Markets Highlights

by

Mark O’Brien, Senior Broker

Standard and Poor 500 Futures: Market Next Move?

It was only three weeks ago that the March E-mini Standard and Poor 500 futures contract hit an all-time high. Markets have been dealt a blow by growth and recession fears, the unpredictability of trade policy, and risks to sector-wide investment and spending.

Whether it’s a good buying opportunity or another growl towards a bear market is still up for debate, the Standard and Poor 500 index futures contract fell into correction territory yesterday, registering a decline of 10% in the span of less than a month. While the Standard and Poor 500 futures contract trimmed some of the losses, big questions are still swirling over what lies ahead. The Trump administration is attempting to engineer a long-term structural change to the U.S. economy. The reality of that goal is hotly debated, but it is no doubt taking a toll on the short-term animal spirits that enveloped the market since November.

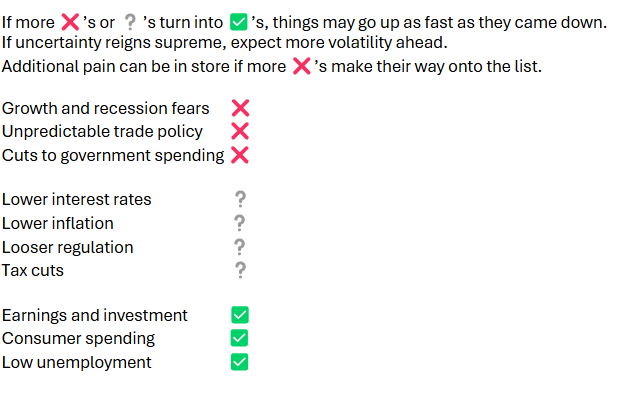

Here’s a 10-point checklist that will determine the market’s future trajectory:

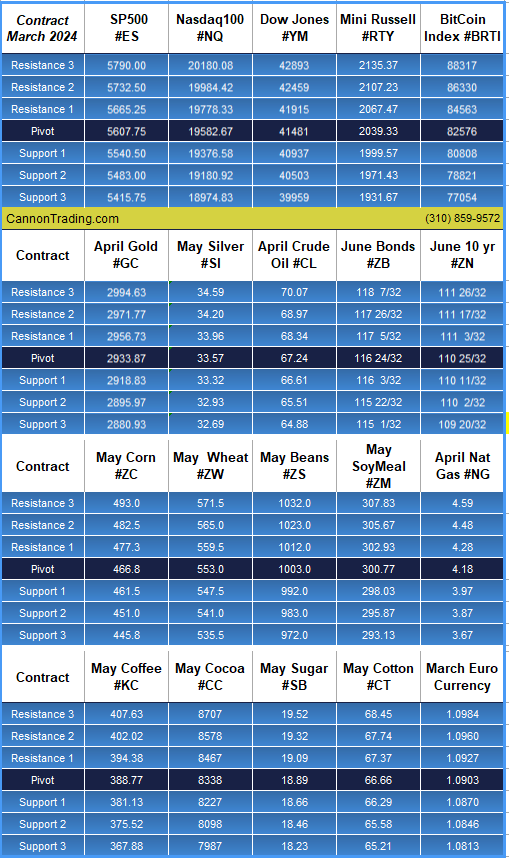

Daily Levels for March 13th, 2025

Want to feature our updated trading levels on your website? Simply paste a small code, and they’ll update automatically every day!

Click here for quick and easy instructions.

Economic Reports

provided by: ForexFactory.com

All times are Eastern Time (New York)

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|