|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

- Bitcoin Futures (114)

- Charts & Indicators (309)

- Commodity Brokers (589)

- Commodity Trading (846)

- Corn Futures (64)

- Crude Oil (230)

- Currency Futures (102)

- Day Trading (658)

- Day Trading Webinar (61)

- E-Mini Futures (163)

- Economic Trading (166)

- Energy Futures (127)

- Financial Futures (181)

- Future Trading News (3,164)

- Future Trading Platform (327)

- Futures Broker (665)

- Futures Exchange (347)

- Futures trade copier (1)

- Futures Trading (1,268)

- futures trading education (446)

- Gold Futures (113)

- Grain Futures (101)

- Index Futures (271)

- Indices (233)

- Metal Futures (144)

- Nasdaq (79)

- Natural Gas (40)

- Options Trading (191)

- S&P 500 (145)

- Trading Guide (433)

- Trading Webinar (60)

- Trading Wheat Futures (45)

- Uncategorized (26)

- Weekly Newsletter (224)

Category: Future Trading Platform

A futures trading platform is a single or a group of softwares that it used for enabling Online Futures Trading. The plus point about trading futures is that it enables you as the trading party to leverage both big and small moves. With our future trading platforms you can benefit in a number of ways. Firstly, they provide you with speedy access at any given point of time.

Secondly, they aid you in figuring out which trading method you should use so as to make the best out of the trade. The outcome is that you are able to manage your money, time as well as risk better. Offering futures trading platforms like Ninja Trader, OEC Trader, Shogun Trade Executer. CQG QTrader and more, Cannon Trading can aid you when it comes to commodity and futures trading. Under this particular archive we have detailed the futures trading platforms that we offer.

What we want from you as our trusted users and readers is to read through all the links provided so as to get some idea about how these futures trading platforms function. Although we are always there to advise, being equipped with information is crucial for every person interested in trading.

Futures Traders – 5 Important Facts to Know When Selecting Your Futures Broker

Why skilled futures brokers matter – They provide expertise, guidance, and support in navigating complex futures markets.

Decades of proven experience – Cannon Trading Company brings a long history of trusted service to futures traders.

Cutting-edge trading platforms – Access advanced technology, including CannonX powered by CQG, for professional-grade execution.

Recognized trust and credibility – 5-star TrustPilot reviews highlight customer satisfaction and reliability.

Try a FREE Demo!

In the fast-moving world of futures trading, the presence of a skilled broker often makes the difference between long-term success and costly mistakes. Trading futures requires more than just market knowledge; it demands access to advanced platforms, fast execution, leverage, hedging strategies, and—most importantly—expert guidance when systems fail or emergencies arise.

For futures traders, a futures broker isn’t just a service provider—it’s a lifeline. The broker connects traders to the markets, offers valuable tools for risk management, and provides real-time support when technology fails. This article will explore why skilled futures brokers are vital to every futures trader’s experience, focusing on practical aspects like leverage, diversification, and hedging. It will also demonstrate how Cannon Trading Company embodies these traits through its decades of industry expertise, impeccable regulatory reputation, and top-tier trading platforms like CannonX powered by CQG.

Why Skilled Futures Brokers Are Vital for Futures Traders

-

Access to Leverage

Leverage is one of the most compelling features of futures trading. It allows futures traders to control large contract values with relatively small amounts of margin. A skilled broker ensures traders understand the double-edged nature of leverage—while it amplifies gains, it can also magnify losses.

- Risk education: Brokers help clients assess how much leverage is appropriate for their strategy.

- Margin monitoring: They provide tools and alerts so that futures traders don’t face unexpected margin calls.

- Real-time execution: A broker ensures that leveraged positions are entered and exited quickly, minimizing slippage.

At Cannon Trading Company, brokers work closely with clients to ensure leverage is used responsibly, protecting traders from common pitfalls.

-

Diversification Across Markets

Diversification is another crucial reason a skilled broker matters. Trading futures isn’t limited to one asset class—it spans commodities, currencies, stock indexes, interest rates, and even cryptocurrencies.

- Market access: Brokers open the door to global exchanges, enabling traders to spread risk across different sectors.

- Research support: They provide market insights that help traders identify uncorrelated opportunities.

- Platform technology: Advanced platforms like CannonX powered by CQG give futures traders the ability to track multiple asset classes simultaneously.

By offering a wide range of futures contracts, Cannon Trading empowers its clients to diversify intelligently, reducing portfolio volatility.

-

Hedging Strategies

Hedging is a defining feature of futures trading. Farmers, corporations, and financial institutions use futures contracts to protect against adverse price movements. But hedging can be complex, requiring the expertise of a skilled broker.

- Customized strategies: Brokers help tailor hedges to each client’s specific risk exposure.

- Execution speed: Proper hedges must be executed quickly and accurately.

- Guidance: Brokers provide real-world advice on whether a hedge is effective or needs adjustment.

Cannon Trading Company has decades of experience helping businesses and individual futures traders manage risk through effective hedging strategies, demonstrating its role as a trusted partner.

-

Emergency Support When Systems Fail

No matter how advanced technology becomes, systems can fail. Trading platforms may crash, internet connections may drop, or servers may experience downtime. In these critical moments, futures traders need immediate access to their broker.

- Phone execution: A skilled broker is just one phone call away to enter or exit positions.

- Crisis management: Brokers ensure clients can flatten positions to avoid catastrophic losses.

- Reliability: Traders gain peace of mind knowing they’re never alone in an emergency.

Cannon Trading’s personalized service and accessible team mean traders can rely on fast, human intervention in high-stress moments. This direct support has earned them numerous 5-star TrustPilot ratings.

-

Education and Mentorship

For both beginners and advanced futures traders, education is a cornerstone of success. A skilled broker doesn’t just process trades; they mentor clients on strategies, risk management, and platform use.

- Beginner guidance: Helping new traders understand margin, contract specifications, and order types.

- Advanced support: Assisting experienced traders with algorithmic tools and advanced platform features.

- Educational resources: Many brokers offer webinars, guides, and one-on-one training.

Cannon Trading Company has built its reputation on transparency and education, making sure traders are well-prepared before risking capital.

How Cannon Trading Company Embodies These Traits

Decades of Experience

Founded in 1988, Cannon Trading has decades of expertise in futures trading. This longevity reflects not only its ability to adapt to market changes but also its commitment to integrity and client service.

Reputation with Regulators

Cannon Trading maintains an exemplary record with both federal regulators and independent industry bodies. This compliance gives futures traders confidence that they are working with a trusted and secure partner.

Dozens of satisfied clients have awarded Cannon Trading 5 out of 5 stars on TrustPilot. These reviews often highlight the company’s responsiveness, personalized service, and expert guidance in trading futures.

Advanced Platforms: CannonX Powered by CQG

Technology is at the heart of modern futures trading. Cannon offers a wide selection of platforms, but its flagship CannonX powered by CQG stands out:

- Ultra-low latency execution for high-frequency traders.

- Advanced charting and analytics for in-depth technical analysis.

- Global connectivity to major exchanges, ensuring futures traders never miss an opportunity.

By combining human expertise with cutting-edge technology, Cannon Trading provides a balanced ecosystem for every futures trader.

Related Blog Posts from Cannon Trading Company

To deepen your knowledge, explore these authoritative posts authored by Cannon Trading Company:

- Trading Styles in Futures: Concepts for Futures Traders | Cannon Trading Blog

- Hedging Futures: Managing Risk in Financial Markets | Cannon Trading

- Popular Futures Trading Strategies and Tools for Today’s Market

Each resource reflects Cannon’s ongoing mission to educate and empower futures traders.

Frequently Asked Questions (FAQ)

- Why is a skilled futures broker important?

A skilled broker ensures proper use of leverage, diversification, hedging strategies, and provides emergency support when systems fail. - How does Cannon Trading support clients during emergencies?

Cannon brokers are one phone call away, ready to execute trades when platforms or systems fail, giving traders peace of mind. - What platforms does Cannon Trading offer?

Cannon provides multiple platforms, with CannonX powered by CQG being the flagship choice for serious futures traders. - What makes Cannon Trading trustworthy?

Decades of industry experience, 5-star TrustPilot reviews, and an exemplary record with regulators showcase Cannon’s reliability. - Can Cannon Trading help new traders?

Yes, Cannon offers educational resources, personalized support, and mentorship for beginners entering futures trading.

The world of trading futures is both exciting and challenging. Success requires more than market knowledge; it requires the expertise, support, and technology that only a skilled broker can provide. From managing leverage and diversification to ensuring traders have immediate help during emergencies, brokers play an irreplaceable role.

Cannon Trading Company exemplifies all these qualities—backed by decades of experience, a stellar regulatory reputation, 5-star TrustPilot ratings, and advanced platforms like CannonX powered by CQG. For futures traders looking for reliability, education, and execution speed, Cannon stands out as a top choice in the industry.

Try a FREE Demo!

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

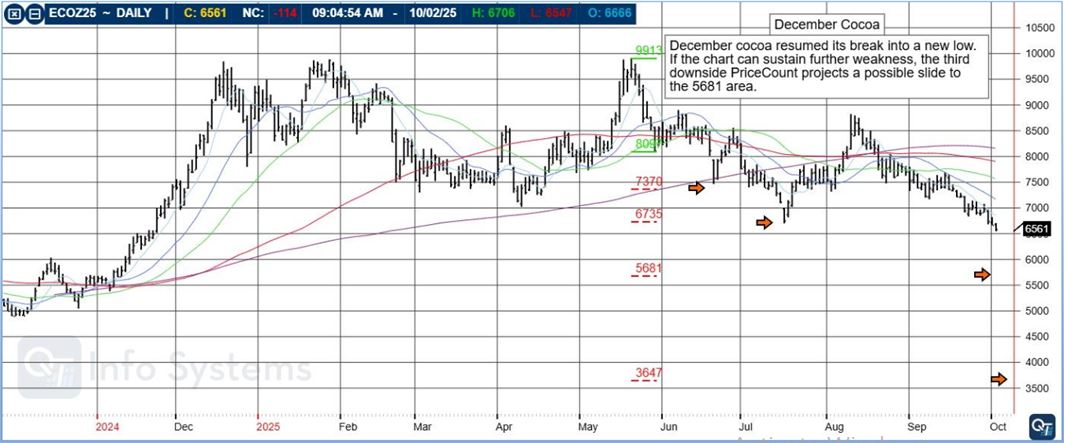

Trade and Risk Management, December Cocoa, Levels, Reports; Your 4 Important Must-Knows for Trading Futures on October 3rd, 2025

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

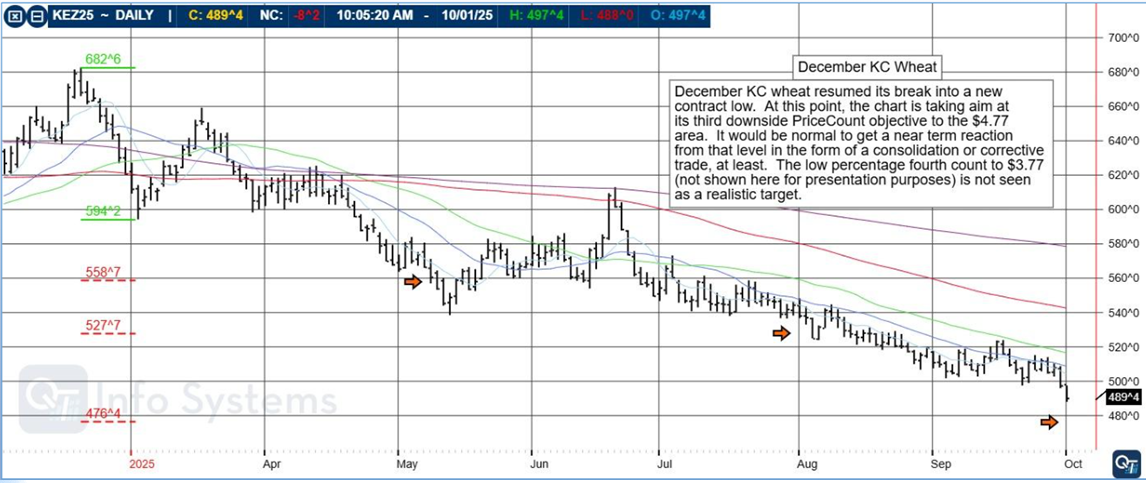

First Notice/Last Trading Days of October, Kansas City Wheat, Levels, Reports; Your 4 Important Must-Knows for Trading Futures on October 2nd, 2025

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

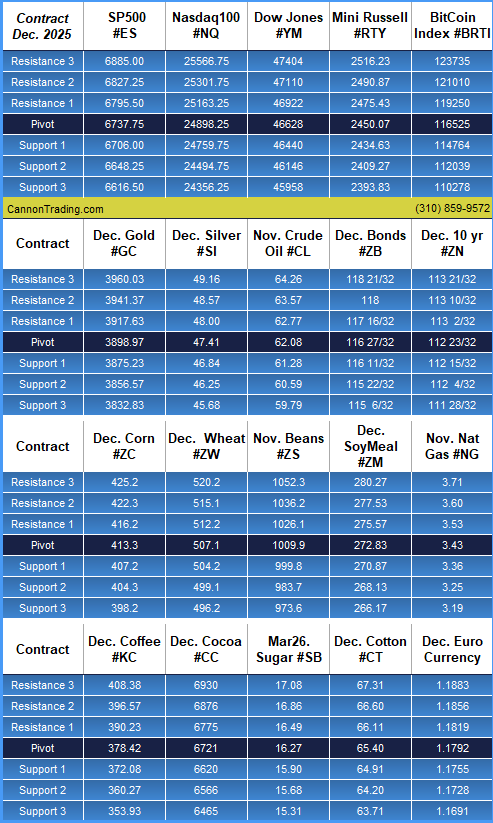

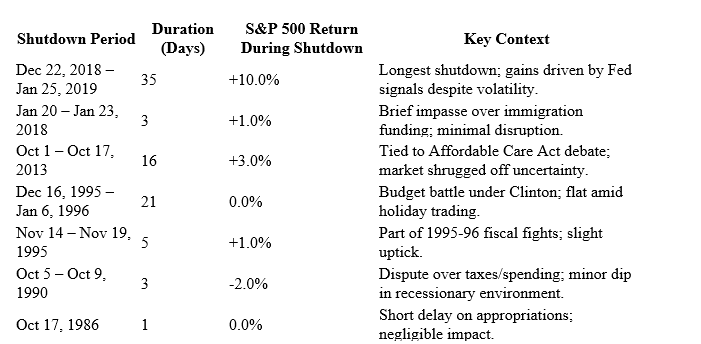

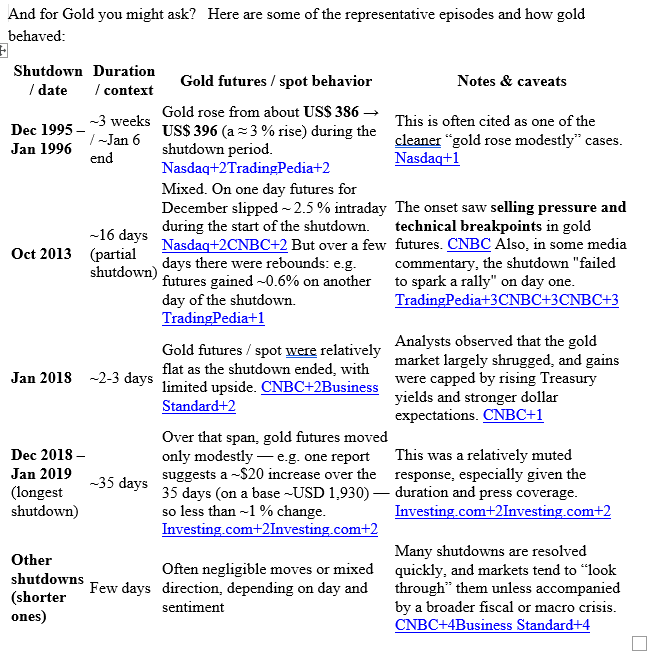

Government Shut Down, Class III Milk, Levels, Reports; Your 5 Important Must-Knows for Trading Futures on October 1st, 2025

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Last Trading Day of the Month + Levels & Reports; Your 4 Important Must-Knows for Trading Futures on September 30th, 2025

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

NFP next Friday, December Dollar Index, Levels, Reports; The Important Need-To-Knows for Trading Futures The Week of September 29th, 2025

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Trading in Futures | 5 Important Facts to Support Your Daily Futures Trading

Trading in futures

- How futures contracts function as agreements to buy or sell assets at a future date.

- The mechanics of entering and exiting futures positions.

Trading with futures

- Using futures as tools for speculation, hedging, or portfolio diversification.

- Leveraging futures contracts to manage risk and pursue opportunities in different markets.

The importance of skilled brokers

- Guidance on navigating complex futures markets.

- Expertise in execution, strategy, and risk management.

- Personalized support tailored to traders’ needs.

Cannon Trading Company’s advantages

- Decades of industry expertise and trusted reputation.

- Verified 5-star ratings on TrustPilot, showcasing client satisfaction.

- Access to cutting-edge platforms, including CannonX powered by CQG, for professional-grade futures trading.

Try a FREE Demo!

The Landscape of Futures Trading

Trading in futures and trading with futures are at the core of modern financial markets. Futures contracts allow traders to speculate on price movements of commodities, indices, currencies, bonds, and digital assets. These markets attract participants ranging from institutional investors hedging risk to individual retail traders seeking leverage and opportunity.

But while the potential of futures trading is immense, it also carries significant complexity and risk. Here is where the role of a skilled futures broker becomes critical. A futures broker is not simply a middleman executing trades; rather, they are a partner in helping futures traders succeed by providing access to technology, liquidity, market education, and—most importantly—timely support in moments of urgency.

Among leading firms, Cannon Trading Company has set itself apart for decades. With a sterling reputation among regulators, many 5-star TrustPilot reviews, and a diverse range of top-performing futures trading platforms—including CannonX powered by CQG—Cannon Trading embodies what traders seek in a brokerage.

This article explores the essentials of trading in futures and trading with futures, why brokers are indispensable, and how Cannon Trading Company’s unique approach supports traders across every stage of their journey.

Trading in Futures: A Brief Overview

What Does It Mean to Trade Futures?

Trading in futures involves buying or selling standardized contracts that obligate the trader to buy or sell an asset at a predetermined price on a specified date. These contracts are highly regulated, traded on exchanges, and cover a vast range of markets, including:

- Commodities such as oil, gold, and wheat

- Financial instruments like U.S. Treasury bonds

- Stock indices such as the S&P 500

- Currencies including euro, yen, and emerging market pairs

- Cryptocurrency derivatives like micro ether futures

Unlike stocks or bonds, futures contracts are leveraged products, which means traders can control a large notional value with relatively little upfront capital.

Why Do Traders Engage in Trading in Futures?

There are three primary motivations:

- Speculation – Traders attempt to profit from price movements.

- Hedging – Businesses, investors, and funds use futures to offset risks in underlying assets.

- Diversification – Futures give access to asset classes that may not be accessible through conventional stock or bond portfolios.

Trading in Futures: How It Works in Practice

The Mechanics of Trading in Futures

Trading with futures requires opening a brokerage account that supports futures products, funding the account, and gaining access to an electronic trading platform. Futures brokers provide traders with the platform, execution services, and clearing through an exchange.

Key components include:

- Margin and Leverage – Futures traders can control large positions with smaller capital commitments, amplifying both potential gains and losses.

- Liquidity – Futures markets, especially in contracts like the S&P 500 E-mini, are among the most liquid in the world.

- Round-the-Clock Markets – Futures trading operates nearly 24 hours, allowing global participation and responsiveness to news events.

Risks and Rewards of Trading in Futures

While leverage and liquidity create opportunity, they also heighten risks. A sudden move against a futures position can cause outsized losses. For this reason, professional support from a futures broker is not a luxury—it is a necessity.

The Vital Role of a Skilled Futures Broker Supporting Your Trading in Futures

A broker’s value extends far beyond order routing. Below are key reasons why futures traders rely heavily on skilled brokers:

- Access to Leverage

Futures brokers provide traders with access to leverage. However, responsible brokers like Cannon Trading Company guide clients in understanding the risks of leveraged products, ensuring they manage margin appropriately.

- Diversification Opportunities

By offering access to multiple markets—commodities, indices, bonds, and currencies—brokers help traders diversify beyond traditional equities.

- Hedging Support

Futures brokers help clients design and execute hedging strategies, whether protecting against currency risk, commodity price fluctuations, or portfolio drawdowns.

- Emergency Execution: One Call Away

When technology fails, systems go down, or internet connections are lost, a skilled broker can literally save a trader’s account. Cannon Trading Company, for example, ensures that traders can reach a licensed professional with one phone call to liquidate or adjust a position in real time.

- Guidance and Education

Top brokers provide ongoing education, analysis, and resources to help traders sharpen their skills and stay ahead of market shifts.

- Platform Expertise

From CannonX powered by CQG to other top-performing platforms, skilled brokers match traders with technology that fits their style—whether day trading, swing trading, or algorithmic trading.

How Cannon Trading Company Embodies Broker Excellence

A Tradition of Decades Trading in Futures

Founded decades ago, Cannon Trading Company has earned its reputation by guiding generations of traders through evolving futures markets. The firm’s longevity itself is a testament to reliability and consistent client satisfaction.

Five-Star Reputation on TrustPilot

TrustPilot reviews consistently rate Cannon Trading Company as 5 out of 5 stars. Traders frequently highlight the firm’s responsiveness, professionalism, and personalized service.

Regulatory Trust and Compliance

Cannon Trading maintains exemplary standing with both federal regulators and independent futures industry watchdogs. This demonstrates a culture of compliance, transparency, and ethical client service.

Wide Selection of Futures Trading Platforms

Cannon Trading offers multiple leading platforms, including its flagship CannonX powered by CQG. This platform combines deep liquidity access, advanced order routing, and sophisticated analytics, making it a top choice for traders seeking speed and precision.

Other platforms offered by Cannon Trading accommodate futures traders at every level, from beginner-friendly solutions to advanced institutional-grade platforms.

Human Support of your Trading in Futures That Stands Out

When systems go down, Cannon Trading’s team remains one phone call away—providing emergency order execution or strategy adjustments that can make the difference between success and disaster. This personalized support defines Cannon Trading’s broker-client relationship.

CannonX Powered by CQG: A Competitive Edge

CannonX powered by CQG has become a centerpiece of Cannon Trading Company’s offerings. With cutting-edge charting, market depth analysis, and direct exchange connectivity, it empowers traders to execute their strategies seamlessly.

The platform stands out for:

- Speed of execution

- Robust risk management tools

- Flexible customization for active traders

By combining Cannon Trading’s broker support with CQG’s technology, CannonX powered by CQG creates a unique advantage for futures traders seeking precision and reliability.

Why Traders Trading in Futures Choose Cannon Trading Company

- Decades of market expertise

- Top-rated client reviews

- Broad selection of platforms

- Immediate support in emergencies

- Reputation for compliance and integrity

For traders serious about trading in futures and trading with futures, these qualities are indispensable.

Related Reading from Cannon Trading Company Blog to Support Your Trading in Futures

- Futures Trading: Beginner’s Guide To Trading | Cannon Trading

- Hedging Futures: Managing Risk in Financial Markets | Cannon Trading

- Best Futures Trading Platform Guide | Cannon Trading

- How to Invest in Commodities – Guide & Tips | Cannon Trading

Frequently Asked Questions regarding Trading in Futures

- What is the difference between trading in futures and trading with futures?

Trading in futures refers to the act of buying and selling futures contracts, while trading with futures emphasizes the practical strategies and tools used to trade them effectively. - Why is a futures broker essential?

A broker provides access to leverage, diversified markets, hedging strategies, and emergency execution services—benefits that technology alone cannot guarantee. - What makes Cannon Trading Company stand out?

Decades of experience, a 5-star TrustPilot reputation, regulatory excellence, and a range of platforms—including CannonX powered by CQG—set Cannon apart. - How does leverage work in futures trading?

Leverage allows traders to control larger contract values with smaller capital, amplifying both potential gains and losses. - What happens if my trading system goes down?

With Cannon Trading Company, one call to a licensed broker ensures positions can be closed or adjusted immediately, protecting traders in emergencies.

Trading in futures and trading with futures offer tremendous opportunities for speculation, hedging, and diversification. Yet these opportunities come with complexity and risk that require more than just technology—they require trusted human expertise.

A skilled futures broker is essential to managing leverage responsibly, executing strategies effectively, and being available when systems fail. Cannon Trading Company exemplifies these qualities, combining decades of experience, 5-star TrustPilot reviews, and advanced platforms like CannonX powered by CQG. For traders seeking reliability, speed, and personalized service, Cannon Trading remains a benchmark in the futures industry.

Try a FREE Demo!

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

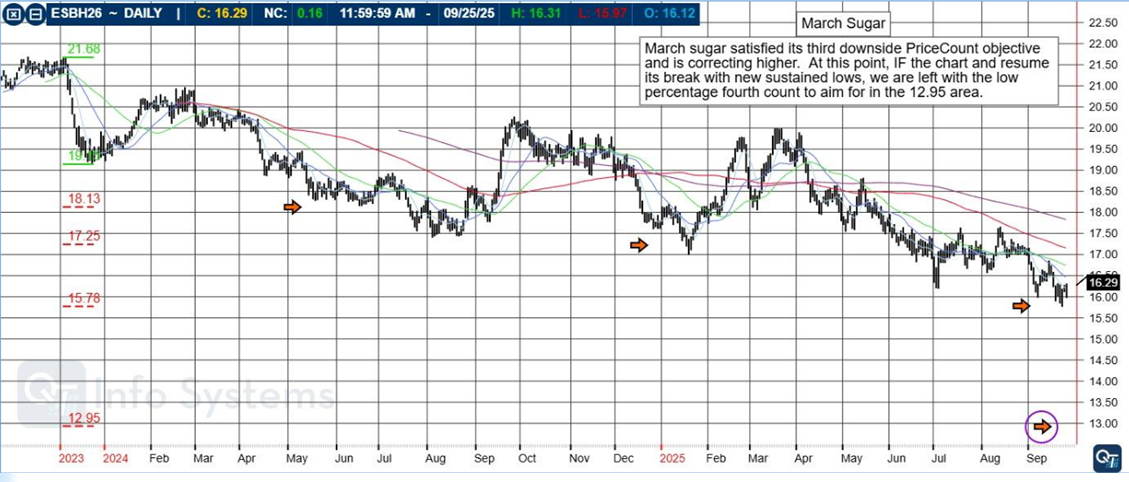

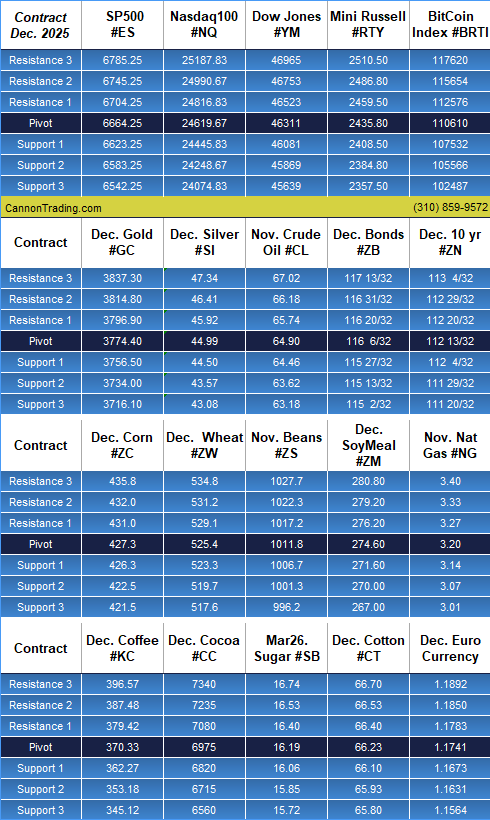

PCE: What to Know, What to Look For, March Sugar, Levels, Reports: The Important Parts of Trading Futures on September 26th, 2025

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Futures Trading | 5 Important Points to Keep in Mind during your daily Futures Trading

Leverage opportunities – Skilled futures brokers guide traders in using leverage effectively and responsibly while futures trading.

Diversification strategies – Brokers help spread risk across markets to strengthen trading outcomes.

Hedging expertise – Support in protecting portfolios and managing volatility through futures contracts.

Emergency support – Reliable assistance during critical market moments to safeguard traders.

Cannon Trading Company advantage – Decades of experience, stellar TrustPilot reviews, regulatory excellence, and cutting-edge platforms like CannonX powered by CQG.

Try a FREE Demo!

The Crucial Role of a Skilled Futures Broker

Futures trading is one of the most dynamic and potentially rewarding areas of financial markets. By allowing participants to speculate, hedge, and diversify across commodities, currencies, bonds, indexes, and cryptocurrencies, futures trading provides unparalleled opportunities. However, trading futures also comes with significant risks that require knowledge, precision, and reliable support. This is where skilled futures brokers prove indispensable.

A seasoned futures broker is not merely a transaction processor; they are an extension of a trader’s strategy. They ensure smooth execution, provide emergency support during technical failures, assist with risk management, and offer access to cutting-edge platforms such as CannonX powered by CQG. Choosing the right partner in this space can make the difference between trading futures with confidence and exposing oneself to unnecessary risk.

Cannon Trading Company embodies the gold standard of futures brokerage. With decades of experience, consistent 5-star TrustPilot reviews, a spotless reputation with regulators, and a wide suite of professional-grade trading platforms, Cannon Trading demonstrates how the right futures broker elevates the entire trading journey.

Why Skilled Futures Brokers Are Vital to Futures Trading

- Leverage: Maximizing Opportunity with Guidance

Leverage is one of the defining characteristics of futures trading. A small margin deposit allows traders to control large contract values. This magnifies both potential gains and risks. Without proper guidance, traders can misuse leverage and suffer significant losses.

A skilled futures broker provides essential education and context. They help clients understand how margin requirements work, how to size positions responsibly, and how to avoid overexposure. At Cannon Trading, brokers don’t just approve accounts—they walk traders through risk assessments, position sizing, and platform settings to ensure leverage is used effectively.

When trading futures, leverage is a double-edged sword. A futures broker who emphasizes discipline and education ensures traders avoid costly mistakes while harnessing leverage to unlock growth.

- Diversification: Expanding Horizons Beyond Stocks

Unlike equities, futures trading provides access to diverse asset classes including agricultural commodities, energy, metals, stock indexes, currencies, and digital assets. This breadth allows traders to diversify strategies and hedge exposure to multiple markets.

A skilled futures broker serves as a guide through this landscape, explaining contract specifications, seasonal factors, and liquidity considerations. Cannon Trading offers access to a broad selection of global futures exchanges and platforms, including CannonX powered by CQG, which provides professional-grade tools for tracking and executing trades across multiple asset classes.

By diversifying with futures, traders spread their risks while exploring profit potential in markets that move independently of equities. Brokers are critical in advising how to balance portfolios and avoid concentration risk.

- Hedging: Protecting Portfolios and Businesses

For institutional players, corporations, and even sophisticated retail traders, hedging is one of the most powerful functions of trading futures. Whether it’s an airline locking in fuel prices, a farmer hedging corn production, or an investor protecting equity exposure with S&P 500 futures, hedging stabilizes outcomes.

A seasoned futures broker explains how to structure hedging positions, match contract sizes, and roll over contracts efficiently. Cannon Trading has spent decades assisting commercial clients with hedging strategies, ensuring they not only meet risk objectives but also maintain compliance with regulatory standards.

Hedging requires precision. Without skilled futures brokers, traders may face slippage, mismatched exposures, or excessive margin costs. Cannon’s team ensures hedges are properly constructed and monitored in real time.

- Emergency Support: One Phone Call Away

Technology is the backbone of modern futures trading, but systems can fail. Internet outages, platform crashes, or power failures can trap traders in vulnerable positions. In such cases, the ability to call a live futures broker to exit or add a position is not just convenient—it can be lifesaving for one’s account.

Cannon Trading emphasizes this broker accessibility. In emergencies, clients can immediately reach licensed brokers who will execute trades on their behalf. This human safety net is what differentiates full-service futures brokers from purely online discount firms.

Being one call away ensures traders never feel helpless when trading futures. Cannon’s reliability in this regard builds trust, confidence, and long-term relationships.

- Expert Guidance and Education

Beyond trade execution, a skilled futures broker serves as an educator. Futures markets can be complex, with unique contract rules, expiration cycles, and margin requirements. Brokers like Cannon Trading publish educational blogs, market commentary, and strategy guides to empower traders.

They also guide traders on platform usage—whether navigating advanced charting tools on CannonX powered by CQG or understanding order types like OCO (one cancels other) and bracket orders. This personalized guidance helps traders avoid errors that can otherwise prove costly.

How Cannon Trading Company Embodies Broker Excellence

Decades of Experience in Futures Trading

Cannon Trading has served traders for over three decades. This longevity in the highly competitive brokerage industry underscores its reliability, adaptability, and credibility. In an era when many firms come and go, Cannon’s resilience demonstrates the trust it has earned from generations of traders.

Cannon Trading is consistently praised by clients with glowing 4.9/5 TrustPilot reviews. Traders highlight the firm’s personalized service, quick response times, and dependable execution. In a field where customer experience can make or break success, Cannon’s reputation shines as a competitive edge.

Regulatory Reputation

Cannon Trading maintains exemplary standing with both federal and independent futures regulators. Compliance with the National Futures Association (NFA) and Commodity Futures Trading Commission (CFTC) is not optional—it’s mandatory. Cannon’s spotless track record with these bodies reassures traders that they’re working with a futures broker who values transparency, integrity, and professionalism.

CannonX Powered by CQG: Platform Excellence

Technology defines success in modern futures trading. Cannon offers clients a suite of platforms, with CannonX powered by CQG standing out as a premier choice. This platform combines speed, reliability, and deep market access with advanced analytics, making it an indispensable tool for trading futures across asset classes.

By pairing platform power with broker guidance, Cannon ensures traders have the best of both worlds: cutting-edge execution and personalized support.

Related Reading on the Cannon Trading Blog

For readers looking to dive deeper into related topics, Cannon Trading’s Blog is an excellent resource:

- Gold Futures; Your 8 Important Need-To-Knows for Trading Gold Futures | Cannon Trading Blog

- Hedging with Futures and Speculating with Futures in Futures Trading | Cannon Trading Blog

- Why Futures Trading Platforms Like CannonX Powered by CQG Stand Out

Frequently Asked Questions (FAQ)

- Why do traders need a skilled futures broker?

A skilled futures broker provides essential services such as leverage guidance, diversification opportunities, hedging expertise, and emergency support, all of which enhance trading outcomes. - How does Cannon Trading help during emergencies?

If a trader’s system fails, Cannon brokers are just a phone call away, ready to execute trades to exit or adjust positions, preventing catastrophic losses. - What makes CannonX powered by CQG unique?

CannonX powered by CQG offers professional-grade execution speed, advanced analytics, and deep market access, making it ideal for active traders. - How does Cannon Trading maintain its strong reputation?

Through decades of service, 5-star TrustPilot reviews, and spotless regulatory compliance, Cannon Trading consistently proves its credibility and trustworthiness. - Can futures trading help with diversification?

Yes, trading futures allows diversification into commodities, currencies, indexes, and more, which helps spread risk beyond traditional stocks.

Futures trading is a powerful avenue for speculation, hedging, and diversification, but it demands discipline, knowledge, and reliable support. Skilled futures brokers are not optional—they are vital partners who empower traders to succeed. From guiding leverage usage to providing emergency assistance, their role ensures traders navigate markets safely and strategically.

Cannon Trading Company exemplifies what traders should seek in a futures broker. With decades of experience, flawless regulatory reputation, top-rated TrustPilot reviews, and elite platforms like CannonX powered by CQG, Cannon proves that broker excellence directly translates to trading success.

By working with Cannon, traders gain more than a brokerage—they gain a trusted ally in the challenging yet rewarding world of futures trading.

Try a FREE Demo!

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

- March 2026

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010