The Time for Online Futures Trading is Now, August 31st 2010

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

“A Recipe for a much Different Trading Day”

We have a full day of reports tomorrow, including FOMC MINUTES. that should be a recipe for a much different trading day than we had today.

I would categorize today’s session, as lower volume, lower volatility but yet wide enough ranges on the stock indices to produce different set ups to go with the reversal trend. If I had to guess for tomorrow session, I would guess higher volatility with swings in both direction. Knowing what type of trading day you are in early enough or the type of personality the market is having on any certain trading day is HUGE in my opinion as different types of trading days require different approaches/ methods and trading style.

GOOD TRADING!

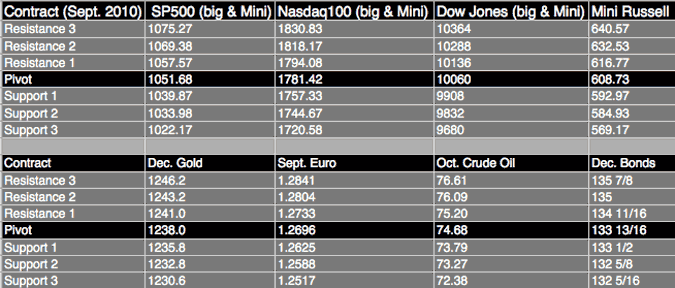

Futures Trading Levels

This Week’s Calendar from Econoday.Com

All reports are EST time

Another great source for economic reports around the globe with “report importance indicator” at: http://www.forexfactory.com/calendar.php

Tuesday, August 31st – http://mam.econoday.com/byweek.asp?cust=mam

- ICSC-Goldman Store Sales

7:45 AM ET - Redbook

8:55 AM ET - S&P Case-Shiller HPI

9:00 AM ET - Chicago PMI

9:45 AM ET - Consumer Confidence

10:00 AM ET - State Street Investor Confidence Index

10:00 AM ET - 4-Week Bill Auction

11:30 AM ET - FOMC Minutes

2:00 PM ET - Farm Prices

3:00 PM ET

Disclaimer:

Trading commodity futures and options involves substantial risk of loss. The recommendations contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results. This is not a solicitation of any order to buy or sell, but a current futures market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!