Futures Options Broker

The Growing Relevance of Futures Options Brokers in Modern Trading

In today’s rapidly evolving financial landscape, the role of a futures options broker has become more critical than ever. With the explosion of algorithmic and AI-powered futures options trading platforms, more traders—from retail to institutional—are seeking experienced and technologically advanced brokerages to help navigate the complexities of commodities trading and speculative derivatives. This is where brokerage services like E-Futures.com shine, delivering unparalleled expertise, reliability, and technological edge through their top-tier platform, CannonX powered by CQG.

To understand what makes a futures broker options provider like E-Futures.com exceptional in 2025, we must first explore the historical development of futures options trading, including the pivotal moments and individuals that shaped the speculative markets we know today.

Try a FREE Demo!

Historical Origins of Options in Speculation and Commodity Markets

Ancient Roots of Options Trading

Though futures options trading may seem like a product of modern finance, its roots stretch back thousands of years. One of the earliest known uses of options-like contracts occurred in ancient Greece. The philosopher Thales of Miletus reportedly used early options contracts to secure the rights to olive presses in advance of harvest, anticipating high demand. This speculative use of future rights demonstrated the powerful concept of leveraging predictions about future value.

The concept resurfaced in early Japanese rice markets in the 1600s. The Dojima Rice Exchange in Osaka became the world’s first formal commodity trading exchange, where merchants employed forward contracts and proto-options to hedge against price fluctuations. These mechanisms were vital in establishing confidence and liquidity in agricultural markets—principles that remain foundational to futures options trading today.

The Birth of Modern Futures and Options Markets

The modern era of commodities trading began with the founding of the Chicago Board of Trade (CBOT) in 1848. Initially focusing on agricultural futures contracts, the CBOT provided a formalized structure to a previously informal network of spot trading and forward agreements. Traders could now lock in prices for commodities like corn and wheat, reducing exposure to volatility.

By the 1970s, the CBOT and the Chicago Mercantile Exchange (CME) began introducing standardized futures options trading contracts. These contracts allowed speculators to trade options on futures contracts themselves—a significant leap in market complexity and flexibility.

The 1973 introduction of options on futures was revolutionary, enabling traders to control leveraged positions in commodities with reduced upfront capital and predefined risk. This development transformed how both hedgers and speculators approached the market.

Key Innovators Behind Futures Options Trading

Fischer Black and Myron Scholes

The creation of the Black-Scholes model in 1973 by Fischer Black and Myron Scholes—later extended by Robert Merton—provided the mathematical foundation for pricing options. Their work enabled market participants to determine fair values for options based on volatility, time to expiration, and interest rates.

This pricing model, while initially developed for stock options, was quickly adapted for futures options trading, fueling the growth of options markets globally. Their work earned Scholes and Merton a Nobel Prize in Economics (Fischer Black died before he could be awarded).

Leo Melamed and the CME

Leo Melamed, a former chairman of the Chicago Mercantile Exchange, was instrumental in transforming Chicago into the global hub of commodity trading innovation. Under his leadership, the CME launched the International Monetary Market and introduced financial futures, including options on currency and interest rate futures.

Melamed was a strong advocate for electronic trading and helped lay the groundwork for today’s high-speed futures options trading platforms. His vision of global access, market transparency, and trader education still informs how brokerages like E-Futures.com operate.

The Role of Regulation

The Commodity Futures Trading Commission (CFTC) was created in 1974 to regulate the U.S. derivatives markets, followed by the National Futures Association (NFA) in 1982. These organizations provided crucial oversight and investor protection, helping to legitimize futures broker options services and foster trust in the emerging industry.

Today’s Futures brokers USA, including E-Futures.com, operate under these regulatory bodies, ensuring that traders are protected and markets remain transparent.

Why E-Futures.com Is a Top Choice Futures Options Broker in 2025

- A Legacy of Trust and Performance

With 38 years of experience in the industry, E-Futures.com has developed a reputation for excellence among independent traders, institutional clients, and regulators alike. With multiple 5 out of 5-star ratings on TrustPilot, the brokerage’s reliability, customer service, and trading infrastructure have earned the trust of thousands of users globally.

Unlike newer entrants to the space, E-Futures.com offers a rare combination of institutional-grade infrastructure and boutique-level support.

- Industry-Leading Technology: CannonX Powered by CQG

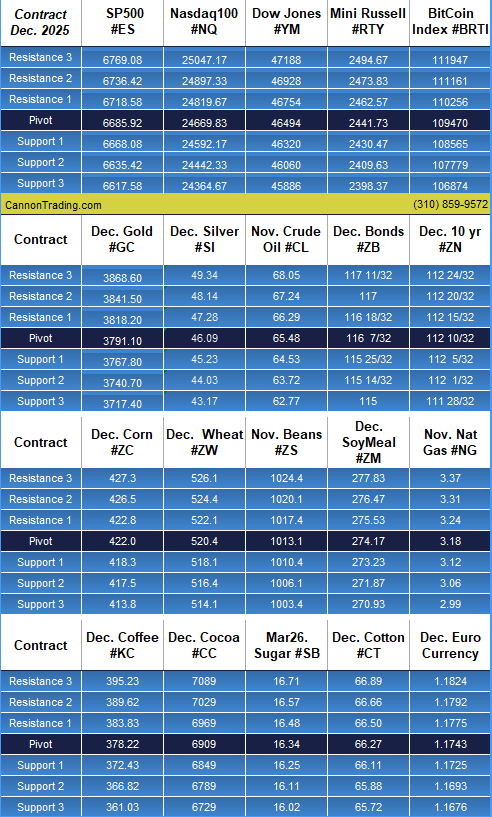

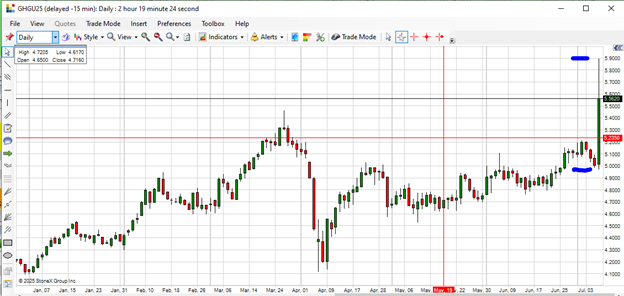

One of the cornerstones of E-Futures.com’s success is its CannonX powered by CQG platform. Known for its speed, reliability, and precision, CannonX combines CQG’s institutional-grade backend with Cannon Trading Company’s intuitive user experience. It enables traders to execute strategies in real-time across global markets with deep liquidity and cutting-edge analytics.

For serious traders seeking a powerful, responsive interface with real-time charting and order routing capabilities, CannonX is among the top futures options trading platforms available in the market today.

Key benefits of CannonX powered by CQG:

- Lightning-fast execution

- Comprehensive options analytics

- Advanced charting tools for commodity trading

- Seamless mobile and desktop integration

Try a FREE Demo!

- Unmatched Customer Support and Regulatory Integrity

E-Futures.com is distinguished among Futures brokers USA for its emphasis on client relationships. All clients receive one-on-one onboarding, platform training, and 24/7 support from experienced brokers—many with decades of market experience.

Regulatory compliance is a cornerstone of their operation. As an NFA-member and CFTC-regulated broker, E-Futures.com operates with full transparency and client protection protocols.

Whether you’re a retail trader new to futures options trading or a high-volume professional looking to optimize your execution strategy, E-Futures.com offers a secure and supportive environment to trade with confidence.

- Comprehensive Range of Tradable Instruments

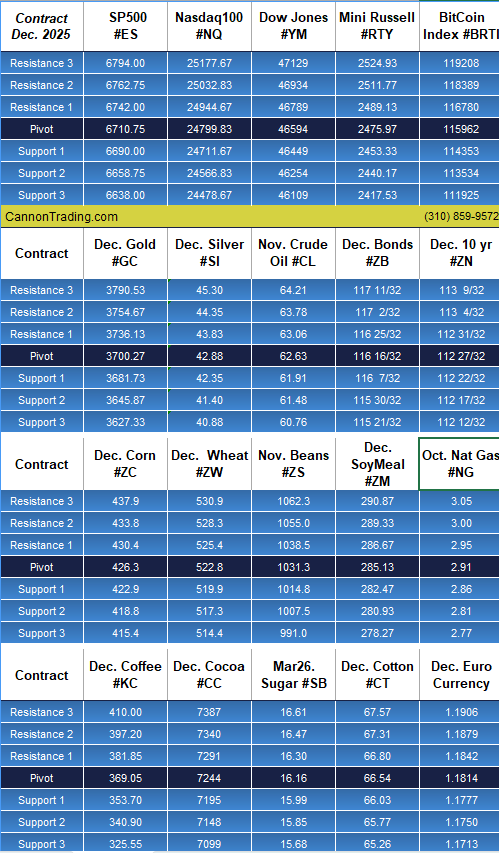

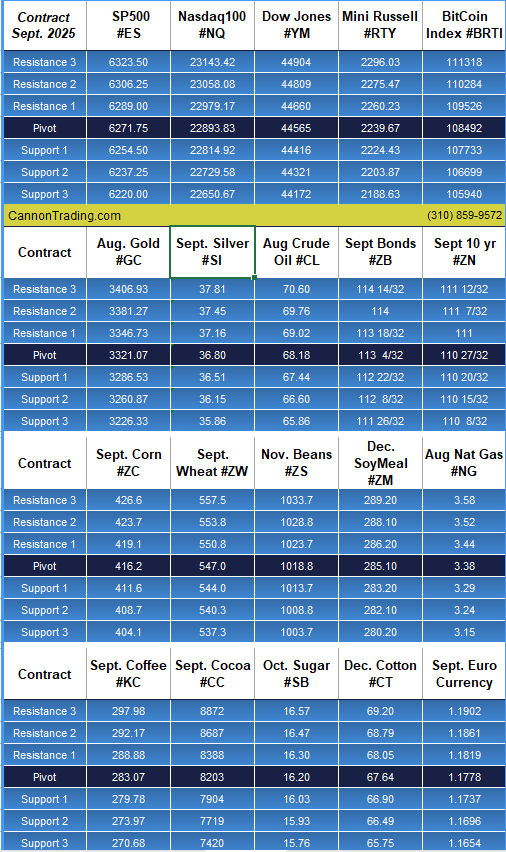

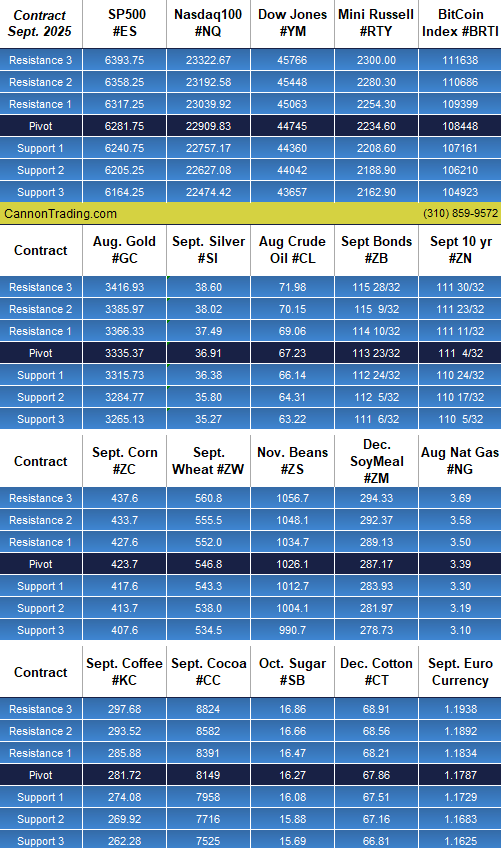

Traders at E-Futures.com gain access to a diverse array of tradable products:

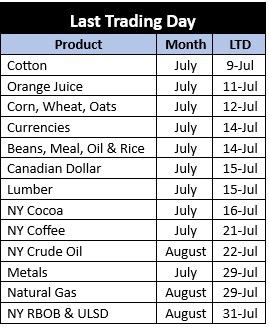

- Agricultural, energy, metals, and soft commodity trading

- Interest rate, equity index, and currency futures

- Options on futures, including calendar spreads and complex strategies

The firm’s deep understanding of both underlying commodities trading and options mechanics makes it a top-tier partner for executing sophisticated trades.

- Education and Risk Management Tools

Unlike many platforms that leave traders to learn by trial and error, E-Futures.com invests heavily in trader education. Resources include:

- Live webinars and archived tutorials

- Strategy-specific guides for futures options trading

- Platform walkthroughs for CannonX and CQG

- Customized risk management templates

This dedication to education helps traders avoid common pitfalls and build sustainable, long-term trading strategies.

The 2025 Landscape: Why a Trusted Futures Options Broker Matters Now More Than Ever

Increased Volatility and Market Interconnection

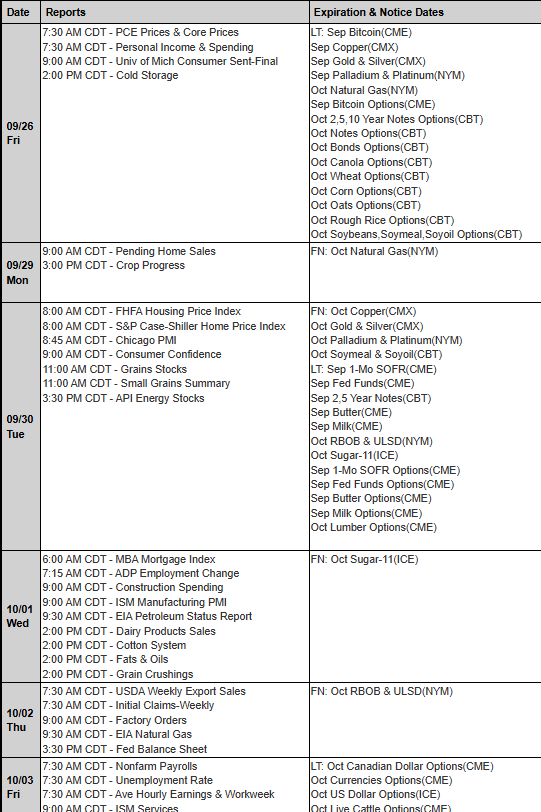

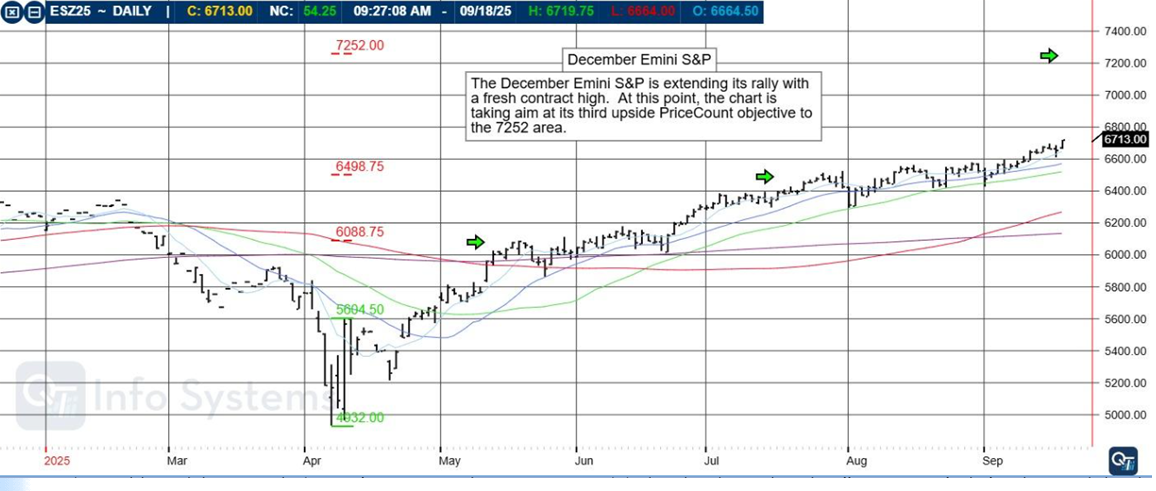

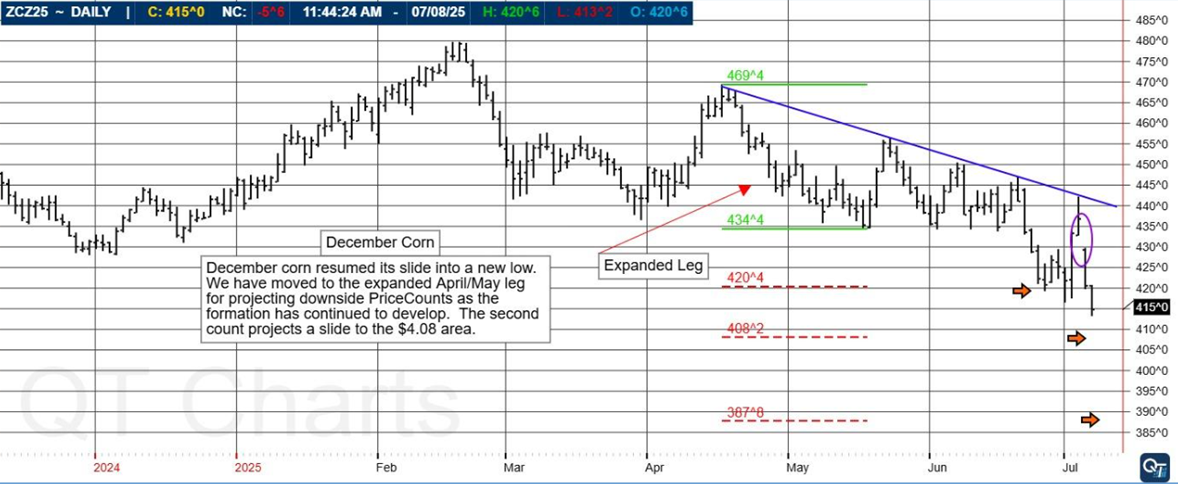

The second half of 2025 is shaping up to be a period of increased volatility and global market uncertainty. With ongoing geopolitical tensions, shifting interest rate policies, and fluctuating commodity prices, traders need precision tools and reliable execution more than ever.

A brokerage that combines the experience, reputation, and platform sophistication of E-Futures.com ensures traders can stay agile, informed, and efficient.

Rise of Algorithmic and AI-Powered Trading

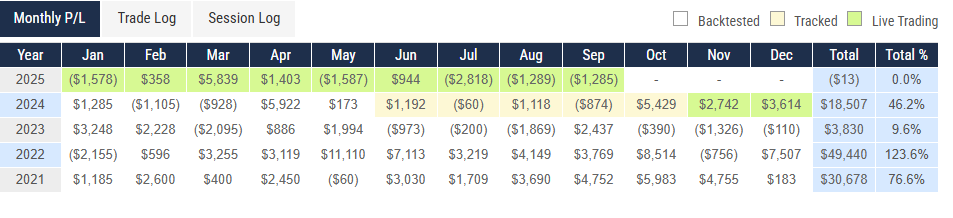

As more traders deploy automated strategies and AI-powered systems, the reliability and latency of a trading platform becomes paramount. Platforms like CannonX powered by CQG are specifically built for this next generation of trading strategies, offering API access, backtesting capabilities, and integrated market data.

Partnering with a futures broker options firm that understands this tech evolution is critical in maintaining a competitive edge.

Compliance and Safety

In an era of data breaches and financial fraud, regulatory compliance isn’t optional—it’s essential. Futures brokers USA like E-Futures.com that comply strictly with CFTC and NFA guidelines offer traders peace of mind that their capital and data are secure.

As the regulatory environment continues to evolve, brokers with a track record of ethical behavior and transparency will thrive. E-Futures.com is not just a technology provider, but a fiduciary partner.

Conclusion: Futures Broker Options and the Path Forward

The development of futures options trading is a story of innovation, risk management, and speculative opportunity. From ancient Greek philosophers to modern-day electronic platforms like CannonX powered by CQG, options and futures have evolved to meet the changing needs of traders and hedgers across centuries.

In this complex and ever-changing ecosystem, choosing the right brokerage partner is one of the most important decisions a trader can make. With its decades of experience, sterling reputation, regulatory compliance, and cutting-edge platform, E-Futures.com remains one of the premier Futures brokers USA for traders in 2025.

Whether you’re seeking to trade agricultural contracts, hedge geopolitical risk, or leverage volatility in metals and energy, E-Futures.com provides the technological muscle and human insight necessary to succeed.

For any serious trader or investor looking to excel in futures options trading, there’s no better partner than a brokerage that merges institutional performance with personalized service.

Try a FREE Demo!

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with E-Futures.com today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading