Cannon Futures Weekly Letter

In Today’s Issue #1235

May Cocoa, Bitcoin Futures

- The Week Ahead – Inflation Data, Earnings & Housing

- Futures 102 – Intro to Bitcoin Futures

-

Hot Market of the Week – May Cocoa

- Broker’s Trading System of the Week – Mini SP500 intraday System

- Trading Levels for Next Week

- Trading Reports for Next Week

|

|

Important Notices: The Week Ahead

By John Thorpe, Senior Broker

Where will volatility come from next week?

Highlights next week will include more Housing data and plenty of “Soft Data” about consumer confidence and hard data about inflation. Earnings are in the bottom of the Ninth inning, I have included below the largest cap stocks reporting next week, you will agree: these should not have much of an impact on the price of any of the indices.

Finally, the FED Speakers are back! 9 separate speeches, the times are below.

Earnings Next Week:

- Mon. McCormick Spice co

- Tue. Gamestop

- Wed. Cintas, Paychex,inc, Dollartree

- Thu. Lululemon

- Fri. Quiet

FED SPEECHES:

- Mon. Bostic 12:45 CDT, Barr 2:10 CDT,

- Tues. Kugler 7:40 CDT, Williams 8:05 CDT ,

- Wed. Kashkari 9:00 CDT, Musalem 9:10 CDT

- Thu. Barkin 3:30 CDT

- Fri. Barr 11:15 CDT, Bostic 2:30 CDT

Economic Data week:

- Mon. Chicago Fed Nat’ l activity index, S&P Global composite PMI

- Tue. Redbook, Case Schiller Home Price index, Consumer confidence, New Home Sales, Richmond Fed Mfg. Index,

- Wed. Durable Goods, EIA Crude Stocks

- Thur. GDP Final (consensus 2.3 % ann growth rate) , Core PCE (consensus 2.7%) Initial Jobless Claims, Pending Home Sales, EIA Nat Gas.

- Fri. Core PCE M o M, Michigan Consumer Sentiment

|

|

Futures 102: Introduction to Cryptocurrency futures

Course overview

Cryptocurrency futures, available at CME Group, provide market participants with multiple products for cryptocurrency risk management or market expression. Expand your understanding of the cryptocurrency markets, products, and underlying reference rates. This course covers:

-

Bitcoin

- Ether

-

Micro Bitcoin

- Micro Ether

-

Options on Bitcoin futures

- BTIC on Cryptocurrency futures

|

|

Hot Market of the Week

Hot market of the week is provided by QT Market Center, A Swiss army knife charting package that’s not just for Hedgers, Cooperatives and Farmers alike but also for Spread traders, Swing traders and shorter time frame application for intraday traders with a unique proprietary indicator that can be applied to your specific trading needs.

May Cocoa

May cocoa completed its first downside PriceCount objective early this month and spent time trading sideways in a consolidation trade. Now, the chart is threatening to break down again where new sustained lows would project a possible slide to the second count in the 7130 area.

The PriceCount study is a tool that can help to project the distance of a move in price. The counts are not intended to be an ‘exact’ science but rather offer a target area for the four objectives which are based off the first leg of a move with each subsequent count having a smaller percentage of being achieved.

It is normal for the chart to react by correcting or consolidating at an objective and then either resuming its move or reversing trend. Best utilized in conjunction with other technical tools, PriceCounts offer one more way to analyze charts and help to manage your positions and risk. Learn more at www.qtchartoftheday.com

Trading in futures, options, securities, derivatives or OTC products entails significant risks which must be understood prior to trading and may not be appropriate for all investors. Past performance of actual trades or strategies is not necessarily indicative of future results.

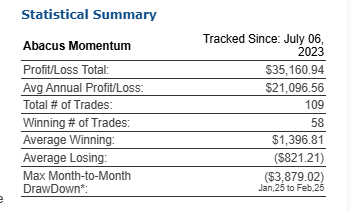

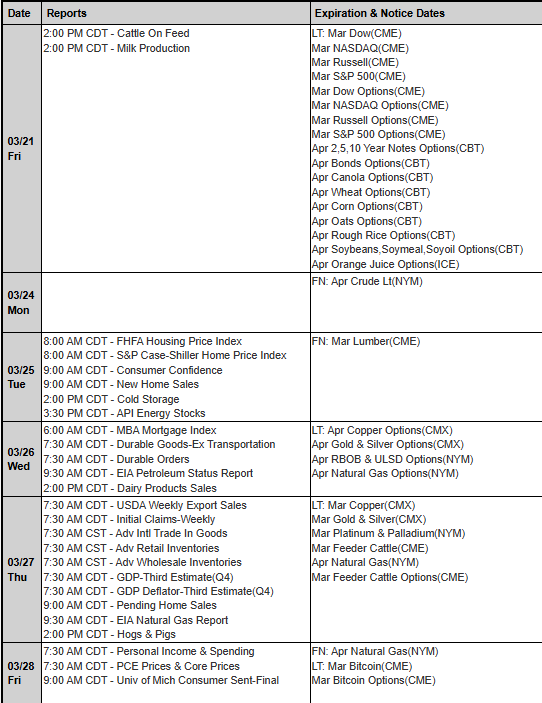

Brokers Trading System of the Week

Abacus Momentum Trading System

System Description

Market Sector: Stock Indexes

Markets Traded: ES ,

System Type: Day Trading

Risk per Trade: varies

Trading Rules: Not Disclosed

Suggested Capital: $19,500

System Description:

An ES day trading system currently traded by the developer who has 15+ years’ experience. The system seeks to catch significant intra-day moves (long or short) on days when market movement is expected to be above average.

Short positions trade one contract but long positions trade two contracts to reflect a lower risk/reward profile. Correlation to the S&P500 index is very low and the system is designed to perform in both bull and bear markets. The system is robust with simple logic and averages 5-6 trades a month without the risk of overnight positions.

Recommended Cannon Trading Starting Capital

$20,000

COST

Developer Fee per contract: $145.00 Monthly Subscription

Get Started

Learn More

Disclaimer The risk of trading can be substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance is not necessarily indicative of future results.

Futures Trading Disclaimer:

Transactions in securities futures, commodity and index futures and options on futures carry a high degree of risk. The amount of initial margin is small relative to the value of the futures contract, meaning that transactions are heavily “leveraged”. A relatively small market movement will have a proportionately larger impact on the funds you have deposited or will have to deposit: this may work against you as well as for you.

You may sustain a total loss of initial margin funds and any additional funds deposited with the clearing firm to maintain your position. If the market moves against your position or margin levels are increased, you may be called upon to pay substantial additional funds on short notice to maintain your position.

If you fail to comply with a request for additional funds within the time prescribed, your position may be liquidated at a loss and you will be liable for any resulting deficit.

Please read full disclaimer HERE.

| Would you like to get weekly updates on real-time, results of systems mentioned above? |

|

|

|

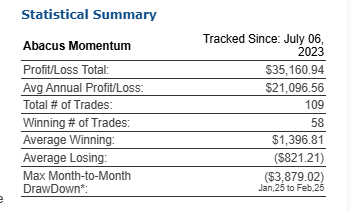

Trading Levels for Next Week

Daily Levels for March 24th, 2025

|

|

| Would you like to receive daily support & resistance levels? |

|

|

|

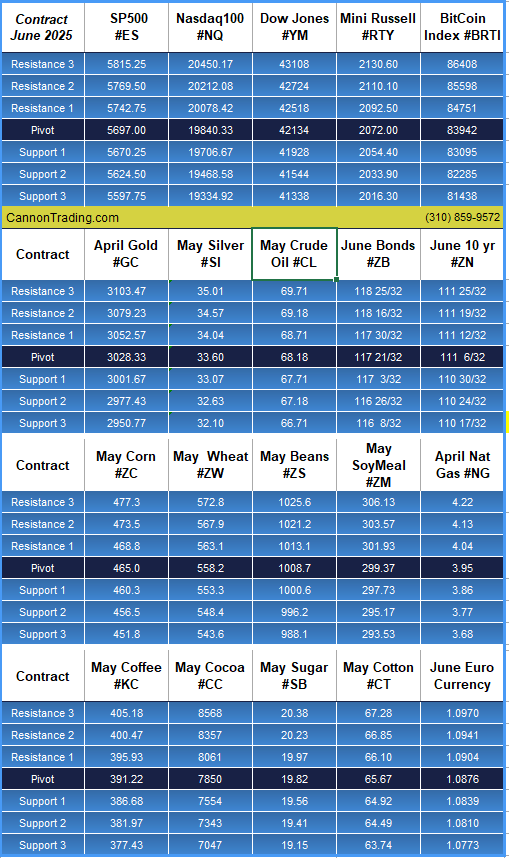

Trading Reports for Next Week

First Notice (FN), Last trading (LT) Days for the Week:

www.mrci.com

|

|

|

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

|

|

|

|

|

|

|