX, are leading choices for futures trading.

What are Class 3 Milk Futures?

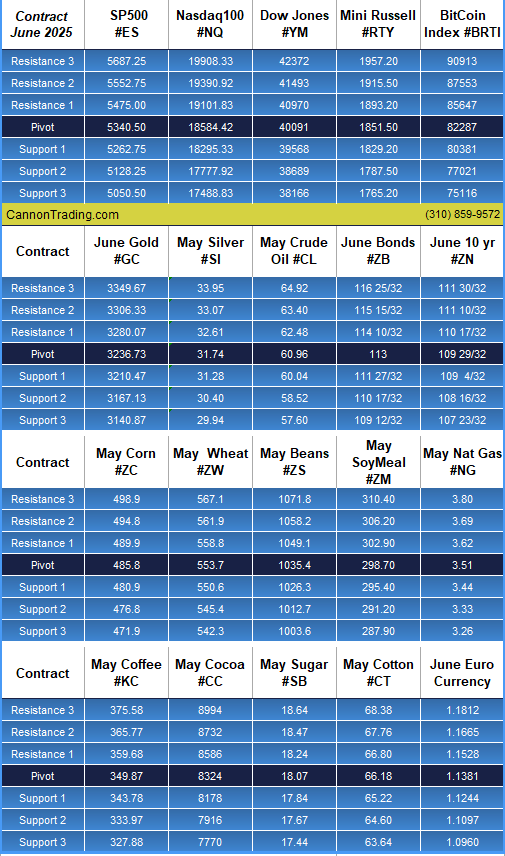

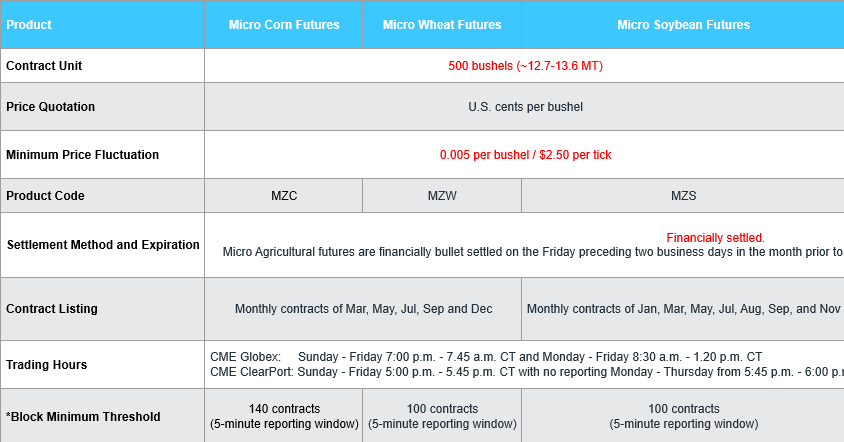

Class 3 milk futures are standardized financial contracts traded on the Chicago Mercantile Exchange (CME) that represent 200,000 pounds of milk, priced per hundredweight (cwt). These contracts are primarily utilized to hedge and speculate on the price movements of milk used in the production of cheese, which is why they are directly influenced by the supply and demand for cheese in the United States.

Milk is categorized into different classes based on its end-use. Class 3 milk pertains specifically to milk used in the manufacturing of hard cheeses such as cheddar. The price of class 3 milk is influenced by several factors including cheese prices, butterfat content, and protein values. Traders engaging in class 3 milk futures are essentially betting on the fluctuations of these key components within the dairy market.

The Relevance of “Class 3” in Futures Contracts

The term “class 3” in futures contracts denotes the categorization established by the U.S. Department of Agriculture (USDA) under the Federal Milk Marketing Orders (FMMO). Milk is classified into four main categories:

- Class 1: Milk used for fluid consumption.

- Class 2: Milk used for soft products like yogurt and cottage cheese.

- Class 3: Milk used for hard cheeses.

- Class 4: Milk used for butter and dry milk products.

Class 3 milk is particularly volatile due to the fluctuating demand and supply conditions in the cheese market. The futures contracts based on this class enable participants to manage risk associated with such volatility effectively.

Differentiation from Other Dairy Futures Contracts

Class 3 milk futures differ from other dairy futures contracts such as class 4 milk futures, nonfat dry milk futures, and butter futures in several key ways:

- Underlying Commodity: Class 3 futures are based on milk used specifically for cheese production, whereas class 4 milk futures pertain to butter and nonfat dry milk.

- Volatility: Due to the perishable nature of cheese and its demand dynamics, class 3 milk futures are generally more volatile, attracting speculators looking for short-term gains as well as hedgers needing robust risk management.

- Pricing Mechanism: Class 3 milk prices are calculated using the cheese, dry whey, and butterfat prices published by the USDA. This differs from the pricing mechanisms used in class 4 and other dairy futures.

- Market Participants: Class 3 milk futures attract a unique set of market players, including cheese manufacturers, large-scale dairy farms, institutional commodity brokers, and even speculative traders focusing on agriculture.

Historical Trends in Class 3 Milk Futures

Historically, class 3 milk futures have demonstrated notable price swings tied closely to macroeconomic indicators and agricultural policies. Over the past decade, prices have fluctuated between lows of around $12/cwt to highs exceeding $24/cwt. This variability often correlates with shifts in feed costs, weather patterns, and international dairy demand.

The COVID-19 pandemic further exposed the volatility inherent in dairy markets. Disruptions in supply chains, changes in consumer behavior, and export inconsistencies led to sharp price adjustments. These historical lessons underscore the critical role class 3 milk futures play in providing price certainty and risk mitigation in commodities trading.

Global Influence on Class 3 Milk Futures

The global market exerts considerable influence on class 3 milk futures. Key international developments—such as EU dairy subsidies, New Zealand milk production, and Chinese import policies—can ripple through U.S. markets.

- Export Demand: Nations such as Mexico, China, and South Korea are among the largest importers of U.S. dairy. Rising global cheese consumption can increase demand for class 3 milk, pushing futures prices upward.

- Geopolitical Events: Trade agreements and sanctions impact dairy exports and influence price dynamics. The U.S.-Mexico-Canada Agreement (USMCA) continues to affect milk futures through tariff structures and import quotas.

- Climate Change: Extreme weather events across the globe affect feed availability and animal health, influencing production costs and, consequently, class 3 milk futures prices.

Risk Management with Class 3 Milk Futures

Managing risk is essential in futures trading, and class 3 milk futures offer an efficient tool for this purpose. Dairy producers use these contracts to lock in prices, securing future revenue and planning capital expenditures more accurately. Processors and distributors also hedge to stabilize their input costs.

Strategies commonly employed include:

- Hedging through Direct Contracts: Locking in sales or purchase prices for future milk deliveries.

- Options on Futures: These provide flexibility and are used to protect against downside risk while preserving upside potential.

- Spread Trading: Traders take advantage of price differences between months or related commodities to mitigate risk.

These strategies allow participants to insulate themselves from adverse price movements, turning volatility into opportunity.

Forecasting Class 3 Milk Futures for 2025

First Trimester (January to April 2025)

Seasonal trends suggest an increase in class 3 milk futures prices during the early months of the year due to winter production slowdowns and elevated holiday cheese demand. Weather conditions affecting feed quality may also contribute to reduced milk output, tightening supply.

Second Trimester (May to August 2025)

Spring flush traditionally brings increased milk production, which could result in lower class 3 prices. However, if export demand for cheese rises, it may mitigate some downward pressure. Futures traders should monitor USDA reports and global cheese market dynamics during this period.

Third Trimester (September to December 2025)

The lead-up to the holiday season often sees increased cheese demand, leading to higher class 3 milk prices. In 2025, with anticipated growth in foodservice and retail sectors, this trend may be more pronounced, presenting a bullish outlook for class 3 milk futures contracts.

Cannon Trading Company and CannonX: Leaders in Futures Trading

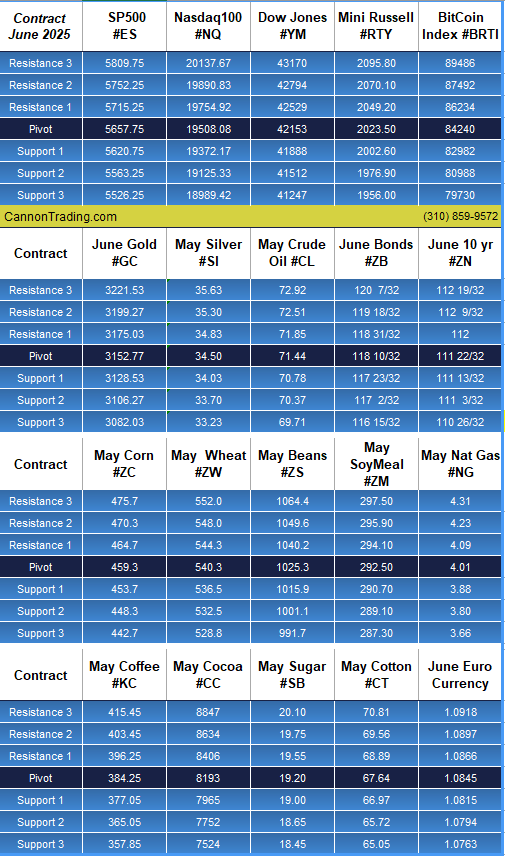

Cannon Trading Company has cemented its reputation as a premier commodity broker through decades of exemplary service, advanced technology, and a client-first approach. Particularly for those involved in trading futures like class 3 milk futures, CannonX—the firm’s proprietary platform—offers unmatched capabilities.

- Experienced Brokers: One of the most distinguishing features of Cannon Trading is the accessibility of seasoned brokers with decades of experience. Clients speak directly to knowledgeable professionals—there is no automated answering service acting as a barrier. This personalized touch ensures informed decision-making in real time.

- Top-Rated Service: With numerous 5 out of 5-star TrustPilot rankings, Cannon Trading Company has proven its commitment to customer satisfaction. Clients consistently praise its transparency, educational resources, and trading support.

- Best Trading Platform Futures: CannonX ranks among the best trading platform futures options on the market. With its intuitive interface, real-time analytics, and broad asset class integration, it supports all kinds of futures contracts, including class 3 milk futures.

- Free Top-Performing Platforms: Traders gain access to a wide selection of FREE, top-performing trading platforms tailored to various strategies and preferences. Whether you’re interested in mobile trading, algorithmic strategies, or manual order entry, Cannon has a solution.

- Industry Trust and Compliance: Cannon Trading Company maintains an exemplary reputation with industry regulators, underscoring its integrity and commitment to ethical commodity trading practices.

- Commodities Trading Education: Cannon provides a rich library of resources—from webinars to tutorials—that equip clients with the tools needed for successful commodities trading. These materials cover everything from class 3 milk futures to broader futures trading methodologies.

- Scalable Solutions for All Traders: Whether you’re a retail trader new to trading futures or a seasoned commodity broker managing institutional accounts, Cannon Trading Company offers flexible solutions that scale with your needs.

As the commodities trading landscape continues to evolve, class 3 milk futures remain a vital tool for hedging and speculation in the dairy sector. Understanding their unique attributes, market dynamics, and forecasted trends for 2025 is crucial for effective trading. Cannon Trading Company, with its robust platform CannonX, emerges as a superior choice for both novice and seasoned traders. From expert brokers just a call away to unparalleled customer satisfaction and regulatory trust, Cannon sets the benchmark in futures trading.

In an increasingly complex market, success in commodities trading depends not only on knowledge and timing but also on the right platform and support system. For anyone looking to succeed in class 3 milk futures, Cannon Trading Company offers not just a trading platform, but a strategic partnership.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading(Instagram)

@cannontrading(X)

Cannon Trading on Facebook

E-Futures on Facebook