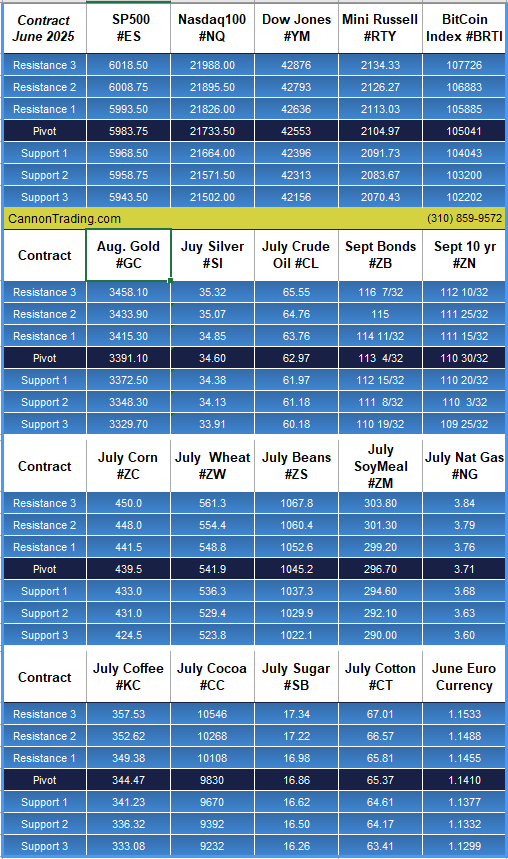

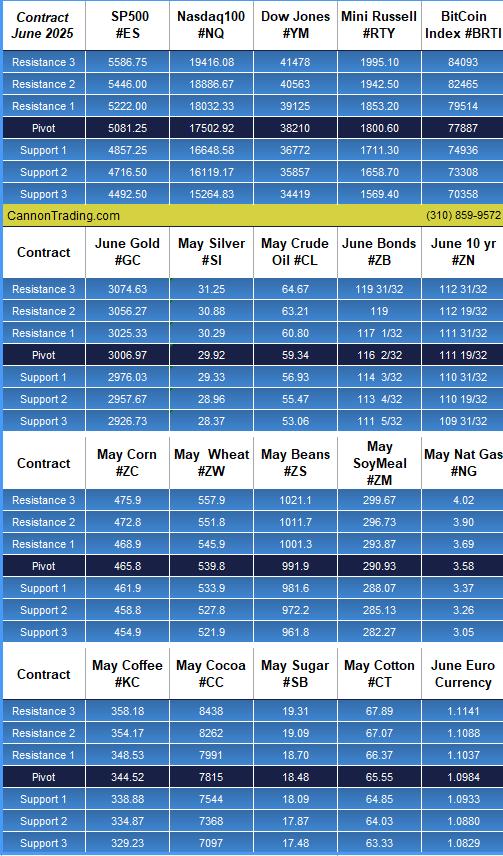

Standard and Poor 500 Futures

Index futures are the workhorses of professional risk management and active speculation. They let traders express a view on the broad market in a capital-efficient way, hedge portfolios quickly, and trade nearly 24 hours a day. Among them, standard and poor 500 futures are the flagship product for U.S. equity exposure, while the smaller e-mini and Micro E-mini contracts have helped a new generation of traders access the same market with less capital.

This guide explains how standard and poor 500 futures, e-mini contracts, and Micro E-minis work, then compares emini futures trading to full-size “traditional” futures on the S&P 500 and Nasdaq. We’ll cover contract specs, mechanics, margin, liquidity, volatility, trading hours, and real-world use cases. Then we’ll lay out the pros and cons of each contract type, plus a practical FAQ.

What Are Standard and Poor 500 Futures?

Standard and poor 500 futures are derivatives based on the S&P 500 Index, a basket of 500 large-cap U.S. companies. These futures trade on CME (Chicago Mercantile Exchange) and are cash-settled, meaning no one delivers shares of all 500 stocks at expiration. Instead, profits and losses settle in cash based on the index’s final value.

How the contract tracks the index

The futures price reflects:

- The spot index level

- Expected dividends from index constituents

- Financing costs (interest rates)

- Supply/demand and risk sentiment

In normal conditions, futures trade near “fair value,” which is spot plus net carry (interest minus dividends). When volatility spikes, the futures can trade at a notable discount or premium, but arbitrage and hedging usually pull prices back toward fair value.

The traditional full-size S&P 500 futures

Before the e-mini era, traders used the full-size S&P 500 futures contract. Today the full-size contract still exists (symbol SP), though most volume migrated to the E-mini line.

Key idea: full-size S&P futures provide the same exposure as E-mini, but with a bigger multiplier and larger tick value.

The Rise of the E-mini and Micro E-mini

What is the e-mini?

The e-mini is simply a smaller version of a traditional futures contract. For the S&P 500, the E-mini (symbol ES) launched in 1997 to give traders the same index exposure with lower margin requirements and smaller position sizes.

- If the S&P 500 is at 5,000:

- Full-size S&P futures exposure is much larger.

- E-mini exposure is about one-fifth of the full-size.

The smaller size made intraday and swing trading more accessible. It also boosted liquidity because many more participants could trade it.

What is the Micro E-mini?

Micro E-minis (symbol MES for S&P 500) launched in 2019 as another step down in size. Each Micro E-mini is one-tenth of an E-mini. This lets traders fine-tune risk, scale in/out more precisely, and participate with even smaller accounts.

Why this matters for emini futures trading

Emini futures trading grew into the dominant way to trade U.S. equity index futures. ES volume often exceeds several million contracts per day, and MES provides a lower-capital on-ramp to the same market.

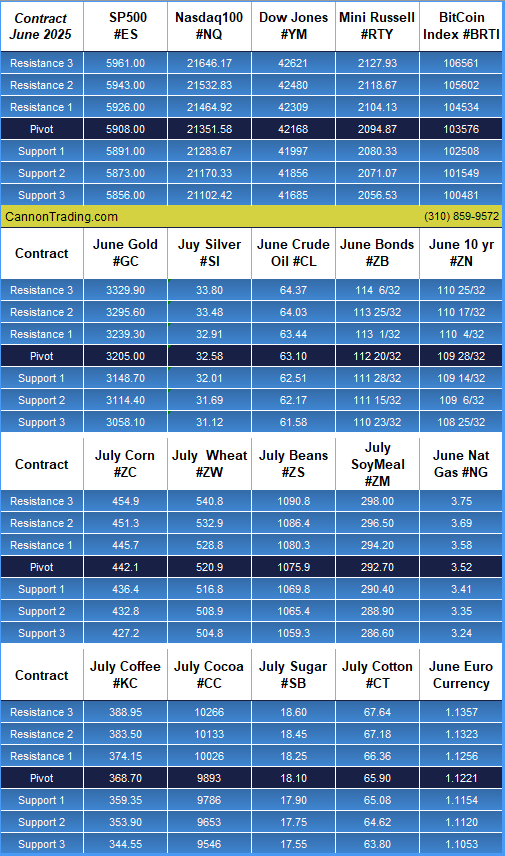

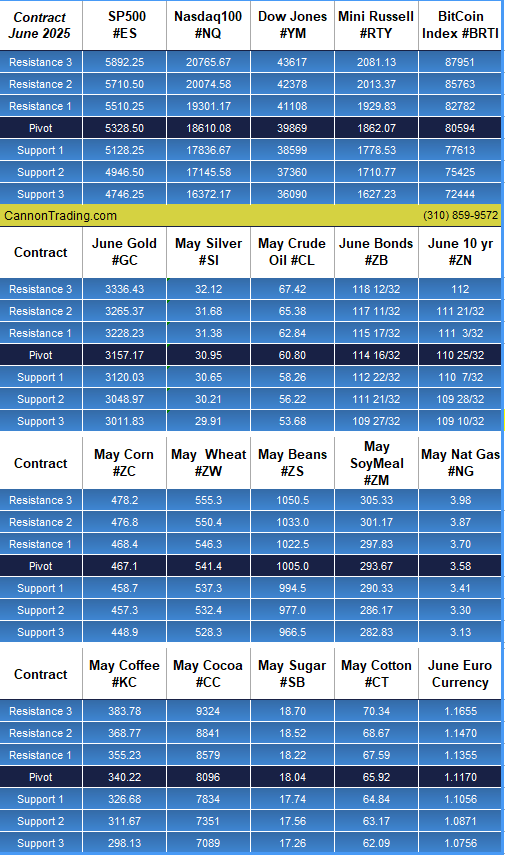

Contract Specs: Full-Size vs E-mini vs Micro E-mini

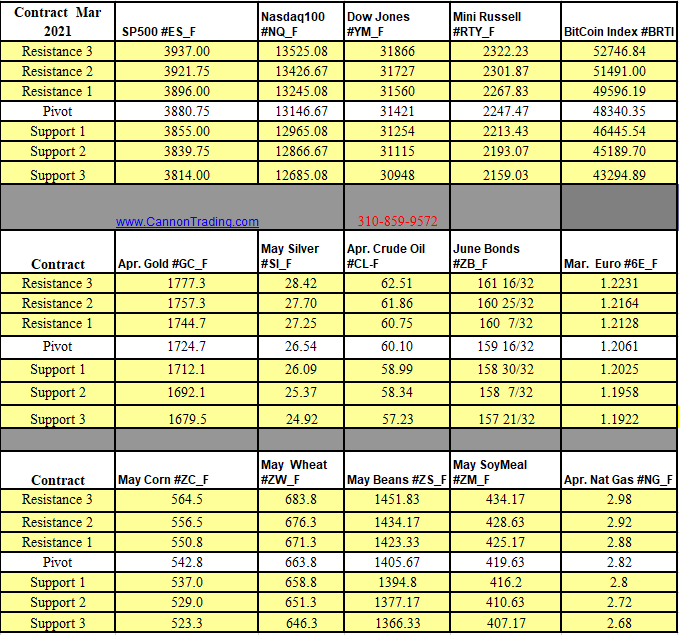

Let’s compare the S&P 500 family. Values change with index level; these are structural differences:

Full-size S&P 500 futures (SP)

- Multiplier: larger than E-mini (historically $250 × index)

- Tick size: 0.10 index point

- Tick value: larger (more dollars per tick)

- Typical users: institutions, big hedges, some large speculators

- Liquidity: good but much smaller than ES

E-mini S&P 500 futures (ES)

- Multiplier: $50 × index

- Tick size: 0.25 index point

- Tick value: $12.50 per tick

- Typical users: institutions and active retail traders

- Liquidity: extremely high

Micro E-mini S&P 500 futures (MES)

- Multiplier: $5 × index

- Tick size: 0.25 index point

- Tick value: $1.25 per tick

- Typical users: newer retail traders, precise risk managers

- Liquidity: strong and growing, though below ES

Even if you don’t memorize every number, the hierarchy is what counts:

full-size > E-mini > Micro E-mini in exposure per contract.

This same scaling applies to other indices like Nasdaq 100 (NQ and MNQ), Dow (YM and MYM), and Russell 2000 (RTY and M2K).

Nasdaq Futures and How They Compare

When traders say “traditional futures contracts such as the S&P 500 and Nasdaq,” they’re usually referring to full-size and E-mini versions of both indices.

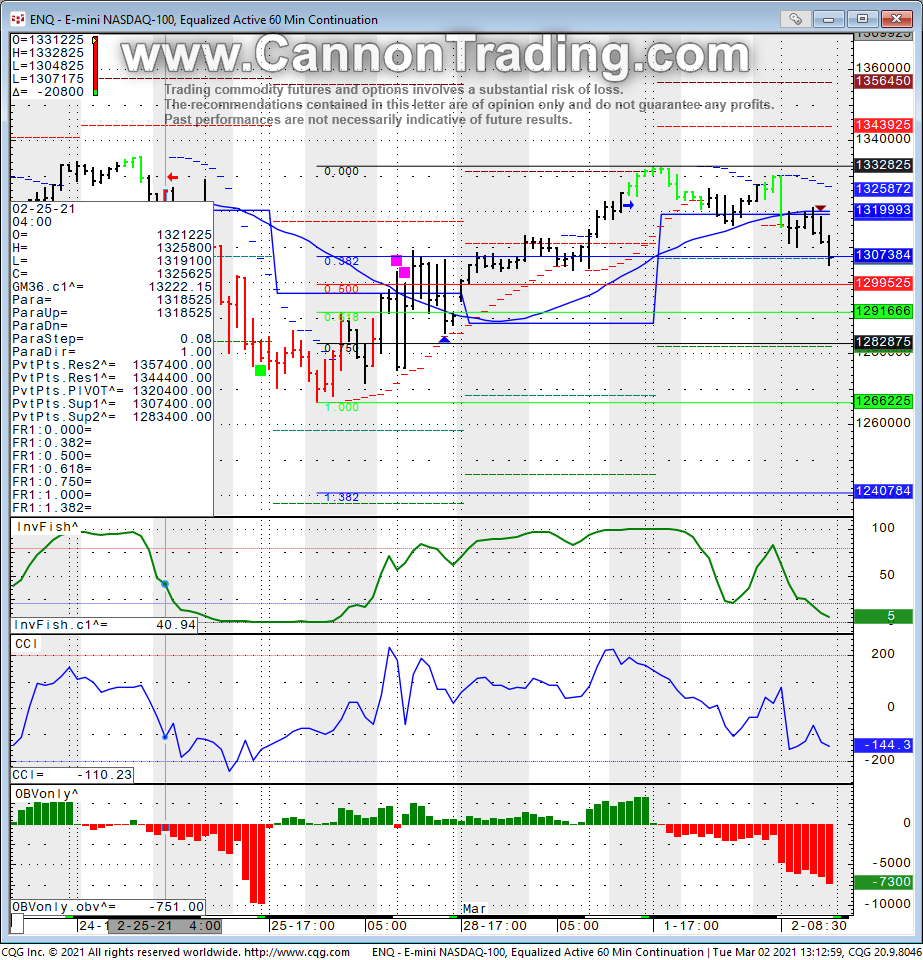

Traditional Nasdaq 100 futures vs E-mini Nasdaq

- Full-size Nasdaq 100 futures (symbol ND) are larger and far less liquid.

- The E-mini Nasdaq 100 (symbol NQ) is the market standard, just like ES is for S&P exposure.

- Micro E-mini Nasdaq (MNQ) is one-tenth NQ.

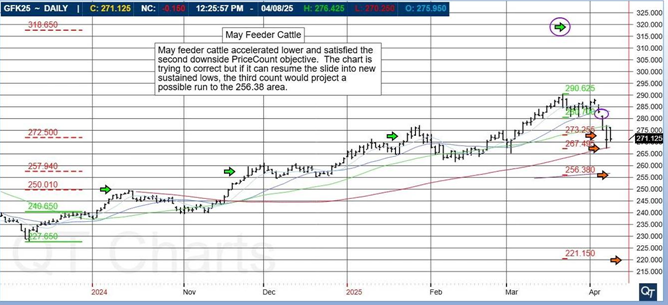

Nasdaq futures tend to be more volatile than standard and poor 500 futures, because the Nasdaq 100 is more concentrated in tech and growth stocks. That means bigger moves, bigger opportunities, and bigger risk per point.

Where DJIA Index Futures Fit In

DJIA index futures track the Dow Jones Industrial Average—30 blue-chip U.S. companies. On CME, the E-mini Dow (YM) and Micro E-mini Dow (MYM) are most traded, while full-size DJIA futures are rarely used by retail traders.

Why trade Dow exposure?

- The Dow is price-weighted, so high-priced stocks like UnitedHealth or Goldman Sachs can move the index more than lower-priced names.

- The Dow can behave a bit differently from the S&P 500 in certain rotations, especially when industrials or financials lead.

Still, for broad market hedging and “benchmark” trading, standard and poor 500 futures dominate.

Mechanics of Futures Trading: The Stuff You Must Know

Margin and leverage

Futures use performance bond (margin), not a down payment on the full notional. Exchanges set initial and maintenance margin. Brokers may require more.

Example conceptually:

- ES might require a few thousand dollars in day margin.

- MES might require a few hundred.

Same market, different access point.

Leverage cuts both ways. A 1% S&P move can be large relative to margin, which is why risk controls matter so much in emini futures trading.

Mark-to-market and daily settlement

Gains and losses are realized every day. If you’re long and the market rises, cash is credited to your account; if it falls, cash is debited. That’s why traders can’t ignore losses in futures the way some people do with long-term stock holdings.

Trading hours and liquidity cycles

Index futures trade nearly 24/5. Liquidity is highest:

- During U.S. equity hours (9:30 a.m.–4:00 p.m. ET)

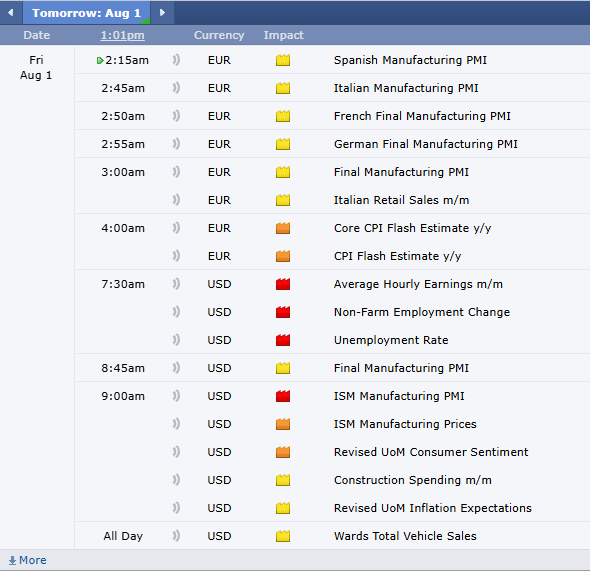

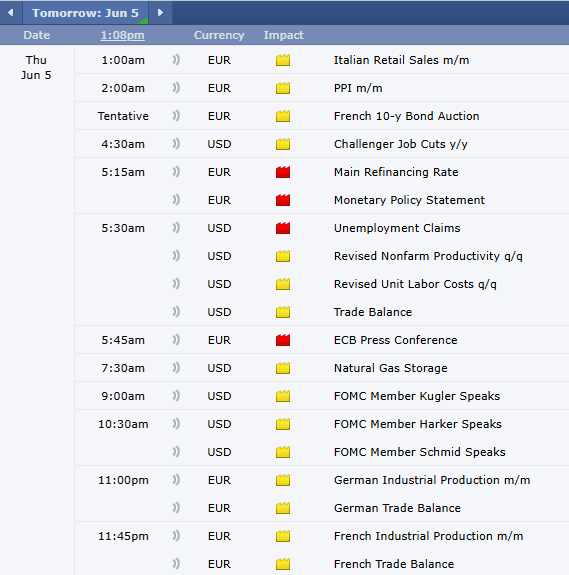

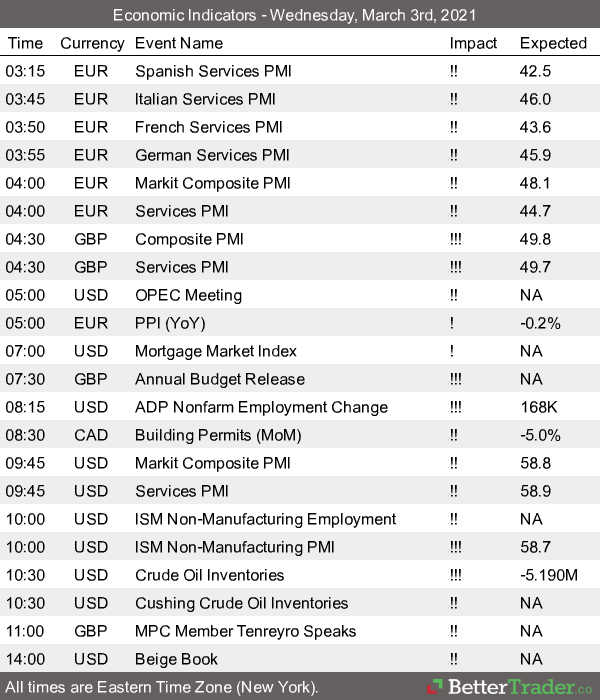

- Around major economic reports

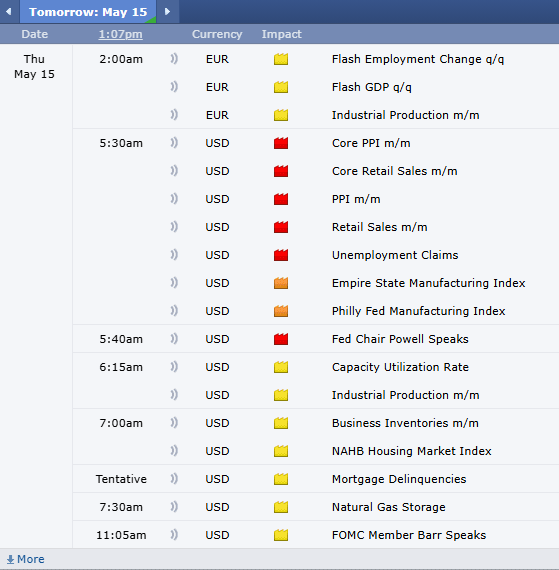

- In the “cash open” and “cash close” windows

ES is the deepest book. MES is active too, but bid/ask spreads widen more during thin hours.

Expiration and roll

Most traders roll positions to the next quarterly contract before expiration. Volume shifts from the front month to the next month during “roll week.”

E-mini and Micro E-mini Trading Styles

Because ES and MES are so liquid, many strategies evolved around them:

- Day trading: scalping and momentum trades around intraday levels.

- Swing trading: holding for days to weeks based on trend or macro themes.

- Hedging: protecting a stock portfolio or ETF exposure.

- Spread trading: trading ES vs NQ, or ES vs RTY.

- Event trading: aligning with CPI, Fed meetings, earnings seasons.

Micro E-minis made these styles more precise. You can trade 3 MES instead of 1 ES to size between risk levels.

Emini Futures Trading vs Traditional Full-Size Index Futures

Let’s get direct about the comparison traders care about.

Access and capital efficiency

- Traditional full-size contracts require higher margin and larger risk per tick. Great for big hedges, but hard for smaller traders.

- E-mini contracts lowered the barrier.

- Micro E-mini lowered it again.

So the main advantage of emini futures trading is that it democratizes the same market exposure.

Liquidity and execution

- ES/NQ/YM are insanely liquid. Slippage is small even on market orders in normal hours.

- Full-size contracts usually have wider spreads and thinner depth.

- MES/MNQ are liquid enough for most retail traders, but very large orders still prefer ES/NQ.

Risk control and scaling

- Full-size contracts jump too much for many accounts. One downtick can feel like a gut punch.

- E-mini contracts allow scaling in 1-contract increments for medium accounts.

- Micro E-mini contracts allow “risk granularity,” like adjusting by small steps.

Market impact

Retail traders essentially never move ES. But if you trade full-size, your order is larger relative to liquidity, so you can create more market impact and pay more in spreads.

Cost per exposure

Per contract commissions are often similar, which means:

- ES offers more notional per commission dollar.

- MES offers less exposure per commission dollar but lets you trade smaller.

So the most cost-efficient for active traders is usually ES, while MES is a training and precision tool.

Pros and Cons by Contract Type

Standard and Poor 500 Futures (full-size) — Pros

- High notional exposure per contract. Efficient for large hedges.

- Lower total commissions for big positions (fewer contracts needed).

- Institutional alignment: some large funds still prefer full-size for hedging mandates.

Full-size standard and poor 500 futures — Cons

- High margin requirement: not accessible to many retail traders.

- Bigger tick value: harder to manage drawdowns.

- Lower liquidity than ES: wider spreads, more slippage.

- Less flexible scaling: you can’t easily size between whole contracts.

E-mini S&P 500 (ES) — Pros

- Top-tier liquidity. Tight spreads and deep order book.

- Accessible leverage for active traders without being tiny.

- Best cost per exposure for most traders.

- Massive ecosystem: data, indicators, and strategies built around ES.

- Ideal for hedging mid-size portfolios quickly.

ES — Cons

- Still leveraged: losses can mount fast without discipline.

- Psychological pressure: tick value is meaningful; overtrading is common.

- Gap risk overnight: global events can move the market while you sleep.

Micro E-mini S&P 500 (MES) — Pros

- Lowest barrier to entry for futures on the S&P 500.

- Perfect for learning without a single tick ruining your day.

- Fine-tuned position sizing: scale in/out in small steps.

- Great for smaller hedges or partial hedges.

MES — Cons

- Higher relative commissions per unit of exposure.

- Slightly thinner liquidity than ES, especially off-hours.

- Temptation to over-size: “cheap” contracts can lead traders to grab too many.

E-mini Nasdaq 100 (NQ) — Pros

- Higher volatility = higher opportunity for trend/momentum traders.

- Strong liquidity during U.S. hours.

- Good hedge for tech-heavy portfolios.

NQ — Cons

- Bigger swings mean bigger risk. Stops need more room.

- More whipsaws in choppy regimes.

- Correlation shifts can hurt spreads vs ES.

Micro E-mini Nasdaq (MNQ) — Pros

- Same benefits as MES applied to Nasdaq exposure.

- Great for traders who want Nasdaq volatility with manageable dollars.

MNQ — Cons

- Costs per exposure similar to MES.

- Liquidity thinner than NQ during nights.

DJIA Index Futures (YM/MYM) — Pros

- Different index behavior can offer diversification.

- Cleaner trend days sometimes occur due to fewer constituents.

- Useful for portfolio hedges tied to Dow benchmarks.

DJIA index futures — Cons

- Price-weighted index can be less intuitive.

- Lower liquidity than ES and NQ.

- Heavily influenced by a few high-priced names.

Choosing Between S&P, Nasdaq, and Dow Futures

If your goal is broad U.S. market exposure, standard and poor 500 futures are the default. If your strategy needs more volatility, Nasdaq contracts are a natural fit. For a different lens on blue-chip industrials and financials, djia index futures can make sense.

A simple rule:

- Benchmark trading and hedging: ES or MES.

- High-beta tactical trading: NQ or MNQ.

- Blue-chip rotation views: YM or MYM.

Also consider time horizon:

- Day traders usually prefer ES/NQ for liquidity.

- Swing traders may choose based on thesis (macro vs tech vs value tilt).

- Hedgers choose the contract that best matches their portfolio beta.

For global (GEO) context: because ES, NQ, and YM trade nearly around the clock, international macro events—Asia open, Europe close, or overnight central-bank surprises—often show up in futures first, before the U.S. cash session even begins. Traders worldwide use these contracts as the “first read” on risk sentiment.

Practical Risk Management for E-mini and Micro E-mini Traders

In emini futures trading, staying in the game beats any single win.

- Define risk per trade (dollars, not points).

- Size by volatility: wider stop = fewer contracts.

- Respect the session: volatility differs between Asia, Europe, and U.S. cash hours.

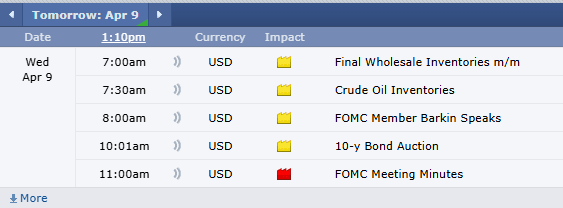

- Plan for news: CPI, NFP, FOMC days can turn ES into a rocket.

- Use bracket orders: entry, stop, and target set together.

- Avoid emotional averaging down in a trending market.

Micros are especially good for this because you can test a strategy with low risk, then scale up to ES once performance is consistent.

Why Cannon Trading is a Great Choice to Trade Futures With

Standard and poor 500 futures remain the core index futures tool for U.S. equity exposure. The full-size contracts serve institutions, but most trading now happens in the e-mini and Micro E-mini ecosystem. E-mini contracts deliver the best liquidity and cost efficiency for most active traders, while Micro E-minis provide an accessible, fine-grained way to learn and size risk.

Comparing emini futures trading to traditional full-size futures comes down to four things: capital requirement, liquidity, risk control, and cost per exposure. For many traders, ES is the “sweet spot,” with MES as a stepping stone or precision hedge. Add Nasdaq and djia index futures to your toolkit when your strategy or portfolio calls for different volatility or factor exposure.

FAQ: Standard and Poor 500 Futures, E-mini, and Micro E-mini

Are standard and poor 500 futures the same as the S&P 500 index?

They track the same underlying index, but futures are leveraged contracts with margin, daily settlement, and expiration. The cash index is not leveraged and doesn’t expire.

Why is emini futures trading more popular than full-size futures?

Because E-minis require less margin, are more flexible for position sizing, and have far higher liquidity and tighter spreads.

What is the best contract for beginners: e-mini or Micro E-mini?

Most beginners start with Micro E-mini because the tick value and margin are smaller, allowing learning with lower financial stress.

How do Nasdaq futures differ from standard and poor 500 futures?

Nasdaq futures track the tech-heavy Nasdaq 100 and usually move more per day. That’s good for opportunity but increases risk.

What are djia index futures used for today?

They’re used for Dow-based hedging or for traders who want exposure to a blue-chip, price-weighted index with slightly different behavior than the S&P.

Do E-mini contracts trade overnight?

Yes. ES, NQ, and YM trade almost 24 hours a day, five days a week, with brief maintenance breaks.

What happens at expiration?

Index futures are cash-settled. If you hold through expiration, your position settles based on the final index value. Most traders roll earlier.

Is the Micro E-mini less liquid than the e-mini?

Yes, but MES liquidity is still strong during U.S. hours. For very fast scalping, ES remains better.

Can I hedge an ETF portfolio with Micro E-minis?

Yes. Many traders hedge partial exposure with MES because sizing is precise.

Are commissions higher on Micro E-minis?

The commission per contract is similar, so per dollar of exposure Micro E-minis cost more. The tradeoff is better risk control and lower capital requirements.

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading