Futures quotes are fundamental to the world of futures trading, serving as the essential indicators of market sentiment, pricing, and future expectations across a broad array of asset classes. These quotes play a vital role for various market participants, from commodities brokers and future brokers to retail and institutional traders, as well as hedgers. By offering detailed insights into contract prices, trade volumes, and open interest, futures quotes help in making informed trading and hedging decisions, enhancing the efficiency of the entire marketplace.

What are Futures Quotes?

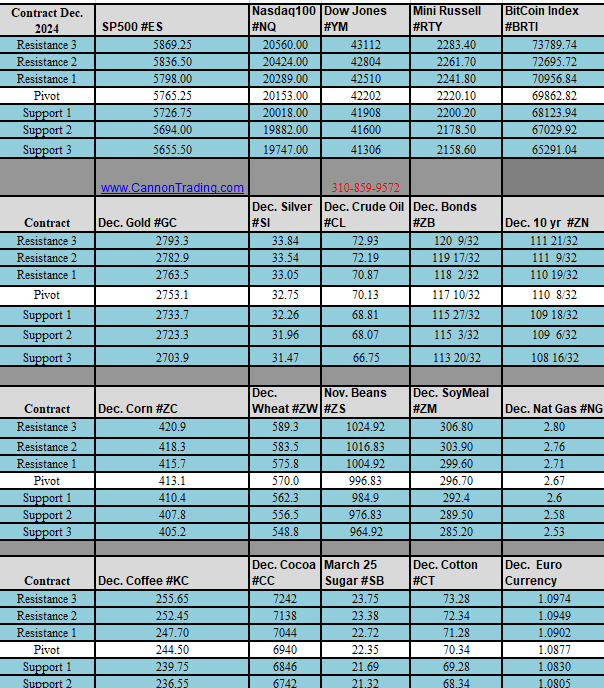

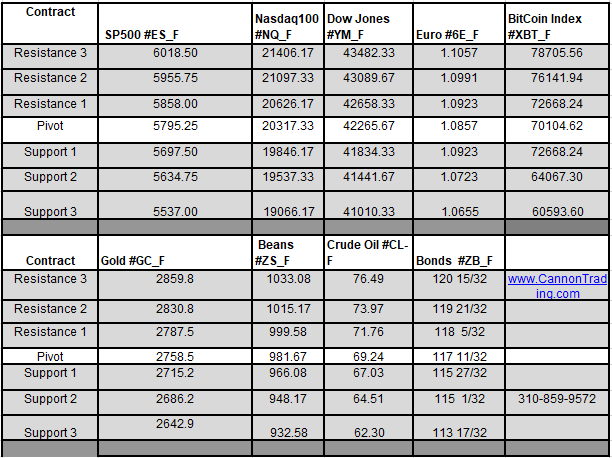

Futures quotes represent the current prices and associated data for futures contracts in the market. They typically include key information such as the bid (the highest price a buyer is willing to pay), ask (the lowest price a seller is willing to accept), last traded price (the most recent transaction price), open interest (total number of open contracts), and volume (the number of contracts traded over a given period). The price of a futures quote fluctuates in real time based on supply and demand and reflects the market’s expectations of where an asset’s price is headed in the future.

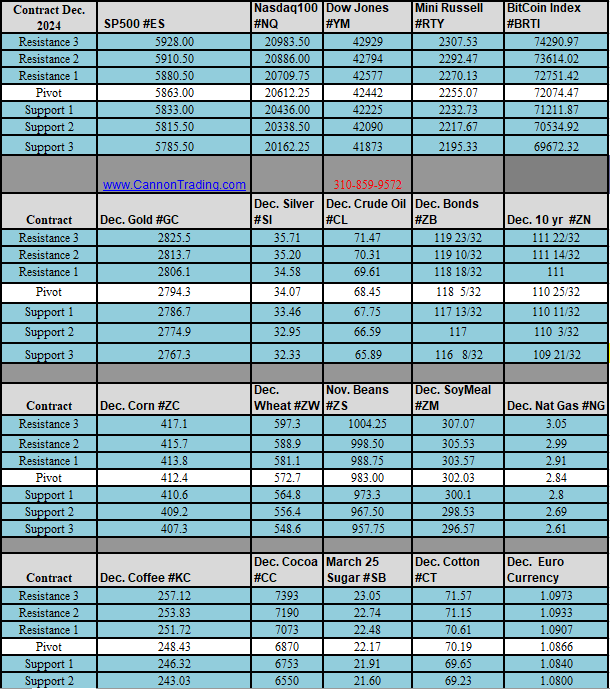

These quotes are crucial for market participants because they provide insights into the current sentiment and expected direction of prices for various commodities, currencies, stock indices, and other underlying assets. By interpreting futures quotes, traders and brokers can gauge market conditions, strategize on entry and exit points, and anticipate potential price movements to maximize profitability or mitigate risks.

How Futures Quotes Inform Traders and Brokers

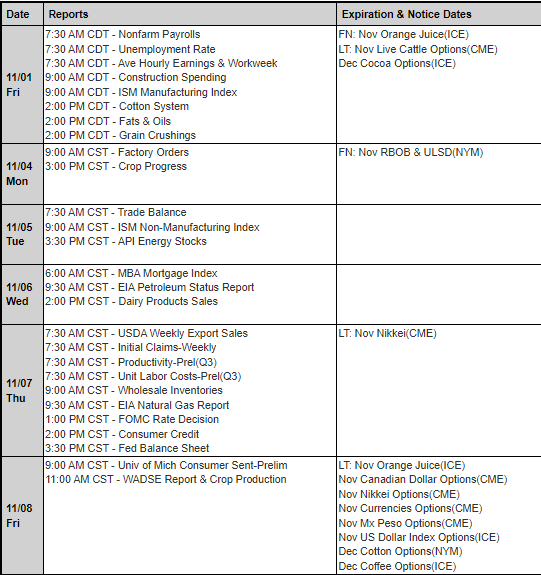

Traders, brokers, and investors alike use futures quotes as a real-time source of information for decision-making. These quotes allow them to monitor market trends and price fluctuations and analyze supply and demand dynamics in the futures market. For example, commodities brokers closely follow futures quotes to assess the prices of agricultural products, metals, or energy resources. Future brokers, on the other hand, may focus on quotes across different asset classes, offering insights and trading options to their clients.

Futures quotes also help market participants recognize patterns and trends. If a quote shows a consistent upward trend, traders might interpret this as a signal of increasing demand or decreasing supply. In contrast, if a futures quote exhibits frequent fluctuations or erratic movements, this could suggest market uncertainty or volatility, potentially influencing brokers’ and traders’ strategies. By understanding these patterns, traders and brokers can make more informed decisions, placing themselves in a stronger position to capitalize on price movements.

Sources of Futures Quotes

Access to real-time futures quotes is essential for traders who want to act on the most current information. Futures quotes can be found through several sources, including online trading platforms, financial news websites, brokerage platforms, and dedicated market data providers. Many commodities brokers and future brokers provide real-time or delayed futures quotes on their trading platforms, making it convenient for clients to monitor market changes and adjust their strategies accordingly.

Popular sources of futures quotes include:

- Brokerage Platforms: Most brokers, whether focused on commodities or futures trading, provide real-time futures quotes on their trading platforms. These platforms allow traders to monitor their desired contracts, conduct analysis, and place trades.

- Financial News Websites: Websites such as CNBC, Bloomberg, and Reuters offer futures quotes, often accompanied by news, analysis, and expert opinions. This comprehensive view helps traders interpret data within the larger economic context.

- Market Data Providers: Specialized market data providers, like CME Group, ICE (Intercontinental Exchange), and Nasdaq, offer extensive futures data across multiple asset classes. These platforms provide up-to-date data that’s especially valuable to institutional traders and hedgers.

- Trading Terminals: Professional trading terminals like Bloomberg Terminal and Thomson Reuters Eikon provide in-depth access to futures quotes, alongside various analysis tools and market insights.

- Mobile Apps and Online Platforms: Retail traders frequently use mobile apps and online platforms like TD Ameritrade, E*TRADE, and Interactive Brokers to obtain futures quotes on the go. These platforms are often geared toward retail investors and provide a user-friendly interface with real-time quotes.

How Retail Traders Use Futures Quotes to Their Advantage

Retail traders, or individual investors, can leverage futures quotes to develop strategies for short-term trading, day trading, or long-term positions. By analyzing futures quotes, they can spot opportunities for profit in trending markets or capitalize on price swings. Here are a few strategies through which retail traders use futures quotes to their advantage:

- Timing Entry and Exit Points: Futures quotes help retail traders determine the optimal times to enter or exit trades. By studying fluctuations in bid and ask prices, retail traders can decide when to place orders based on their price targets.

- Analyzing Open Interest and Volume: Open interest and volume data included in futures quotes indicate market activity and liquidity. High volume and increasing open interest generally suggest a strong trend, which can be a signal for traders to join a market move, while declining volume may indicate a trend reversal.

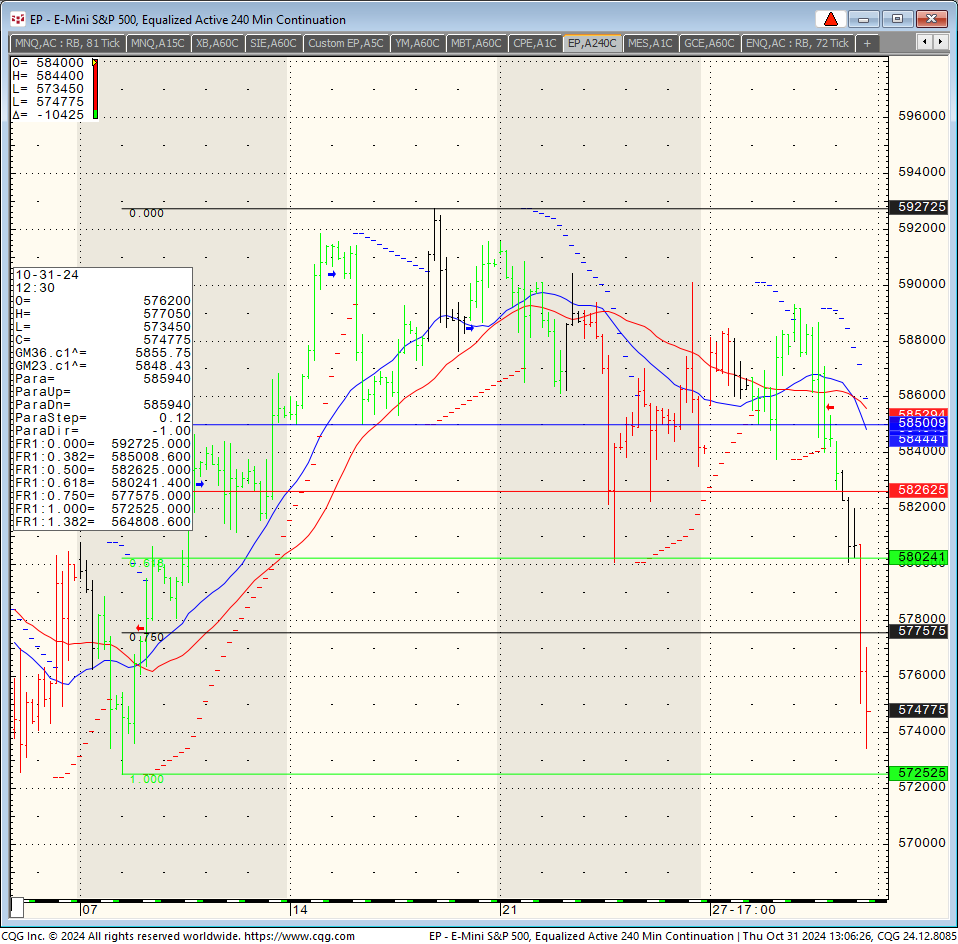

- Anticipating Market Movements with Technical Analysis: Futures quotes allow retail traders to use technical analysis indicators, such as moving averages or Bollinger Bands, to predict price movements. Technical analysis based on real-time futures quotes helps retail traders make more precise and informed decisions.

- Hedging: Some retail traders use futures to hedge against other investments in their portfolio. For instance, if a trader has a substantial investment in stocks, they might hedge by taking a position in stock index futures as a way to mitigate downside risk.

By using futures quotes as the foundation of their trading strategies, retail traders can enhance their potential for success and build more resilient portfolios.

Institutional Traders and Futures Quotes

Institutional traders, such as hedge funds, mutual funds, and large investment firms, often rely on futures quotes as part of their sophisticated trading strategies. Institutional traders tend to have access to high-quality, real-time data and advanced trading platforms, enabling them to process vast amounts of information and respond quickly to market changes. Futures quotes offer institutional traders various advantages:

- Leveraging Large Market Movements: Institutional traders often use futures quotes to identify large-scale price movements across commodities, indices, and interest rates. By analyzing futures quotes, they can make highly leveraged trades and achieve substantial profits from even minor price changes.

- Market Analysis and Predictions: Institutional traders typically have access to proprietary models and algorithms that analyze futures quotes in conjunction with other market data to make predictions about future market behavior. This allows them to trade with a data-backed understanding of market expectations.

- Arbitrage Opportunities: Futures quotes also reveal price discrepancies between different markets, and institutional traders capitalize on these discrepancies through arbitrage. For example, if the price of a futures contract differs between two exchanges, institutional traders can buy on one exchange and sell on the other to profit from the difference.

- Hedging and Risk Management: Institutional traders often use futures to hedge against various risks. For instance, a pension fund might use bond futures to hedge against interest rate changes, while an international firm might use currency futures to hedge against forex risks.

Institutional traders’ use of futures quotes highlights the flexibility and potential for profit that these quotes offer, particularly for those with the resources and expertise to interpret and act on complex market information.

Hedgers and Futures Quotes

Hedgers, including agricultural producers, manufacturers, and corporations, use futures quotes to reduce price uncertainty and protect against adverse price movements in the underlying assets they rely on. Here are a few ways hedgers utilize futures quotes:

- Locking in Prices for Commodities: Futures quotes allow hedgers to lock in prices for future purchases or sales of commodities. For example, a farmer might sell futures contracts on wheat based on futures quotes to lock in a selling price before the harvest, thereby reducing the risk of price declines.

- Protecting Against Market Volatility: Futures quotes provide a real-time picture of market volatility, which can guide hedgers in implementing risk management strategies. By following the quotes, hedgers can make timely adjustments to their positions, reducing the impact of sudden price swings.

- Budgeting and Cost Management: Corporations can use futures quotes to predict future expenses more accurately, especially for key materials. For instance, an airline might rely on fuel futures quotes to project fuel costs, enabling better budget planning and cost management.

- Currency and Interest Rate Hedging: Companies involved in international trade might use futures to hedge against currency risk, while those dependent on debt financing may use interest rate futures to manage interest rate exposure. Futures quotes provide these companies with up-to-date information on currency and interest rate trends, allowing them to anticipate and mitigate risk.

Hedgers’ primary objective is not profit but risk mitigation, and futures quotes serve as a vital tool to achieve this goal. By using futures quotes, hedgers can achieve greater financial stability, protecting themselves against market fluctuations that might otherwise impact their business operations.

Companies Known for Producing Futures Quotes

Certain companies stand out in the industry for producing reliable and comprehensive futures quotes. These organizations provide real-time data feeds, analysis tools, and market insights that serve brokers, traders, and investors alike.

- CME Group: One of the most prominent companies for futures quotes, the CME Group offers a vast range of futures data across various asset classes, including commodities, currencies, interest rates, and indices. With its robust data services and platforms, CME Group is a go-to source for both retail and institutional traders.

- Intercontinental Exchange (ICE): ICE provides futures quotes for commodities, financials, and currencies, along with real-time and historical data. It is well-known for its role in energy futures, particularly crude oil, natural gas, and power markets.

- Bloomberg: Bloomberg is highly regarded for its real-time data and trading analytics. The Bloomberg Terminal is a powerful tool for futures quotes, providing in-depth market data and advanced analytical tools that benefit institutional traders.

- Thomson Reuters: Now part of Refinitiv, Thomson Reuters is a major player in financial data and offers futures quotes across multiple asset classes. Its Eikon platform is popular among professional traders for its comprehensive data and advanced features.

- Nasdaq: Known for equities and options data, Nasdaq also provides futures quotes, particularly in the index futures space. Nasdaq’s market data is accessible to both retail and institutional traders.

Each of these companies offers a range of tools to facilitate trading, hedging, and market analysis, making them indispensable for accessing reliable futures quotes.

Futures quotes are an indispensable tool for understanding market sentiment, predicting price movements, and making informed trading and hedging decisions. For commodities brokers and future brokers, these quotes are essential for providing clients with actionable information and market access. Retail traders rely on futures quotes to time trades, analyze trends, and execute hedging strategies, while institutional traders use them for advanced analysis, arbitrage, and risk management. Hedgers, on the other hand, utilize futures quotes to stabilize costs and secure prices for future transactions.

By interpreting and leveraging futures quotes, all market participants can gain an edge, allowing them to navigate complex and often volatile markets more effectively. Companies like CME Group, ICE, Bloomberg, Thomson Reuters, and Nasdaq play a critical role in providing access to high-quality futures quotes, enhancing the accessibility and transparency of the futures market for everyone involved.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading