Commodities and Futures Trading Levels, September 16th 2010

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

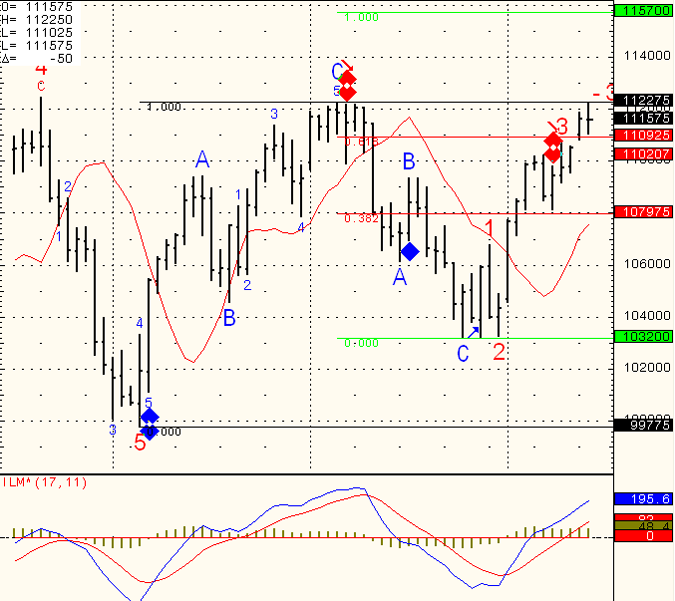

Well by now this is the 3rd or 4th time we are knocking on 1122.75…..that means one out of two (in my opinion): Tomorrow morning reports help this market break this level and start another leg up towards 1157.00

OR…..

Market fails one more time against this level, fills the gap below ( 1105.75) before giving us some additional clues.

I would love to have the “correct answer” to give you but only time and price action will tell….

SP 500 Day Trading

GOOD TRADING!

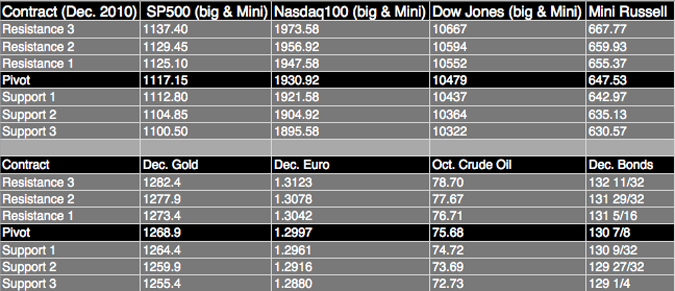

FUTURES TRADING LEVELS

Futures Trading Levels

This Week’s Calendar from Econoday.Com

All reports are EST time

Another great source for economic reports around the globe with “report importance indicator” at: http://www.forexfactory.com/calendar.php

Thursday, September 16th 2010 – http://mam.econoday.com/byweek.asp?cust=mam

Weekly Bill Settlement

Producer Price Index

8:30 AM ET

Jobless Claims

8:30 AM ET

Current Account

8:30 AM ET

Treasury International Capital

9:00 AM ET

Elizabeth Duke Speaks

9:30 AM ET

Tim Geithner Speaks

10:00 AM ET

Philadelphia Fed Survey

10:00 AM ET

EIA Natural Gas Report

10:30 AM ET

3-Month Bill Announcement

11:00 AM ET

6-Month Bill Announcement

11:00 AM ET

52-Week Bill Announcement

11:00 AM ET

Fed Balance Sheet

4:30 PM ET

Money Supply

4:30 PM ET

Disclaimer:

Trading commodity futures and options involves substantial risk of loss. The recommendations contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results. This is not a solicitation of any order to buy or sell, but a current futures market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!