7 Powerful Reasons Crude Oil Futures Remain a Top Trading Opportunity

Crude oil plays a pivotal role in the global economy. It fuels transportation, powers industries, and supports the manufacture of countless products, from plastics to chemicals. Given its strategic importance, it’s no surprise that crude oil is one of the most actively traded commodities in the world. Trading crude oil futures has become an essential activity for hedgers, speculators, and institutional investors alike. This research paper delves into why crude oil futures are among the most coveted contracts in the futures market, their historical origins, evolution, risk assessments, and the benefits of using a reputable brokerage like Cannon Trading Company to engage in oil futures trading.

Origins of the Crude Oil Futures Contract

The crude oil futures contract as we know it today traces its origins back to the 1980s. Before this, crude oil was primarily traded via long-term physical contracts between producers and consumers. However, market volatility and geopolitical tensions in the 1970s, notably the oil embargo of 1973 and the Iranian Revolution of 1979, exposed the need for a more flexible pricing mechanism.

In response to these events, the New York Mercantile Exchange (NYMEX) introduced the first crude oil futures contract in 1983. This innovation provided market participants with a standardized, regulated mechanism to hedge against price volatility or speculate on price movements. The introduction of this oil futures contract was a watershed moment in the history of commodity trading, laying the groundwork for the sophisticated oil futures trading systems we see today.

Why Crude Oil Futures Are Highly Coveted

Several factors contribute to the popularity of crude oil futures contracts:

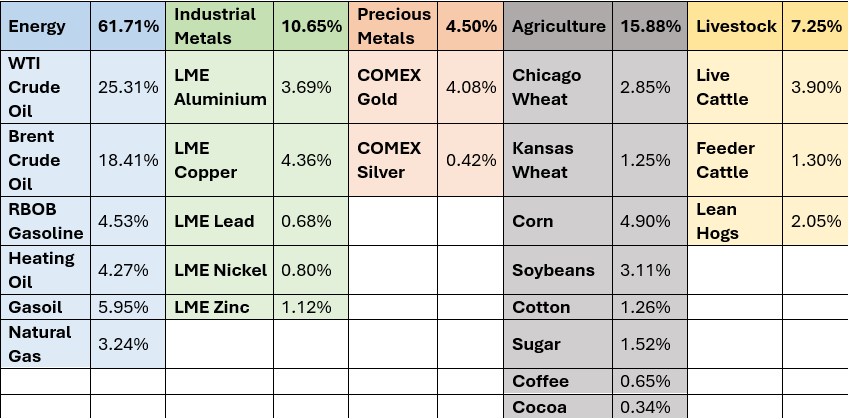

- Liquidity and Volume: Crude oil futures are among the most liquid commodities traded. The high trading volume ensures tight bid-ask spreads and minimal slippage, making them ideal for both institutional and retail traders.

- Global Relevance: Oil is a universally consumed commodity, and geopolitical events affecting oil-producing regions can cause significant price fluctuations. This global relevance ensures that oil futures trading remains dynamic and closely watched.

- Volatility and Opportunity: While volatility can pose risks, it also creates opportunities for substantial profits. Traders who understand the market dynamics can capitalize on rapid price movements.

- Accessibility and Leverage: Trading crude oil futures allows traders to control large contract sizes with relatively small margins, increasing their potential returns.

- Hedging Mechanism: For oil producers, refineries, and large-scale consumers, crude oil futures provide a means to lock in prices and mitigate risks associated with market fluctuations.

The Rise of Speculation in Oil Futures Trading

Initially, the crude oil futures market was dominated by commercial players seeking to hedge their exposure. However, the landscape began to change in the late 1990s and early 2000s with the influx of hedge funds, institutional investors, and retail traders. Several factors contributed to this shift:

- Financialization of Commodities: Commodities, including crude oil, were increasingly viewed as investment assets. The launch of commodity index funds and ETFs made it easier for investors to gain exposure to oil futures.

- Technological Advancements: Online trading platforms and real-time data enabled more participants to engage in oil futures trading with greater ease and speed.

- Macro-economic Events: Events like the 2008 financial crisis and subsequent quantitative easing measures by central banks led investors to seek alternative assets. Crude oil, being a tangible asset with intrinsic value, attracted speculative interest.

- Price Swings and Media Coverage: High-profile price swings, such as oil reaching $147 per barrel in 2008 and the historic dip into negative prices in April 2020, generated significant media attention and drew in speculative traders.

As a result, speculators now account for a significant portion of the open interest in crude oil futures markets, adding to both the liquidity and volatility of these contracts.

Key Events That Shaped the Oil Futures Market

- 1973 Oil Embargo: Highlighted the vulnerability of oil supply chains and the need for risk management tools.

- 1983 Launch of NYMEX Oil Futures: Marked the formal beginning of exchange-traded oil futures.

- 2008 Oil Price Spike: Drew attention to the potential profits in trading crude oil futures.

- 2014 Oil Price Crash: Demonstrated the impact of oversupply and changing global demand.

- 2020 COVID-19 and Negative Oil Prices: A historic moment where crude oil futures briefly traded below zero due to storage issues, underscoring the complexity and risk of these contracts.

Each of these events has contributed to the continued popularity of trading crude oil futures by highlighting both the risks and rewards inherent in the market.

Risk Assessment and Profit Potential

Trading crude oil futures involves significant risk, but it also offers considerable profit potential. Here is a breakdown of both:

Risks:

- Price Volatility: Crude oil prices can fluctuate wildly due to geopolitical tensions, natural disasters, OPEC decisions, and economic indicators.

- Leverage Risk: While leverage can amplify gains, it can also magnify losses. A small adverse movement can result in significant financial loss.

- Market Sentiment and Speculation: The market is often driven by sentiment and news, which can lead to unpredictable price swings.

- Liquidity Risk: While crude oil futures are generally liquid, during periods of extreme volatility, liquidity can dry up, resulting in wider spreads.

Profit Potential:

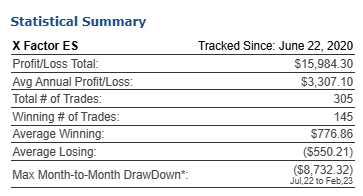

- Strategic Speculation: Traders who accurately predict price movements can realize substantial gains.

- Arbitrage Opportunities: Differences between spot and futures prices, or between different delivery months, can be exploited.

- Hedging and Risk Transfer: Commercial players can lock in prices, reducing uncertainty and improving financial planning.

Over the years, risk management tools such as stop-loss orders, advanced charting, algorithmic trading, and diversified portfolios have evolved, helping traders navigate the complexities of oil futures trading more effectively.

How to Trade Oil Futures

Trading crude oil futures involves several key steps:

- Choosing a Broker: A reliable and experienced broker is essential. They provide the platform, market data, and support needed for successful trading.

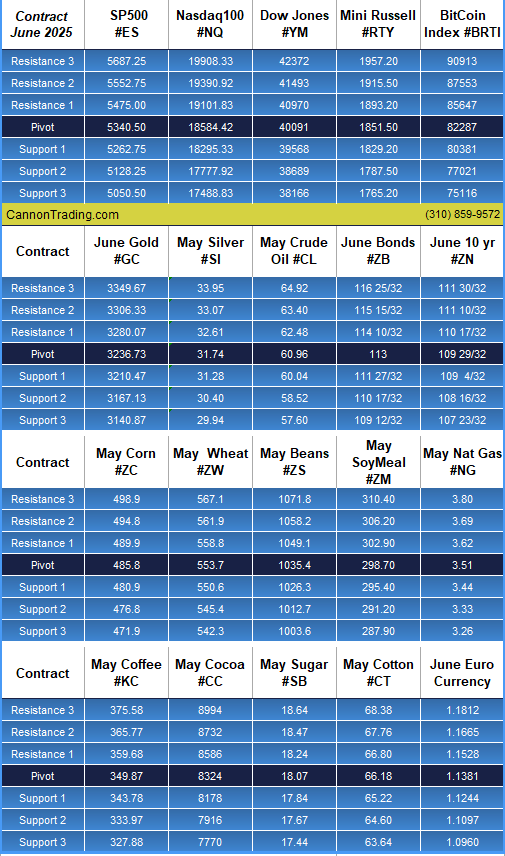

- Understanding the Contract Specifications: Most crude oil futures contracts are standardized (e.g., NYMEX WTI contracts represent 1,000 barrels of crude).

- Analyzing the Market: Traders use technical, fundamental, and sentiment analysis to make informed decisions.

- Managing Risk: This includes setting stop-loss levels, using appropriate position sizing, and monitoring market exposure.

- Executing and Monitoring Trades: Once trades are placed, they need to be monitored, and exit strategies should be in place.

The key to success in trading crude oil futures lies in education, discipline, and access to the right tools and information.

Why Cannon Trading Company Is Ideal for Oil Futures Trading

Cannon Trading Company stands out as a premier brokerage for trading crude oil futures for several compelling reasons:

- Free Trading Platforms: Cannon Trading offers a wide selection of top-performing, professional-grade trading platforms at no cost. These platforms include advanced charting tools, real-time data, and intuitive interfaces that are perfect for both beginners and seasoned traders engaging in oil futures trading.

- Highly Rated Customer Service: With countless 5-star ratings on TrustPilot, Cannon Trading has built a reputation for reliability, transparency, and client satisfaction. Their team is known for being the first to pick up the phone, ensuring that traders receive timely support during critical trading hours.

- Experienced Brokers: The company’s onsite brokers bring decades of hands-on experience in trading crude oil futures. Their deep market knowledge and personalized support can be invaluable, especially during volatile market conditions.

- Strong Regulatory Record: Cannon Trading has an exemplary compliance history with industry regulators, providing clients with confidence in the firm’s integrity and operational security.

- Educational Resources: Cannon Trading is also committed to trader education, offering webinars, articles, and real-time market insights to help clients understand how to trade oil futures effectively.

These factors make Cannon Trading an excellent partner for anyone looking to explore or expand their oil futures trading activities. Whether you’re a novice wanting to learn how to trade oil futures or a seasoned investor seeking a better platform, Cannon Trading delivers on all fronts.

Trading crude oil futures has evolved into one of the most dynamic and potentially lucrative areas of the financial markets. From its origins in the 1980s to the speculative booms of the 21st century, the oil futures contract has proven its resilience and relevance. Despite inherent risks, the contract’s liquidity, volatility, and global importance continue to attract traders and investors from around the world.

Choosing the right broker can significantly enhance one’s oil futures trading experience. Cannon Trading Company, with its cutting-edge free trading platforms, exceptional customer service, and seasoned brokers, provides an optimal environment for trading crude oil futures successfully.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading