- Leverage: Understand how your futures broker helps you maximize capital efficiency and control larger market exposure with smaller margin requirements.

- Diversification: See how brokers enable access to multiple markets and asset classes, allowing you to balance and broaden your trading strategies.

- Hedging: Learn how your broker assists in managing portfolio risk and protecting existing investments using S&P 500 futures.

- Emergency support: Discover why having a broker that’s one phone call away is critical during system outages or volatile market conditions.

- Advanced platforms: Explore how innovative technology and professional-grade tools empower precise and reliable S&P 500 futures trading.

- Cannon Trading Company provides:

-

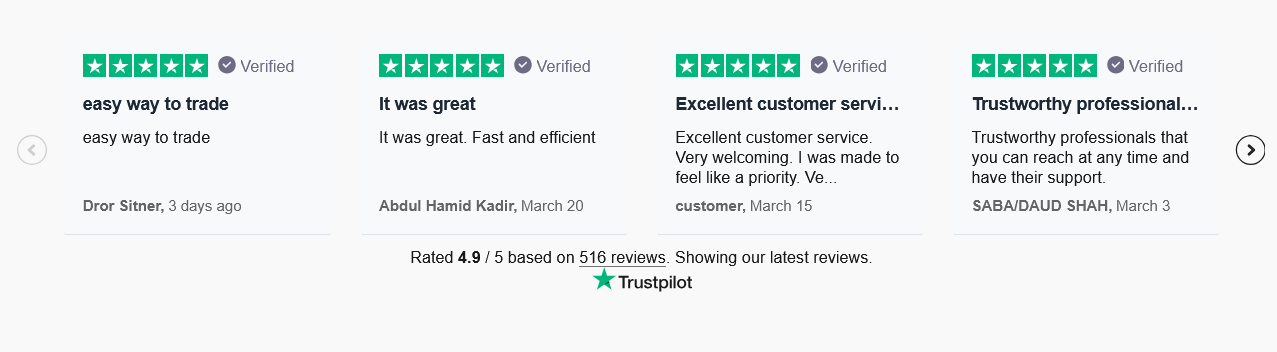

- 5/5-star TrustPilot ratings backed by strong client testimonials.

- Decades of experience in the futures industry.

- Maintains regulatory trust and exemplary standing with federal and independent futures regulators.

- Offers CannonX powered by CQG, a top-performing, professional futures trading platform.

Trading the S&P 500 via futures is a powerful, flexible, and efficient way to gain exposure to the broad U.S. equity market, hedge existing portfolios, or express directional views with leverage. But doing so successfully requires more than just picking a direction — it requires the backing of a strong, responsive, knowledgeable futures broker.

In this long-form article, we’ll explore how your futures broker can materially assist you in S&P 500 futures trading (sometimes called futures SP, SP 500 futures trading, or simply “SP futures”) and then dive deeply into how Cannon Trading Company exemplifies each of those beneficial traits. We’ll integrate references to CannonX powered by CQG, the many 5 out of 5-star ratings on TrustPilot, decades of experience in the industry, regulatory reputation, platform selection, and more.

Why Trade S&P 500 Futures?

Before focusing on broker support, it helps to recap what makes S&P 500 futures such an attractive instrument (and why a futures broker matters).

- Leverage / capital efficiency: With futures, you can control a notional exposure much larger than your margin deposit, meaning small percentage moves in the S&P 500 can lead to amplified profits and losses.

- Liquidity & tight spreads: The S&P 500 index futures (especially E-mini / Micro E-mini) are among the most heavily traded financial futures globally, ensuring you can often enter/exit with minimal slippage.

- Diversification / broad market exposure: Rather than betting on one stock, the futures S&P contract gives you exposure to 500 large-cap U.S. stocks as a bundle.

- Hedging and risk management: If you hold an equity portfolio, you can offset downside risk by shorting S&P futures.

- Efficient directional trading: No need to pick individual stocks; you can express macro views about the overall economy or market direction.

- Operational efficiency and roll flexibility: Futures contracts roll (e.g. quarterly) without you having to sell individual stocks.

But with these advantages come risks: leverage can magnify losses, margin calls loom, volatility can surprise, and you may need swift help in emergencies. That’s where the quality of your futures broker becomes critical.

How a Futures Broker Assists Your S&P 500 Futures Trading

A competent futures broker adds value well beyond merely executing your orders. Below are key roles and services a futures broker plays in helping you trade the S&P 500.

- Leverage structure, margin management, and capital allocation

- Setting margin levels: Your broker helps set (or communicates) the initial and maintenance margin requirements for S&P 500 futures contracts (e.g. E-mini, Micro E-mini).

- Monitoring margin changes: During volatile markets, exchanges may raise margin requirements. A proactive broker alerts you in advance to manage your capital.

- Leverage guidance: Because futures are leveraged, a broker can assist you in calibrating appropriate leverage, recommending safe position sizing, and helping you avoid overexposure.

- Intraday margin / intraday credits: Some brokers offer intraday margin relief or intra-day borrowing adjustments (for high-frequency trades), meaning you might be able to carry larger notional exposures intraday before settling.

- Margin loans or lines of credit (if applicable): Some brokers have facilities to provide temporary extension or funding, especially for institutional clients.

- Diversification across products and strategies

- Access to multiple markets: A good futures broker doesn’t limit you to just S&P 500 futures; they provide access to commodities, interest rates, FX, energy, and other financial futures. This allows you to hedge cross-market risk or diversify your trading approach.

- Strategy overlay: Your broker can help you run multi-leg strategies, such as spreading between different index futures, cross-asset hedges (e.g. S&P futures vs treasury futures), or even combining with options.

- Portfolio-level analysis: For clients with equity holdings or multiple assets, the broker can help you see correlation, exposures, and hedging needs across your portfolio using S&P futures as a tool.

- Hedging existing portfolios or overlay protection

- Equity portfolio hedge: If you own a basket of U.S. stocks, you can reduce downside risk by taking short futures S&P positions. The broker can assist in determining hedge ratios, slippage, roll cost, etc.

- Dynamic hedging / adjustments: As your equity portfolio changes, the broker can help rebalance futures hedges dynamically.

- Overlay strategies: In some cases, you might use S&P futures to overlay macro hedging over other holdings — for example, running a partial short futures hedge during a macro event.

- Execution, routing, and algorithmic support

- Smart order routing and execution algorithms: Brokers often provide ‘smart’ routing logic to find the best liquidity across CME, Globex, etc. For SP 500 futures, that means better fills, less slippage, and faster execution.

- Access to low-latency infrastructure: Especially for active traders, brokers with co-location, high-speed data links, and ultra-low latency are vital.

- Algorithmic tools / execution brokers: Some futures brokers offer prebuilt or customizable algos (TWAP, VWAP, ICE, etc.) for S&P 500 futures trades to reduce market impact.

- Order types and advanced features: Advanced conditional orders (OCO, trailing stops, auto roll, etc.) help traders in volatile SP markets.

- Emergency support and phone-order / voice assistance when systems fail

- One phone call away: A hallmark of a high-tier futures broker is that if your trading systems crash, your broker is ready to take voice orders immediately. This is vital in emergencies—be it margin stress, flash crashes, or platform outages.

- Manual intervention in crises: Brokers can intervene (within regulatory and internal guidelines) to help you get out of poor positions, flatten exposure, or switch to safer modes.

- Failover systems, backup points of presence: Brokers maintain redundant systems, backup connectivity, alternative servers, and contingency protocols so that even when your local system fails, they can route your trade through alternate channels.

- Broker-assisted liquidation / position adjustments: In cases where markets move violently and your stops don’t execute; the broker may assist in liquidating positions to preserve capital.

- Risk management, monitoring, and margin calls

- Real-time risk dashboards: Brokers provide monitoring tools that show margin usage, P&L burn rates, exposure, and scenario risk for S&P 500 futures positions.

- Alerts and notifications: You receive alerts when margin thresholds are reached or when volatility exceeds limits.

- Stop-loss and protective orders: Brokers help you implement protective orders, limit orders, or even cross-check for excess risk.

- Stress testing and “what-if” modeling: Some brokers help run scenario analyses (e.g. ±2% move in S&P) to see which positions might trigger margin calls.

- Education, analytics, signals, and market intelligence

- Research and commentary: Brokers often produce market outlooks, technical analysis, S&P 500 futures charts, support/resistance levels, and trade ideas.

- Signals and technical tools: Some brokers integrate signals or proprietary indicators into their platforms to help you time entries/exits in SP futures.

- Webinars, training, mentoring: For traders of any level, brokers provide education on S&P 500 futures trading, risk control, hedging, and trading discipline.

- Backtesting and historical data access: To test strategies in S&P 500 futures or futures SP, your broker may supply historical data feeds and backtesting tools.

- Regulatory compliance, clearing, and trust

- Regulated clearing and compliance: A reputable futures broker ensures your S&P 500 futures trades are cleared through trustworthy clearinghouses, segregated accounts, and adhere to regulatory standards.

- Transparency in fees and commissions: A good broker provides clear commission structures, exchange fees, and margin rules—nothing hidden.

- Audit trails, reporting, and accountability: Your broker must maintain audit trails, statements, trade confirmations, and regulatory reporting, giving you confidence.

- Dispute resolution and membership in regulatory bodies: If issues arise, you need a broker that has a solid, clean record with NFA, CFTC, etc.

- Platform choice and technology

- Multiple platform support: Because trading styles differ, brokers often support different platforms (desktop, web, mobile) — let’s say CannonX powered by CQG, Rithmic, Sierra, etc.

- Interoperability / multi-platform access: You can test strategies across platforms or switch if one fails.

- Customization and APIs: Brokers may provide APIs or plug-in access so you can build custom tools tied into S&P 500 futures trading.

- Stable, scalable infrastructure: High uptime and minimal latency are key, especially in fast-moving SP markets.

How Cannon Trading Company Embodies These Broker Benefits

ow that we’ve laid out what a strong futures broker should offer, let’s examine how Cannon Trading Company stands as a real-world example of a broker that delivers on all those fronts — particularly for s&p 500 futures, futures SP, and SP 500 futures trading.

Decades of experience and institutional pedigree

Cannon Trading Company has been operating since 1988 (over 35 years), giving it institutional depth, continuity, and resilience. Trustpilot+2Cannon Trading Company, Inc.+2 That long track record means that clients benefit from lessons across multiple market cycles, regulatory shifts, and technological transitions.

In blog content published by Cannon, the firm often points out that their decades of experience in the futures industry are a differentiator when interpreting macro and technical signals in the S&P 500 futures market. Cannon Trading Company, Inc.+2Cannon Trading Company, Inc.+2

Trust and reputation — 5 out of 5 TrustPilot ratings

Cannon Trading boasts numerous 5 out of 5-star ratings on TrustPilot, often cited in their marketing and client testimonials. Trustpilot+4Cannon Trading Company, Inc.+4Cannon Trading Company, Inc.+4 They maintain a TrustScore effectively near 4.9 to 5.0, with over 500 reviews. Cannon Trading Company, Inc.+3Trustpilot+3Cannon Trading Company, Inc.+3 Client reviews frequently mention how they feel “one call away,” or how brokers have helped during technical issues, which maps directly to the value of voice support and emergency assistance. Cannon Trading Company, Inc.+2Cannon Trading Company, Inc.+2

Exemplary regulatory standing and compliance

Cannon is a member of the National Futures Association (NFA) and subject to Commodity Futures Trading Commission (CFTC) regulations. Trustpilot+2Cannon Trading Company, Inc.+2 Their public statements emphasize a “pristine reputation with federal and independent futures industry regulators alike.” Cannon Trading Company, Inc.+3Cannon Trading Company, Inc.+3Cannon Trading Company, Inc.+3 In addition, they often promote that regulatory confidence is essential for futures traders in high-leverage markets like futures SP. Cannon Trading Company, Inc.+3Cannon Trading Company, Inc.+3Cannon Trading Company, Inc.+3

Because the futures industry is heavily regulated, knowing your broker is credible, transparent, and compliant is non-negotiable — especially when trading S&P 500 futures.

Platform excellence and technological depth: CannonX powered by CQG

One of Cannon’s standout offerings is CannonX powered by CQG — their flagship platform that combines CQG’s powerful data engine, charting, and execution capabilities with Cannon’s front-end customization and support. Cannon Trading Company, Inc.+3Cannon Trading Company, Inc.+3Cannon Trading Company, Inc.+3 This platform ensures traders in s&p 500 futures trading get low-latency data, advanced charting, custom layouts, and smooth trade routing.

In addition to CannonX, they also support other industry platforms to ensure flexibility and failover options. Cannon Trading Company, Inc.+3Cannon Trading Company, Inc.+3Cannon Trading Company, Inc.+3 That aligns exactly with the broker trait of giving you platform choice, redundancy, and API-level access.

Emergency support and voice assistance

Cannon emphasizes that traders are never left hanging: “Real, licensed futures brokers are just a call away — a rarity in today’s automated world.” Cannon Trading Company, Inc.+1 Their promotional and testimonial narratives underscore that in moments of platform failure or high volatility, their brokers can take telephone orders, flatten positions, or intervene as needed. Cannon Trading Company, Inc.+3Cannon Trading Company, Inc.+3Cannon Trading Company, Inc.+3 That element—“one phone call in case of emergency”—is featured repeatedly by clients reviewing the firm on TrustPilot. Cannon Trading Company, Inc.+1

Risk management, alerts, analytics, and client support

Cannon offers real-time support, educational materials, market commentary, and analytics tailored to S&P 500 futures, supporting both novice and advanced traders. Cannon Trading Company, Inc.+3Cannon Trading Company, Inc.+3Cannon Trading Company, Inc.+3 Their blog often contains articles on support/resistance levels, futures SP strategies, handling liquidity gaps, and technical indicators. Cannon Trading Company, Inc.+5Cannon Trading Company, Inc.+5Cannon Trading Company, Inc.+5 For example, they publish regular daily support & resistance levels for S&P 500 Index futures. Cannon Trading Company, Inc. They have also posted deep-dive articles like “Futures on S&P 500: Your 8 Important Need-to-Knows” to demystify challenges in futures S&P trading. Cannon Trading Company, Inc.

Client-centric service and personalization

Cannon markets itself as a broker that treats clients not as numbers, but as partners. Cannon Trading Company, Inc.+3Cannon Trading Company, Inc.+3Cannon Trading Company, Inc.+3 Their TrustPilot reviews often praise the prompt, personal responses, dedicated broker assignments, and hands-on help in platform setup or strategy implementation. Cannon Trading Company, Inc.+1 That level of client-centric service helps ease the steep learning curve of trading SP 500 futures.

Transparency of costs and commission

Cannon is clear about commissions, margin rules, exchange fees, and platform fees. Cannon Trading Company, Inc.+2Cannon Trading Company, Inc.+2 Transparent cost structures are vital for futures traders who often run high turnover in futures SP or SP 500 futures trading strategies.

For More on S&P 500 Futures Trading with Cannon

Cannon’s own blog domain carries domain authority and hosts multiple well-ranked articles focusing precisely on S&P 500 futures, futures SP, and SP 500 futures trading. For instance:

FAQ

Q1: Why not just trade S&P 500 ETFs instead of futures SP?

A1: ETFs require full capital for exposure, have slower execution, and can’t provide the same leverage, intraday hedging, or roll flexibility. Futures SP offers more efficiency, tighter spreads, and robust hedging capacity.

Q2: How risky is using leverage in SP 500 futures?

A2: High leverage amplifies both gains and losses. If the market moves sharply against your position, you may face margin calls or forced liquidation. A good futures broker helps you calibrate risk, alerts you early, and assists you in adverse conditions.

Q3: What if my broker doesn’t support platform redundancy or voice support?

A3: You may be stranded during technical failures or crises. That’s why selecting a broker like Cannon (with multi-platform support and phone backup) is essential for serious s&p 500 futures traders.

Q4: Can I hedge only part of my equity portfolio with S&P futures?

A4: Yes. Many traders run partial hedge overlays to limit downside, maintain upside participation, or dynamically adjust hedge ratios as markets shift.

Q5: Is CannonX powered by CQG available to all clients?

A5: Yes — brokers like Cannon offer access to CannonX (with the underlying CQG engine) alongside other platforms, giving traders flexibility in choosing the interface and tools they prefer.

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading