Find out more about futures trading with Cannon Trading Company here.

Trading futures is a complex endeavor that demands expertise, strategic acumen, and the support of a knowledgeable and transparent futures broker. This article delves into the world of futures trading, explores the importance of commodity brokers, and highlights Cannon Trading’s exemplary reputation in the industry.

Understanding Futures Trading

Futures trading involves the buying and selling of standardized contracts for the future delivery of underlying assets, which can range from commodities like crude oil and gold to financial instruments such as stock indices or interest rates. It is a highly leveraged and speculative form of trading, often used by traders and investors to hedge risk or seek profit from price fluctuations.

The Role of Futures Brokers

Futures brokers serve as intermediaries between traders and the futures markets. They play a pivotal role in facilitating futures trading by providing access to trading platforms, executing orders, and offering expert guidance. The choice of a futures broker is a critical decision for traders, as it can significantly impact their trading experience and success.

Transparency in Futures Trading

Transparency is a foundational element in futures trading. Traders need to have a clear understanding of the costs involved, the mechanics of trading, and the risks associated with various contracts. A transparent futures broker ensures that clients have access to accurate and comprehensive information, promoting trust and confidence in the trading relationship.

Why Knowledge Matters in Futures Trading

The futures markets are dynamic and multifaceted, with a wide range of contracts and strategies. Knowledgeable futures brokers bring invaluable expertise to the table by:

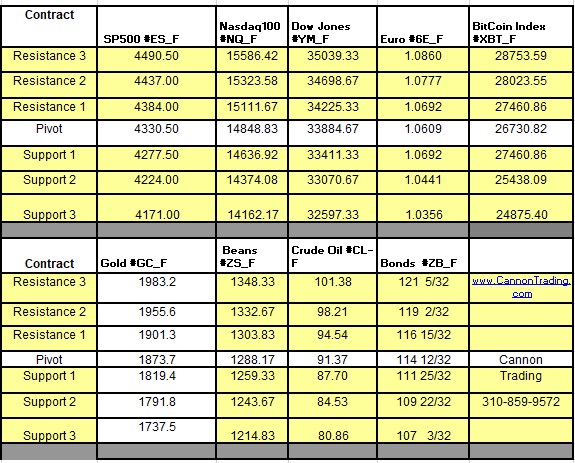

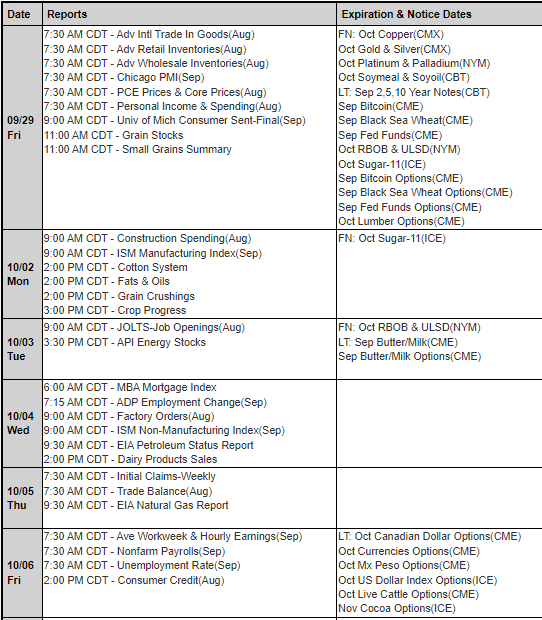

- Market Analysis: They provide insights into market trends, supply and demand dynamics, and geopolitical factors that can influence prices.

- Risk Management: Experienced brokers help traders develop risk management strategies, including stop-loss orders and position sizing, to protect their capital.

- Contract Selection: They guide traders in choosing the right futures contracts based on their trading objectives and risk tolerance.

- Execution Efficiency: Knowledgeable brokers execute orders swiftly and accurately, ensuring traders can capitalize on market opportunities.

- Regulatory Compliance: They adhere to regulatory guidelines, safeguarding traders’ interests and ensuring the legitimacy of the trading process.

The Significance of Transparency in Commodity Brokers

Commodity brokers specialize in the trading of physical commodities, such as agricultural products, energy resources, and precious metals. Like futures brokers, transparency is paramount in commodity trading. Commodity brokers should provide clients with clear information regarding contract specifications, fees, and potential risks associated with commodity trading.

Cannon Trading: Where Futures Clients Come First

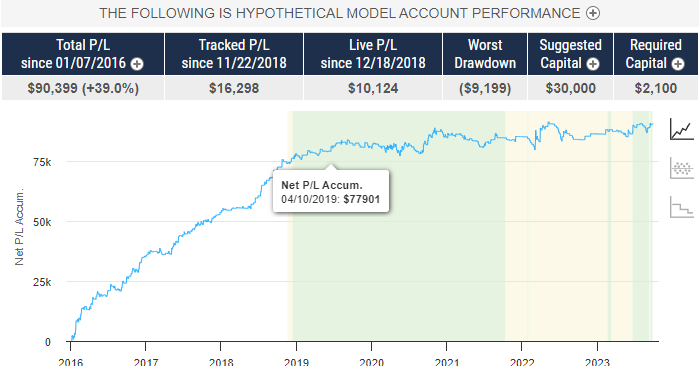

Cannon Trading is a distinguished player in the world of futures trading and a shining example of a brokerage where futures clients are the top priority. Founded in 1988, the firm has built a solid reputation for its unwavering commitment to transparency, exceptional customer service, and client-centric approach. Here’s why Cannon Trading stands out:

- Transparency as a Cornerstone : Cannon Trading places transparency at the heart of its operations. The brokerage is meticulous in providing clients with accurate and comprehensive information about trading costs, margin requirements, and contract specifications. This commitment to transparency fosters trust and confidence among traders.

- Expertise and Knowledgeable Brokers : One of the key strengths of Cannon Trading is its team of knowledgeable brokers. These professionals possess extensive experience in the futures markets and are well-versed in market analysis, risk management, and trading strategies. They stand ready to guide traders through the complexities of futures trading, offering valuable insights and personalized advice.

- Client-Centric Philosophy : At Cannon Trading, the client always comes first. The brokerage prioritizes the needs and goals of its clients, whether they are seasoned traders or newcomers to the futures markets. This client-centric philosophy is reflected in the prompt resolution of issues and the provision of timely support.

- Award-Winning Service : Cannon Trading’s dedication to excellence has earned it numerous accolades and a stellar reputation. The firm’s clients consistently commend its customer service, transparency, and commitment to client success.

- Wide Range of Futures Trading Options : Cannon Trading offers a diverse range of futures trading software, catering to traders with various preferences and trading styles. These platforms are designed to be user-friendly and technologically advanced, ensuring that traders have the tools they need to succeed.

- Regulatory Compliance and Credibility : With a history dating back to 1988, Cannon Trading has established a strong standing with regulators. The firm diligently adheres to regulatory guidelines, ensuring the safety and security of its clients’ funds and trading activities.

Best Practices of Commodity Brokers

While Cannon Trading specializes in futures trading, many of the best practices associated with futures brokers also apply to commodity brokers. Here are some key best practices for commodity brokers:

- Transparency: Just like futures brokers, commodity brokers should prioritize transparency in all their dealings with clients. Clear and accurate information about contracts, fees, and risks is essential.

- Market Knowledge: Commodity brokers should possess a deep understanding of the commodities they trade, including supply and demand dynamics, geopolitical factors, and market trends.

- Risk Management: Brokers should assist clients in developing effective risk management strategies to protect their capital from market volatility.

- Timely Execution: Swift and accurate execution of commodity orders is crucial, allowing clients to capitalize on price movements.

- Regulatory Compliance: Commodity brokers must adhere to relevant regulatory guidelines to ensure the integrity and fairness of commodity trading.

Trading futures and commodities is a challenging endeavor that demands the support of knowledgeable and transparent brokers. Cannon Trading exemplifies the qualities that traders should seek in a futures broker, with its unwavering commitment to transparency, extensive market knowledge, and client-centric approach. Whether you are a futures or commodities trader, aligning yourself with a reputable and trusted broker like Cannon Trading can significantly enhance your trading experience in these dynamic markets.

Ready to start trading futures? Call 1(800)454-9572 and speak to one of our experienced, Series-3 licensed futures brokers and start your futures trading journey with Cannon Trading Company today.

Disclaimer – Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.