The below commentary about tomorrow’s FOMC minutes is provided by www.NewSquawk.com

FOMC MINUTES (WED): After economic data for January highlighted a hot economy where inflation appears to be sticky, traders will look through the minutes for clues about how the central bank could respond, specifically looking at any commentary that indicates officials have appetite for rate hikes to resume with jumbo increments above 25bps, or even expectations of a higher terminal rate for the cycle. As a reminder, the Fed hiked its FFR by 25bps to 4.5-4.75% at its February meeting, as expected.

The statement said the central bank continues to see “ongoing increases” in the Fed rate as being appropriate, coming against some expectations that the line could be dropped in order to give optionality for a lower terminal rate than the 5-5.25% median dot in the December SEPs. While that didn’t happen, we did see a switch in language on guidance from the “pace of future increases” to the “extent of future increases,” suggesting that debate is moving from the size of hike increments to how many hikes remain in the cycle, a dovish offset to the continued use of “ongoing increases”. Elsewhere in the statement, the Fed acknowledged that inflation had eased

somewhat, but remained elevated. Chair Powell sat on the fence on many topics he was asked about in his postmeeting press conference, rather than cut off his options.

The Fed Chair confirmed that the disinflation process was underway, albeit he was eager to highlight that core services inflation, ex-housing, had not shown progress. He believes that policy is still not ‘sufficiently restrictive’, but left optionality by stressing data dependence, later saying that it is possible that the Fed updates its policy path if the data came in differently to what it expects. Powell said the Fed has not yet made a decision on the terminal rate, and that it will look at the data between now and the March SEPs.

The Fed chief sees a path to getting inflation to 2% without significant economic decline, though it could take more slowing in the economy than it expects.

The below commentary about tomorrow’s FOMC minutes is provided by www.NewSquawk.com

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

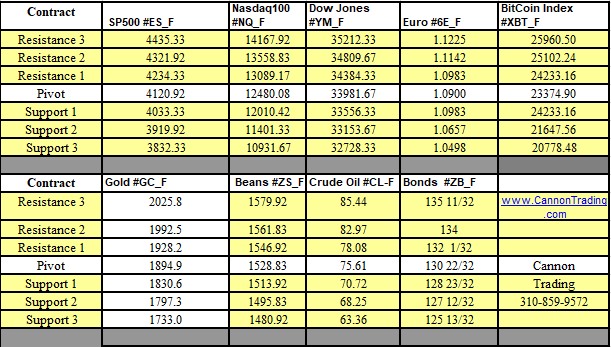

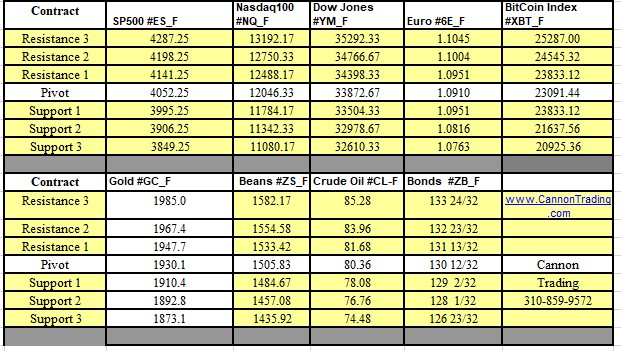

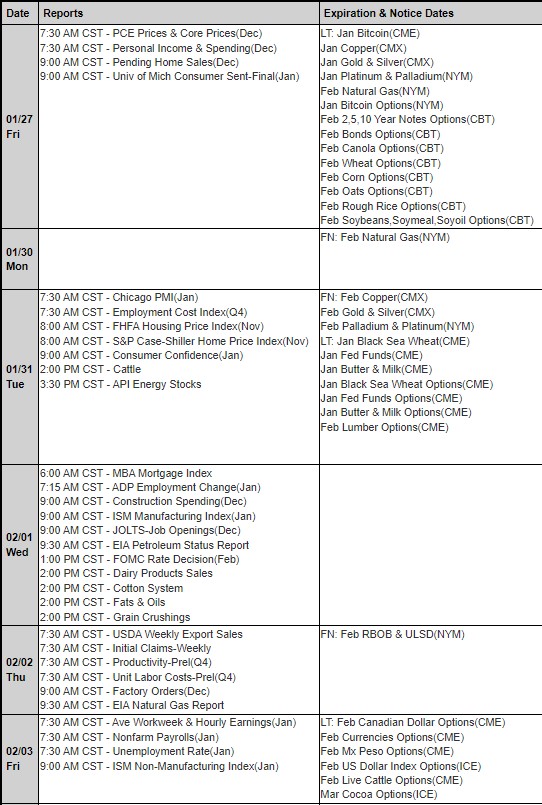

Futures Trading Levels

02-22-2023

Improve Your Trading Skills

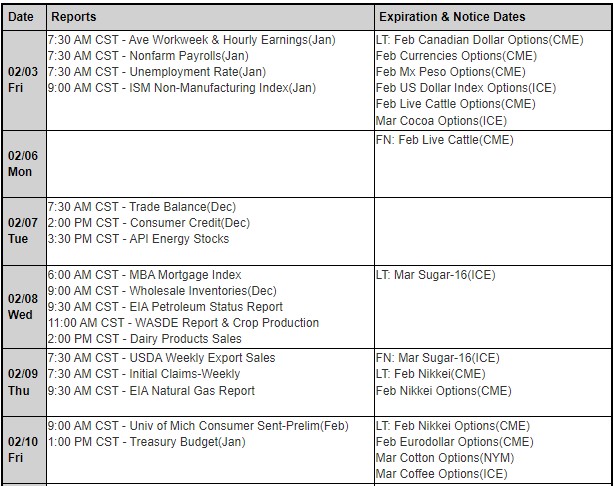

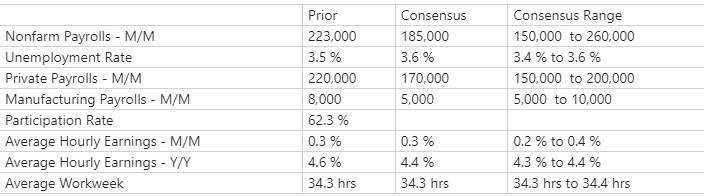

Economic Reports, Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.