The Day Ahead in Futures Trading

by Mark O’Brien, Senior Broker

S&P 500, Gold, Crude Oil

Bullet Points, Highlights, Announcements

Indexes:

The March E-mini S&P 500 traded within striking distance of its life-of-contract high posted back on Dec. 4th and 6th (6164.00) breaching that price intraday with a 6166.50 print and closing today at 6163.00

Energy:

Oil prices rose on Wednesday, extending gains to a third-consecutive session amid growing supply worries.

March futures for West Texas Intermediate Crude traded briefly above $73.00 per barrel, a ±75 intraday increase and trading up ± 46 cents per barrel at ±$72.31.

If you missed it, EIA Energy Stocks were NOT released today, as is usual. Due to the Presidents’ Day holiday, the report will be release tomorrow, 30 minutes after the EIA Gas Stocks report: 7:30 A.M., Central Time (gas), 8:00 A.M. (energy).

Metals:

Gold prices wavered near unchanged at this blog’s submission after trading ±$15 above and below yesterday’s settlement and near its all-time highs near $2,950 per ounce.

Fueling safe-haven demand for the precious metal, the Trump administration plans to impose tariffs of around 25% on U.S. bound autos and auto-building components, semiconductors and pharmaceuticals as early as April 2.

April gold futures have gained about 12% so far this year, with analysts expecting higher prices in a trade war. On Monday, Goldman Sachs raised its year-end 2025 gold price forecast to $3,100 per ounce.

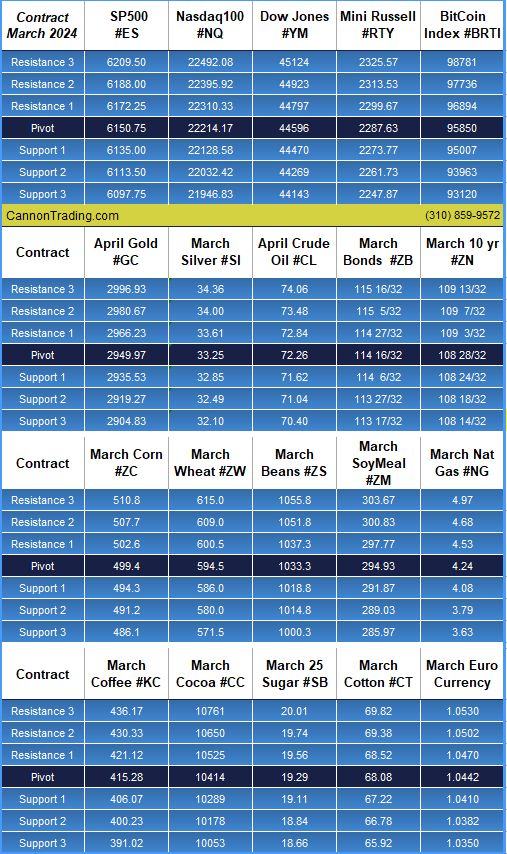

Daily Levels for February 20th, 2025

Want to feature our updated trading levels on your website? Simply paste a small code, and they’ll update automatically every day! Click here for quick and easy instructions.

Economic Reports

provided by: ForexFactory.com

All times are Eastern Time (New York)

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|