Introduced in April 1982 by the Chicago Mercantile Exchange (CME), the S&P 500 Futures Contract represented a turning point in financial markets. Before its debut, traders had limited tools to hedge or speculate on the broader U.S. equity market. The S&P 500 index, comprising 500 of the largest publicly traded companies in the U.S., was already a key benchmark of market performance. By creating a derivative tied to the index, the CME provided traders and institutions with a liquid, leveraged way to manage risk or profit from market movements.

This new financial instrument quickly gained traction. Unlike individual stocks, S&P 500 Futures Contracts allowed participants to trade the entire market with a single position. It was a game-changer for portfolio managers, hedge funds, and individual traders alike.

Evolution of the S&P 500 Futures Contract

Over the decades, the S&P 500 Futures Contract has undergone significant evolution. Initially, the contract was accessible only to institutional players with deep pockets. The margin requirements and notional value of the contract were high, making it impractical for smaller traders. However, the CME’s introduction of E-mini S&P 500 Futures in 1997 dramatically expanded accessibility.

These smaller contracts mirrored the original S&P 500 Futures Contract but with reduced notional value and margin requirements. Retail traders could now participate in the same market as institutional giants, leveling the playing field and increasing liquidity. The introduction of Micro E-mini S&P 500 Futures in 2019 further democratized futures trading, enabling even smaller trades with minimal financial commitment.

Technological advancements have also played a significant role. The advent of electronic trading platforms in the late 1990s transformed the market, making trading faster, more transparent, and widely accessible. Today, traders around the globe execute futures SP trades with just a few clicks, relying on real-time data and advanced analytics to inform their decisions.

The Current State of S&P 500 Futures

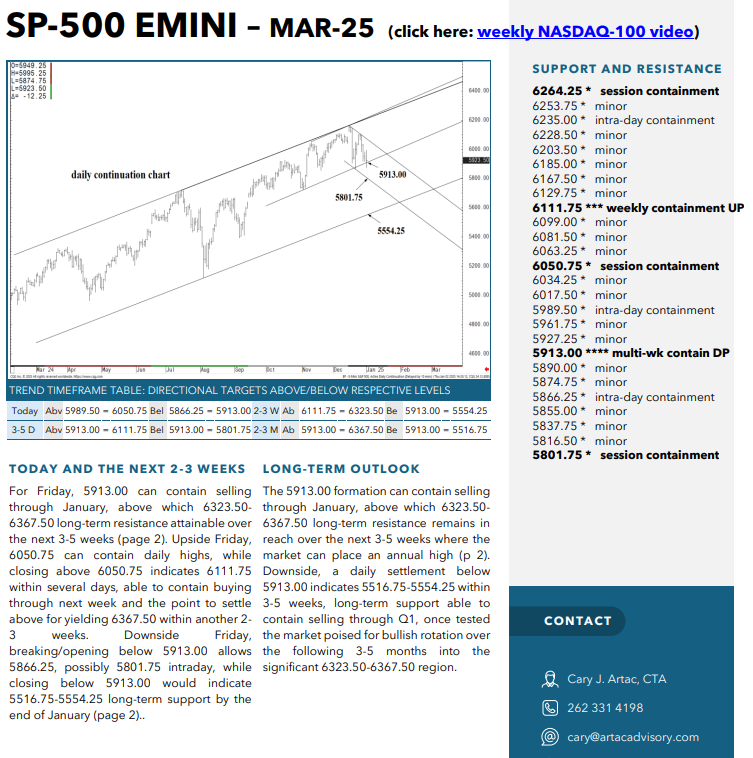

As we approach 2025, the S&P 500 Futures Contract remains a cornerstone of global financial markets. It serves three primary purposes:

- Hedging: Institutions use the contract to mitigate risk. For example, a pension fund heavily invested in U.S. equities might short the S&P 500 Futures Contract to protect its portfolio during market downturns.

- Speculation: Speculative traders often look fo market fluctuations, leveraging the contract’s high liquidity and transparency to execute short-term strategies.

- Portfolio Diversification: The S&P 500 Futures Contract enables investors to gain or reduce exposure to U.S. equities without trading individual stocks.

In recent years, rising geopolitical tensions, pandemic-related economic shocks, and rapid technological innovation have contributed to heightened market volatility. This volatility has increased the appeal of S&P 500 Futures Contracts, as traders capitalize on swift market movements.

What’s Next for the S&P 500 Futures Contract?

Looking ahead to 2025, several trends are likely to shape the future of the S&P 500 Futures Contract:

- Increased Algorithmic Trading: Algorithms now dominate the trading of S&P 500 Futures Contracts. In 2025, advancements in artificial intelligence (AI) are expected to further refine these systems, enhancing market efficiency while potentially increasing competition among traders.

- Sustainability and ESG Factors: As environmental, social, and governance (ESG) considerations gain prominence, derivatives linked to ESG-focused indices are growing in popularity. The CME may introduce variations of the S&P 500 Futures Contract tied to ESG criteria, offering traders new opportunities to align their strategies with ethical investing principles.

- Regulatory Developments: As global regulators continue to monitor derivative markets, traders can expect enhanced safeguards against systemic risks. These measures aim to ensure the long-term stability of the market, preserving its appeal for both retail and institutional participants.

- Expansion of Retail Participation: With brokers like Cannon Trading Company leading the charge, retail participation in S&P 500 Futures Contracts is expected to surge. Advances in education, trading platforms, and tools will further empower individual traders to harness the potential of these contracts.

Why Cannon Trading Company Is the Ideal Partner for Futures Traders

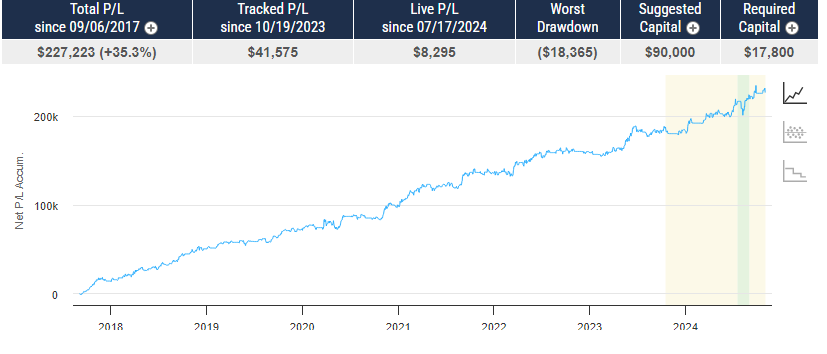

For traders looking to capitalize on the opportunities offered by the S&P 500 Futures Contract, choosing the right brokerage is critical. Cannon Trading Company stands out as a premier choice for several compelling reasons.

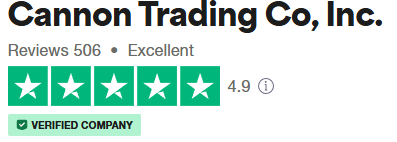

- Exceptional Reputation: With a flawless 5 out of 5-star rating on TrustPilot, Cannon Trading Company has earned the trust of traders worldwide. Clients consistently praise the firm for its transparency, reliability, and personalized support.

- Decades of Experience: Founded in 1988, Cannon Trading Company has decades of expertise in the futures markets. Its team of seasoned professionals offers invaluable insights and guidance, ensuring that traders are equipped to succeed in even the most challenging market conditions.

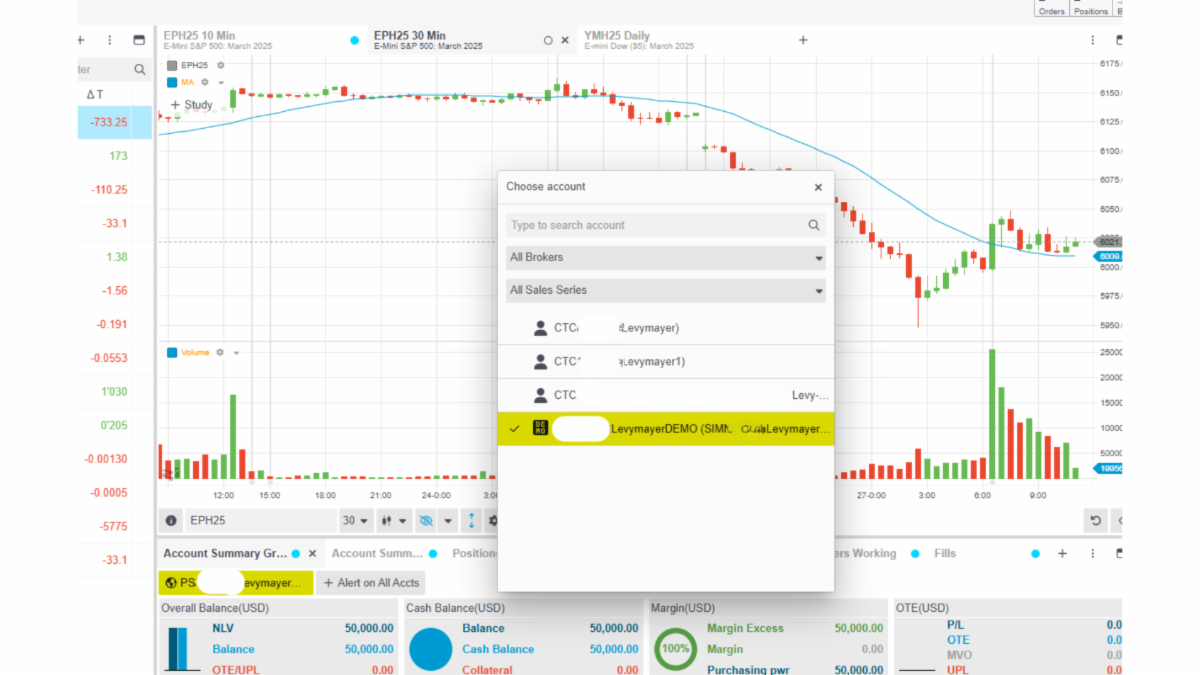

- Free Trading Platforms: Cannon Trading Company provides access to cutting-edge trading platforms at no cost. These platforms offer advanced charting tools, real-time data, and customizable features, enabling traders to execute their futures SP strategies with precision.

- Regulatory Excellence: The firm’s impeccable regulatory record underscores its commitment to integrity and client protection. Cannon Trading Company operates under the strict oversight of the National Futures Association (NFA) and the Commodity Futures Trading Commission (CFTC), providing peace of mind to traders.

- Comprehensive Support: From novice traders to seasoned professionals, Cannon Trading Company caters to all levels of experience. Its educational resources, including webinars, blogs, and one-on-one consultations, empower clients to master the complexities of S&P 500 Futures Contracts.

Why Trade S&P 500 Futures with Cannon Trading Company?

The S&P 500 Futures Contract offers unparalleled flexibility and potential. Whether you aim to hedge against market risk, speculate on short-term price movements, or diversify your portfolio, this contract is a powerful tool. Partnering with a trusted brokerage like Cannon Trading Company amplifies these advantages, ensuring that you have the resources, support, and technology needed to excel in futures trading.

Trading prowess often hinges on timing, knowledge, and execution. With Cannon Trading Company by your side, you can navigate the complexities of the S&P 500 Futures Contract with confidence, turning market challenges into opportunities for growth.

The journey of the S&P 500 Futures Contract is a testament to the innovation and resilience of global financial markets. From its inception in 1982 to its modern iterations, the contract has continually adapted to the needs of traders and investors. As we approach 2025, its relevance remains stronger than ever, promising new opportunities amid evolving market dynamics.

For traders seeking to unlock the full potential of S&P 500 Futures Contracts, partnering with an experienced and reputable brokerage like Cannon Trading Company is a winning strategy. With its stellar reputation, advanced tools, and commitment to client success, Cannon Trading Company is the ultimate ally for navigating the exciting world of futures trading.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading