In today’s complex financial environment, hedging in futures stands as one of the most effective tools for managing risk. From multinational corporations to individual traders, futures hedging strategies play a pivotal role in preserving capital, ensuring predictability in uncertain markets, and enhancing portfolio performance. But what does it truly mean to hedge futures? Why should traders care about this centuries-old technique? And how does a trusted brokerage like Cannon Trading Company, backed by five-star TrustPilot ratings and a stellar compliance history, elevate the experience of futures contract trading?

Let’s dive deep into the world of hedging futures, its tangible benefits, drawbacks, historical journey, and what traders can expect moving into the second half of the 2020s.

Try a FREE Demo!

What Does It Mean to Hedge Futures?

Hedging in futures refers to the strategic use of futures contracts to reduce or eliminate the risk of adverse price movements in an asset. It’s akin to buying insurance—traders or businesses enter into offsetting futures positions to protect their core holdings or future purchases.

Imagine a wheat farmer who anticipates a harvest in three months. Concerned about falling prices, they may hedge futures by selling a wheat futures contract today. If prices decline by harvest time, the loss in the cash market is counterbalanced by the gain in the futures trading position. Conversely, a bakery needing flour might lock in prices via futures contract trading to avoid unexpected cost increases.

This duality—protection against price volatility—is the essence of futures hedging.

How Traders Benefit by Hedging Futures

The advantages of hedging in futures stretch across industries and trader profiles. Let’s examine some of the most impactful benefits:

- Risk Mitigation

Whether you’re a commodity producer, institutional investor, or individual speculator, futures hedging offers a buffer against unfavorable price shifts. Energy companies, for instance, often hedge crude oil using emini contracts on energy commodities to stabilize revenue streams.

- Profit Preservation

In volatile markets, the profits from core investments can be eroded quickly. By entering futures contract trading positions that move inversely to one’s portfolio, traders can protect gains.

- Predictability for Budgeting and Planning

Hedging allows for cost and revenue predictability—especially vital for businesses. Airlines frequently use futures hedging to lock in fuel prices, ensuring their cost structures remain intact even amid market upheavals.

- Increased Leverage and Capital Efficiency

Because futures trading allows for high leverage, hedging requires a relatively small upfront margin. This is particularly beneficial for firms managing large inventories or exposures.

- Access to Liquid and Transparent Markets

Thanks to institutional-grade exchanges and institutional trading platforms, hedging futures is straightforward, auditable, and liquid. Traders can easily enter or exit positions without concerns about counterparty risk.

Pros and Cons of Hedging in Futures

While futures hedging is powerful, it’s not without challenges. Let’s break down both sides:

✅ Pros

- Risk Reduction: The core advantage, of course, is insulation from market volatility.

- Predictability: Businesses and traders alike benefit from known outcomes, enabling better planning.

- Flexibility: A wide range of futures contract trading options—from e mini indices to metals—allows tailored strategies.

- Cost Effectiveness: Hedging via emini contracts can provide inexpensive protection due to high liquidity and tight spreads.

- Execution Speed: Platforms like those offered by Cannon Trading Company allow rapid execution on global exchanges.

❌ Cons

- No Participation in Favorable Moves: If the market moves in a favorable direction, a hedge might cancel out those potential profits.

- Margin Requirements: Hedging, while cost-efficient, still ties up margin capital.

- Complexity: Misunderstanding how a hedging futures position correlates with the underlying asset can backfire.

- Basis Risk: The hedge may not perfectly align with the actual exposure, particularly with customized or exotic products.

- Opportunity Cost: Committing capital to a hedge may prevent allocation to more profitable ventures.

Despite these drawbacks, the risk-return tradeoff often justifies hedging—especially when executed with a knowledgeable partner.

How Hedging in Futures Has Evolved Over the Years

The roots of futures contract trading trace back to ancient Mesopotamia, where farmers and merchants agreed on prices ahead of time. The modern era of futures trading, however, began with the Chicago Board of Trade in the 19th century. Back then, hedging futures was predominantly used by agricultural producers and processors.

20th Century Innovations

The 1970s brought financial futures—contracts on currencies, interest rates, and later stock indexes. The launch of e mini contracts in the late 1990s revolutionized access, allowing individual traders to hedge and speculate alongside institutions.

The 2000s: Digital Transformation

The rise of online institutional trading platforms in the early 2000s, along with algorithmic execution and real-time analytics, made futures hedging faster, more precise, and accessible to a wider audience. Tools like stop-loss hedging, delta-neutral strategies, and multi-leg spreads became common.

Hedging Futures in the 2020s and Beyond: What’s Next?

As we advance into the second half of the 2020s, several trends are reshaping the futures hedging landscape:

- AI-Powered Hedging Algorithms

Artificial intelligence is optimizing hedging in futures by analyzing historical data, real-time feeds, and macroeconomic indicators. Platforms now offer automated hedge suggestions for retail and institutional users alike.

- Blockchain and Smart Contracts

Smart contracts on blockchain networks are being explored to automate and validate futures contract trading without intermediaries, reducing costs and increasing transparency.

- Micro Futures & E-Mini Evolution

New products such as Micro E-mini contracts have enabled precision futures hedging for smaller portfolios, reducing margin requirements while maintaining effectiveness.

- Environmental, Social, and Governance (ESG) Integration

With ESG concerns rising, trading futures linked to carbon credits, sustainable commodities, and energy transitions is growing. Companies can now hedge not just financial exposure, but environmental compliance risks too.

- Regulatory Enhancements

Post-2020s regulations from entities like the CFTC and NFA have refined risk disclosure and margin policies. Trustworthy brokers like Cannon Trading Company maintain a top-tier compliance track record, crucial for safe futures trading.

Why Cannon Trading Company Is a Leader in Hedging Futures

When it comes to selecting a brokerage for futures contract trading, not all brokers are created equal. Here’s why Cannon Trading Company consistently stands out:

- ⭐ Unmatched Industry Reputation

With decades of experience, Cannon Trading boasts a pristine record with federal and independent regulators, including the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA).

- ⭐Top-Rated TrustPilot Reputation

Numerous five-out-of-five-star reviews on TrustPilot testify to Cannon’s integrity, customer service, and performance in both hedging futures and trading futures executions.

- ⭐ Vast Platform Options

From institutional trading platforms like CQG, Rithmic, and Firetip, to user-friendly solutions for beginners and pros alike, Cannon ensures clients can hedge futures effectively, no matter their experience level.

Try a FREE Demo!

- ⭐ Custom Hedging Support

Cannon’s expert team provides guidance tailored to individual clients—whether you’re an options trader hedging exposure, a commercial hedger seeking commodity protection, or a retail trader using emini contracts for equity index positions.

- ⭐Education and Tools

With robust educational resources, webinars, blog updates, and dedicated account reps, Cannon Trading demystifies futures hedging, empowering clients to make confident, informed decisions.

Real-World Use Cases of Hedging in Futures

Case 1: Equity Portfolio Hedging

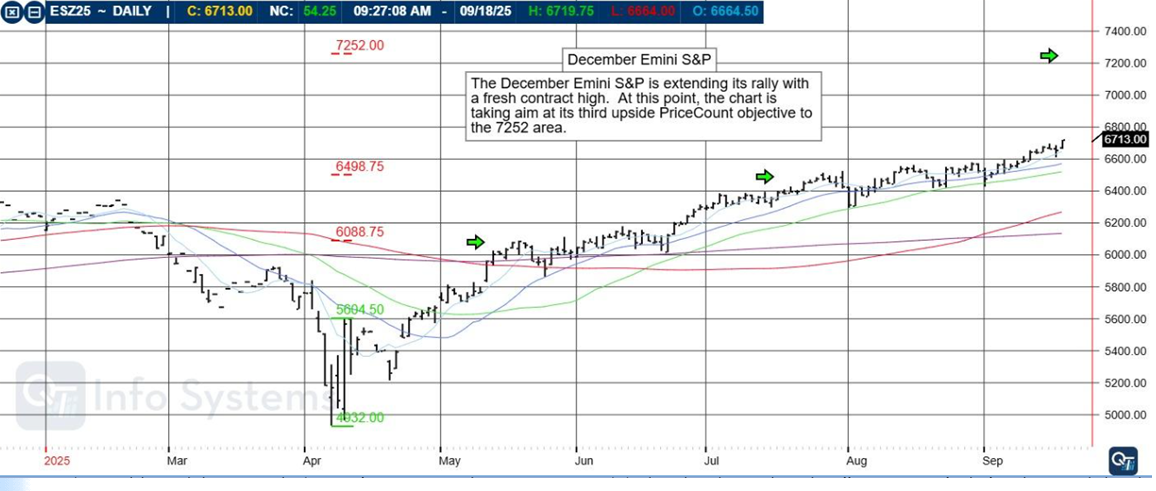

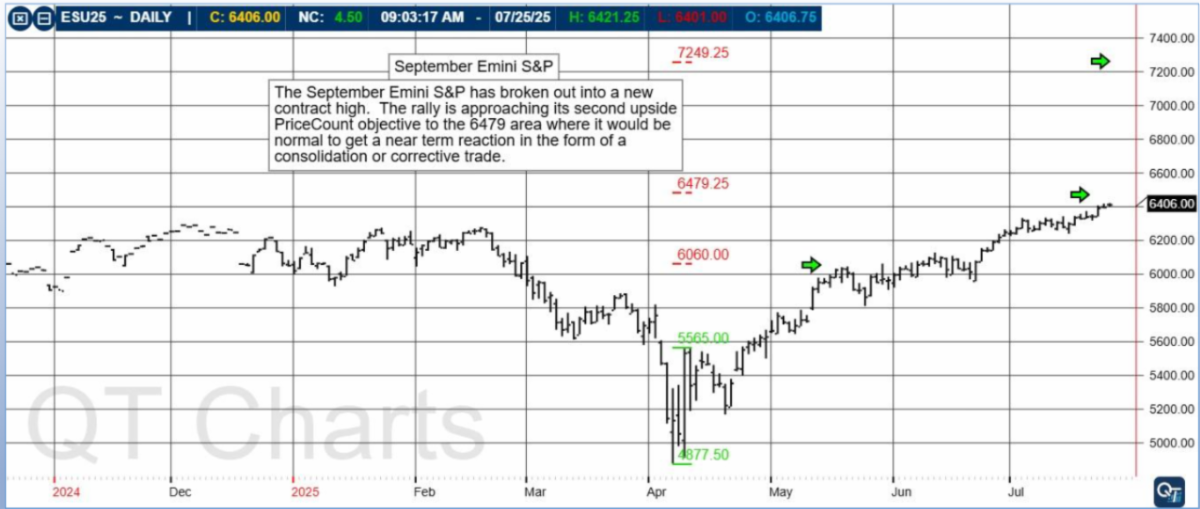

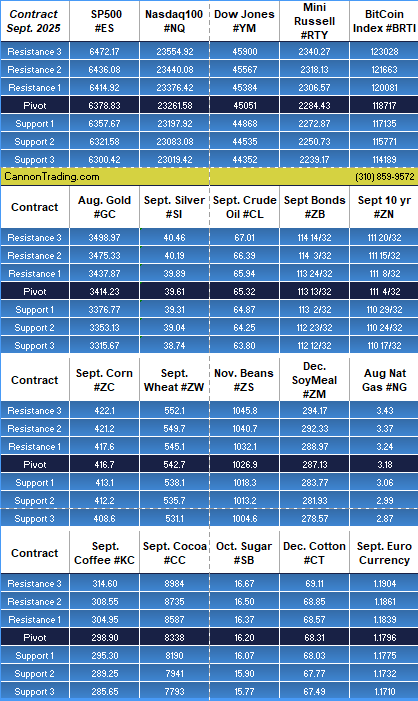

An investor with a $1 million stock portfolio might fear a market downturn. They could sell E-mini S&P 500 futures to hedge. If the market drops, the loss in the portfolio is offset by gains in the emini position.

Case 2: Agricultural Hedging

A corn producer facing uncertain prices can sell corn futures contracts during planting season. Come harvest, if prices drop, the futures gain compensates the cash market loss.

Case 3: Corporate Currency Risk

An exporter expecting €5 million in receivables three months from now can sell euro futures contracts to lock in the exchange rate, avoiding surprises from currency fluctuations.

Hedging in futures is not merely a defensive tool—it’s a proactive strategy to stabilize income, reduce uncertainty, and navigate complex markets. While it has risks and requires expertise, the evolution of institutional trading platforms, coupled with sophisticated analytics, has made futures hedging more accessible and impactful than ever before.

As we move further into the 2020s, advancements like AI-driven hedging, ESG-linked products, and decentralized infrastructure will further reshape how traders and institutions hedge futures.

For traders seeking a reliable partner to navigate these changes, Cannon Trading Company stands as a gold standard—offering trusted expertise, five-star service, and cutting-edge platform diversity to support every kind of futures trading journey.

Try a FREE Demo!

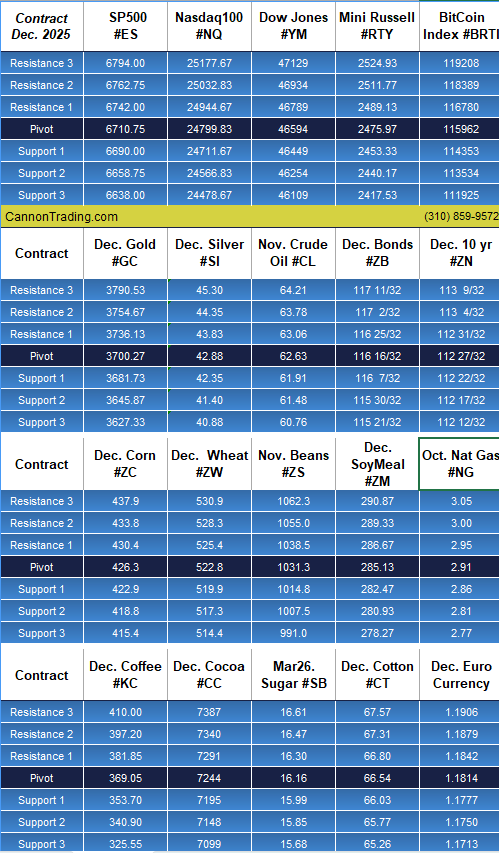

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading