Important Notices: The Week Ahead

By John Thorpe, Senior Broker

Iran

Can the market withstand the civil unrest planned for this weekend in our country? How about the situation in the Middle East with Israel striking Iran nuclear facilities? Stay tuned…

Equity Rollover, FOMC, Juneteenth Holiday and the longest day of the year in the northern hemisphere!

Rollover

Roll the Equity Index contracts to September (U) for Monday trading.

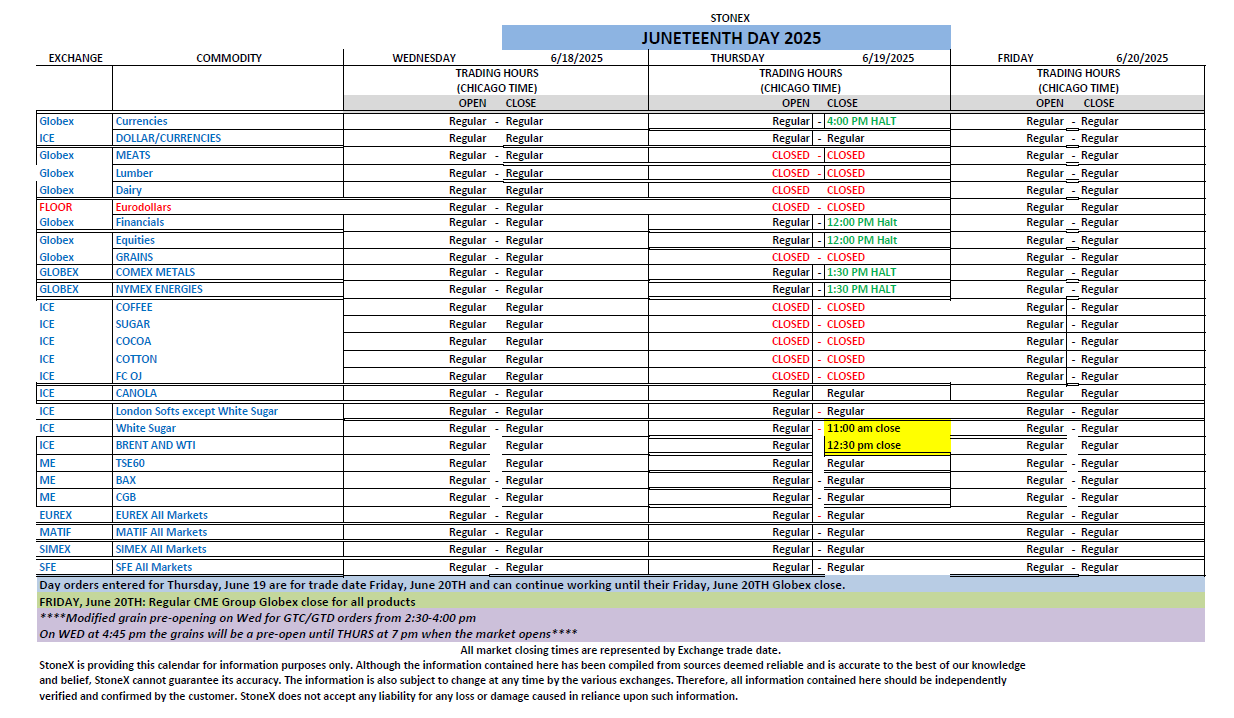

Roll your equity index contracts to September (U) e.g., ESU25 or EPU25, also this week, due to the Juneteenth holiday, some markets will have reduced hours and others will be closed.

Reduced hours include the Equities, Metals, Energies. Since Juneteenth falls on a Thursday, the regularly scheduled EIA Weekly Natural Gas storage report will be released a day earlier: Wed. at the same time as the FOMC rate announcement. 1PM CT.

Remember that current market drivers for Equities are hard data on Jobs, Inflation, Trump tweets and Geopolitics, clearly the Israel/Iran conflict jumps to the top of the list here.

Continued volatility to come as next week all markets will be reacting to whatever comes out of the Israel/Iran conflict, The FRB, U.S. Govt leadership relating to conflicts cessation and trade deals.

Therefore, increased volatility expectations with periodic choppiness as the administration Vs the Courts seem to also be in the middle innings of their tariff battle.

Earnings Next Week:

- Mon. Lennar Corp

- Tue. Jabil Inc

- Wed. Korn Ferry

- Thu. Empire LTD

- Fri. Accenture, Kroger (impending strike in California)

FED SPEECHES: (all time CDT)

- Mon. FED

- Tues. Black OUT

- Wed. FOMC Rate Decision 1:00pm CT Powell@1:30 pm CT

- Thu. Quiet

- Fri. Quiet

Economic Data week:

- Mon. NY Empire State Manufacturing index,

- Tue. Retail Sales, RedBook, Capacity Utilization, Business inventories, NAHB Housing market Index

- Wed. Building Permits, EIA Crude oil stocks, Housing Starts, Initial Jobless Claims, EIA Weekly Nat Gas Storage @ 1:00 pm CT FOMC Rate decision @ 1:00 pmCT, FOMC Economic Projections,

- Thur. JUNETEENTH Natl Holiday

- Fri. Philly Fed, CB Leading indicators

|