Cannon Futures Weekly Newsletter Issue # 1125

Join our private Facebook group for additional insight into trading and the futures markets!

- Important Notices – Rollover

- Trading Resource of the Week – Educational Videos

- Hot Market of the Week – Silver

- Broker’s Trading System of the Week

- Trading Levels for Next Week

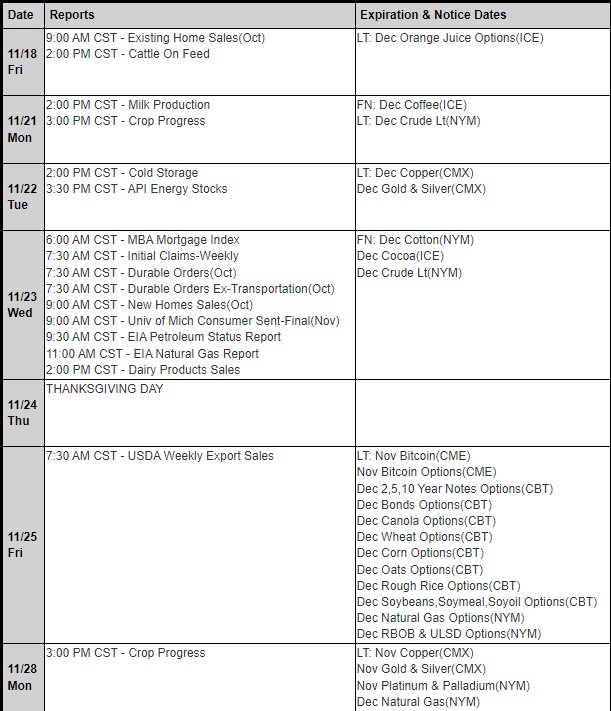

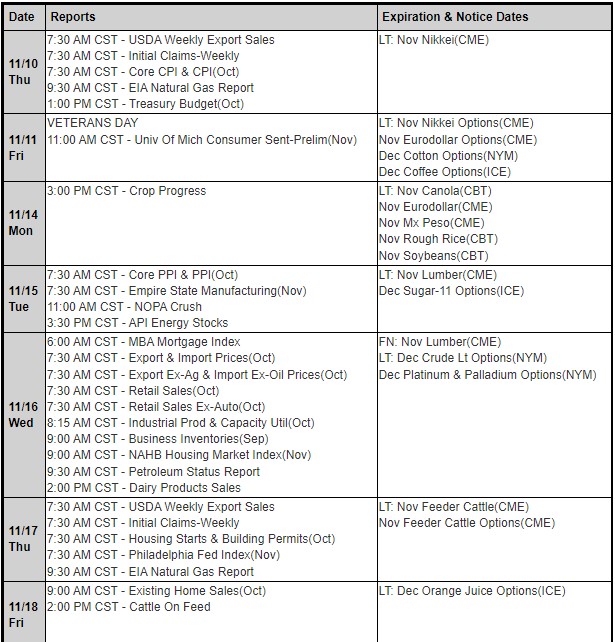

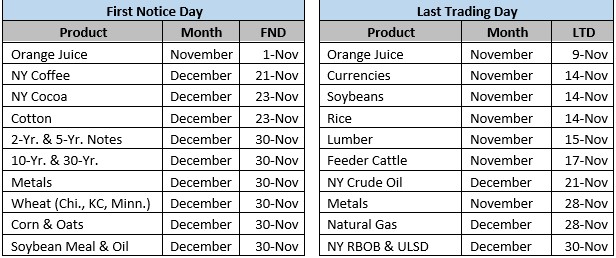

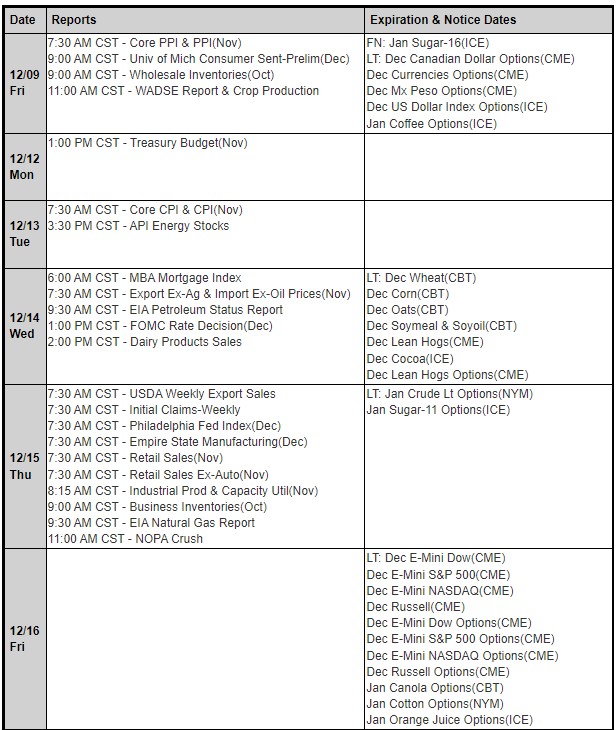

- Trading Reports for Next Week

-

-

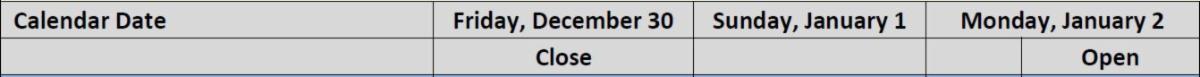

Important Notices – Rollover

Rollover is here for stock indices. i.e., the E-mini and Micro S&P, Nasdaq, Dow Jones and Russell 2000.I personally start trading MARCH this Monday when the volume on March is higher than the December.Volume in the December contracts will begin to drop off until their expiration next Friday, December 16th (8:30 A.M., Central Time). At that point, trading in these contracts halts. Stock index futures are CASH SETTLED contracts. If you hold any December futures contracts through 8:30 A.M., Central Time on Friday, Dec. 16th, they will be offset with the cash settlement price, as set by the exchange.Monday, December 19th is Last Trading Day for June currency futures. It is of the utmost importance for currency traders to exit all December futures contracts by Friday, December 16th and to start trading the March futures. Currency futures are DELIVERABLE contracts.The month code for March is ‘H.’ Please consider carefully how you place orders when changing over. -

-

-

Trading Resource of the Week

Get access to variety of videos such as trading techniques, trading platforms, trading psychology and more!Click on the subscribe and get notified as soon as a new video is published!Below you will see a unique way to customize your E-Futures DOM! -

-

-

Hot Market of the Week – March Silver

Hot market of the week is provided by QT Market Center, A swiss army knife charting package that’s not just for Hedgers, Cooperatives and Farmers alike but also for Spread traders, Swing traders and shorter time frame application for intraday traders with a unique proprietary indicator that can be applied to your specific trading needs.PriceCounts – Not about where we’ve been , but where we might be going next! -

-

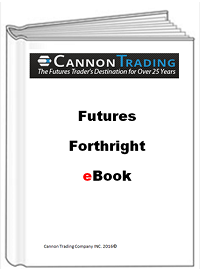

Trading Levels for Next Week

Weekly Levels

-

Trading Reports for Next Week

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading