Have a great weekend!

GOOD TRADING!

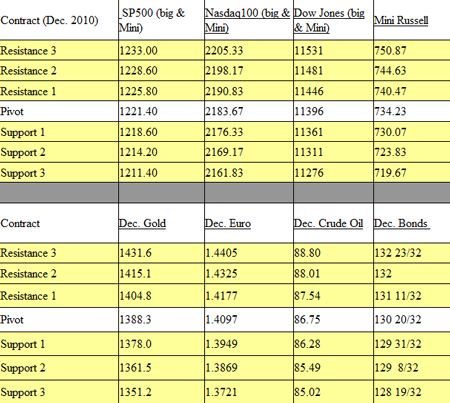

TRADING LEVELS

Continue reading “Futures Trading Levels for November 8th, 2010”

Continue reading “Futures Trading Levels for November 8th, 2010”

Have a great weekend!

GOOD TRADING!

TRADING LEVELS

Continue reading “Futures Trading Levels for November 8th, 2010”

Continue reading “Futures Trading Levels for November 8th, 2010”

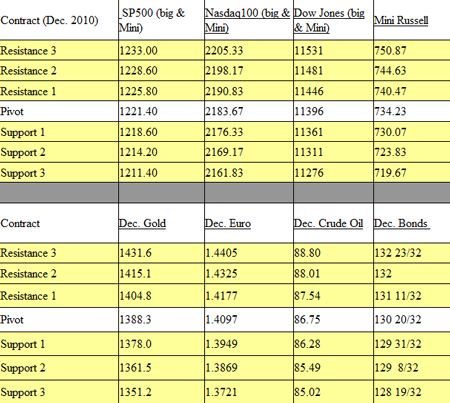

Some potential levels to watch on the way up and/or on pullbacks in the mini Russell WEEKLY chart below:

Continue reading “Futures Trading Levels and Economic Reports for November 5th 2010”

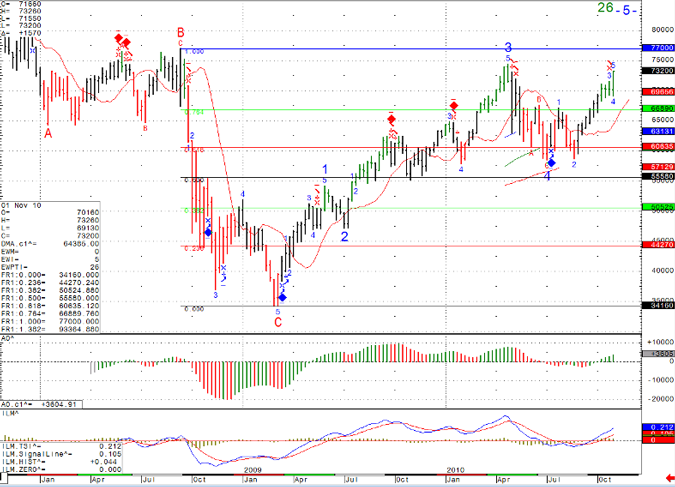

Screen shot from today’s session during our “live charts” service where one can see realtime trade set ups below.

For a free trial please visit:

https://www.cannontrading.com/tools/intraday-futures-trading-signals

Continue reading “Futures & Commodity Trading Levels and Charts for October 15th 2010”

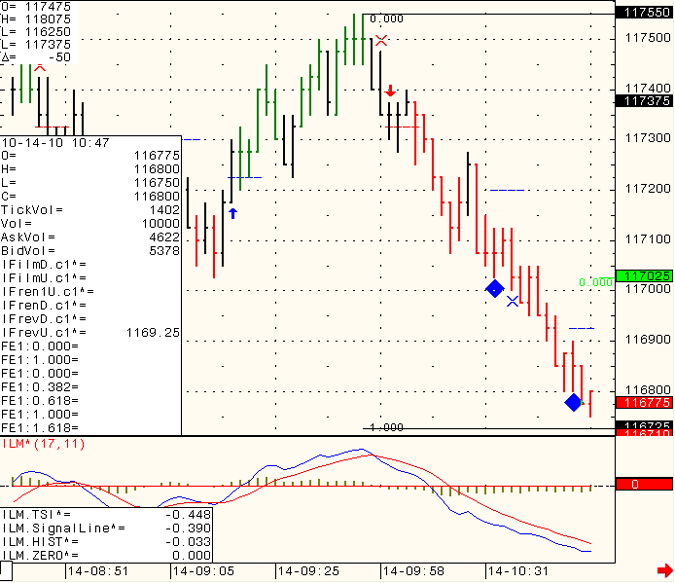

The FED keeps pumping money through its “Quantitative Easing” and the market continues to bounce higher.

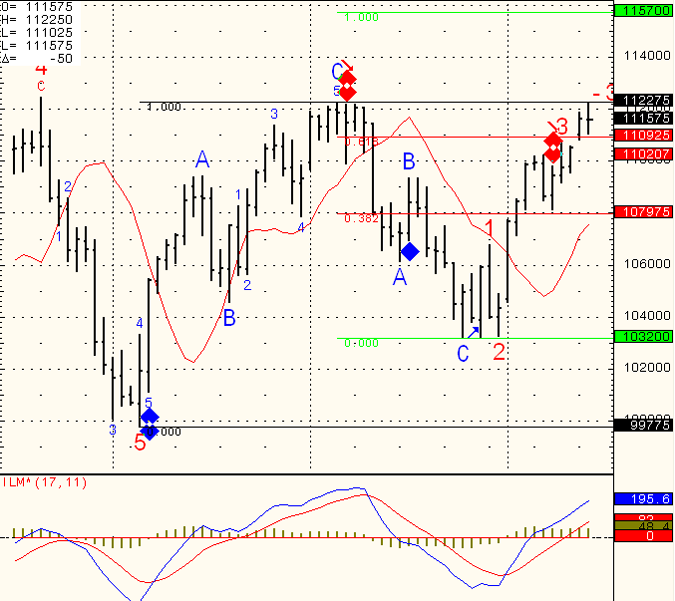

Not sure how long this “game” will continue but a technical overview of the mini Russell (which I feel is the leader amongst indicies) is below for your information.

Continue reading “Futures Trading Levels & Economic Reports for October 14th 2010”

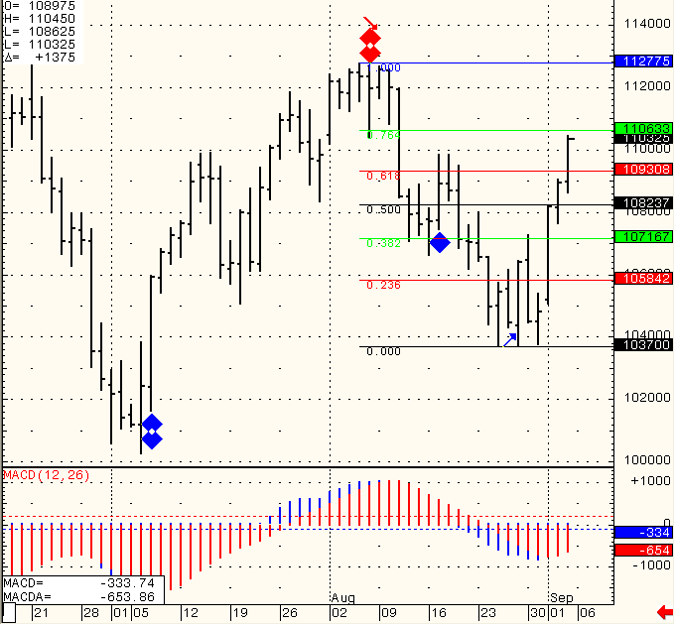

FOMC tomorrow around 2:15 Eastern time. Even before that we will start the day with some important housing numbers. FOMC days have different characteristics than other trading days. If you have traded for a while, check your trading notes from past FOMC days that may help you prepare for tomorrow. If you are a newcomer, take a more conservative approach and make sure you understand that the news can really move the market. My observations suggest choppy, low volume up until announcement, followed by some some sharp volatile moves right during and after the announcement. I am including 5 minutes chart from August 10th of this year, which was the last FOMC we had for your reference. Continue reading “FOMC to Provide Futures Trading Market with Direction, September 21st, 2010”

Well by now this is the 3rd or 4th time we are knocking on 1122.75…..that means one out of two (in my opinion): Tomorrow morning reports help this market break this level and start another leg up towards 1157.00

OR…..

Market fails one more time against this level, fills the gap below ( 1105.75) before giving us some additional clues.

I would love to have the “correct answer” to give you but only time and price action will tell….

Continue reading “Commodities and Futures Trading Levels, September 16th 2010”

Market had some what of an odd rhythm today after the long weekend. We saw big moves in both currencies and bonds. I think that we should see clearer picture tomorrow as more traders will be back after Labor day + we have a few economic reports while today we did not have any reports.

Some levels to watch for tomorrows action from the hourly chart below.

Continue reading “The Return of Traders Should Make for Better Market Rhythm, September 8th, 2010”

I mentioned a couple of days ago that this morning report will determine if we can reach the 1100’s on the SP. Well the answer turned out to be YES. As always in the futures business the current question of what’s next is more important than the previous one….

Well we are trading right against a major retracement level at 1106.50.

As long as pull backs do NOT break 1093, my bias is to the upside. Tuesday should be interesting as we should get an indication if the upside momentum has more legs or not.

Until then, enjoy the long weekend, recharge. Keep in mind the regular session is closed Monday but there is a night session Sunday night and Monday night. More info below.

Holiday schedule at:

*********************************************

https://www.cannontrading.com/community/newsletter/

*********************************************

Continue reading “Will Stock Index Futures Upside Momentum Continue?”

Unemployment numbers tomorrow will provide some action ahead of the long weekend.

Holiday schedule at:

************************************

https://www.cannontrading.com/community/newsletter/

************************************

Continue reading “Unemployment Numbers are The Deciding Factor for Futures Trading”

We have a full day of reports tomorrow, including FOMC MINUTES. that should be a recipe for a much different trading day than we had today.

I would categorize today’s session, as lower volume, lower volatility but yet wide enough ranges on the stock indices to produce different set ups to go with the reversal trend. If I had to guess for tomorrow session, I would guess higher volatility with swings in both direction. Knowing what type of trading day you are in early enough or the type of personality the market is having on any certain trading day is HUGE in my opinion as different types of trading days require different approaches/ methods and trading style.

Continue reading “The Time for Online Futures Trading is Now, August 31st 2010”