The Week Ahead:

By John Thorpe, Senior Broker

Which economic number(s) can direct the Equity markets this week?

The answer , in advance of the upcoming July 4th week, is probably very few.

Most of the reports releasing this week will probably not shed any new light on what is already known. so far, with the aid of a strong labor market, the US economy is sufficiently resilient to remain out of recession despite the aggressive series of rate hikes begun in March 2022 to fight inflation.

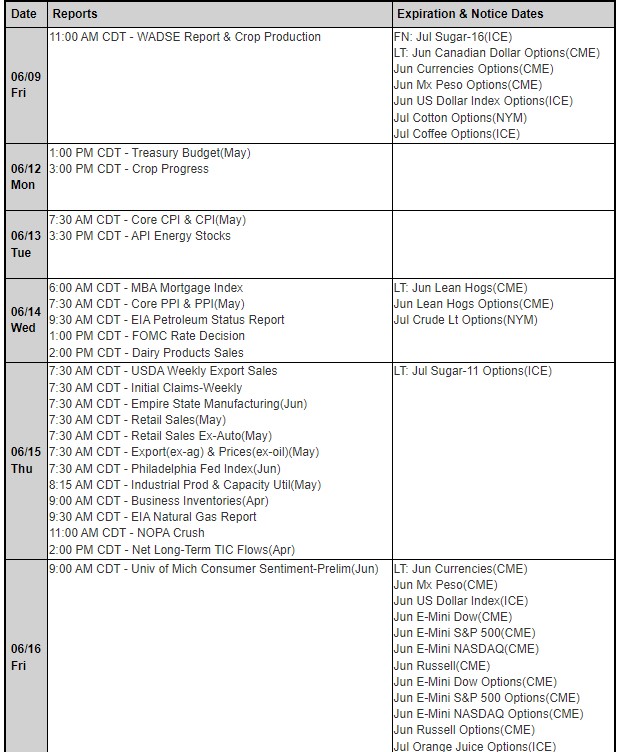

For us traders, it will always remain important to know the TIME these reports are going to be released so you can anticipate the market behaving differently up to, during and following these government report releases. whether they are considered barn burners or not.

With possible statistical chance for range bound and choppy trading, traders may want to look at trading intraday spreads or even swing trading spreads such as Russell versus ES.

All times CDT – Tuesday Durable Goods 7:30 am,

Consumer Confidence and new home sales at 9:00 am,

Wednesday Fed Chair Jerome Powell 8:30 am,

Thursday GDP 3rd look at 1st quarter and Jobless claims, both at 7:30 am.

Friday, personal income and outlays.

Plan your trade and trade your plan.

Day trading Margins?

Overnight Margins?

Initial? Maintenance?

Watch the video below for a brief explanation on all of the above!

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

Futures Trading Levels

for 06-27-2023

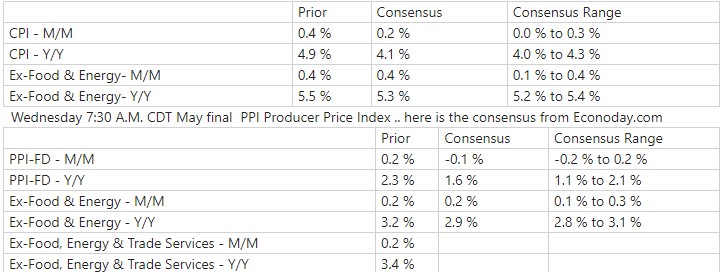

Economic Reports, Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.