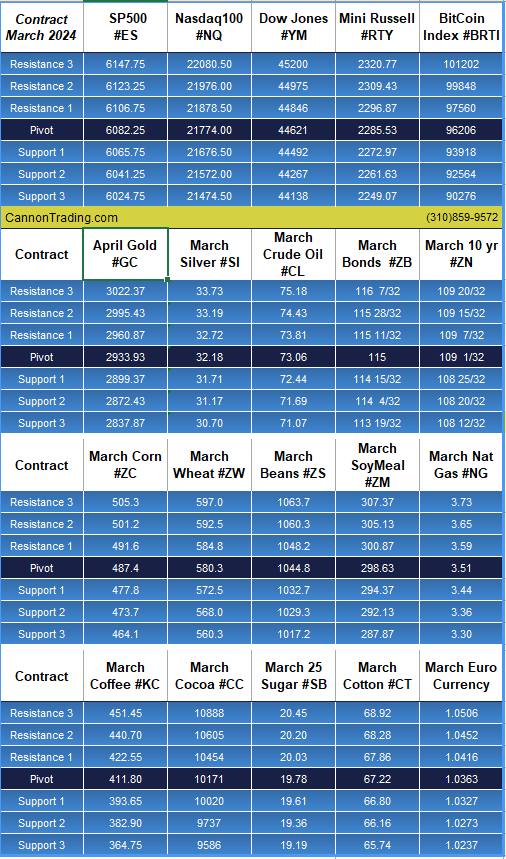

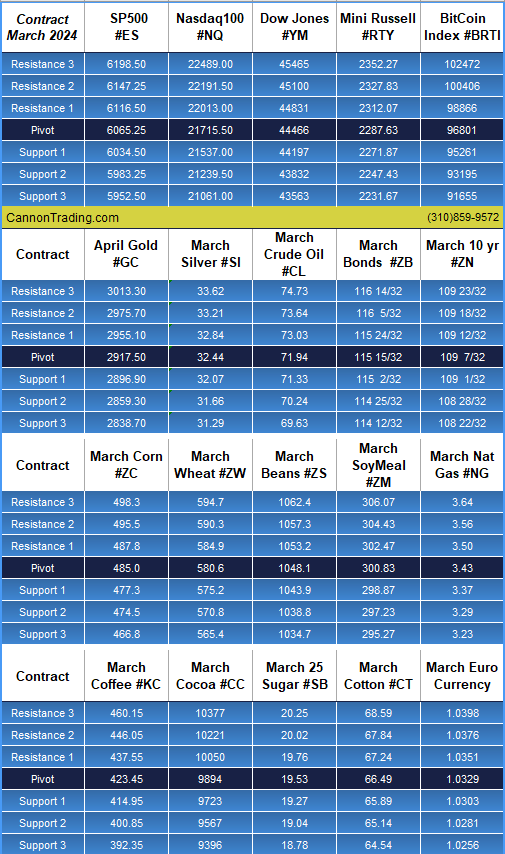

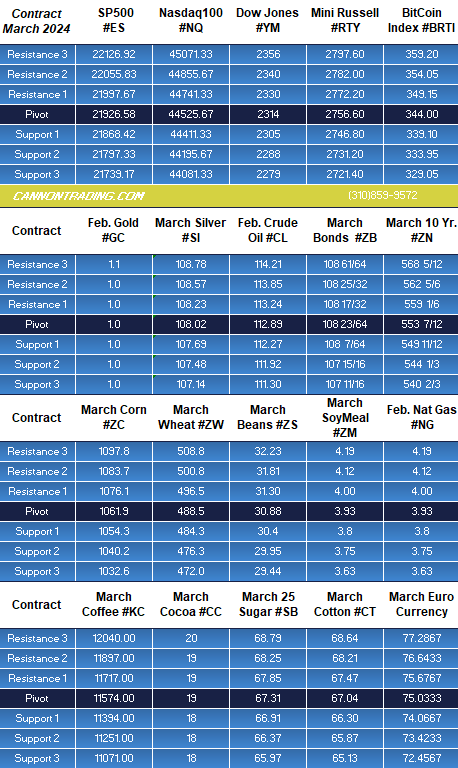

Treasury Bonds & Notes – Different market, different trading environments

Each market has different personality, different behavior along with different times of the day when it is most active. If you are finding that the ES (mini SP) is not giving you enough risk/opportunities, then start monitoring a couple of other markets and perhaps explore them in demo / simulated mode.

There are more than a few markets I think are suitable for day-trading. Below you will find some observations, tips along with what is unique about these markets, personality and most active trading hours.

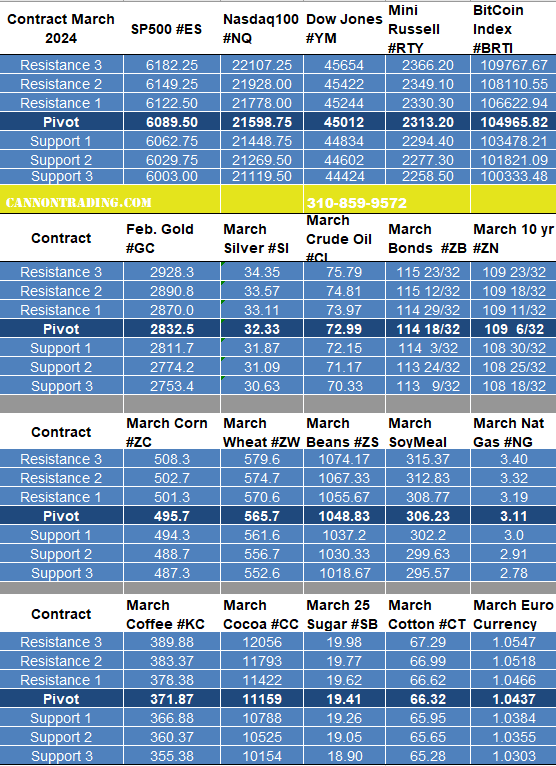

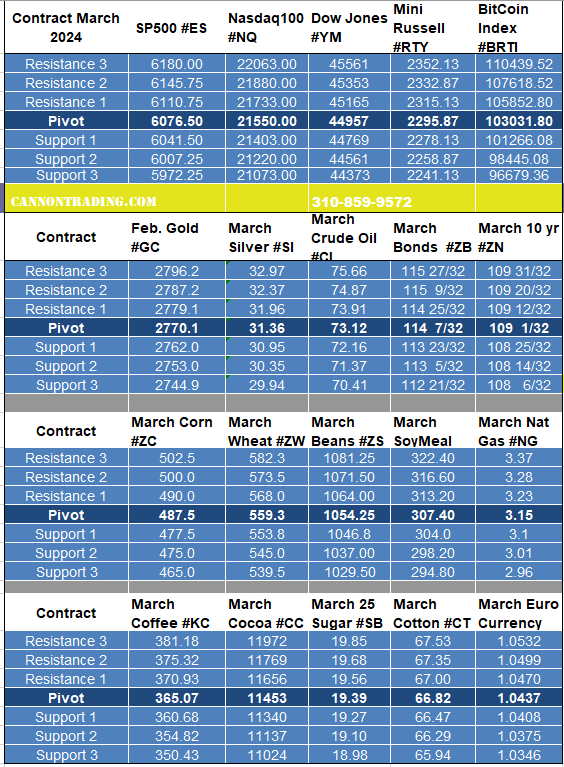

Interest rates, mostly the ten year and 30-year.

In most platforms, the symbols are ZB for 30-year bonds and ZN for 10-year notes.

Product Symbol

ZB

Treasury Bonds

Contract Size

The unit of trading shall be U.S. Treasury Bonds having a face value at maturity of one hundred thousand dollars ($100,000) or multiples thereof

Price Quotation

Points ($1,000) and 1/32 of a point. For example, 134-16 represents 134 16/32. Par is on the basis of 100 points.

Product Symbol

ZN

Underlying Unit

One U.S. Treasury note having a face value at maturity of $100,000 < Treasury Bond.

Price Quote

Points ($1,000) and halves of 1/32 of a point. For example, 126-16 represents 126 16/32 and 126-165 represents 126 16.5/32. Par is on the basis of 100 points.

Tick Size

(minimum fluctuation)

One-half of one thirty-second (1/32) of one point ($15.625, rounded up to the nearest cent per contract), except for intermonth spreads, where the minimum price fluctuation shall be one-quarter of one thirty-second of one point ($7.8125 per contract).

Contract Months

The first five consecutive contracts in the March, June, September, and December quarterly cycle.

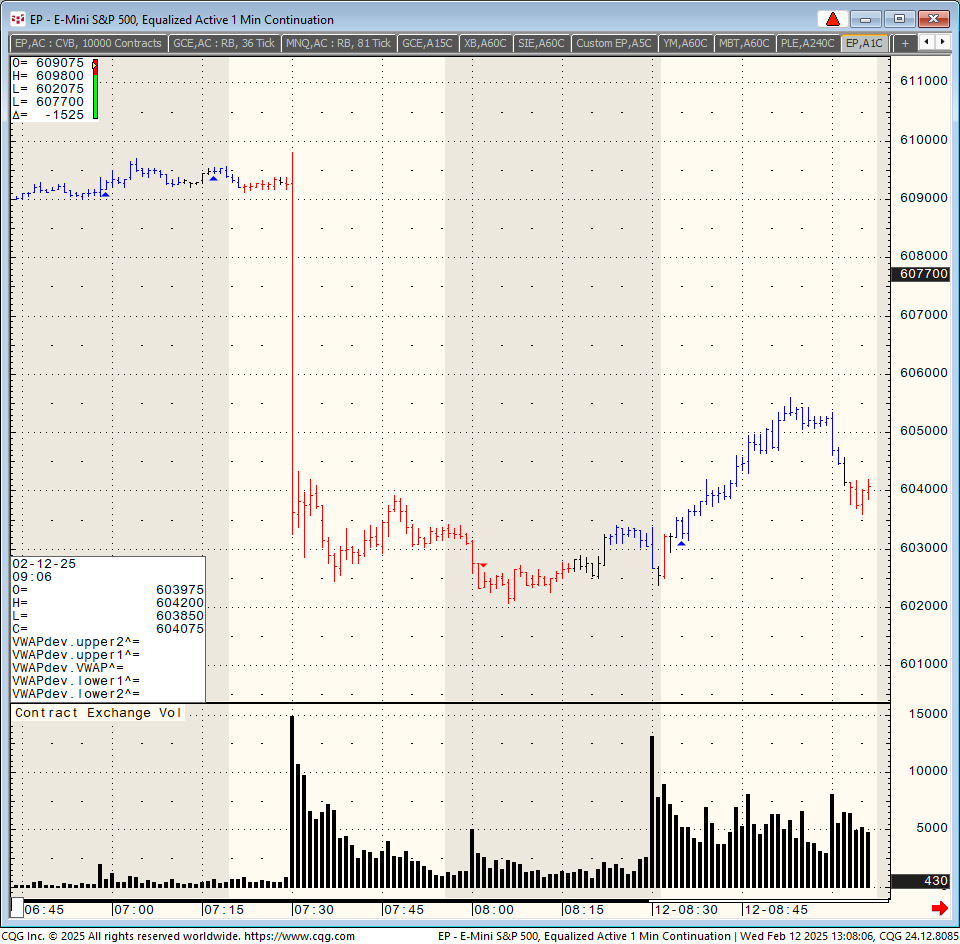

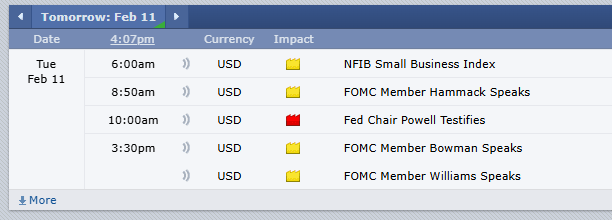

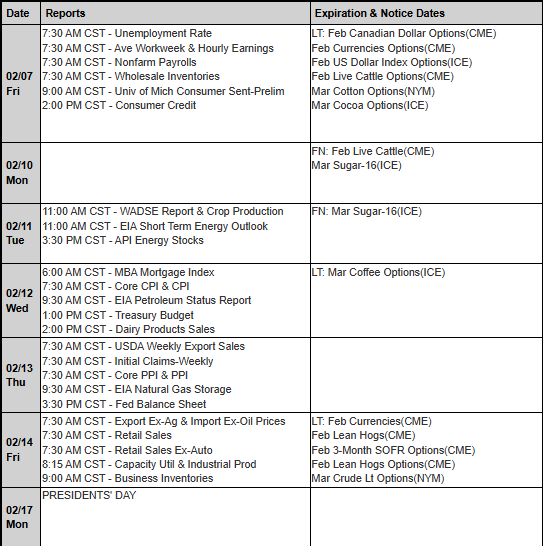

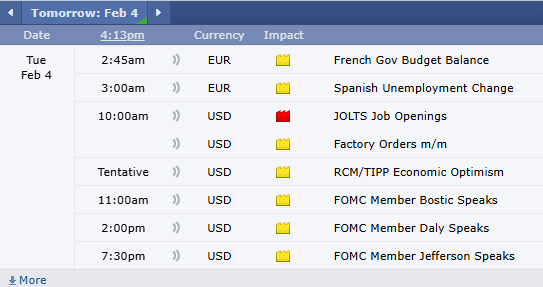

These contracts are often affected by many of the economic reports that come out at 8:30 Am Eastern and there is very active volume between the hours of 8 am EST and 3 PM EST

Volume on both contracts is very good. Ten years will often have 1 million contracts traded per day (might be the second most active US futures market after the mini SP 500) and the bonds will avg. around 1,300,000 contracts.

These markets can experience very volatile movements during and right after different reports but then will often trade smooth or in an intraday trend the rest of the day.

Another advantage for these markets is that the exchange fees per trade are LOWER than the ones on the stock index futures. |