In today’s fast-paced trading landscape, choosing a high-performance futures trading platform can be the difference in the bottom line. One standout tool in the industry is the Bookmap futures platform, designed to provide unparalleled transparency and control to traders. Leveraging real-time data and dynamic visualization, Bookmap desktop software transforms how traders interpret markets.

Cannon Trading Company, a leading name among brokerage firms, complements this tool perfectly. With deep roots in futures markets, Cannon Trading offers unmatched expertise and service—essential qualities when navigating an online futures trading platform._NICE!

This guide explores the essential features of Bookmap and walks through the Bookmap download. We intoduce Bookmap pricing options, Bookmap demo, and explain why Cannon Trading is the ideal brokerage for futures traders.

What Is the Bookmap Futures Platform?

The Bookmap futures platform presents traders with a comprehensive view of market liquidity by visualizing full-depth order book data through heatmaps. Far more than a typical charting tool, Bookmap reveals the live action of market participants, giving both scalpers and swing traders an edge.

The Bookmap desktop version gives traders a complete trading environment. From basic charts to highly detailed heatmap displays, every element is designed to show real-time market activity with remarkable precision.

The Bookmap demo is a great entry point for those who want to explore these capabilities before committing financially. Whether you choose the standalone software or a Bookmap desktop demo, you gain access to a set of tools that highlight the platform’s core strengths.

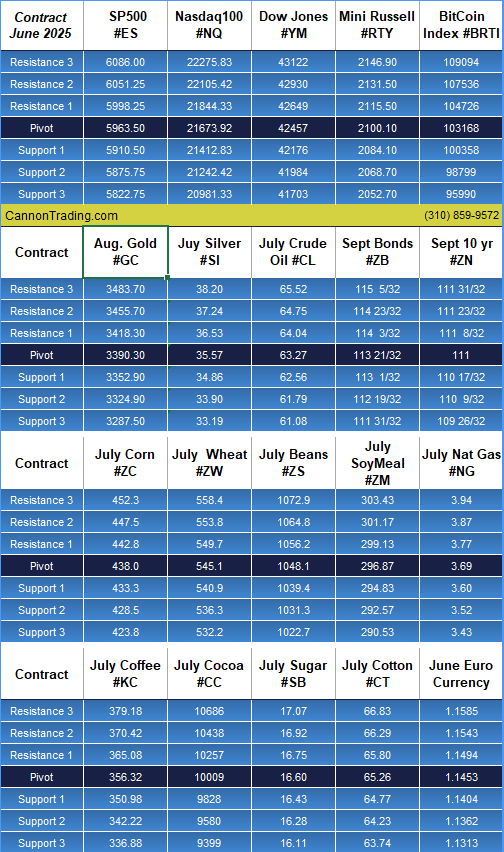

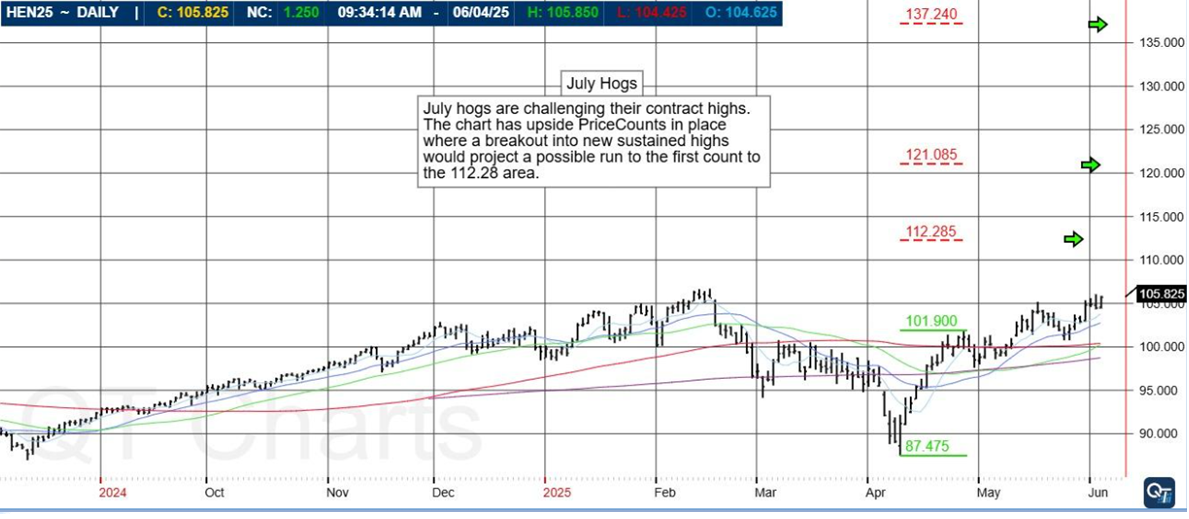

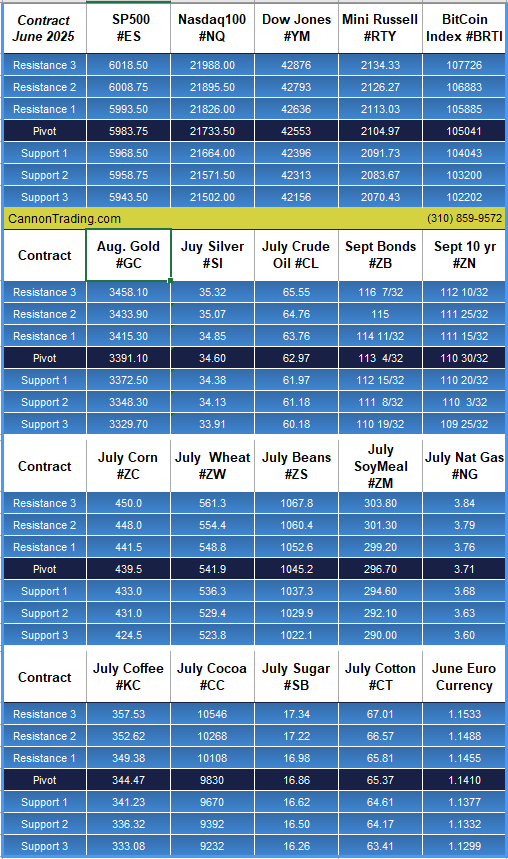

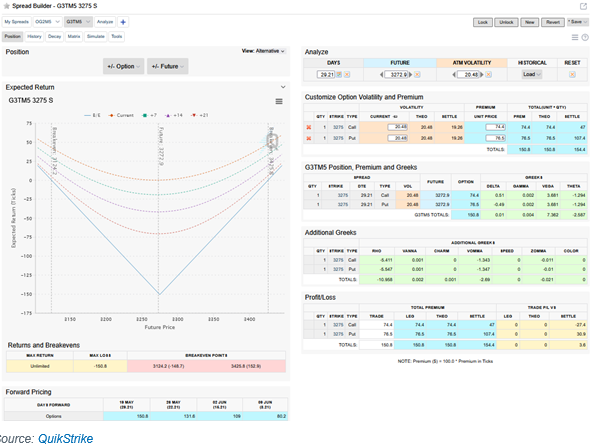

An integral part of the experience is Bookmap data—accurate, timely, and granular. These feeds deliver insights that help traders make sense of market movements, anticipate order flow shifts, and plan their entries and exits accordingly. Through providing unique analysis as shown below..

Key Features of the Bookmap Desktop Platform

- Heatmap Visualization

The cornerstone of the Bookmap futures platform is its HEATMAP, showing historical and real-time order book data. Large orders appear as bright zones, making it easier to recognize areas of market interest or potential reversal points.

- Order Flow and Liquidity Monitoring

Bookmap is widely considered the premier futures trading platform for order flow analysis. Traders can observe the dynamic interplay of limit and market orders, view liquidity zones, and track price impacts in real time.

- Volume Dots and Delta Indicators

For traders who rely on volume analysis, Bookmap provides a unique toolset. Volume dots and volume delta indicators help pinpoint where trades are executed, giving online futures trading platform users the data clarity they need for split-second decisions.

- Replay Functionality

The ability to rewind market action using the replay tool helps traders refine their skills. Whether you’re backtesting a strategy or learning from past trades, this feature provides a controlled environment to improve.

- Third-Party Plugin and API Support

With API access and plugin compatibility, the Bookmap desktop app can be fully customized. Add-ons extend functionality, from trading automation to alerts, turning your system into a highly personalized futures trading platform.

- Desktop and Web Access

Whether you’re using Bookmap desktop or accessing Bookmap through a browser, the flexibility ensures you’re able to connect on the go. Both options sync seamlessly, letting you trade from virtually anywhere.

Exploring the Bookmap Desktop Demo

A Bookmap desktop demo is the perfect way to test-drive the platform. It mirrors the full experience while limiting some premium features, offering traders a zero-risk way to explore.

There are multiple ways to access a Bookmap demo:

- Through Cannon Trading’s promotional offers: https://cannontrading.com/software/bookmap

- Direct from Bookmap’s website

- Via educational programs and webinars

Bookmap desktop demo lets you get comfortable with its tools, from heatmaps to replay, before making a financial commitment.

Understanding Bookmap Pricing Tiers

Before you sign up, it’s crucial to compare Bookmap pricing plans:

- Bookmap Free: Great for exploring the basics, it includes limited Bookmap data and simple charting features.

- Digital+: Adds more detailed visualizations and expanded indicator sets.

- Global: Designed for active futures traders, offering full-depth data and premium studies.

- Global+: The elite tier with powerful add-ons like Large Lot Tracker and advanced performance modules.

No matter your experience level, there’s a Bookmap pricing plan for you. Better yet, the Bookmap download process is simple—compatible with both Mac and Windows, making setup hassle-free.

Step-by-Step: How to Initiate Your Bookmap Download

To get started with the Bookmap futures platform, follow these five simple steps:

- Visit the Cannon Trading Official Site: https://cannontrading.com/software/bookmap

- Pick the Right Plan: Choose a pricing tier that matches your trading style and platform needs.

- Complete the Download: Installing the Bookmap desktop version takes just minutes.

- Connect to Bookmap Data Feeds: Use built-in options or link your broker feed.

- Launch Your Bookmap Demo: A Bookmap desktop demo is available for all plans, giving you instant access to heatmaps and liquidity tools.

From that point, you’re ready to experience trading with one of the most advanced tools available.

Why Cannon Trading Is a Great Broker for Bookmap

Selecting the right broker is vital when using an online futures trading platform like Bookmap. Cannon Trading stands out for several compelling reasons:

- Deep Industry Experience

Since 1988, Cannon Trading has built a reputation for excellence in the futures trading platform space. Their seasoned team understands the nuances of Bookmap and offers guidance through onboarding, data feeds, and platform setup.

- Regulatory Compliance

Cannon is a registered Introducing Broker with both the NFA and CFTC. This ensures client safety, transparent practices, and compliance with all industry standards.

- Full Support for Bookmap Users

Cannon offers hands-on assistance for installing the Bookmap download, setting up a Bookmap demo, and connecting Bookmap data feeds. This ensures a seamless start, even for traders new to advanced platforms.

- Multiple Trading Platforms

In addition to Bookmap, Cannon gives clients access to over a dozen other online futures trading platforms, including CQG, Sierra Chart, and Rithmic. This diversity lets you explore multiple systems under one brokerage umbrella.

- Educational Resources

From tutorials to live webinars, Cannon Trading empowers users with educational content focused on the Bookmap futures platform, including insights on how to interpret the heatmap and use the replay tool effectively.

Trading Excellence with Cannon and Bookmap

The synergy between the Bookmap futures platform and Cannon Trading creates a powerful trading solution. Whether you’re using the Bookmap desktop application for live scalping or analyzing markets with historical data, you benefit from world-class technology backed by expert support.

Cannon Trading helps you unlock the full potential of Bookmap—from navigating Bookmap pricing plans to optimizing your use of Bookmap data feeds. With both the platform and the brokerage working in harmony, your trading journey is poised for success.

The Bookmap futures platform is revolutionizing the way traders visualize and interact with the market. With tools like the Bookmap desktop demo, rich Bookmap data, multiple Bookmap pricing tiers, and a seamless Bookmap download process, it caters to traders at every level.

When you partner with Cannon Trading—a trusted name in the online futures trading platform industry—you gain not only access to cutting-edge software but also decades of brokerage expertise. Bookmap and Cannon Trading provide the tools, support, and insight to help you thrive.

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading