FOMC Takeaways

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Trading guide, as you can understand from the term, is a compilation of tips and tricks that can help you in trading. Whether you are new to the world of trading or are an expert in it, a trading guide is a very useful document.

Moreover, every trading guide has a specific purpose. So, if you are thinking about trading, a trade guide will serve you like a self-help manual. So, whether it is about trading options, metals, grains or any other futures contract– a trading guide has all the information in it.

You don’t need to buy one, for you will able to find a number of them online. We at Cannon Trading help you make the most of your trading ventures. Therefore, we have compiled some of the best trading guides for you to learn from. Listed under this category archive are some trade guides using which you can use to help you succeed in many trading ventures. There is enough information in these guides that can help you master the art of trading futures and options smartly.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

However, with volatility, you need to double check the status daily at:

Below you will see a quick video on how to set and utilize the bracket orders feature on the StoneX futures platform/ CQG desktop

BRACKET ORDERS VIDEO

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

In the dynamic world of online futures trading platforms, few names stand out as boldly as MotiveWave. As technology continues to evolve, traders demand more robust, analytical, and user-friendly tools. The MotiveWave Futures Trading Platform meets these demands head-on, delivering a comprehensive suite of features that elevate the trading experience for both novice and professional futures traders alike.

This article provides a deep dive into the MotiveWave trading environment, highlights key features that make it a premier choice for futures trading, and explores why Cannon Trading Company is the ultimate partner for leveraging MotiveWave’s power.

What is MotiveWave?

MotiveWave is a professional-grade futures trading platform known for its advanced charting tools, algorithmic trading capabilities, and comprehensive market analysis features. Initially gaining traction among forex and equity traders, MotiveWave has carved a prominent space within the online futures trading platform sector due to its reliability and feature-rich design.

Whether you’re focused on short-term scalping or long-term market trend analysis, MotiveWave trading tools are tailored to adapt to your trading style. From MotiveWave mobile access to full desktop integration via MotiveWave download, the platform ensures seamless continuity for traders on the move. Additionally, it supports custom workspaces and scripting with Java-based extensions, further enhancing the functionality for sophisticated trading needs.

Most Important Features for Futures Trading on MotiveWave

Accessing your trading environment is easy with the MotiveWave login process. The interface is secured with two-factor authentication, ensuring your data and trading activities are protected. Users can customize their workspace upon login, allowing for a personalized experience that matches individual trading preferences.

The MotiveWave download is available directly from the official website. Installation is straightforward, with support available for Windows, macOS, and Linux operating systems. Regular updates ensure the platform remains secure and compatible with the latest system features.

A common query among new users is: Is MotiveWave free? While MotiveWave offers a free trial version, its full capabilities are unlocked through tiered pricing plans. This freemium model allows users to test the interface and decide on the best plan that suits their trading needs. Considering its robust toolset, the MotiveWave price offers excellent value compared to competitors.

There are also occasional promotions through partners like Cannon Trading, which may include extended trial periods or discounted subscriptions. This makes testing the MotiveWave trading experience even more accessible.

Choosing the right brokerage is as crucial as selecting the right futures trading platform. Cannon Trading Company excels in this regard. Here’s why:

MotiveWave Review Summary

The feedback from users paints a highly favorable MotiveWave review. Traders cite the platform’s depth of analysis, customizability, and professional-grade tools as reasons for their loyalty. Whether evaluating MotiveWave software for the first time or switching from another futures trading platform, users consistently highlight its seamless performance and insightful analytics.

Professional traders appreciate how MotiveWave trading aligns with institutional tools, while new users benefit from the clear documentation and visual guides. This inclusivity ensures a smoother learning curve, especially when paired with educational materials from Cannon Trading.

Furthermore, the synergy between MotiveWave and Cannon Trading amplifies the platform’s benefits. Combining advanced technology with decades of industry expertise creates a powerful trading environment that is both innovative and secure.

The MotiveWave Futures Trading Platform stands out in a crowded marketplace by offering unparalleled features, powerful analytical tools, and wide-ranging compatibility. The repeated queries of MotiveWave login, MotiveWave price, and MotiveWave download are justified by the platform’s capabilities and reliability. While MotiveWave mobile ensures traders are never disconnected, the question “Is MotiveWave free” is best answered by its generous trial options and value-packed pricing tiers.

When partnered with a top-tier brokerage like Cannon Trading Company, traders gain access to world-class tools, unbeatable service, and a trusted advisor in their futures trading journey. If you’re looking to elevate your futures trading game, MotiveWave combined with Cannon Trading is a combination worth serious consideration.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

|

|

|

|

|

|

|

|

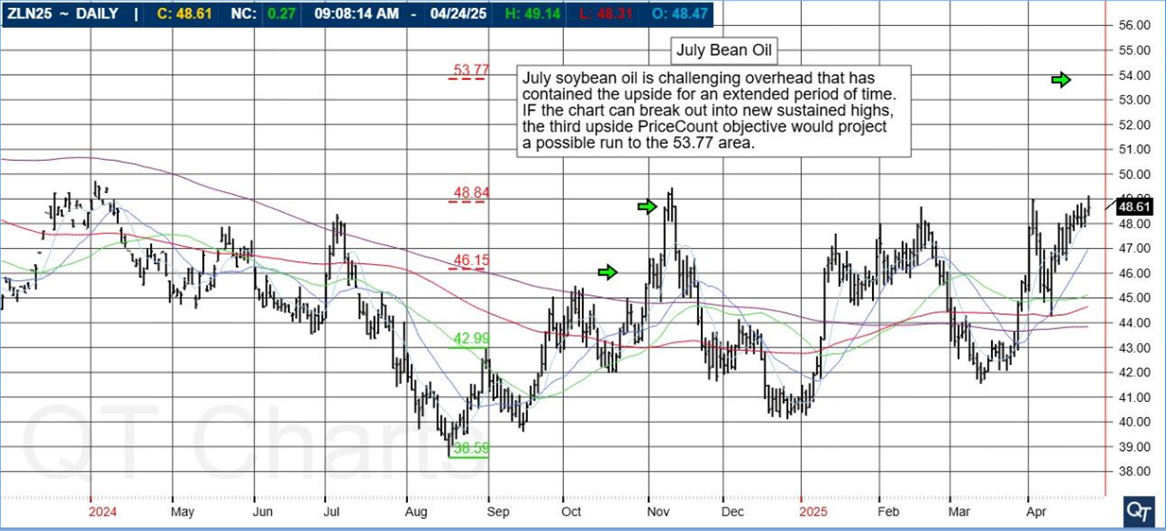

The PriceCount study is a tool that can help to project the distance of a move in price. The counts are not intended to be an ‘exact’ science but rather offer a target area for the four objectives which are based off the first leg of a move with each subsequent count having a smaller percentage of being achieved.

It is normal for the chart to react by correcting or consolidating at an objective and then either resuming its move or reversing trend. Best utilized in conjunction with other technical tools, PriceCounts offer one more way to analyze charts and help to manage your positions and risk. Learn more at www.qtchartoftheday.com

Trading in futures, options, securities, derivatives or OTC products entails significant risks which must be understood prior to trading and may not be appropriate for all investors. Past performance of actual trades or strategies is not necessarily indicative of future results.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Day Trading margins are back to normal!

However, with volatility, you need to double check the status daily at:

Below you will see a quick video on how to set and utilize the bracket orders feature on the StoneX futures platform/ CQG desktop

July soybean oil is challenging overhead that has contained the upside for an extended period of time. IF the chart can break out into new sustained highs, the third upside PriceCount objective would project a possible run to the 53.77 area.

The PriceCount study is a tool that can help to project the distance of a move in price. The counts are not intended to be an ‘exact’ science but rather offer a target area for the four objectives which are based off the first leg of a move with each subsequent count having a smaller percentage of being achieved.

It is normal for the chart to react by correcting or consolidating at an objective and then either resuming its move or reversing trend. Best utilized in conjunction with other technical tools, PriceCounts offer one more way to analyze charts and help to manage your positions and risk.

Learn more at www.qtchartoftheday.com

Trading in futures, options, securities, derivatives or OTC products entails significant risks which must be understood prior to trading and may not be appropriate for all investors. Past performance of actual trades or strategies is not necessarily indicative of future results.

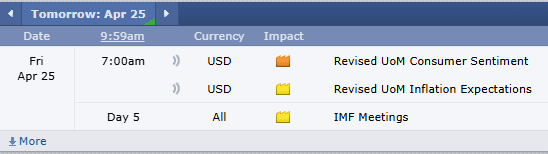

provided by: ForexFactory.com

All times are Eastern Time (New York)

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|