|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

- Bitcoin Futures (114)

- Charts & Indicators (307)

- Commodity Brokers (589)

- Commodity Trading (846)

- Corn Futures (64)

- Crude Oil (230)

- Currency Futures (102)

- Day Trading (658)

- Day Trading Webinar (61)

- E-Mini Futures (163)

- Economic Trading (166)

- Energy Futures (127)

- Financial Futures (178)

- Future Trading News (3,160)

- Future Trading Platform (327)

- Futures Broker (665)

- Futures Exchange (347)

- Futures Trading (1,266)

- futures trading education (446)

- Gold Futures (111)

- Grain Futures (101)

- Index Futures (271)

- Indices (233)

- Metal Futures (141)

- Nasdaq (79)

- Natural Gas (40)

- Options Trading (191)

- S&P 500 (145)

- Trading Guide (431)

- Trading Webinar (60)

- Trading Wheat Futures (45)

- Uncategorized (26)

- Weekly Newsletter (224)

Category: Trading Webinar

Trading is not for everyone; however, with the availability of trading experts, one can think about taking up trading and experiencing how risk taking can be converted into a profitable deal. To trade; however, you need to understand at least the basics. Therefore the more you read, the better it is for you. For those who do not have the time to read and understand the details of trading, you will be required to hire a professional who can guide and advise you about trading.

We at Cannon Trading help you in understanding the techniques and tricks of trading. With the enormous pool of information that we have listed you can definitely learn about trading different commodities. This category archive on trading webinar, gives not just text based information, but also webinars that talk about the concept of trading in detail. We advise you to go through these and be more informed. Do feel free to share to help others understand the details of trading.

FOMC Rate Decision, December Corn, Sentinel Gold 15, Levels, Reports; Your 5 Important Must Knows for Trading Futures the Week of September 15th, 2025

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

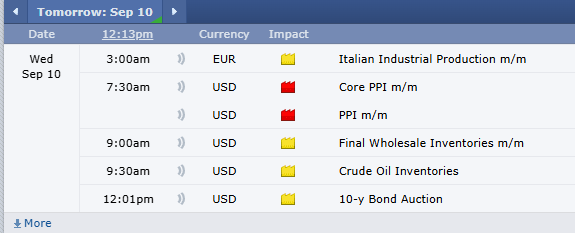

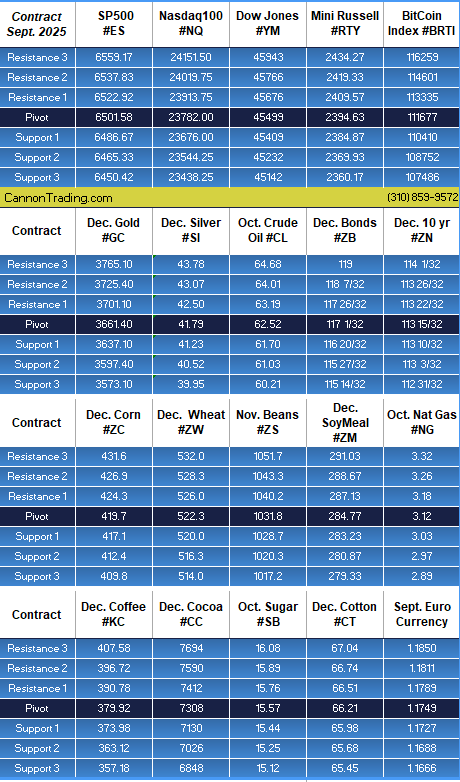

Cattle – Live & Feeder, Core PPI, Webinar TOMORROW MORNING!!! Levels, Reports; Your 5 Important Must-Knows for Trading Futures on Wednesday, September 10th, 2025

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

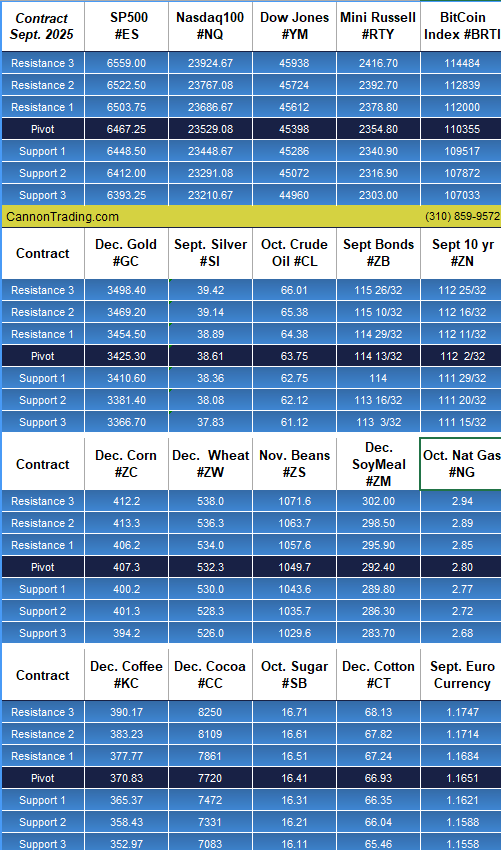

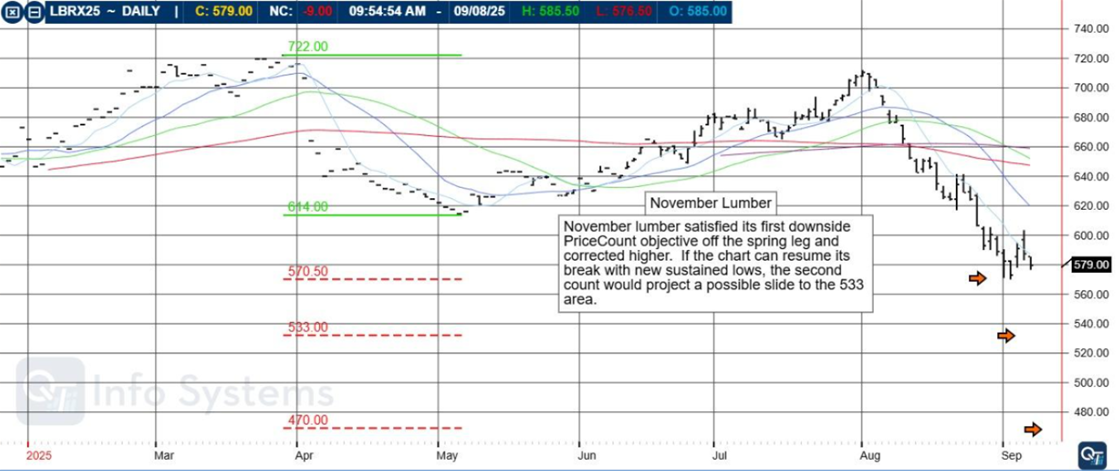

Webinar Wednesday – Decoding the Markets, November Lumber, Levels, Reports: Your 4 Important Must-Knows for Trading Futures on September 9th, 2025

|

|

|

Futures Brokers; Five Undeniable Traits of the Top Futures Brokers

Futures Brokers

The second half of 2025 presents traders with extraordinary opportunities in futures trading, but it also demands heightened responsibility, discipline, and insight. Volatility remains elevated across commodities, equities, cryptocurrencies, and interest-rate derivatives as central banks adjust policies amid a turbulent global economy. Traders are increasingly relying on their futures brokers not just for execution but also for guidance, risk management tools, and robust trading platforms.

Choosing the best futures brokers isn’t just about low commissions or fast executions—it’s about aligning yourself with a trusted partner who helps you navigate complexity with confidence. In this context, Cannon Trading Company stands out as one of the top-rated futures brokers USA, thanks to its decades of industry experience, an exemplary regulatory record, cutting-edge platform offerings, and hundreds of verified five-star ratings on TrustPilot.

In this article, we’ll explore:

- How traders can leverage their futures broker to ensure responsible trading in H2 2025.

- The evolving role of futures brokers in the age of AI-driven, high-speed markets.

- Why Cannon Trading Company is a leading ally for traders navigating today’s markets.

- The importance of technology, compliance, and education when trading futures responsibly.

Try a FREE Demo!

The Evolving Role of Futures Brokers in 2025

In 2025, the role of a futures broker has transformed from that of a simple trade executor to that of a comprehensive trading partner. Traditional brokers offered order execution and access to exchanges, but modern futures brokers are now:

- Risk Advisors – Helping traders understand leverage, margin requirements, and downside exposure.

- Platform Gatekeepers – Providing access to powerful futures options trading platforms like CQG, Rithmic, TradingView, MotiveWave, and Bookmap.

- Compliance Leaders – Ensuring traders meet federal regulations and exchange guidelines.

- Educators – Equipping traders with research, insights, and learning resources.

- Innovation Hubs – Integrating AI, analytics, and high-speed routing to support optimal trade decisions.

When working with the best futures brokers, traders aren’t just selecting a transactional service—they’re choosing a strategic partner capable of helping them make smarter, more responsible decisions when trading futures.

Why Responsible Futures Trading Matters in H2 2025

The second half of 2025 brings heightened uncertainty across asset classes:

- Interest Rates: Central banks are balancing inflation and slowing growth.

- Commodities: Energy and agricultural markets remain volatile amid supply chain disruptions.

- Equity Futures: The S&P 500 and Nasdaq futures show increased sensitivity to geopolitical developments.

- Digital Assets: Cryptocurrencies and micro ether futures continue attracting speculative interest.

These dynamics underscore the importance of disciplined strategies. Traders who over-leverage or ignore risk parameters face amplified losses. Responsible trading in this environment involves:

- Setting realistic position sizes.

- Using stop-loss orders effectively.

- Diversifying across asset classes.

- Leveraging analytics from futures options trading platforms.

- Working closely with a knowledgeable futures broker to stay informed and compliant.

The right futures brokers USA empower traders to adapt, manage risk, and maintain consistency amid shifting markets.

How Traders Can Leverage Their Futures Broker for Responsible Trading

- Access to Top-Tier Futures Trading Platforms

In H2 2025, execution speed and analytical capabilities matter more than ever. The best futures brokers provide traders with access to world-class futures options trading platforms, such as:

- CQG – Known for lightning-fast execution and institutional-grade charting.

- TradingView – Offers an intuitive interface and integrated social trading insights.

- Bookmap – Delivers granular order-flow visualization for scalpers and high-frequency traders.

- Rithmic/RTrader Pro – Ideal for algorithmic traders seeking low-latency connectivity.

- MotiveWave – Advanced Elliott Wave and Gann analysis tools for technical traders.

By leveraging these technologies, traders can better evaluate price action, manage positions, and implement advanced strategies responsibly.

- Guidance on Risk Management

A seasoned futures broker serves as an invaluable resource for risk mitigation. They help traders:

- Understand margin requirements for different contracts.

- Set maximum daily loss limits to prevent emotional overtrading.

- Implement trailing stops and hedge positions using futures options trading strategies.

- Diversify across multiple products to reduce portfolio volatility.

Traders working with experienced futures brokers USA gain a safety net against avoidable mistakes, enabling them to maintain longevity in volatile markets.

- Education and Market Research

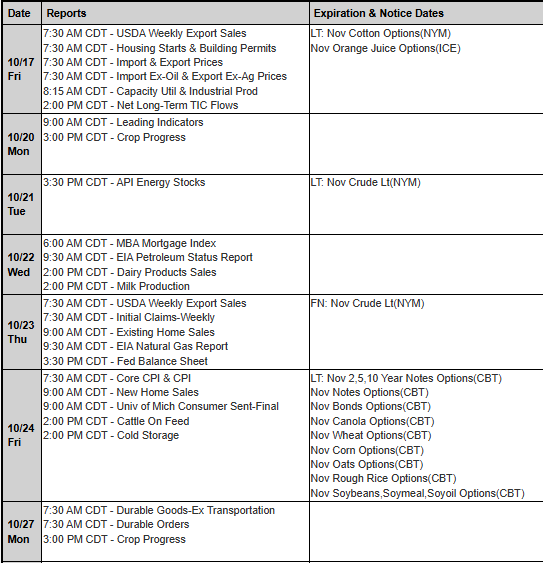

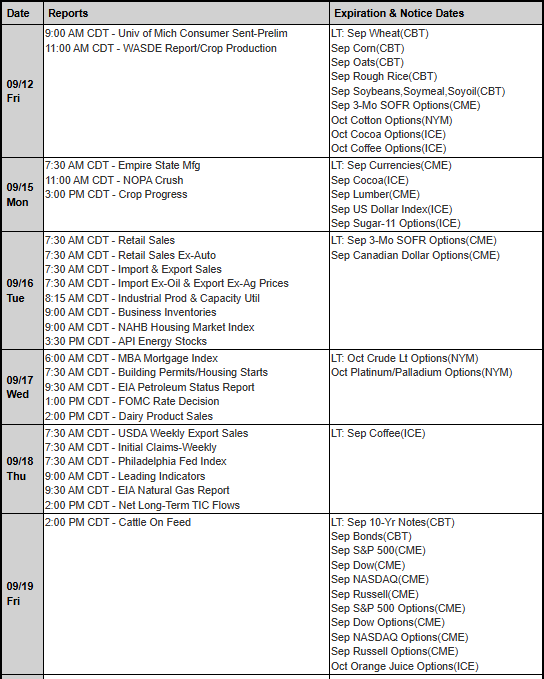

The best futures brokers go beyond execution to deliver actionable intelligence. Educational resources include:

- Webinars on evolving futures markets and strategies.

- Real-time news feeds and economic event alerts.

- Analysis of open interest, volume, and sentiment data.

- Tutorials on futures broker options for hedging and speculation.

This combination of technology and education is essential for building a disciplined approach to trading futures responsibly.

- Personalized Support and Compliance Assistance

Unlike discount-only firms, full-service futures brokers like Cannon Trading Company offer personal guidance. In 2025, compliance remains critical as regulators tighten oversight to protect retail traders. A trusted futures broker helps ensure:

- Adherence to CFTC and NFA guidelines.

- Correct reporting of positions and margins.

- Proper understanding of leverage and exposure.

By acting as both a compliance resource and execution partner, a broker reduces legal and financial risks for traders.

Why Cannon Trading Company Stands Out

Decades of Experience

Founded in 1988, Cannon Trading Company has spent nearly four decades helping traders succeed in dynamic futures markets. This depth of experience gives the firm unparalleled insight into market cycles, trader psychology, and technological innovation.

Five-Star TrustPilot Ratings

With numerous verified 5 out of 5-star ratings on TrustPilot, Cannon Trading Company has earned a stellar reputation among traders worldwide. These reviews highlight exceptional customer service, transparent pricing, and fast execution.

Exemplary Regulatory Reputation

Cannon maintains spotless relationships with federal and independent regulators, including the CFTC and NFA. Their emphasis on compliance gives traders confidence that they’re working with one of the best futures brokers in the industry.

Wide Selection of Futures Trading Platforms

Unlike brokers tied to a single platform, Cannon offers a diverse suite of futures options trading platforms to match every trader’s style, including CQG, Rithmic, TradingView, and MotiveWave.

This flexibility empowers traders to choose the ideal tools for their strategy while enjoying expert support from Cannon’s team.

The Power of Futures Options with the Right Broker

An area where a skilled futures options broker shines is helping traders incorporate options into their strategies. Options on futures contracts enable traders to:

- Hedge against downside risks while holding long futures positions.

- Generate income through premium-selling strategies.

- Structure trades with asymmetric risk-reward profiles.

With Cannon Trading Company’s expertise, traders gain access to cutting-edge futures broker options and personalized guidance on how to integrate options into their portfolio responsibly.

Responsible Trading Strategies for H2 2025

To thrive in today’s markets, traders should combine advanced tools with discipline. Here are key strategies:

- Adopt a Risk-First Mindset

- Limit exposure per trade to a fixed percentage of account equity.

- Use volatility-based position sizing to account for fluctuating markets.

- Leverage Broker Research and Insights

- Utilize analytics and educational materials provided by futures brokers USA.

- Use Futures and Options Together

- Combine outright futures contracts with protective options to limit downside while keeping upside potential.

- Harness Automation Responsibly

- Use algorithmic features on futures options trading platforms but maintain manual oversight.

With a trusted futures broker like Cannon Trading Company, these strategies become easier to execute effectively.

The second half of 2025 will test traders’ discipline, adaptability, and strategy. Partnering with the best futures brokers—especially those with deep experience, regulatory excellence, and cutting-edge tools—is essential for success.

Cannon Trading Company continues to stand out as a premier choice among futures brokers USA, offering:

- Decades of expertise.

- Exceptional customer satisfaction with countless five-star TrustPilot reviews.

- A strong regulatory reputation.

- Access to elite futures options trading platforms for every trading style.

For traders looking to navigate complex markets responsibly, Cannon Trading Company is more than just a futures broker—it’s a strategic ally.

Try a FREE Demo!

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

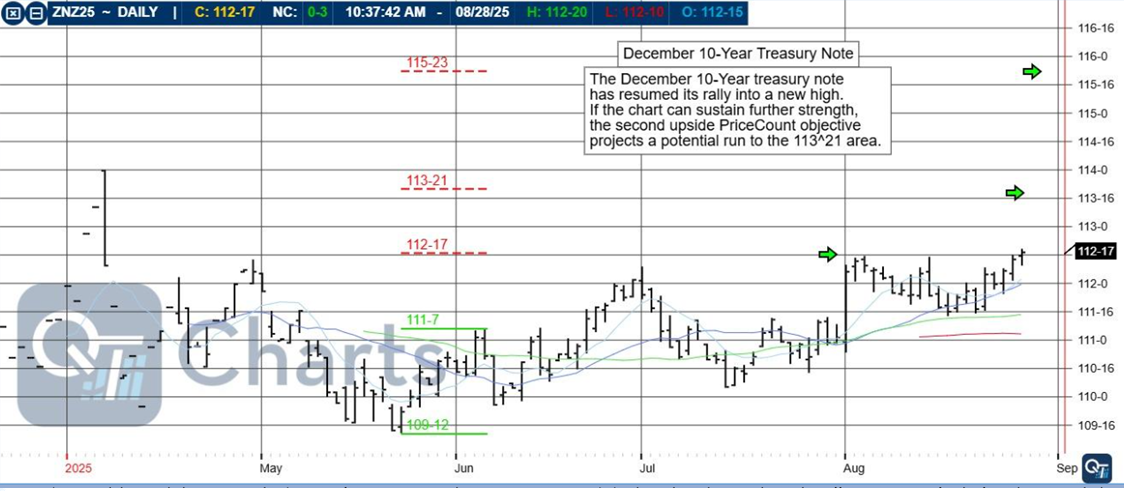

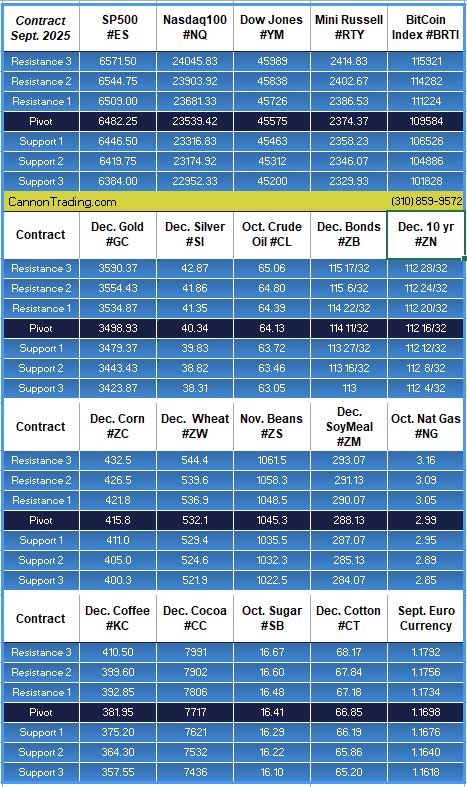

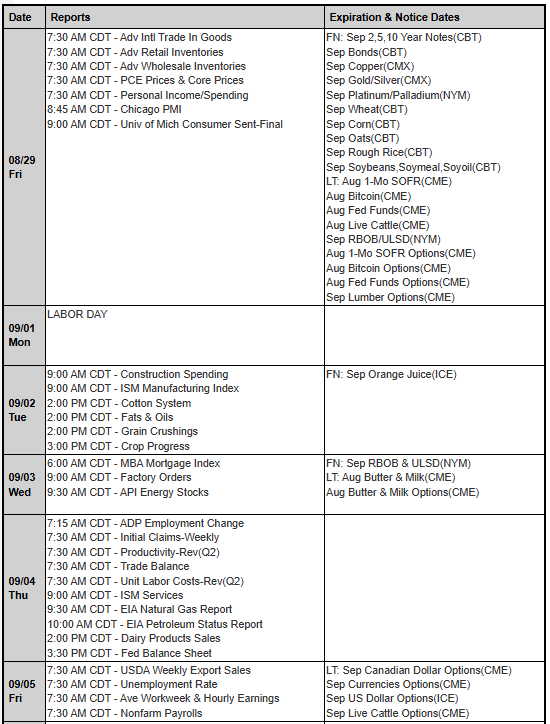

Labor Day Weekend 2025, Non Farm Payroll, December 10 Year Notes, Levels, Reports; Your 4 Important Must-Knows for Trading Futures the Week of September 1st, 2025

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Best Futures Brokers

When navigating the complex and fast-paced world of futures trading, choosing the right broker can be the difference between long-term success and costly missteps. The best futures brokers don’t just provide access to markets—they deliver performance, reliability, and client-focused service. In a market where traders need every edge, selecting the best futures brokerage is a strategic decision that goes beyond commissions and technology.

As a trader, whether you’re managing a diversified commodity portfolio or scalping market volatility, you’re likely looking for top rated futures brokers who can offer a blend of deep industry experience, regulatory credibility, advanced trading platforms, and client-centered service. This is where Cannon Trading Company shines—not just as a viable contender but as a top-rated commodities brokerage with nearly four decades of operational excellence.

A Legacy of Excellence Since 1988

Founded in 1988, Cannon Trading Company has become one of the most enduring and respected names among top rated futures brokers in the United States. With nearly 40 years of uninterrupted service, Cannon Trading has weathered market cycles, regulatory changes, technological revolutions, and the digital transformation of the financial services industry.

Their longevity is not by chance. It is rooted in a relentless pursuit of excellence and adaptability. While some firms operate in reaction to market conditions, Cannon Trading is proactive—constantly evaluating its services, expanding its platform offerings, and optimizing client experiences.

When traders research the best futures brokers, one of the key indicators they often seek is industry tenure. A firm like Cannon Trading, with decades of proven performance, assures traders of stability and expertise—an essential edge in an unpredictable market landscape.

Regulatory Reputation and Trust

Any claim to being among the top-rated commodity brokers is incomplete without impeccable regulatory standing. Cannon Trading Company boasts a pristine record with U.S. futures regulators, including the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA). This clean record is not merely a badge of honor—it is a testament to the company’s commitment to integrity, compliance, and transparency.

This kind of regulatory fidelity elevates Cannon Trading above many competitors who may offer flashy tools but lack the trustworthy foundation required for long-term engagement. For clients who take compliance and security seriously, choosing a top-rated futures brokerage like Cannon Trading ensures peace of mind.

Client Satisfaction and 5-Star TrustPilot Ratings

In today’s digital era, online reputation matters more than ever. Independent reviews are often more insightful than promotional materials. Cannon Trading Company has earned consistent 5 out of 5-star ratings on TrustPilot—a rare feat in the brokerage industry.

Clients praise the firm for personalized service, fast response times, and trading desk professionals who understand the nuances of both retail and institutional trading. These reviews are not marketing hyperbole—they are public testimonies from real users that back Cannon’s position among the best futures brokers in the country.

Whether you’re a beginner who needs handholding or a veteran seeking high-frequency trading solutions, Cannon Trading’s tailored approach to customer support ensures you’re not just a number in a CRM database—you’re a partner in success.

Platform Diversity: A Personalized Trading Experience

One of Cannon Trading’s most distinctive features as a top-rated futures brokerage is its vast selection of world-class trading platforms. Unlike many brokers that lock you into one or two interfaces, Cannon empowers you to choose from a broad spectrum, including:

- CannonX

- CQG

- RTrader Pro

- Bookmap

- MotiveWave

- Sierra Chart

- MultiCharts

- TradingView

- Firetip

- iBroker

- And more…

This flexibility enables traders to match their personal trading style with the tools they need. Whether you’re looking for advanced charting, market depth visualization, algorithmic trading support, or mobile-friendly execution, Cannon Trading delivers.

This breadth of choice alone elevates Cannon Trading to the upper echelon of top-rated commodity brokers. Personalized trading is no longer a luxury—it’s a necessity, and Cannon ensures you’re equipped.

Dedicated Support from Experienced Professionals

Cannon Trading’s support team isn’t composed of outsourced reps reading scripts. Instead, the company invests in experienced brokers and support staff who know the markets. Their team includes licensed professionals who can assist with strategy, risk management, platform configuration, and more.

This level of expertise is what separates Cannon from low-cost alternatives. Their team doesn’t just solve problems—they anticipate them. They don’t just process orders—they guide you through market dynamics, trading psychology, and system performance. It’s a hands-on approach that defines what the best futures brokerage should provide.

Competitive Pricing, Transparency, and No Gimmicks

Cannon Trading doesn’t lure clients with deceptive low pricing that later explodes with hidden fees. Instead, the firm maintains a transparent fee structure that caters to traders of all types—from high-volume intraday traders to hedgers and long-term position holders.

Account minimums are reasonable, margins are competitive, and the firm offers both self-directed and broker-assisted services without forcing traders into one-size-fits-all models.

This balanced approach makes Cannon Trading not only one of the top-rated futures brokers but also one of the most honest and accessible futures brokerages in the U.S.

Risk Management and Education

Risk is inherent in futures trading, but proper management is where traders gain the edge. Cannon Trading Company takes risk education seriously. From free webinars to comprehensive articles and one-on-one consultations, Cannon provides a robust educational infrastructure for clients.

Some of the key educational tools include:

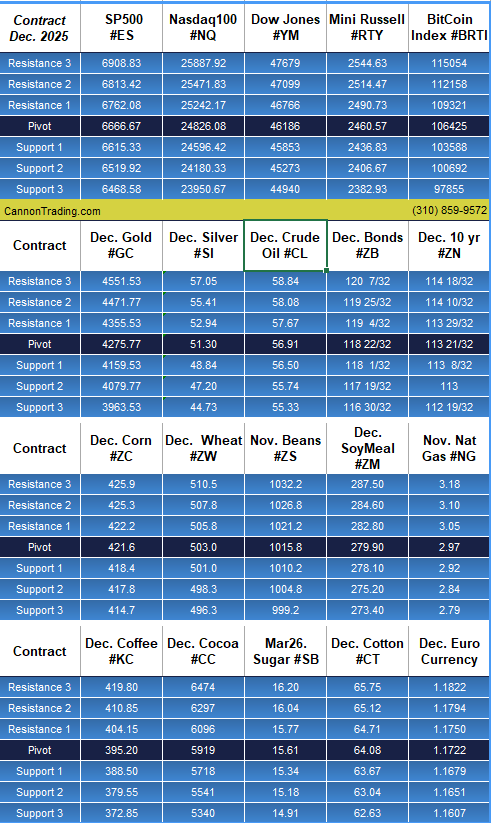

- Daily support & resistance levels

- Market commentary

- Trading tutorials

- Platform-specific guidance

- Broker insights based on current market activity

Cannon’s emphasis on education demonstrates a client-first mentality—another trait that places it high on the list of best futures brokers available to U.S.-based traders.

Custom Brokerage Solutions for Every Trader Type

Whether you’re a day trader seeking tight spreads and rapid execution, or a commodity hedger managing physical positions, Cannon Trading can customize a brokerage solution to fit your needs.

This bespoke brokerage model is what sets Cannon apart from most top-rated commodities brokerages, many of which cater exclusively to either the institutional or retail segment. Cannon manages to serve both ends of the spectrum without compromising quality.

High-Speed Execution and Advanced Order Types

In today’s algorithmic trading environment, execution speed can make or break profitability. Cannon Trading offers:

- Low-latency order routing

- Colocated servers with exchanges

- Access to advanced order types (OCO, brackets, trailing stops)

- Integration with algorithmic systems and APIs

These features aren’t just for show—they represent real competitive advantages that place Cannon Trading among the best futures brokers for speed, precision, and strategy execution.

Recognized Leadership in the Futures Industry

Over the years, Cannon Trading has earned accolades from clients, regulators, and industry peers alike. The firm has been invited to participate in trading expos, industry panels, and educational summits, further cementing its position as a top-rated futures brokerage and thought leader.

Their content is frequently cited in futures forums, educational blogs, and trading academies—another validation of the trust and authority Cannon Trading has cultivated in its nearly 40 years of operation.

Comparing Cannon to Other U.S. Futures Brokers

While many brokers offer competitive rates or sleek platforms, very few combine the full suite of advantages that Cannon does:

| Feature | Cannon Trading Company | Average U.S. Futures Broker |

| Years in Business | ~40 | 10–15 |

| Platform Options | 10+ | 1–3 |

| TrustPilot Rating | 5.0 (multiple ratings) | 3.5–4.5 |

| Regulatory Standing | Clean record with CFTC/NFA | Mixed |

| Broker-Assisted Trading | Available | Often unavailable |

| Custom Solutions | Yes | Limited |

| Education & Risk Tools | Extensive | Minimal |

As this comparison illustrates, Cannon doesn’t just match its competitors—it exceeds them across nearly every meaningful metric.

A Legacy Built for the Future

The title of best futures brokerage isn’t one that can be self-proclaimed—it must be earned through decades of diligence, innovation, client satisfaction, and transparency. Cannon Trading Company exemplifies all of these values. Its nearly 40-year legacy, stellar regulatory history, highly rated client reviews, and unparalleled platform diversity set it apart as a consistent leader.

For any trader looking for the best futures brokers in the U.S., Cannon Trading deserves a place at the top of the list—not just because of what they’ve done, but because of what they continue to do for their clients every day.

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

Hedging in Futures

In today’s complex financial environment, hedging in futures stands as one of the most effective tools for managing risk. From multinational corporations to individual traders, futures hedging strategies play a pivotal role in preserving capital, ensuring predictability in uncertain markets, and enhancing portfolio performance. But what does it truly mean to hedge futures? Why should traders care about this centuries-old technique? And how does a trusted brokerage like Cannon Trading Company, backed by five-star TrustPilot ratings and a stellar compliance history, elevate the experience of futures contract trading?

Let’s dive deep into the world of hedging futures, its tangible benefits, drawbacks, historical journey, and what traders can expect moving into the second half of the 2020s.

What Does It Mean to Hedge Futures?

Hedging in futures refers to the strategic use of futures contracts to reduce or eliminate the risk of adverse price movements in an asset. It’s akin to buying insurance—traders or businesses enter into offsetting futures positions to protect their core holdings or future purchases.

Imagine a wheat farmer who anticipates a harvest in three months. Concerned about falling prices, they may hedge futures by selling a wheat futures contract today. If prices decline by harvest time, the loss in the cash market is counterbalanced by the gain in the futures trading position. Conversely, a bakery needing flour might lock in prices via futures contract trading to avoid unexpected cost increases.

This duality—protection against price volatility—is the essence of futures hedging.

How Traders Benefit by Hedging Futures

The advantages of hedging in futures stretch across industries and trader profiles. Let’s examine some of the most impactful benefits:

- Risk Mitigation

Whether you’re a commodity producer, institutional investor, or individual speculator, futures hedging offers a buffer against unfavorable price shifts. Energy companies, for instance, often hedge crude oil using emini contracts on energy commodities to stabilize revenue streams. - Profit Preservation

In volatile markets, the profits from core investments can be eroded quickly. By entering futures contract trading positions that move inversely to one’s portfolio, traders can protect gains. - Predictability for Budgeting and Planning

Hedging allows for cost and revenue predictability—especially vital for businesses. Airlines frequently use futures hedging to lock in fuel prices, ensuring their cost structures remain intact even amid market upheavals. - Increased Leverage and Capital Efficiency

Because futures trading allows for high leverage, hedging requires a relatively small upfront margin. This is particularly beneficial for firms managing large inventories or exposures. - Access to Liquid and Transparent Markets

Thanks to institutional-grade exchanges and institutional trading platforms, hedging futures is straightforward, auditable, and liquid. Traders can easily enter or exit positions without concerns about counterparty risk.

Pros and Cons of Hedging in Futures

While futures hedging is powerful, it’s not without challenges. Let’s break down both sides:

✅ Pros

- Risk Reduction: The core advantage, of course, is insulation from market volatility.

- Predictability: Businesses and traders alike benefit from known outcomes, enabling better planning.

- Flexibility: A wide range of futures contract trading options—from e mini indices to metals—allows tailored strategies.

- Cost Effectiveness: Hedging via emini contracts can provide inexpensive protection due to high liquidity and tight spreads.

- Execution Speed: Platforms like those offered by Cannon Trading Company allow rapid execution on global exchanges.

❌ Cons

- No Participation in Favorable Moves: If the market moves in a favorable direction, a hedge might cancel out those potential profits.

- Margin Requirements: Hedging, while cost-efficient, still ties up margin capital.

- Complexity: Misunderstanding how a hedging futures position correlates with the underlying asset can backfire.

- Basis Risk: The hedge may not perfectly align with the actual exposure, particularly with customized or exotic products.

- Opportunity Cost: Committing capital to a hedge may prevent allocation to more profitable ventures.

Despite these drawbacks, the risk-return tradeoff often justifies hedging—especially when executed with a knowledgeable partner.

How Hedging in Futures Has Evolved Over the Years

The roots of futures contract trading trace back to ancient Mesopotamia, where farmers and merchants agreed on prices ahead of time. The modern era of futures trading, however, began with the Chicago Board of Trade in the 19th century. Back then, hedging futures was predominantly used by agricultural producers and processors.

20th Century Innovations

The 1970s brought financial futures—contracts on currencies, interest rates, and later stock indexes. The launch of e mini contracts in the late 1990s revolutionized access, allowing individual traders to hedge and speculate alongside institutions.

The 2000s: Digital Transformation

The rise of online institutional trading platforms in the early 2000s, along with algorithmic execution and real-time analytics, made futures hedging faster, more precise, and accessible to a wider audience. Tools like stop-loss hedging, delta-neutral strategies, and multi-leg spreads became common.

Hedging Futures in the 2020s and Beyond: What’s Next?

As we advance into the second half of the 2020s, several trends are reshaping the futures hedging landscape:

- AI-Powered Hedging Algorithms

Artificial intelligence is optimizing hedging in futures by analyzing historical data, real-time feeds, and macroeconomic indicators. Platforms now offer automated hedge suggestions for retail and institutional users alike.

- Blockchain and Smart Contracts

Smart contracts on blockchain networks are being explored to automate and validate futures contract trading without intermediaries, reducing costs and increasing transparency.

- Micro Futures & E-Mini Evolution

New products such as Micro E-mini contracts have enabled precision futures hedging for smaller portfolios, reducing margin requirements while maintaining effectiveness.

- Environmental, Social, and Governance (ESG) Integration

With ESG concerns rising, trading futures linked to carbon credits, sustainable commodities, and energy transitions is growing. Companies can now hedge not just financial exposure, but environmental compliance risks too.

- Regulatory Enhancements

Post-2020s regulations from entities like the CFTC and NFA have refined risk disclosure and margin policies. Trustworthy brokers like Cannon Trading Company maintain a top-tier compliance track record, crucial for safe futures trading.

Why Cannon Trading Company Is a Leader in Hedging Futures

When it comes to selecting a brokerage for futures contract trading, not all brokers are created equal. Here’s why Cannon Trading Company consistently stands out:

- ⭐ Unmatched Industry Reputation

With decades of experience, Cannon Trading boasts a pristine record with federal and independent regulators, including the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA). - ⭐Top-Rated TrustPilot Reputation

Numerous five-out-of-five-star reviews on TrustPilot testify to Cannon’s integrity, customer service, and performance in both hedging futures and trading futures executions. - ⭐ Vast Platform Options

From institutional trading platforms like CQG, Rithmic, and Firetip, to user-friendly solutions for beginners and pros alike, Cannon ensures clients can hedge futures effectively, no matter their experience level.

Try a FREE Demo! - ⭐ Custom Hedging Support

Cannon’s expert team provides guidance tailored to individual clients—whether you’re an options trader hedging exposure, a commercial hedger seeking commodity protection, or a retail trader using emini contracts for equity index positions. - ⭐Education and Tools

With robust educational resources, webinars, blog updates, and dedicated account reps, Cannon Trading demystifies futures hedging, empowering clients to make confident, informed decisions.

Real-World Use Cases of Hedging in Futures

Case 1: Equity Portfolio Hedging

An investor with a $1 million stock portfolio might fear a market downturn. They could sell E-mini S&P 500 futures to hedge. If the market drops, the loss in the portfolio is offset by gains in the emini position.

Case 2: Agricultural Hedging

A corn producer facing uncertain prices can sell corn futures contracts during planting season. Come harvest, if prices drop, the futures gain compensates the cash market loss.

Case 3: Corporate Currency Risk

An exporter expecting €5 million in receivables three months from now can sell euro futures contracts to lock in the exchange rate, avoiding surprises from currency fluctuations.

Hedging in futures is not merely a defensive tool—it’s a proactive strategy to stabilize income, reduce uncertainty, and navigate complex markets. While it has risks and requires expertise, the evolution of institutional trading platforms, coupled with sophisticated analytics, has made futures hedging more accessible and impactful than ever before.

As we move further into the 2020s, advancements like AI-driven hedging, ESG-linked products, and decentralized infrastructure will further reshape how traders and institutions hedge futures.

For traders seeking a reliable partner to navigate these changes, Cannon Trading Company stands as a gold standard—offering trusted expertise, five-star service, and cutting-edge platform diversity to support every kind of futures trading journey.

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

Book Map

The futures trading industry has witnessed a dramatic transformation over the past two decades, driven largely by advancements in trading technology. Among the most groundbreaking innovations is Book Map, a dynamic and visually-driven platform that has redefined how traders engage with order flow, liquidity, and market depth. Since its inception, Book Map has evolved from a specialized tool used by high-frequency traders and algorithmic firms into a mainstream platform embraced by retail traders and professionals alike.

This article explores the evolution of the Book Map futures trading platform, its standout features compared to other platforms, and how Cannon Trading Company, widely regarded as a best futures broker with stellar TrustPilot reviews, complements Book Map to provide unmatched support for traders at all levels.

The Origins and Early Evolution of Book Map

Book Map was initially developed to address a key challenge faced by professional futures traders: visualizing the true dynamics of market liquidity. Traditional futures trading platforms offered Level 2 quotes and DOM (Depth of Market) tools, but these static interfaces failed to provide a full picture of liquidity behavior over time.

Book Map changed that by introducing a heatmap-based visualization that allowed traders to see liquidity evolve in real time, offering insights that were previously invisible. Early adopters, primarily institutional traders, leveraged these capabilities for trading futures strategies that depended on order flow and market microstructure. The platform soon gained traction for its ability to provide:

- Historical depth-of-market replays

- Real-time order book heatmaps

- Precise volume dots for trade activity

- Millisecond-level updates

Over time, Book Map trading became synonymous with cutting-edge order flow analysis. The platform continuously iterated based on user feedback, adding support for more data feeds, enhanced replay functionality, and customizable indicators.

Key Milestones in Book Map’s Development

Book Map’s trajectory has included several important updates that expanded its functionality and audience:

- Multi-Asset Support

Originally focused on futures contract trading, Book Map eventually expanded to support equities and cryptocurrencies. This allowed traders who employed cross-asset strategies to use a single interface for different markets while still benefiting from Book Map’s unique visualizations. - Third-Party Add-Ons and Marketplace

Book Map introduced a marketplace for third-party developers to offer custom indicators, automated strategies, and analytics. This modularity opened the door for customized Book Map trading strategies tailored to individual risk tolerances and trading styles. - Scripting API and Automation

With its scripting environment and API access, Book Map now caters to algorithmic and semi-automated trading approaches. Traders can backtest and forward-test their logic directly on the visual framework, bridging the gap between manual and algorithmic futures trading. - Connectivity with Top Brokers and Data Feeds

Book Map has formed integrations with the industry’s leading data feeds and brokers. Its compatibility with low-latency feeds such as Rithmic and CQG has made it especially powerful for futures contract trading, where execution speed and data accuracy are crucial.

Unique Features That Set Book Map Apart

Despite the proliferation of advanced platforms in today’s markets, Book Map maintains a distinctive edge due to its innovative approach to visualizing market data. The following features are central to its popularity and effectiveness:

- Heatmap Visualization

The Book Map heatmap shows where liquidity has been added or removed over time. Warmer colors indicate thicker order book levels, while cooler colors show thinner liquidity. This continuous visual feedback allows traders to identify spoofing, iceberg orders, and absorption—concepts critical to futures trading strategies. - Volume Bubbles and Trade Dots

As trades occur, Book Map plots volume dots or bubbles on the price axis. These are color-coded and sized based on the aggressiveness and size of the order. This allows traders to see in real-time how passive and aggressive participants are interacting with the market. - Market Replay

With millisecond precision, Book Map offers full market replay functionality. Traders can go back in time to analyze market behavior around key events and simulate Book Map trading decisions as if the session were unfolding live. - Custom Indicators and Algorithmic Tools

The platform includes support for proprietary indicators such as:- Stop & Iceberg Detection

- Absorption Indicator

- Correlation Tracker

These tools help traders develop nuanced strategies for trading futures, based on both price action and order flow dynamics.

- Impeccable Data Precision

Unlike platforms that rely on summarized or delayed market data, Book Map connects directly to low-latency feeds like Rithmic and CQG, enabling traders to receive tick-by-tick data for ultra-precise futures contract trading.

Try a FREE Demo!

How Book Map Empowers Futures Traders of All Skill Levels

One of Book Map’s most important contributions to the trading world is democratizing advanced tools that were once only available to institutional traders. Today, even novice users can benefit from insights previously reserved for hedge funds and prop desks.

- New traders benefit from the platform’s visual learning curve. Instead of interpreting static DOM numbers, they can see market movement and liquidity changes.

- Intermediate traders use Book Map to refine entries and exits, especially when combining the heatmap with volume-based strategies.

- Advanced users implement automation, custom scripts, and statistical models directly into the platform.

No matter the user level, Book Map trading adds a dimension of clarity and speed that enhances decision-making in fast-paced markets.

Why Cannon Trading Company Is the Ideal Book Map Brokerage Partner

As powerful as Book Map is, it becomes even more effective when paired with a brokerage that understands its value. Cannon Trading Company is one of the few brokerages that checks every box, making it an ideal partner for Book Map users seeking the best futures broker experience.

- Decades of Experience in the Futures Industry

With over 30 years of service in the futures trading arena, Cannon Trading offers clients unmatched institutional knowledge. Their experienced brokers understand the nuances of trading futures and can tailor platform recommendations to individual strategies, including Book Map trading. - Flawless Regulatory Track Record

Cannon Trading has earned accolades not only from clients but from federal and independent futures contract trading regulators alike. Their commitment to compliance and ethical standards ensures traders have peace of mind, knowing they’re working with a reputable broker. - 5-Star Ratings on TrustPilot

Cannon Trading’s near-perfect record on TrustPilot is no accident. Dozens of verified users have praised the firm for its responsive customer service, knowledgeable brokers, and transparency—qualities that cement its status as the best futures broker TrustPilot has to offer. - Wide Selection of Trading Platforms

While Book Map is a standout tool, many traders use multiple platforms depending on their strategy. Cannon Trading offers access to a robust suite of platforms including:- RTrader Pro

- CQG

- MotiveWave

- Sierra Chart

- MetaTrader 5

This flexibility means traders can combine the visual precision of Book Map trading with other analytics or execution tools as needed.

- Dedicated Support and Education

Whether you’re a beginner learning the ropes of futures trading, or a seasoned professional refining a scalping strategy, Cannon Trading provides personalized support. Their team helps clients set up data feeds, optimize platform performance, and troubleshoot in real time.Moreover, the firm regularly publishes webinars, blog content, and market commentary, ensuring that clients stay informed and ahead of the curve.

The Combined Advantage: Book Map + Cannon Trading

The synergy between Book Map and Cannon Trading offers traders a dual advantage:

- Technology Power: Book Map provides unmatched visibility into order flow, market depth, and trade behavior, giving users a strategic edge in fast-moving markets.

- Brokerage Excellence: Cannon Trading offers the infrastructure, support, and experience needed to deploy these insights effectively.

For traders seeking to elevate their performance in futures contract trading, this partnership is hard to beat.

Final Thoughts

In an era where milliseconds matter and transparency is power, Book Map has earned its place among the most elite futures trading platforms. Its evolution from a niche institutional tool to a mainstream powerhouse reflects the broader trend of democratizing financial technology.

But even the most advanced tool is only as good as the support structure behind it. That’s where Cannon Trading Company shines. With its decades of expertise, top-tier client reviews, and stellar regulatory record, Cannon Trading not only complements Book Map—it enhances its value.

Whether you’re new to trading futures or a seasoned expert looking for the best futures broker, pairing Book Map trading with Cannon Trading Company could be the strategic advantage you need.

Try a FREE Demo!

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

CQG Futures Platform

The CQG Platform Advantage for Online Futures Trading

In today’s dynamic financial markets, choosing a dependable futures trading platform is essential for futures trading. The CQG Platform has consistently led the pack by offering powerful tools for market analysis, trade execution, and data access. It’s more than just software—it’s an entire ecosystem supporting traders through interfaces like CQG Desktop, CQG Trader, and CQG Mobile. When paired with a top-tier brokerage like Cannon Trading, which now offers CannonX Powered by CQG, traders benefit from enhanced support, superior execution, and streamlined access to global futures markets.

What Sets the CQG Platform Apart?

At the heart of the CQG Platform is its role as a trading technology provider—not a brokerage. It delivers cutting-edge infrastructure that brokers use to provide clients with secure, low-latency access to futures exchanges. With roots going back over 40 years, CQG has earned its reputation for excellence by offering fast, reliable, and highly accurate data through its industry-leading cqg data feed.

Through interfaces like CQG Desktop, CQG Trader, and CQG Mobile, CQG connects users to a seamless trading environment where analysis, execution, and account management converge. These tools empower traders across experience levels to engage confidently in the fast-moving world of futures.

CQG Desktop: Advanced Trading in a Browser

CQG Desktop is a powerful, browser-based application designed for traders who demand high-end features without needing a heavy install. Many users look for cqg desktop download options, but the beauty of this platform is that it’s fully cloud-based—no bulky software needed. Accessible through any modern web browser, CQG Desktop offers a comprehensive interface with:

- Real-time charting and analytics

- Advanced order entry tools like the Hybrid Order Ticket

- Integrated news feeds and customizable layouts

- Built-in account monitoring with real-time updates

The cqg desktop demo is perfect for new users exploring the platform’s capabilities in a simulated environment. It provides full access to tools powered by the same high-speed cqg data feed, making it a great entry point before committing real capital.

For professionals who value access from any device, CQG Desktop provides one of the most robust solutions among today’s online futures trading platform options.

CQG Trader: Simplicity Meets Speed

While CQG Desktop focuses on comprehensive analysis and flexibility, CQG Trader is all about speed and simplicity. This lightweight application is perfect for traders who want to focus exclusively on execution.

Key features of cqg trader include:

- DOMTrader ladder for depth-of-market insights

- Quick order placement via a simplified Hybrid Order Ticket

- Quote boards for market overview

- Real-time updates on account balances, fills, and positions

Many traders use cqg trader as their primary execution interface, especially if they already rely on third-party charting tools. It offers one of the fastest order execution environments available on a futures trading platform, with minimal resource requirements.

CQG Mobile: Trading Without Limits

In an increasingly mobile world, having access to markets on the go is crucial. CQG Mobile delivers the same reliability and real-time connectivity as other CQG tools, but optimized for iOS and Android devices. This app puts the power of the CQG Platform right in your pocket.

With cqg mobile, users get:

- Streaming quotes and interactive charts

- Full order management and account access

- Biometric login options for enhanced security

- Synchronized account views across desktop and mobile

Because cqg mobile is backed by the same high-performance cqg data feed, you never miss a price move—even away from your desk. It integrates seamlessly with CQG Desktop, so you can check your trades, adjust positions, or monitor markets with ease.

CQG Desktop Demo: Practice Before You Go Live

The cqg desktop demo is one of the most important tools for both new and experienced traders. This paper-trading environment mimics live market conditions without financial risk. You can explore the full capabilities of CQG Desktop and test strategies in real time.

Highlights of the demo include:

- Hands-on experience with charts, orders, and quote boards

- Live cqg data feed for realistic simulation

- A no-pressure introduction to the platform’s interface

- A seamless path from demo to live trading with identical layouts and login procedures

Brokers like Cannon Trading provide easy access to the cqg desktop demo through their portals. It’s also the perfect way to explore CannonX Powered by CQG, a premier solution that gives traders a complete futures trading platform and brokerage experience.

Understanding the CQG Data Feed

Traders rely on accurate and fast data. The cqg data feed is recognized as one of the most robust and reliable in the industry. It supports:

- Real-time market data for futures, options, forex, and more

- Consolidated views across global exchanges

- Co-located servers near exchange engines to minimize latency

- Historical data for research and backtesting

From CQG Desktop to CQG Mobile, the data is fast, clean, and synchronized. This is a key differentiator of the CQG Platform and one of the main reasons professionals choose it for critical decision-making.

Seamless CQG Login Experience

No matter which platform you use, the cqg login experience is unified and efficient. Whether you’re using CQG Desktop, CQG Trader, or CQG Mobile, your single login grants access across all CQG services.

Benefits of this unified approach:

- One cqg login across all platforms

- Secure access with two-factor and biometric authentication

- Real-time sync of orders, positions, and balances

Thanks to CQG’s cloud-based structure, switching between devices is nearly instantaneous. This unified cqg login model enhances convenience while maintaining security and data consistency across the board.

Getting Started with the CQG Desktop Download

Though many traders refer to a cqg desktop download, what they usually mean is gaining access to the web-based CQG platform. CQG Desktop runs on HTML5, meaning no installation is required—just log in and go. However, some users may prefer a launcher or shortcut version, which brokers like Cannon Trading provide.

Steps to get started:

- Sign up with Cannon Trading and request a cqg desktop demo

- Receive login credentials and a quick-start cqg desktop download link if needed

- Begin trading through browser or app interface with the full CQG Platform experience

Accessibility is a core benefit here. Whether you’re on Windows, Mac, or mobile, the CQG Platform adapts to your environment.

Why Cannon Trading and CannonX Powered by CQG?

Selecting the right broker is just as important as the right platform. Cannon Trading has partnered closely with CQG to provide the CannonX Powered by CQG experience—a bundled solution delivering elite execution and premium support.

Why CannonX is the perfect gateway:

- 35+ Years of Experience: Founded in 1988, Cannon Trading brings market knowledge and industry insight.

- Top TrustPilot Ratings: Clients consistently give Cannon 5-star reviews for reliability and service.

- NFA Registered: Complies with the highest standards of trading regulation and safety.

- Platform Versatility: Offers CQG, NinjaTrader, Sierra Chart, and more.

- Dedicated Support: Personalized assistance for cqg desktop demo, setup, and live trading.

With CannonX Powered by CQG, traders receive the full benefit of the CQG ecosystem—combined with personalized brokerage services. From first-time users requesting a cqg desktop download to professionals managing large positions via cqg mobile, CannonX offers a unique advantage.

CQG Platform + CannonX: A Trusted Strategic Advantage

Whether you’re exploring a cqg desktop demo, trading full-time with cqg trader, or checking markets from your phone via cqg mobile, the CQG Platform provides a high-performance environment for all types of traders. Powered by the reliable cqg data feed and unified through a single cqg login, CQG’s tools are engineered for speed, accuracy, and flexibility.

Pairing this elite technology with CannonX Powered by CQG ensures that traders also benefit from seasoned brokerage expertise, regulatory security, and best-in-class customer support. Whether you’re entering the futures world for the first time or upgrading your existing setup, this combination delivers the tools, data, and support you need to succeed.

The future of trading is real-time, mobile, and intelligent. The CQG Platform, enhanced by CannonX Powered by CQG, ensures you’re ready for whatever the markets bring.

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010