Voice from the Tomb

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Sierra Charts is widely regarded as one of the best futures trading platforms available today. Known for its depth, precision, and robust customization, Sierra Chart software is built for traders who value speed, stability, and flexibility in their charting and order execution. Whether you’re a new entrant exploring the world of trading futures or a seasoned institutional trader looking for a powerful toolset, Sierra Charts is designed to meet your needs with professional-grade features.

Cannon Trading Company stands out as the ideal brokerage partner for users of Sierra Charts, offering decades of experience, unmatched client support, and a suite of benefits that enhance every trader’s workflow.

Sierra Chart software is a high-performance, low-latency platform tailored for futures trading. It delivers a comprehensive solution with advanced technical analysis tools, real-time market data, and support for automated trading systems. Developed with an emphasis on efficiency and control, Sierra Charts is not only an institutional trading platform but also accessible to independent traders who demand performance.

Key Advantages:

With support for multiple data providers and brokers, Sierra Charts positions itself as a true institutional trading platform with appeal across the professional spectrum.

Cannon Trading Company is uniquely positioned to support Sierra Charts users for several compelling reasons:

✅ Decades of Experience

With over 35 years in the industry, Cannon Trading is one of the most trusted names in futures trading. Their deep expertise ensures clients receive insightful guidance for both platform use and market strategies.

✅ Stellar Reputation

The firm boasts a near-perfect TrustPilot rating, with many reviews applauding its fast support and knowledgeable brokers—ideal for trading futures confidently.

✅ Regulatory Excellence

Cannon Trading has maintained an exemplary record with regulators, giving traders peace of mind that they are working with a reliable and transparent partner.

✅ Diverse Platform Suite

In addition to Sierra Chart software, Cannon Trading provides access to a top-tier selection of platforms including CTS T4, Firetip, Rithmic, and more—cementing its reputation as a leader in best futures trading platform solutions.

Whether you’re a short-term scalper or a long-term trend trader, Sierra Charts delivers a versatile, robust, and high-performance experience that meets the demands of modern futures trading. When paired with the trusted, experienced team at Cannon Trading Company, you gain not only the tools but also the support to take your trading futures journey to the next level.

From institutional-grade features to tailored service, the synergy between Sierra Chart software and Cannon Trading is unmatched in the industry.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

By John Thorpe, Senior Broker

|

|

|

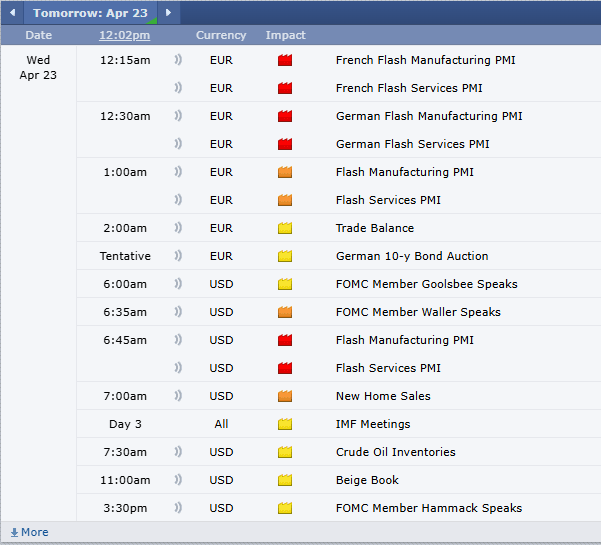

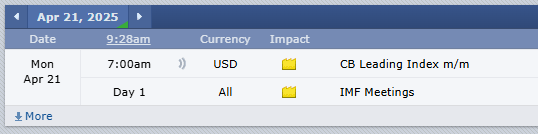

provided by: ForexFactory.com

All times are Eastern Time (New York)

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

In a world that never stops shifting, futures trading has remained a core pillar of modern financial markets. With increased geopolitical uncertainties, ongoing economic upheavals, and recent shifts in U.S. trade policy, professional traders have turned to sophisticated strategies to adapt, survive, and thrive.

At the heart of these strategies is the use of futures contracts, leveraged financial instruments that allow traders to speculate on the direction of prices for commodities, currencies, indices, and interest rates. Today’s article not only highlights 10 expert trading techniques used during market volatility but also explains how your futures broker plays a critical role in facilitating these trades while managing risk. Special attention is given to the ripple effects of tariffs imposed by President Donald Trump and their lingering influence on futures markets. Finally, we’ll spotlight Cannon Trading Company, one of the best futures brokers in the business, exploring how it has built and maintained its impressive legacy.

The tariffs President Trump’s administration imposed—especially on steel, aluminum, and Chinese goods—continue to affect futures markets today. These policies have reshaped global supply chains and introduced lasting price distortions in key commodities like soybeans, crude oil, and industrial metals.

Lingering Impacts Include:

As a result, professional futures trading strategies must now incorporate macroeconomic forecasting and geopolitical analysis to remain effective.

For more than three decades, Cannon Trading Company has been synonymous with excellence in futures trading. Here’s why traders—from beginners to professionals—consider it among the best futures brokers in the industry:

No automated voice systems. At Cannon, real brokers—many with over 20 years of experience—are a call away. This direct human connection ensures that your trades and concerns receive immediate attention.

Whether you prefer technical analysis, fast execution, or automated strategies, Cannon offers FREE access to leading platforms like:

These platforms empower futures traders with speed, precision, and customization.

Boasting numerous 5-star reviews on TrustPilot, Cannon Trading is recognized for its ethical practices and reliability. With a clean regulatory track record and transparent fee structures, clients know they’re in safe hands.

Founded in 1988, Cannon has weathered every market storm from the dot-com bubble to the COVID-19 pandemic. Its endurance is a testament to strong leadership, financial prudence, and client-centric philosophy.

From grains to cryptocurrencies, Cannon supports trading across a broad spectrum of futures contracts, offering both diversity and specialization.

Cannon maintains stellar standing with industry regulators such as the NFA and CFTC. This instills trust and peace of mind for clients around the globe.

In volatile markets, survival depends on precision, discipline, and the right partnerships. Advanced trading techniques are only as good as the tools and guidance behind them. A seasoned futures broker not only facilitates trades but also acts as a strategic ally.

In this ever-evolving landscape, trading futures remains both a science and an art. And with Cannon Trading Company by your side, you gain not just a service provider, but a legacy partner committed to your success.

For more information, click here.

Ready to start trading futures? Call us at1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

|

|

|

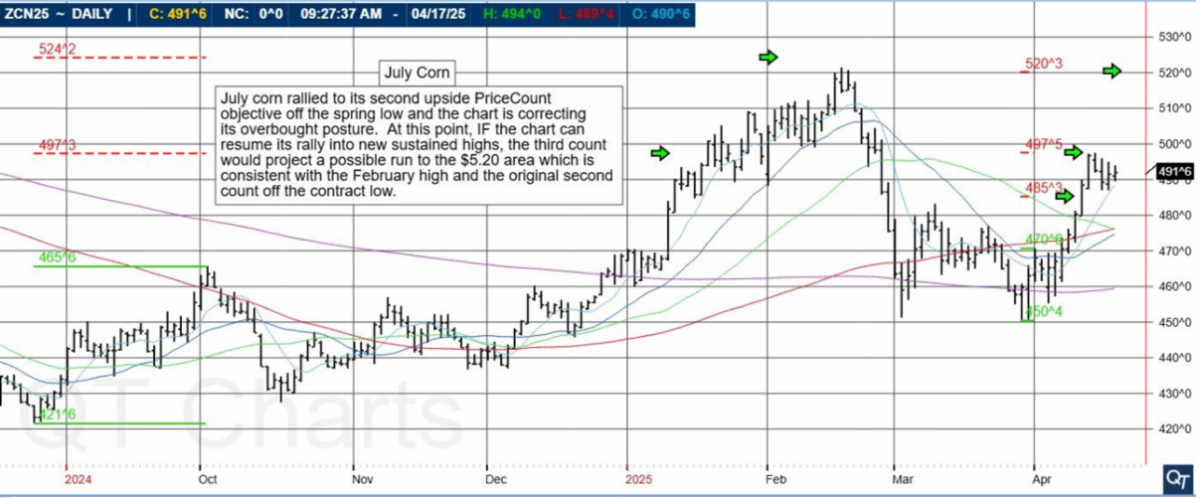

July corn rallied to its second upside PriceCount objective off the spring low and the chart is correcting its overbought posture. At this point, IF the chart can resume its rally into new sustained highs, the third count would project a possible run to the $5.20 area which is consistent with the February high and the original second count off the contract low.

The PriceCount study is a tool that can help to project the distance of a move in price. The counts are not intended to be an ‘exact’ science but rather offer a target area for the four objectives which are based off the first leg of a move with each subsequent count having a smaller percentage of being achieved.

It is normal for the chart to react by correcting or consolidating at an objective and then either resuming its move or reversing trend. Best utilized in conjunction with other technical tools, PriceCounts offer one more way to analyze charts and help to manage your positions and risk.

Learn more at www.qtchartoftheday.com

Trading in futures, options, securities, derivatives or OTC products entails significant risks which must be understood prior to trading and may not be appropriate for all investors. Past performance of actual trades or strategies is not necessarily indicative of future results.

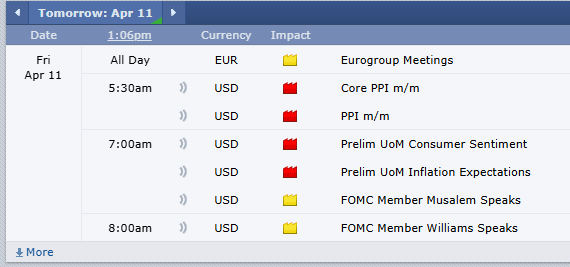

provided by: ForexFactory.com

All times are Eastern Time (New York)

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

|

|

|

provided by: ForexFactory.com

All times are Eastern Time (New York)

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

By Mark O’Brien, Senior Broker

Zero-day options are normal options — puts and calls — that expire in less than one day, hence the “0DTE” nickname (short for “zero days to expiration”).

In the current high-volatility environment we’re experiencing – one very likely to last awhile – one of the better alternatives to day trading, particularly in stock index futures like the E-mini S&P 500, E-mini Nasdaq, etc., is buying short-term call and put options.

With expirations every day of the week, stock index futures options can be purchased with minimal overall time value and give you a maximum risk coupled with a limitless upside potential.

Especially with markets seemingly hair-triggered to make large daily moves, but with erratic action intraday, the purchase of a limited-risk option provides staying power that no amount of rapid in-and-out trading trying to catch a large move can outperform.

provided by: ForexFactory.com

All times are Eastern Time (New York)

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

As of this typing stock index futures and other futures contracts have experienced single-day range moves not seen in years and after being down, finished up:

→ E-mini Dow Jones: UP +3044 points / 8.4%

→ E-mini S&P 500: UP +480 points / 9.5%

→ E-mini Nasdaq: UP +2038 points / 11.71%

→ Crude Oil: UP +320 points / 5.2%

This is a completely different environment of extreme trading volatility than what we were trading in 3-4 weeks ago. Markets are evolving and you must adapt your trading to changing market conditions.

This is where you find out what kind of risk taker you are; brash, overbold, unheeding, or prudent, attentive, discriminating. Everyone possesses these traits – and they influence our decision-making differently in different situations.

In trading, if the historical price moves you’re seeing bring out the daredevil in you, plan to watch your trade results all over the place: up and down more than your everyday swings with the odds increasing your account will hit a wall.

Instead, incorporate patience and prudence. Start your trading by setting daily profit targets and daily loss limits and stick to them. Do that for each trade. These days, be aware of LIMIT moves and understand what happens when the market halts at limit levels.

Find daily price limits for CME Group Agricultural, Cryptocurrency, Energy, Equity Index, Interest Rates, and Metals products: click here.

|

provided by: ForexFactory.com

All times are Eastern Time (New York)

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

|

|

|

|

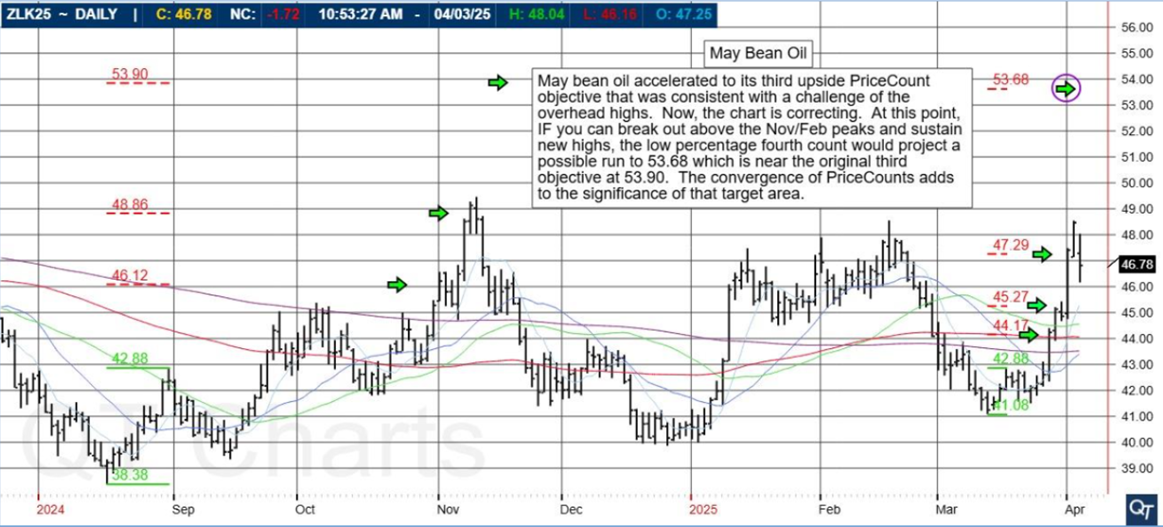

Hot market of the week is provided by QT Market Center, A Swiss army knife charting package that’s not just for Hedgers, Cooperatives and Farmers alike but also for Spread traders, Swing traders and shorter time frame application for intraday traders with a unique proprietary indicator that can be applied to your specific trading needs.

May bean oil accelerated to its third upside PriceCount objective that was consistent with a challenge of the overhead highs. Now, the chart is correcting.

At this point, IF you can break out above the Nov/Feb Peaks and sustain new highs, the low percentage fourth count would project a possible run to 53.68 which is near the original third objective at 53.90.

The convergence of PriceCounts adds to the significance of that target area.

|

|

|

|

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|