Get Real Time updates and more on our private FB group!

Bullet Points, Highlights, Announcements

By Mark O’Brien, Senior Broker

General:

It seems like no futures markets are more focused on trading off expectations than those of interest rate futures, like the 10-year T-note and 30-year T-bond. And those expectations are more focused on one source of information more than any other: the words and actions of the U.S. Federal Reserve Bank’s governors and current chairman, Jerome Powell. The Fed. board’s governors’ words are incessantly parsed for any clues as to the future direction of interest rate policy. Each coming Federal Open Market Committee meeting becomes the latest most important meeting in memory and next week’s is no exception. The U.S. economy is slowing; there are signs inflation is falling and the Fed has kept interest rates steady – at a range of 5.25% to 5.50%, the highest since 2001 – through its last two meetings after raising rates at the conclusion of eleven consecutive meetings before that. If “three is a trend,” and if the Fed. holds interest rates steady (widely forecast) look for the futures markets to pile on to the already-shifting expectation that a rate cut is coming sooner than later. As is customary, Chair Powell will likely try to communicate that the Central Bank’s job of controlling inflation is ongoing and any decision on the future of interest rates – up, down, or steady – will be based on broad definitive proof of the need to act, or not. Next week’s meeting is a 2-day affair, with the announcement scheduled for Wednesday at 1:00 P.M. Central Time, followed by Chair Powell’s press conference. Stay tuned.

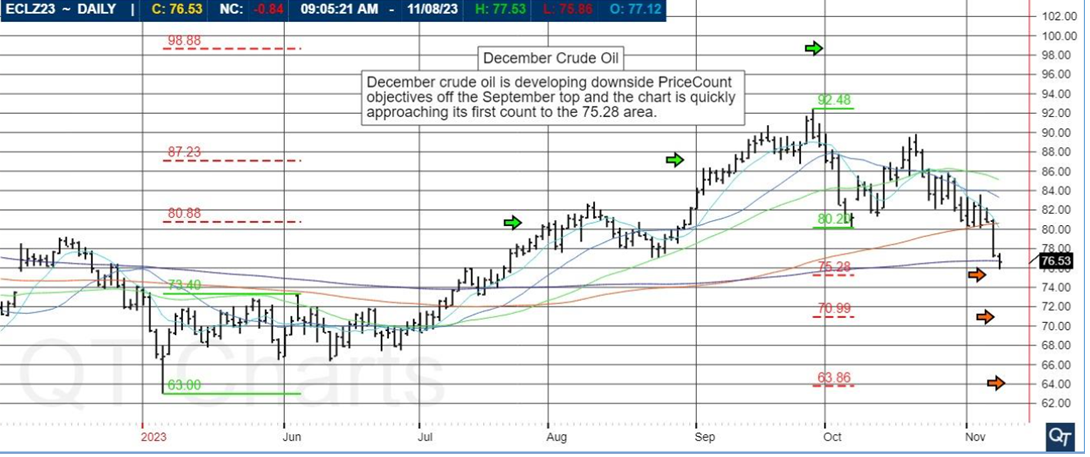

Energy:

Already entering today’s trading on a 4-day losing streak, crude oil futures extended its sell-off which as of this typing broke through $70.00 per barrel to an intra-day low of $69.11, its lowest price since July 3 (basis the January contract).

While today’s weekly Energy Information Administration report showed crude inventories fell by 4.6 million barrels, far exceeding the 1.4 million-barrel drop analysts had expected, U.S. gasoline stocks rose by 5.4 million barrels last week, more than five times the 1 million-barrel rise analysts expected.

News concerning “the elephant in the room” – China’s economic health – also pressed down on prices. Yesterday, rating agency Moody’s lowered the outlook on China’s A1 rating from stable to negative.

Getting help from the currency market, the U.S. dollar stayed on its upward rebound from 3+ month lows of last week to a two-week high. For all things dollar denominated – particularly globally traded commodities – a rising dollar pressures demand by making purchases more expensive for holders of other currencies.

Plan your trade and trade your plan.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

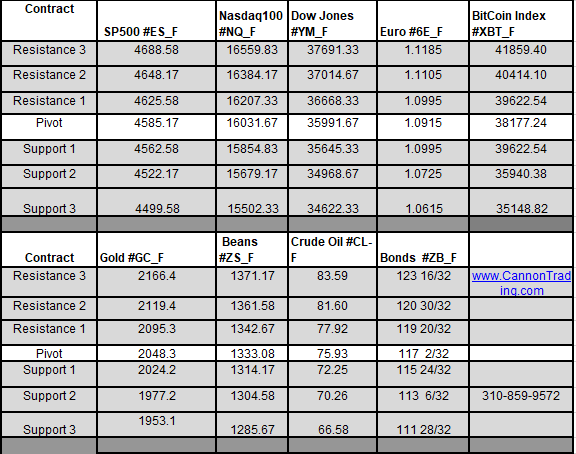

Futures Trading Levels

12-07-2023

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

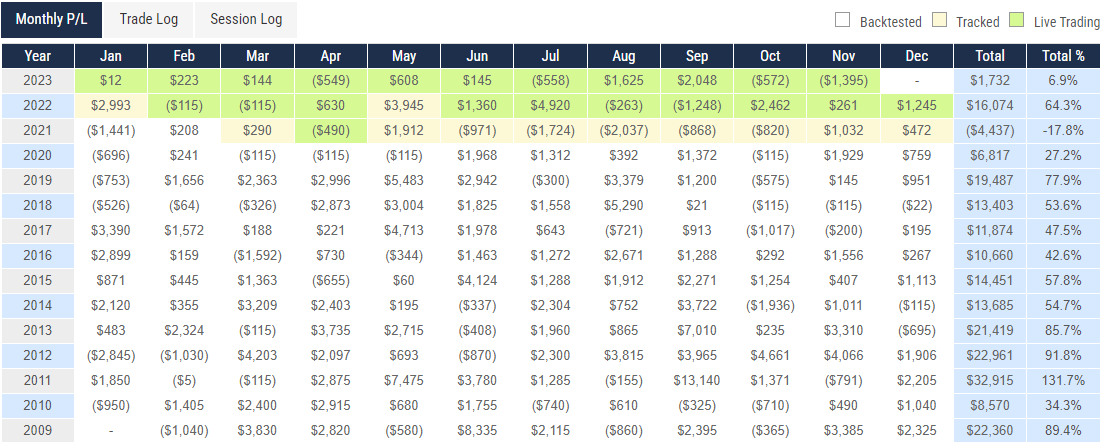

Improve Your Trading Skills

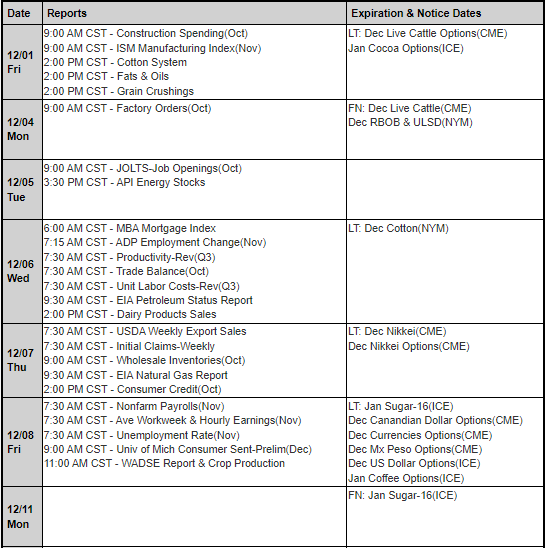

Economic Reports,

Source:

Forexfactory.com

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.