Get Real Time updates and more on our private FB group!

Managing Expectations for the Non Farm Payroll Release.

by John Thorpe, Senior Broker

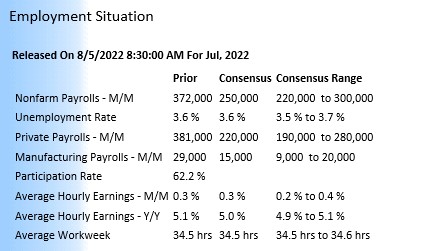

This Friday, we will get the market moving report before the open @ 8:30a.m. EDT. It’s important to understand that this information in this format has already been digested by or priced into the market. These opinions are published by Econoday.com. When the Bureau of Labor Statistics releases the actual numbers, the market may violently react if the numbers in each or several of the below categories differ from the consensus viewpoints. If the numbers are in line with expectations, the markets will typically offer limited change in their pricing of the affected asset(s).

.

Employment Situation

Consensus Outlook

A 250,000 rise is Econoday’s consensus for nonfarm payroll growth in July which would be much lower than June’s as-expected 372,000. Average hourly earnings in June cooled to 0.3 percent on the month and to 5.1 percent on the year with steady showings expected for July, at 0.3 and 5.0 percent.

Definition

The most closely watched of all economic indicators, the employment situation is a set of monthly labor market indicators based on two separate reports: the establishment survey which tracks 650,000 worksites and offers the nonfarm payroll and average hourly earnings headlines and the household survey which interviews 60,000 households and generates the unemployment rate.

Nonfarm payrolls track the number of part-time and full-time employees in both business and government. Average hourly earnings track employee pay while the average workweek, also part of the establishment survey, tracks the number of hours worked. The report’s private payroll measure excludes government workers.

The unemployment rate measures the number of unemployed as a percentage of the labor force. In order to be counted as unemployed, one must be actively looking for work. Other commonly known data from the household survey include the labor supply and discouraged workers.

Why Investors Care

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

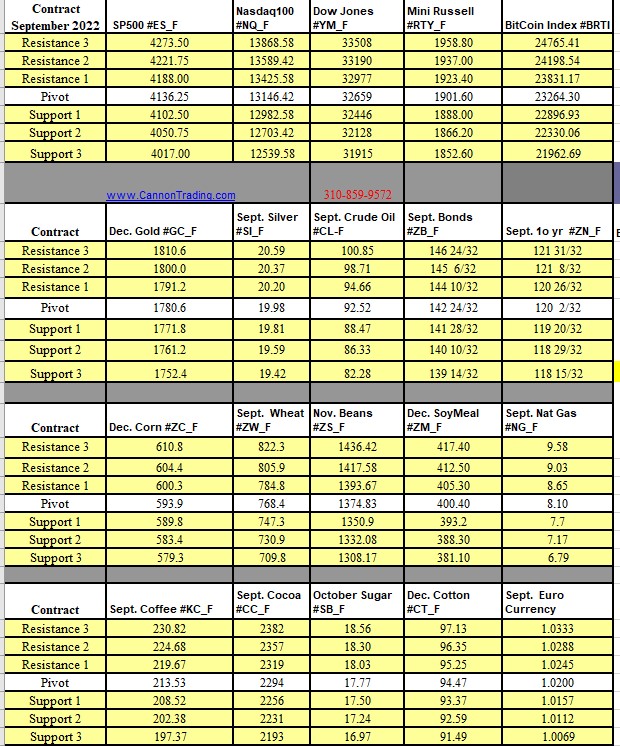

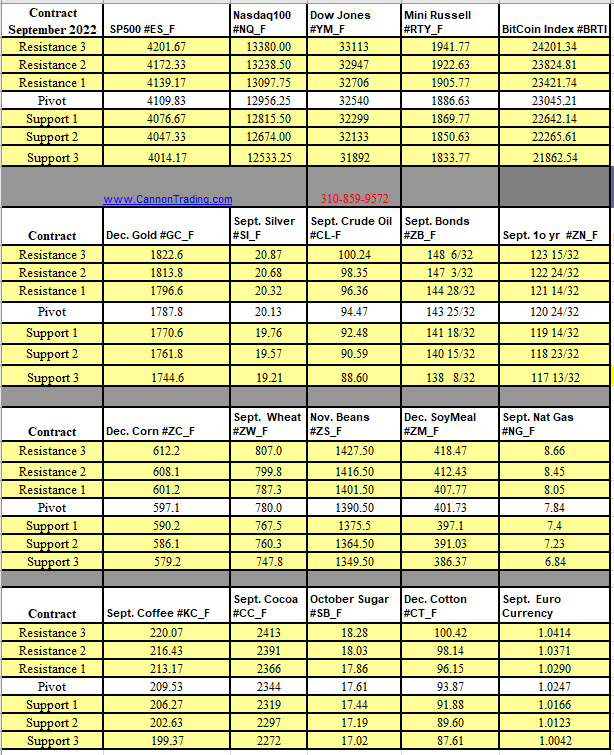

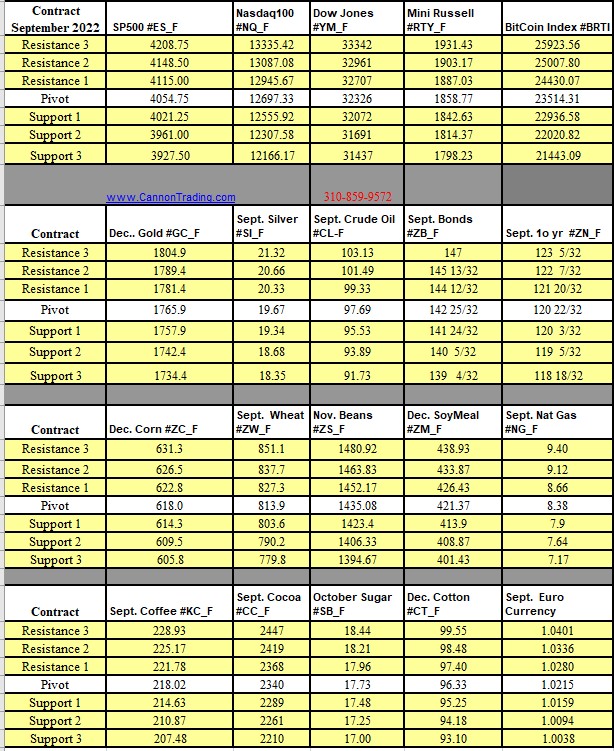

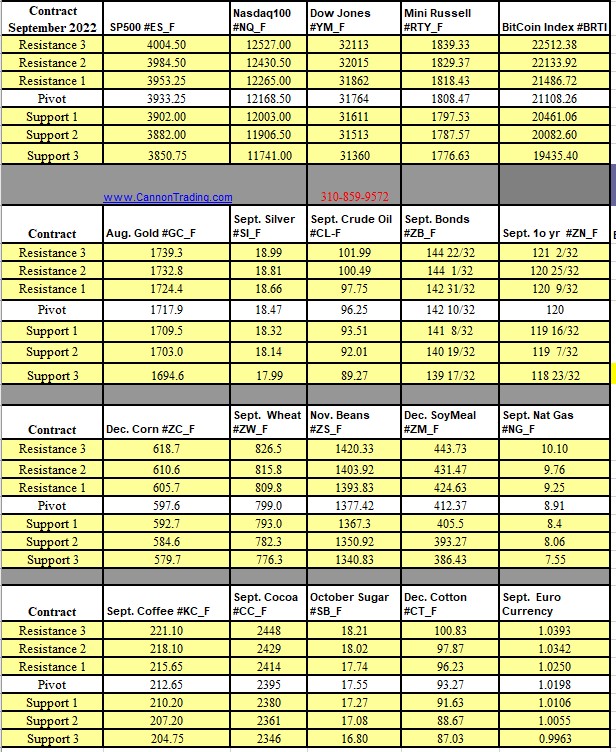

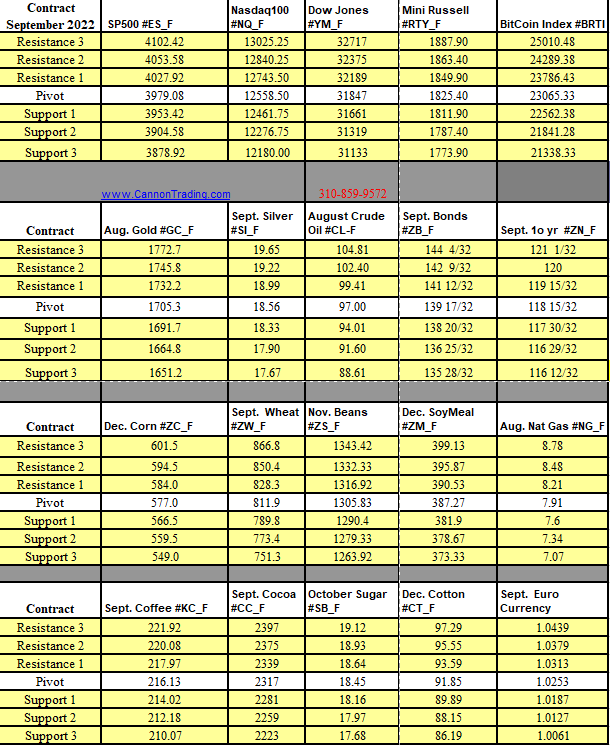

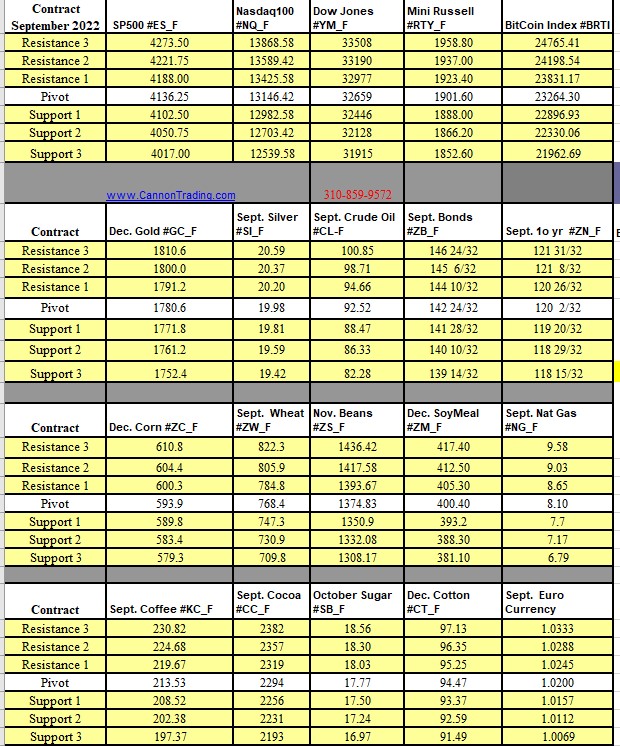

Futures Trading Levels

08-04-2022

Improve Your Trading Skills

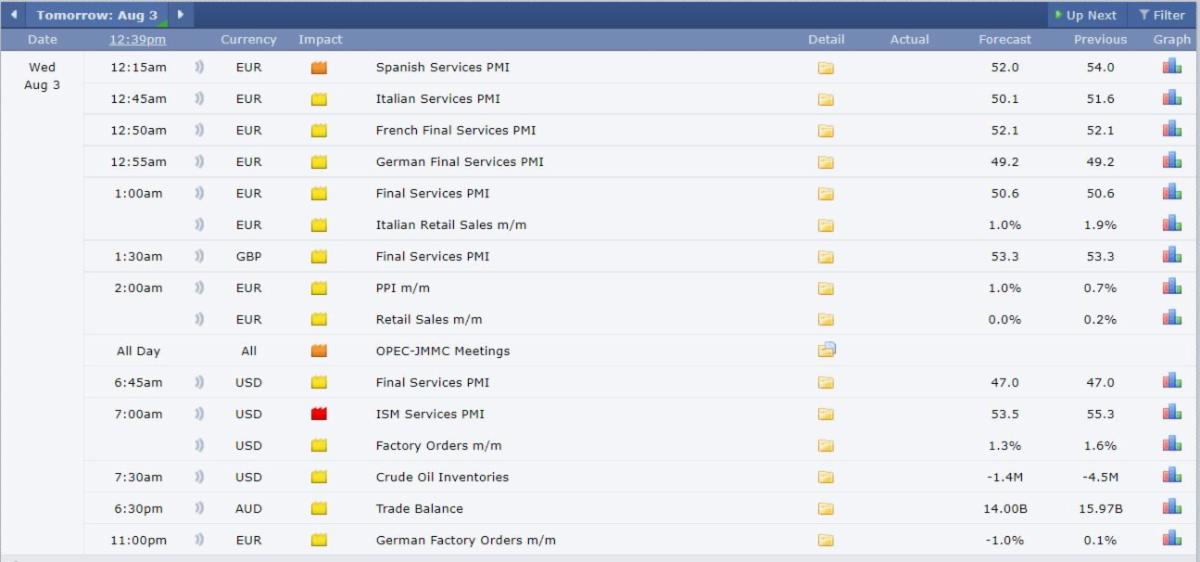

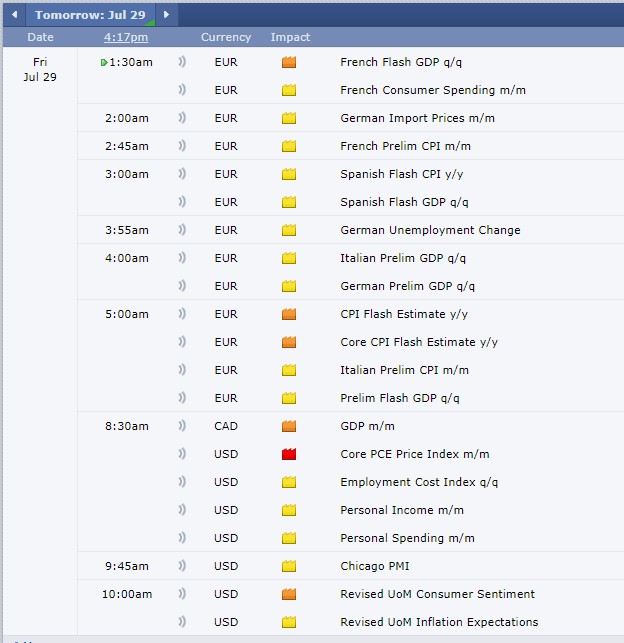

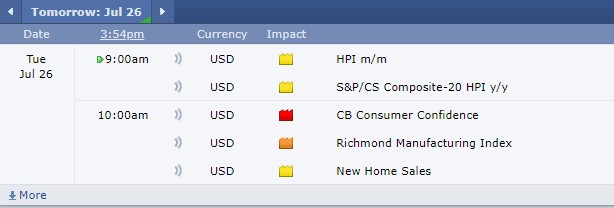

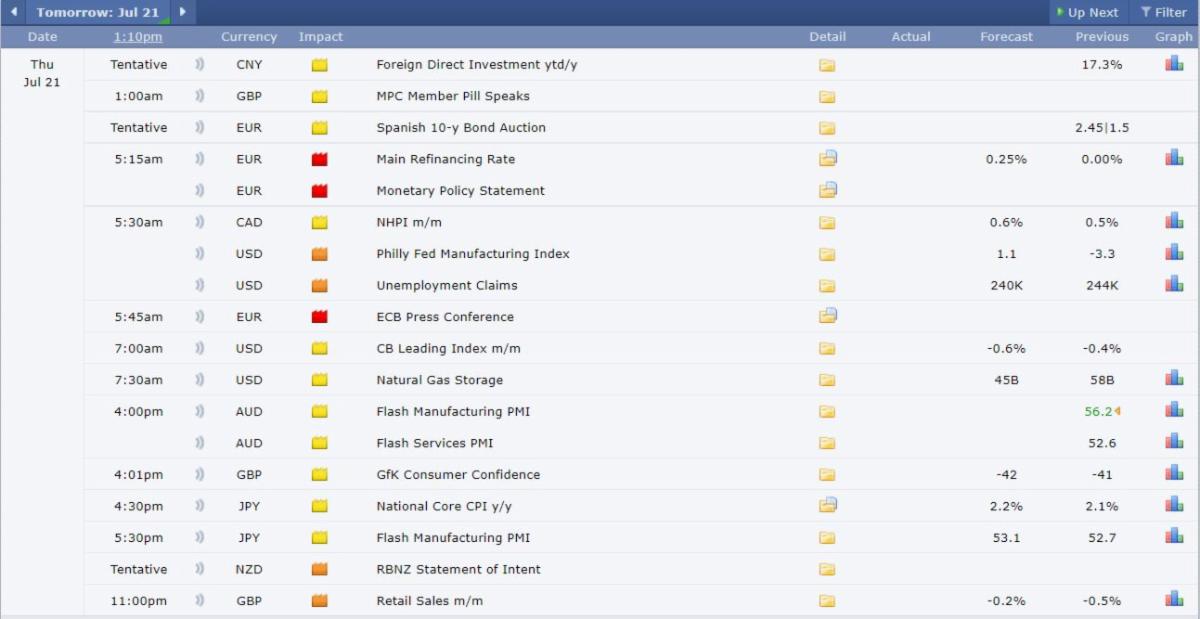

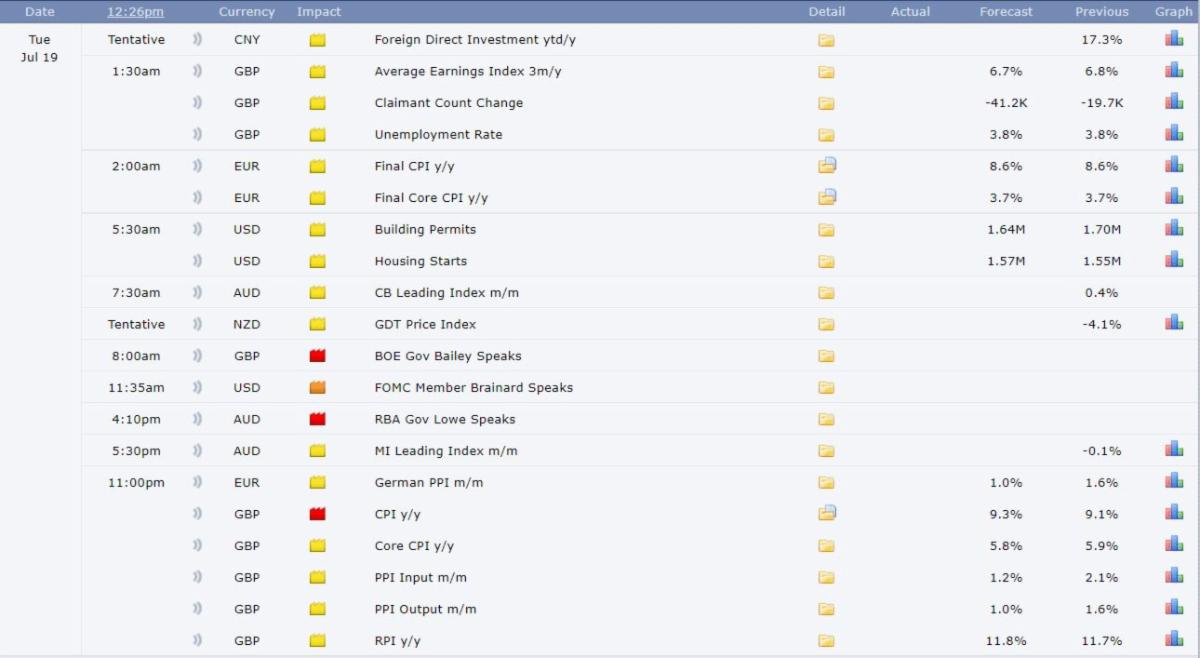

Economic Reports, Source:

Forexfactory.com

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.