|

Bulls are surviving…. for now.Earnings for Q4 to arrive mid-month.The January effect and more…By John Thorpe, Senior Broker |

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Bulls are surviving…. for now.Earnings for Q4 to arrive mid-month.The January effect and more…By John Thorpe, Senior Broker |

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

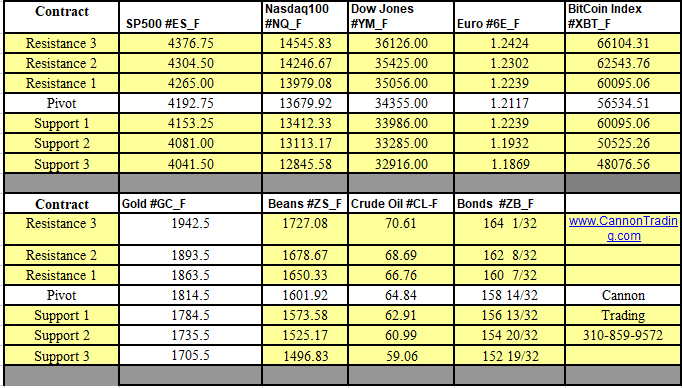

| Instrument | S2 | S1 | Pivot | R1 | R2 | ||

|---|---|---|---|---|---|---|---|

Gold (GC)— Dec (GCZ5) |

3912.00 | 3953.30 | 3977.00 | 4018.30 | 4042.00 | ||

Silver (SI)— Dec (SIZ5) |

45.94 | 46.95 | 47.53 | 48.54 | 49.13 | ||

Crude Oil (CL)— Dec (CLZ5) |

58.50 | 59.05 | 60.07 | 60.62 | 61.64 | ||

Dec. Bonds (ZB)— Dec (ZBZ5) |

115 11/32 | 115 27/32 | 116 28/32 | 117 12/32 | 118 13/32 |

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

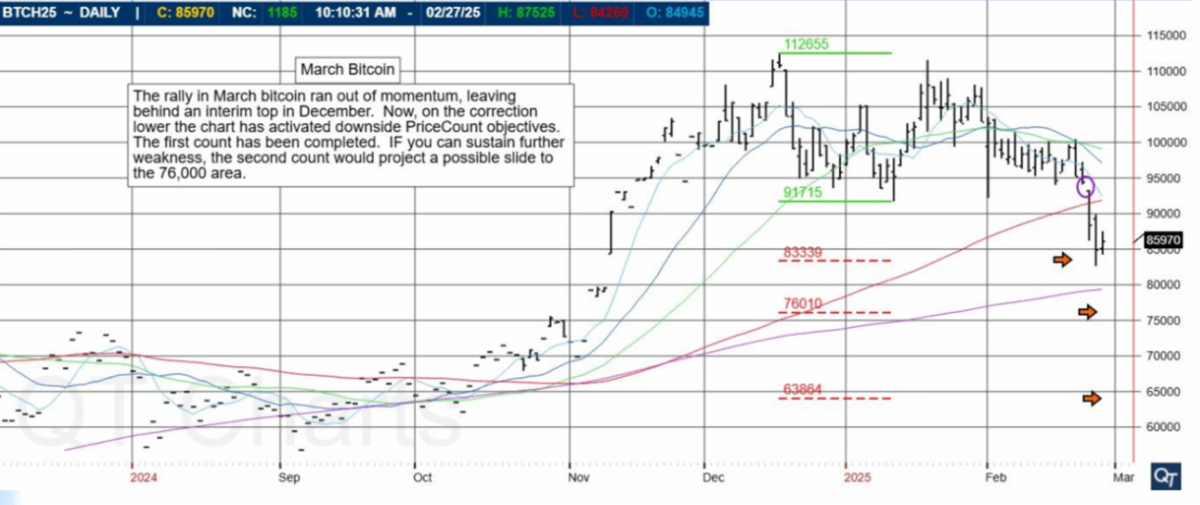

Hot market of the week is provided by QT Market Center, A Swiss army knife charting package that’s not just for Hedgers, Cooperatives and Farmers alike but also for Spread traders, Swing traders and shorter time frame application for intraday traders with a unique proprietary indicator that can be applied to your specific trading needs.

May cocoa completed its first downside PriceCount objective early this month and spent time trading sideways in a consolidation trade. Now, the chart is threatening to break down again where new sustained lows would project a possible slide to the second count in the 7130 area.

The PriceCount study is a tool that can help to project the distance of a move in price. The counts are not intended to be an ‘exact’ science but rather offer a target area for the four objectives which are based off the first leg of a move with each subsequent count having a smaller percentage of being achieved.

It is normal for the chart to react by correcting or consolidating at an objective and then either resuming its move or reversing trend. Best utilized in conjunction with other technical tools, PriceCounts offer one more way to analyze charts and help to manage your positions and risk. Learn more at www.qtchartoftheday.com

Trading in futures, options, securities, derivatives or OTC products entails significant risks which must be understood prior to trading and may not be appropriate for all investors. Past performance of actual trades or strategies is not necessarily indicative of future results.

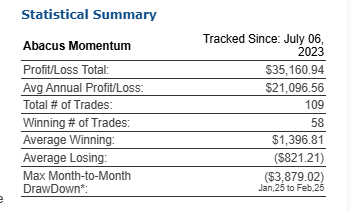

System Description

Market Sector: Stock Indexes

Markets Traded: ES ,

System Type: Day Trading

Risk per Trade: varies

Trading Rules: Not Disclosed

Suggested Capital: $19,500

System Description:

An ES day trading system currently traded by the developer who has 15+ years’ experience. The system seeks to catch significant intra-day moves (long or short) on days when market movement is expected to be above average.

Short positions trade one contract but long positions trade two contracts to reflect a lower risk/reward profile. Correlation to the S&P500 index is very low and the system is designed to perform in both bull and bear markets. The system is robust with simple logic and averages 5-6 trades a month without the risk of overnight positions.

Recommended Cannon Trading Starting Capital

$20,000

COST

Developer Fee per contract: $145.00 Monthly Subscription

Disclaimer The risk of trading can be substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance is not necessarily indicative of future results.

Futures Trading Disclaimer:

Transactions in securities futures, commodity and index futures and options on futures carry a high degree of risk. The amount of initial margin is small relative to the value of the futures contract, meaning that transactions are heavily “leveraged”. A relatively small market movement will have a proportionately larger impact on the funds you have deposited or will have to deposit: this may work against you as well as for you.

You may sustain a total loss of initial margin funds and any additional funds deposited with the clearing firm to maintain your position. If the market moves against your position or margin levels are increased, you may be called upon to pay substantial additional funds on short notice to maintain your position.

If you fail to comply with a request for additional funds within the time prescribed, your position may be liquidated at a loss and you will be liable for any resulting deficit.

Please read full disclaimer HERE.

|

|

|

|

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

|

|

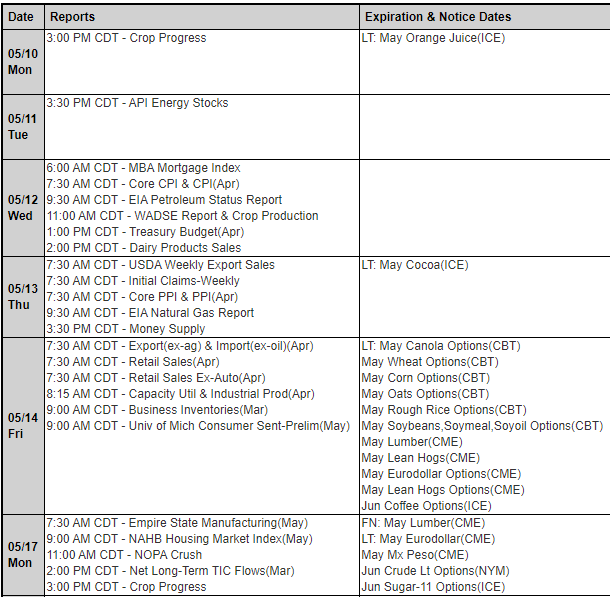

provided by: ForexFactory.com

All times are Eastern Time (New York)

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

Cryptocurrency has taken off as an encrypted alternative to real spending money, giving people more options for doing business. Bitcoin is one of the leading cryptocurrencies on the market, especially after it boomed in 2017. Nowadays, many websites accept Bitcoin payments, which has helped the cryptocurrency market grow significantly. Micro Bitcoin futures have also made a significant impact on the futures trading industry.

Now, many brokers offer futures for Bitcoin and other types of cryptocurrency. It is easier than ever to trade shares of these types of currency, and traders of all experience levels can trade practically anytime and anywhere.

One of the most convenient ways for traders to get the results from cryptocurrency is by trading micro futures. Recently, the CME Group announced new Micro Bitcoin futures, which have revolutionized futures trading. Now, for 1/10 the cost of the average Bitcoin share, a trader can purchase shares of this new type of future.

Cannon Trading has the tools traders need to begin trading cryptocurrency futures. We have various platforms that meet all needs, allowing traders to trade what they want when they want them.

Our experienced brokers are here to help traders of all levels through the process. We specialize in developing innovative platforms that help traders navigate the market.

Whether a trader is part of a professional trading organization or participating in day trading, our brokers can help. We work with clients from various backgrounds, providing everything from multilingual trading services to broker-assisted trading. If a trader is interested in our services, our customer support team of qualified brokers would be happy to help.

Micro Bitcoin Futures and Bitcoin Futures are both offered by CME to traders around the world. These contracts vary in size, depending on whether a client pursues a regular Bitcoin future or a Micro Bitcoin future.

Micro Bitcoin Futures allow traders to access Bitcoin Futures for a tenth of the cost of a regular Bitcoin future. Both types of contracts make it easy to get into the Bitcoin market, allowing clients to get the most out of their trading process.

The CME Group launched Micro Bitcoin Futures in May of 2021 and it has been a successful contract from the start. With Bitcoin rising in prominence worldwide, it is easy to see why this type of futures contract appears to be here to stay.

Bitcoin futures trading has been prominent since 2017 when the CME Group introduced it. Micro futures allow traders to speculate and hedge using 1/10th the size of a single coin of this iconic cryptocurrency. With Bitcoin still dominating the cryptocurrency industry, it is easy to see why many traders prefer the Micro futures over the traditional larger Bitcoin futures as the good faith deposit required is 1/10th of that of the standard Bitcoin contract.

While the new Micro Bitcoin Futures provide a value of 1/10 of a Bitcoin, these contracts are 1/50th the good faith deposit required of a traditional Bitcoin contract. This lower margin requirement allows traders to access more futures, giving them greater control of how much they can invest.

The versatility of the market, along with the lower capital involved, helps more traders access this type of future. It is for this reason that Micro Bitcoin Futures are popular with both active traders and cryptocurrency users.

There are many benefits involved in trading Micro Bitcoin Futures, which can help traders who have just started participating in the market.

Micro Bitcoin futures allow traders to take advantage of the many benefits of Bitcoin futures without investing as much. The CME Group saw the need for a minor Bitcoin futures contract, especially since the traditional contract was worth 5 Bitcoin.

More people could participate in cryptocurrency futures trading by creating this new, minor contract, which helped liquidity.

The institutional volume for Micro Bitcoin Futures has allowed the market to reach over a million contracts in just a short period. While this type of trading launched in the summer of 2021, it has become a popular choice, even seeming to outpace the traditional Bitcoin futures market.

The team here at Cannon Trading can help traders understand this type future, allowing them to get the most out of their opportunities. We understand that our traders have varying needs, which has led us to develop innovative solutions and platforms to achieve them.

Our team wants to help people get the most out of their Micro Bitcoin futures, which is why we have a dedicated group of brokers ready to assist our traders.

We also have platforms for various needs and trading opportunities, from mobile platforms to desktop applications. Our products were designed with traders in mind, giving people the functionality to access the market.

While Micro Bitcoin Futures are relatively new to the market, they have made a significant impact on trading as a whole. This type of contract allows traders to explore the cryptocurrency futures market without spending as much capital as a traditional contract would require or coin in the Cash marketplace..

We understand that new traders may have a lot of questions regarding this type of cryptocurrency futures trading venue. There are risks involved in trading futures and even greater risks when trading Bitcoin and MICRO bitcoin futures. Our team is here to help field any questions a person might have regarding the trading process as a whole. Cannon Trading makes it easy to navigate the market, as we provide cutting-edge platforms that simplify the trading process.

Our brokers have been assisting traders since 1988, which has allowed Cannon Trading to become a leading name in the futures trading business. We opened our online trading service in 1998, which allowed more traders than ever to participate in the market. Over 20 years later, traders have continually recognized us as one of the leading brokerage services.

At Cannon Trading, we have the tools traders need to make informed decisions before investing in the futures market.

We provide access to cutting-edge software and programs that put our traders at the forefront of the industry.

Cannon Trading’s experienced brokers can help clients learn more about oil futures, offering insight into the overall market, as well.

Whether you’re a beginning trader or an experienced one, our brokers can help you navigate the market. We have direct experience with the market so that we can help our clients best navigate the market.

We also provide them with the tools to make the most of markets and manage risk during volatile times.

Our professional commodities brokers will work with you to understand your specific trading style and requirements and provide you the essential advice and information you need to thrive in this highly lucrative market.

As an example, Cannon Trading’s Broker-assisted Trading solution provides traders new to the field with the essential advice and tools they need to accelerate their understanding of some of the mechanisms that affect prices in any futures contract market.

Contact us today to learn more about commodities trading and information on futures options and other listed commodity contracts.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve a substantial risk of loss and are not suitable for all investors.

Past performance is not indicative of future results. You should carefully consider whether trading is suitable for you regarding your circumstances, knowledge, and financial resources.

You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Dear Traders,

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

5-10-2021

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading

Dear Traders,

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

4-26-2021

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading