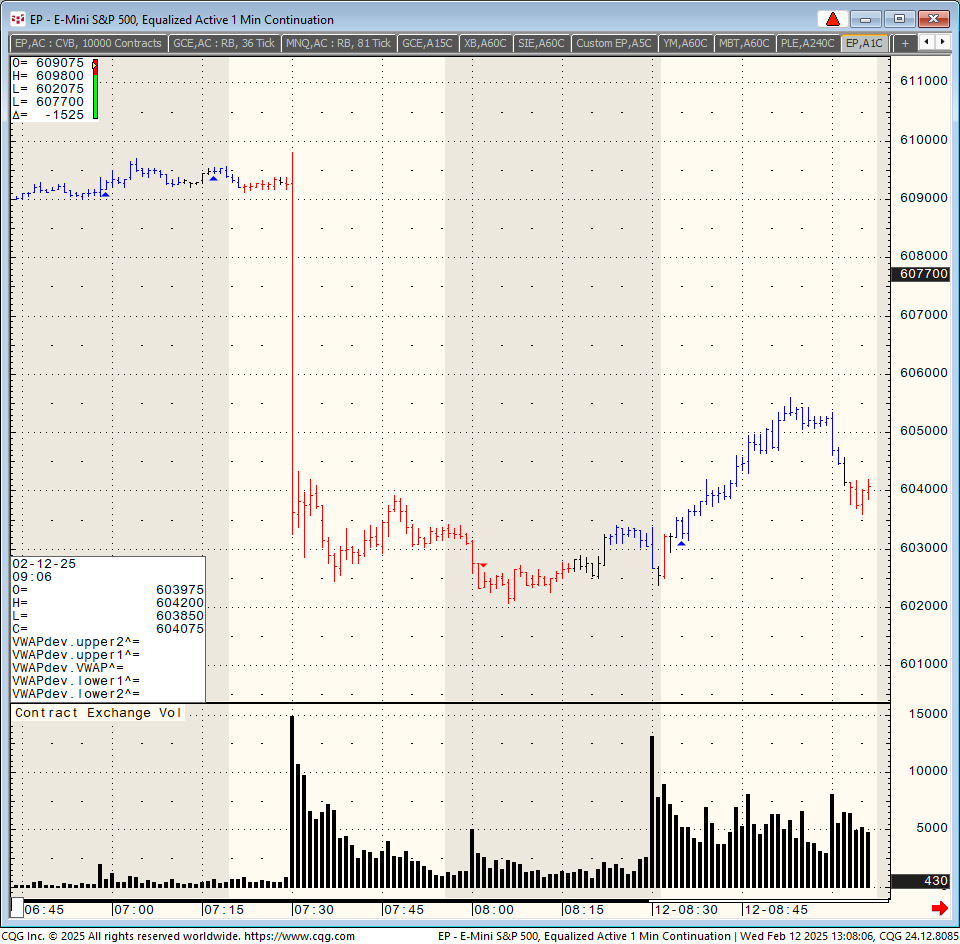

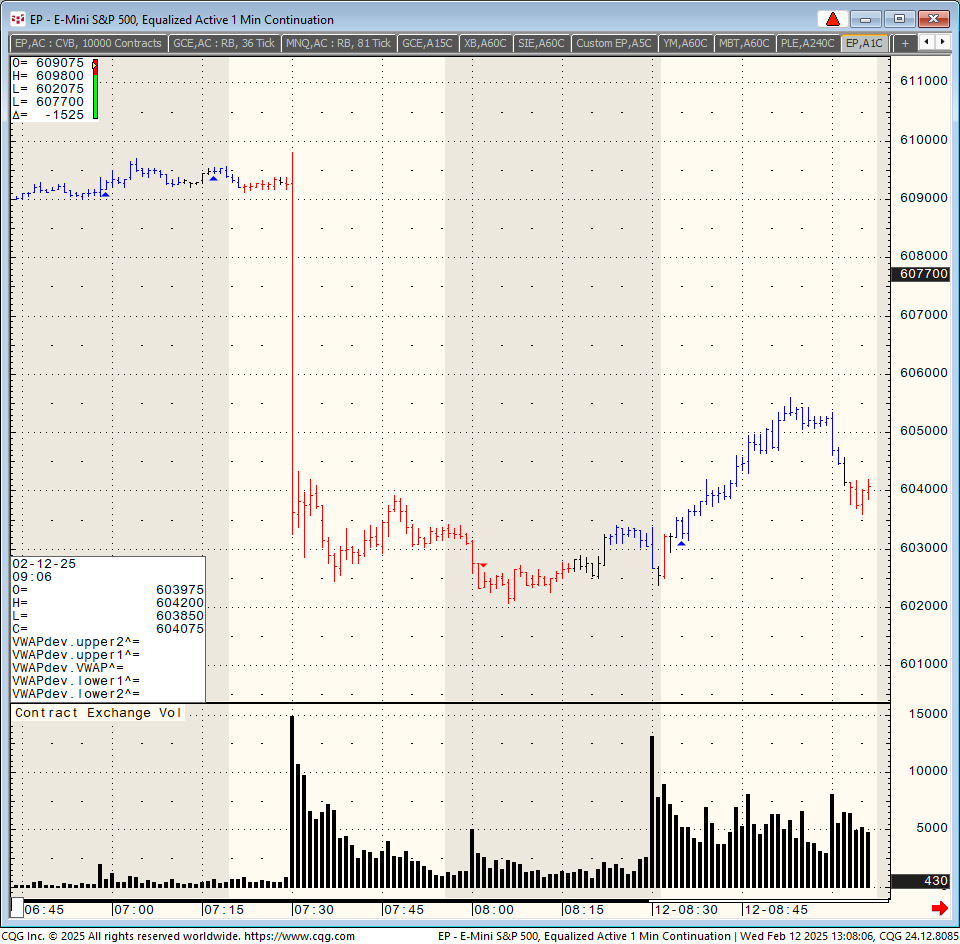

Trading in Front of Reports – Like Today’s CPI – Stock Futures – a Word to the Wise

by Mark O’Brien, Senior Broker

|

|

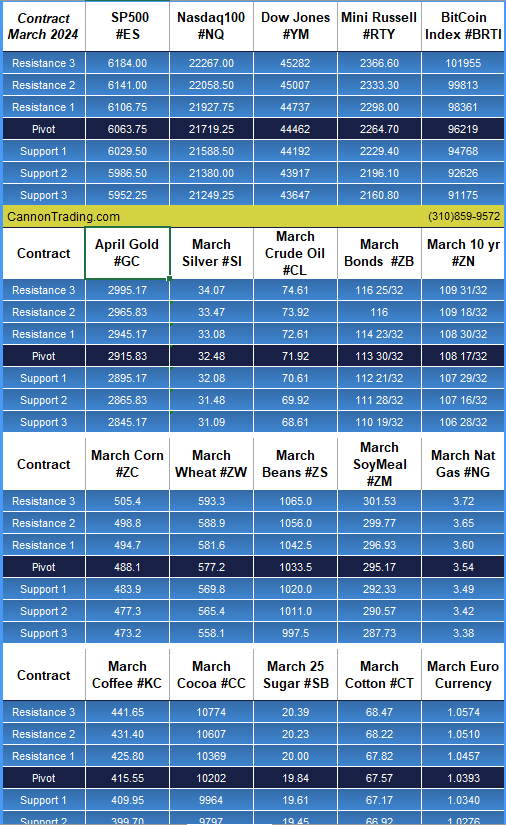

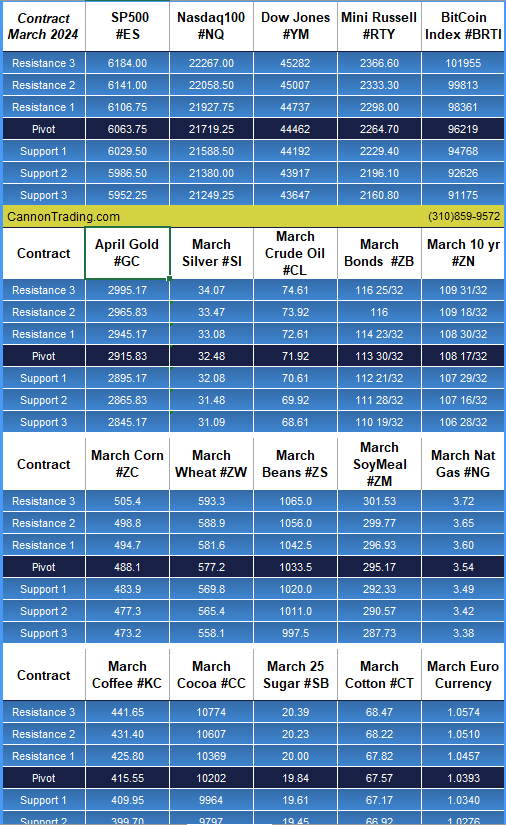

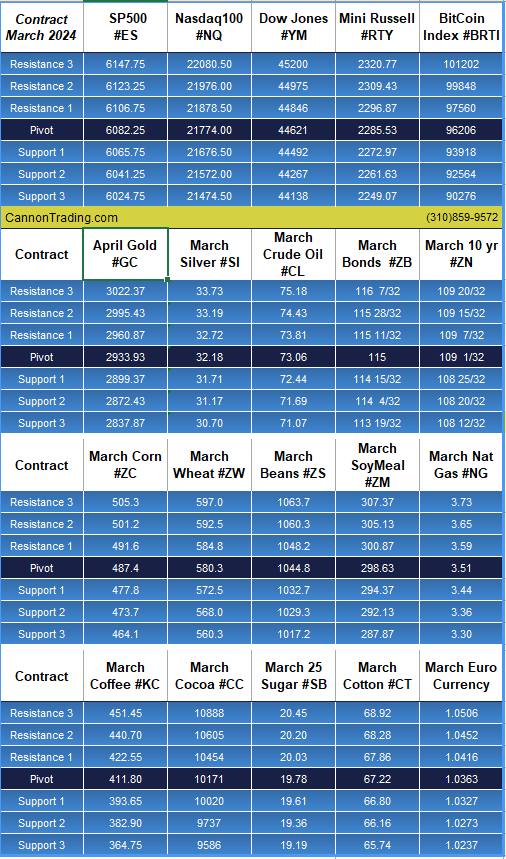

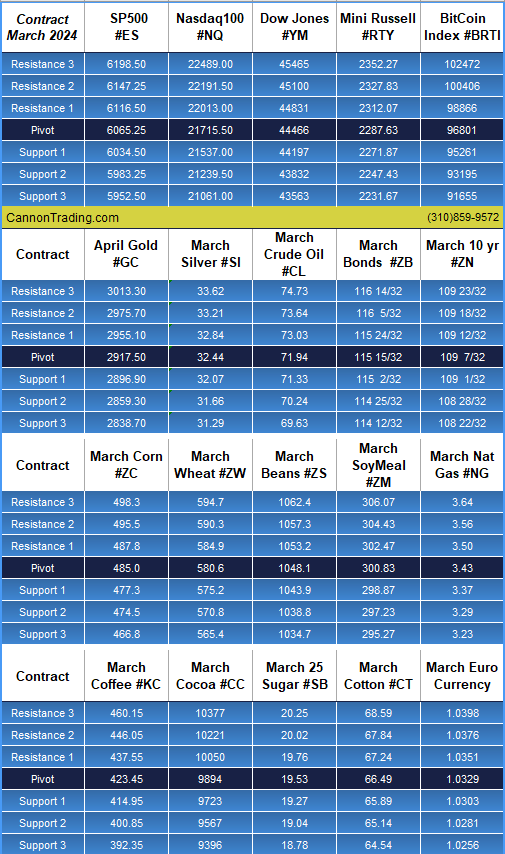

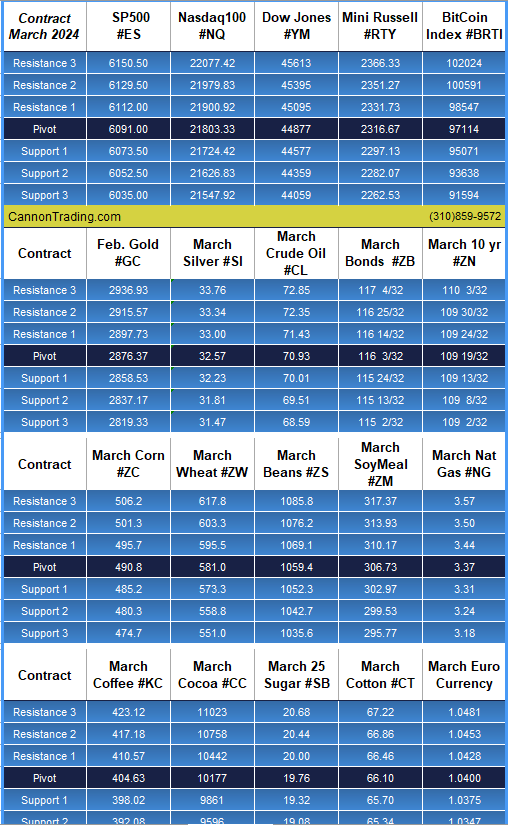

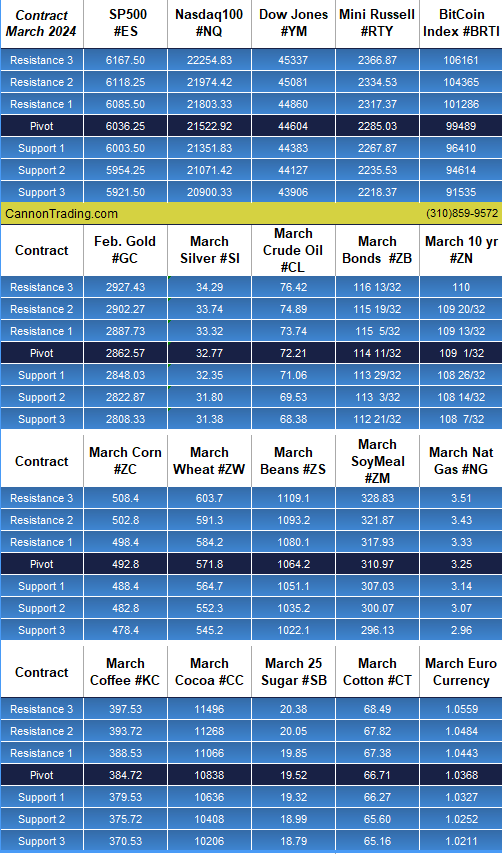

Daily Levels for February 13th, 2025

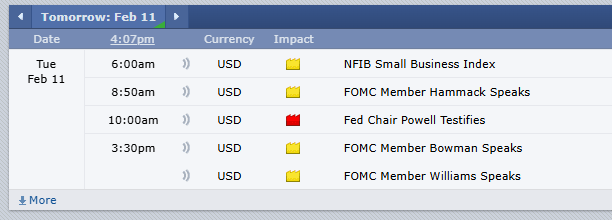

Economic Reports

provided by: ForexFactory.com

All times are Eastern Time (New York)

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

Futures trading is done by two main parties, one of which is the hedger and the other one is the speculator. Where a speculator is there to trade for either their own accounts or that of their clients, a hedger always uses futures as a possible protection from losses. Hedgers can also be described as individuals or business owners who are more risk averse. Speculators and hedgers are likely to benefit from futures trading if the trader has a strong ability to analyze the markets and understands that future behavior. Though futures can behigh risk, they offer an equally high return and are thus very tempting.

In case you are new to futures trading you need to understand how things work. We at Cannon Trading are there to help with your understanding of all the elements of futures trading and also counsel and advise you with the same. Our knowledge base featured on our website, is a store house of information. In order to know every aspect of futures trading, you must read through these articles that have been listed in this category archive. Go through it and get better informed!

|

|

provided by: ForexFactory.com

All times are Eastern Time (New York)

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

|

|

provided by: ForexFactory.com

All times are Eastern Time (New York)

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

|

|

provided by: ForexFactory.com

All times are Eastern Time ( New York)

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

|

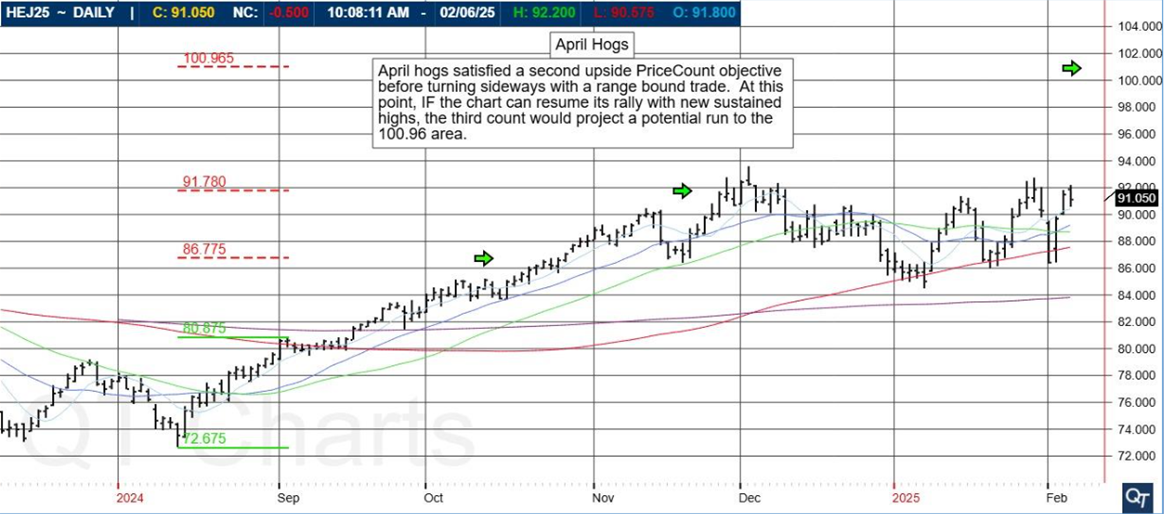

April Hogs satisfied a second upside PriceCount objective before turning sideways with a range bound trade. At this point, IF the chart can resume its rally with new sustained highs, the third count would project a potential run to the 100.96 area. |

provided by: ForexFactory.com

All times are Eastern Time ( New York)

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

|

|

Economic Reports

provided by: ForexFactory.com

All times are Eastern Time ( New York)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|