“Mastering the Market: Strategies to Overcome FOMO in Day Trading”.

By Ilan Levy-Mayer, VP

The unpredictable fluctuations in stock index futures can prompt a discussion on a significant challenge that day traders often encounter: the Fear of Missing Out (FOMO). This phenomenon is particularly prevalent in day trading, where the rapid pace, high leverage and high stakes can lead to hasty decisions.

Imagine a scenario where a trader is monitoring the charts and notices a significant downward trend. The immediate thought might be a concern that the market is on the verge of plummeting to new lows. While this could indeed happen, the trader also has a guideline: avoid initiating short positions when the market is below the lowest Volume Weighted Average Price (VWAP) band. This rule is based on the reasonable expectation that the market may rebound before continuing its descent. However, the swift movements of the market, coupled with emotional impulses and the desire to recoup losses, can result in a trader disregarding their own rules in the heat of the moment.

So, how can one manage this internal conflict? Here are some strategies:

• Document your trading rules. Writing them down can reinforce their importance and make it easier to adhere to them.

• Implement a system of self-discipline. If you find yourself breaking your own rules, consider setting consequences for such actions.

• Accountability is key. Enlist a trusted individual to review your trades with you and hold you responsible for your trading decisions.

• Practice mindfulness. Before making a trade, take a moment to breathe deeply and count to five. This brief pause can help you maintain composure and avoid impulsive actions.

• Embrace patience. Often, the decision not to trade can be as crucial as the trades you make. By reducing the number of impulsive trades and focusing on deliberate, well-thought-out actions, you are likely to see progress and improvement in your trading performance.

Remember, overcoming the urge to act on FOMO is a challenging but essential part of becoming a successful day trader. It’s about finding a balance between being proactive and not letting emotions dictate your trading strategy.

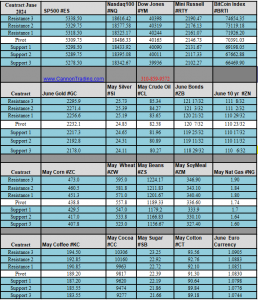

Daily Levels for April 19th, 2024

Improve Your Trading Skills

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.