Copper futures contracts have long been a cornerstone of the commodities market, reflecting the vital role copper plays in global industries, from construction to electronics. The evolution of copper futures and other precious metals futures contracts, such as silver and gold, demonstrates the growing sophistication of futures trading and the vital role these instruments play in global financial markets. This essay explores how these contracts have developed, highlights key real-life examples, provides hypothetical scenarios, and examines why Cannon Trading Company stands out as a premier brokerage for trading copper futures contracts and other precious metals futures.

The Evolution of Copper Futures Contracts

Copper has been a critical material in human development for thousands of years. Its industrial importance, however, surged during the 19th and 20th centuries with the advent of widespread electrification and urbanization. Recognizing copper’s growing economic significance, financial markets began creating instruments to manage price risks associated with its production and consumption. The introduction of copper futures contracts on the London Metal Exchange (LME) and later on the COMEX (a division of the CME Group) revolutionized the way producers, consumers, and investors interacted with this metal.

Initially, copper futures contracts were primarily used by miners and manufacturers to hedge against price volatility. For instance, a mining company might sell copper futures to lock in a price for its future production, while an electronics manufacturer might buy futures to secure raw materials at a predictable cost. Over time, speculators and institutional investors entered the market, adding liquidity and enabling the development of more complex trading strategies.

The rise of electronic trading in the late 20th century further transformed the landscape of copper futures. Platforms like CME Globex allowed traders worldwide to access copper futures contracts seamlessly, increasing market participation and transparency. These advancements mirrored changes in the silver and gold futures markets, which also transitioned from being dominated by industrial users to attracting diverse participants, including retail traders and hedge funds.

Case Studies and Real-Life Examples

One of the most famous examples of copper futures trading is the Sumitomo Corporation scandal of the 1990s. Yasuo Hamanaka, a trader at Sumitomo, attempted to corner the global copper market by manipulating copper futures prices. Over nearly a decade, Hamanaka’s actions led to massive price distortions, ultimately causing Sumitomo to lose over $2.6 billion when his scheme unraveled. This event highlighted both the power and the risks associated with trading futures and led to stricter regulatory oversight.

In a more positive example, consider the use of copper futures by Tesla, Inc. to manage its costs. As a major consumer of copper for electric vehicle production, Tesla strategically uses futures contracts to hedge against price fluctuations. By locking in copper prices, Tesla can ensure stable production costs, even when market conditions change unexpectedly.

Similar strategies are employed in the gold and silver futures markets. For instance, during the COVID-19 pandemic, many investors turned to gold futures as a safe haven, driving prices to record highs. This shift demonstrated how futures contracts can serve as both risk management tools and speculative opportunities in times of economic uncertainty.

Hypothetical Trading Scenarios

To illustrate the practical application of copper futures contracts, let’s consider a hypothetical scenario involving a construction company. Suppose the company has a major project scheduled to begin in six months, requiring substantial copper supplies. Fearing potential price increases, the company decides to purchase copper futures contracts to lock in current prices. If copper prices rise as expected, the company’s futures position offsets the increased costs of purchasing physical copper, effectively stabilizing its budget.

On the speculative side, imagine an experienced trader analyzing market trends and predicting a decline in copper prices due to an anticipated economic slowdown. The trader might sell copper futures contracts, aiming to profit from the price drop. If the trader’s prediction is correct, they can buy back the contracts at a lower price, pocketing the difference as profit.

The same principles apply to silver and gold futures trading. A jeweler, for instance, might buy silver futures to hedge against rising material costs, while a day trader might speculate on short-term movements in gold prices. These examples underscore the versatility of futures contracts in catering to a wide range of market participants.

Why Cannon Trading Company Is an Ideal Brokerage

Cannon Trading Company has built a stellar reputation as a go-to brokerage for trading copper futures contracts and other precious metals futures. Several factors contribute to its appeal, making it an excellent choice for traders of all experience levels.

Wide Selection of Free Platforms

Cannon Trading offers access to a broad array of free trading platforms, catering to diverse trading styles and preferences. Whether you’re a beginner looking for user-friendly software or a seasoned trader requiring advanced charting tools, Cannon’s platform selection ensures that you have the resources needed to succeed in the futures market. This flexibility is particularly valuable when trading copper futures contracts, where real-time data and technical analysis can make a significant difference in decision-making.

Exemplary Reputation and Regulatory Compliance

Cannon Trading’s decades of experience in the futures markets have earned it a 5 out of 5-star rating on TrustPilot, reflecting high customer satisfaction. Moreover, the company’s adherence to strict regulatory standards ensures that traders can trust the integrity of its operations. This commitment to transparency and accountability is crucial in the futures trading industry, where reliability and ethical practices are paramount.

Support for Traders of All Levels

Whether you’re new to futures trading or a seasoned professional, Cannon Trading provides comprehensive support to help you achieve your goals. For beginners, the company offers educational resources and personalized guidance to build confidence in trading copper, silver, and gold futures contracts. Experienced traders benefit from access to advanced tools, competitive commission rates, and expert market insights.

Competitive Edge in Precious Metals Trading

Cannon Trading’s expertise extends beyond copper futures to include silver and gold futures, giving traders the opportunity to diversify their portfolios within the precious metals market. By offering tailored solutions for each metal, Cannon ensures that traders can capitalize on market opportunities while managing risks effectively.

The Role of Futures Trading in Modern Markets

The evolution of copper futures contracts and their counterparts in silver and gold highlights the critical role these instruments play in modern financial markets. Futures trading provides essential benefits, including price discovery, risk management, and market liquidity. For industrial users, futures contracts are indispensable tools for stabilizing costs and ensuring predictable operations. For speculators and investors, they offer opportunities to profit from price movements and hedge against broader economic risks.

The growth of futures trading has been facilitated by technological advancements, regulatory improvements, and increased market access. Today, traders can execute complex strategies with unprecedented speed and efficiency, thanks to platforms like those offered by Cannon Trading Company. These developments have democratized access to futures markets, empowering individuals and institutions alike to participate in global commodity trading.

Copper futures contracts, alongside silver and gold futures, have evolved significantly over the years, reflecting broader changes in the financial markets. From their origins as hedging tools for industrial users to their current status as versatile instruments for a wide range of traders, these contracts have become indispensable components of the global economy. Real-life examples, such as the Sumitomo scandal and Tesla’s hedging strategies, underscore the power and complexity of futures trading.

For traders seeking to navigate the complexities of copper futures contracts and other precious metals futures, Cannon Trading Company stands out as a trusted partner. With its wide selection of free platforms, top-tier reputation, and unwavering commitment to regulatory compliance, Cannon Trading provides the tools and support needed for success in the futures markets. Whether you’re trading copper, silver, or gold, Cannon Trading offers the expertise and resources to help you achieve your financial goals.

For more information, click here.

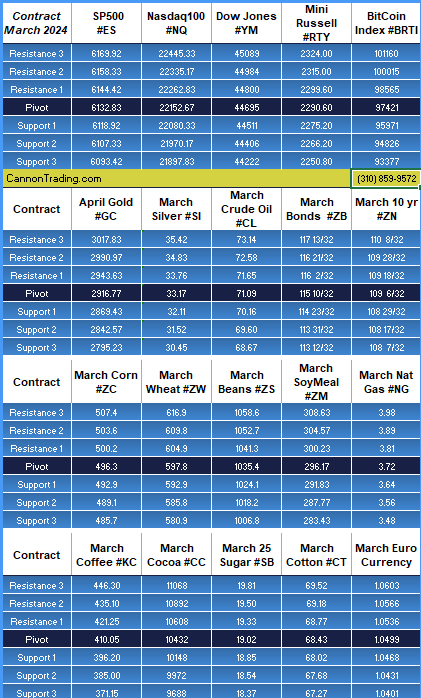

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.