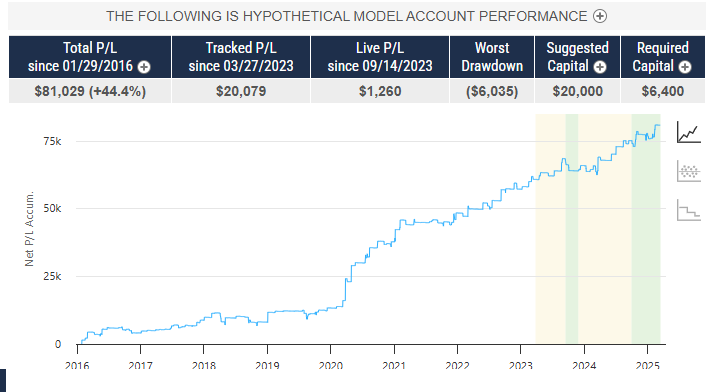

Futures 102: System Traders: Can you handle the drawdowns?

Many investors may think, “I can handle drawdown”, but honestly you have no idea how much drawdown you can handle until you have been stuck in the eye of a number of your own personal drawdown storms.

While drawdown is a natural part of trading and investing, what does differ is how much drawdown each investor can mentally handle. As humans, we all ‘see’ the world differently. What appears as something normal to one person can appear completely disastrous to another. While a 10% portfolio drawdown could be extreme for one investor, the next investor may be able to trade through periods of 50% plus drawdown.

From the behavioral finance point of view, some of the main negative facts of the human brain related to trading are:

- The fact that weak traders tend to be reluctant to realize losses and quick to realize gains. They are more risk averse when dealing with profitable positions and more risk seeking when dealing with losses.

- The fact that weak traders make inconsistent and irrational economic decisions over the same scenario depending on how it is described.

- The fact that weak traders deals with positions as if they were expecting mean reversion of prices. They are expecting the price to return to a long term average. This is the principle that makes them think they are buying expensive positions on volatility breakout or trend following strategies.

It is out of the scope of this article to talk much more about this science, but I will just point that:

- Weak traders know nothing about behavioral finance, so they think that his gut feeling is right and base their decisions on his gut feeling.

- Smart traders knows about behavioral finance. A smart trader has already studied about this and trained himself to overcome this limitations. At least they know how to deal with their brain to avoid most of the damage it can create on their trading accounts. The best traders knows even how to monetize from this herd behavior.

Are drawdown periods a bad thing?

In my opinion, they are not a bad thing, in fact I believe that drawdown periods are a very sane and good thing for any solid strategy. Drawdown periods are very efficient to shake out weak traders from the strategy while smarter traders can pick up their money (which is the name of the game after all).

The time that passes since the first equity high until we reach a new equity high is the drawdown period.

So a drawdown period has two dimensions:

- The drawdown depth

- The drawdown length

Most people mostly care about the drawdown depth as this is what is easier to see on back tests. But human the brain is much more affected by drawdown length. During live trading, it is easier to deal with a 10% drawdown for one week than with a 5% drawdown for five months.

- Detailed statistical information about the strategy: Expected profit, expected drawdown, maximal drawdown depth and length, average win percentage, reward to risk ratio, …

- Different scenarios and the actions to take (if any): intense and/or deep drawdown periods and what to do (or do nothing), whether to trade during Christmas time or summer time, whether to keep opened positions during weekends or not, what to do after a losing year (or do nothing), funding and withdrawing plan, …

- A very clear worst case scenario: it is basically the “line in the sand” where we know that the strategy has lost it’s edge and something must be done (stop trading the strategy, adapting parameters, …). There are many ways to calculate it (double the max historical drawdown, using montecarlo simulations, using regression lines multiplied by x times the standard deviation on the equity curve, …). In the end it is a number. The important thing is to have it written in the trading plan.

When facing a problem that generates pain or panic such as a sudden deep drawdown, most of the time, when analyzed with rigor and care, the problem is not so important, and everything is within expected statistics. You will see that there were many periods in the past with similar characteristics. |