Cannon Futures Weekly Newsletter Issue # 1131

Join our private Facebook group for additional insight into trading and the futures markets!

In this issue:

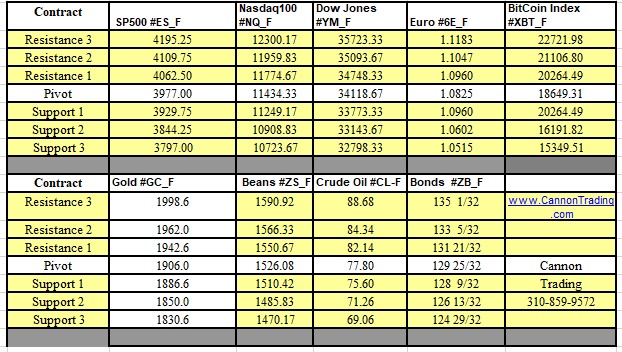

- Important Notices – CME Fees Increase

- Trading Resource of the Week – Options 101/102 FREE COURSE

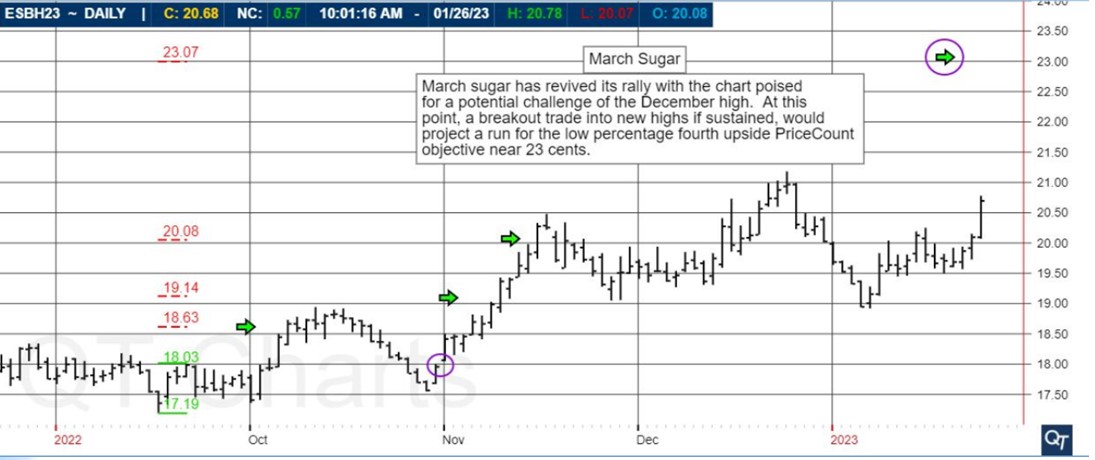

- Hot Market of the Week – March Sugar

- Trading Levels for Next Week

- Trading Reports for Next Week

-

-

-

Important Notices – CME to raise fees on certain markets. Both MICROS and emini stock indices are being increased by 5 cents per side.

-

-

- Options on Futures 101 – Guide to different Future & Commodity options strategies. Options on futures can be an exciting as well as confusing trading world. From simple calls and puts to advanced options strategies.

- Understanding Options Contract Details

- Explaining Call Options (Short and Long)

- The mathematical expectation model and how it can decrease your losses

- Understanding the Difference: European vs. American Style Options

- Calculating Options Moneyness & Intrinsic Value

- Introduction to Options Theoretical Pricing

- Options on Futures vs. ETFs

-

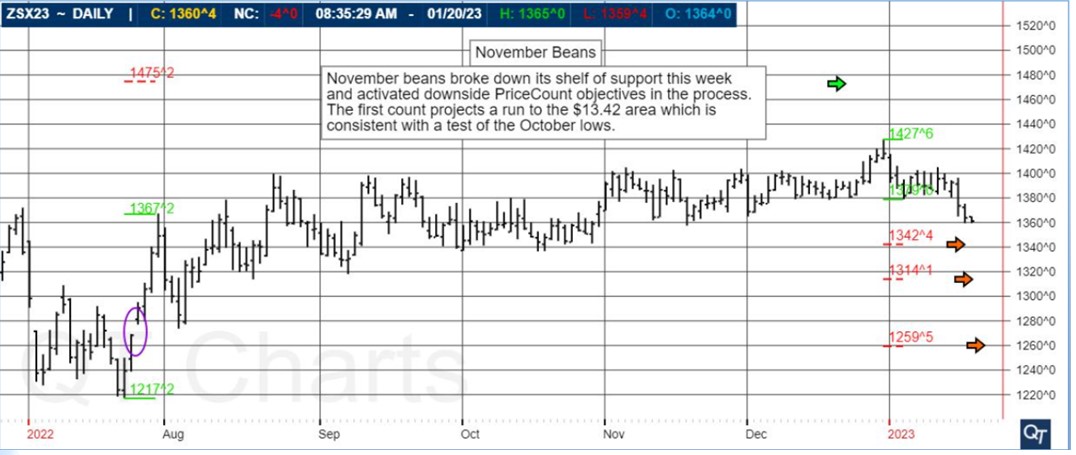

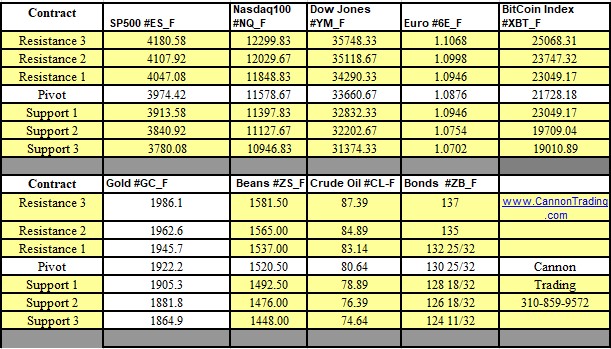

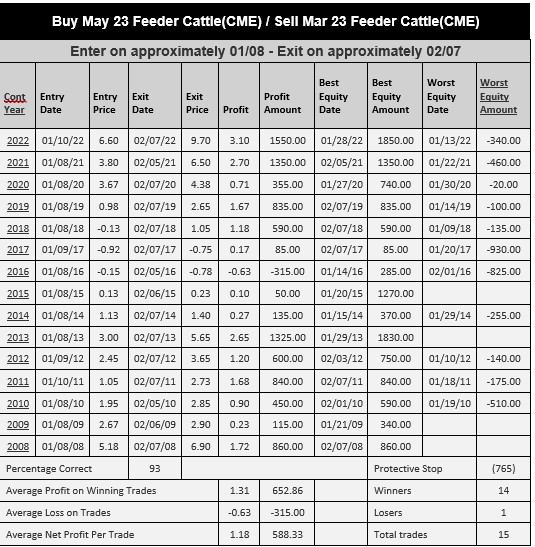

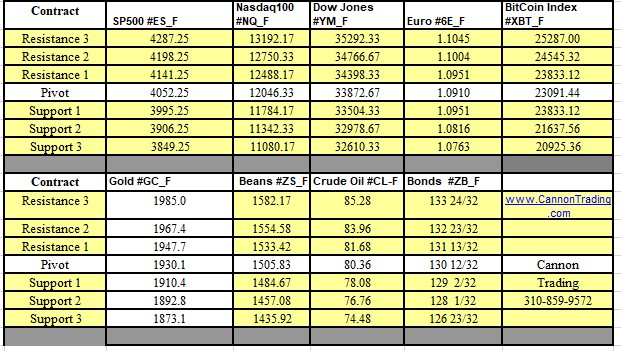

Trading Levels for Next Week

Weekly Levels

-

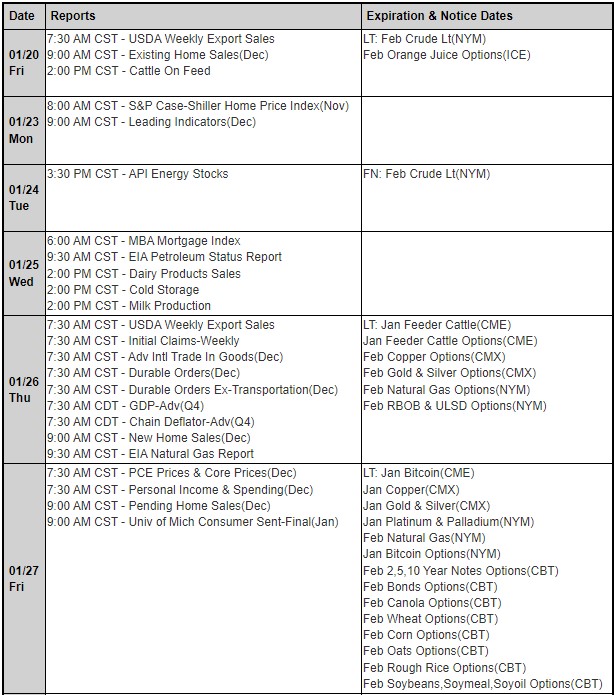

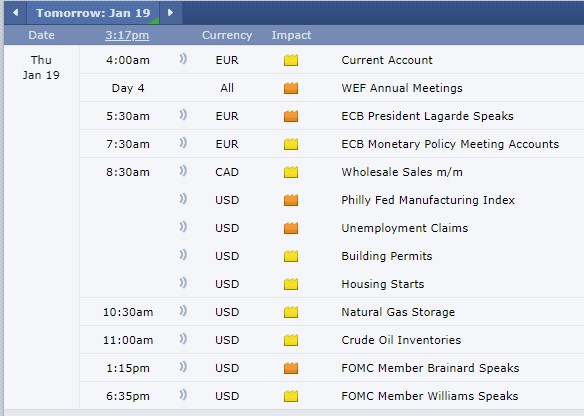

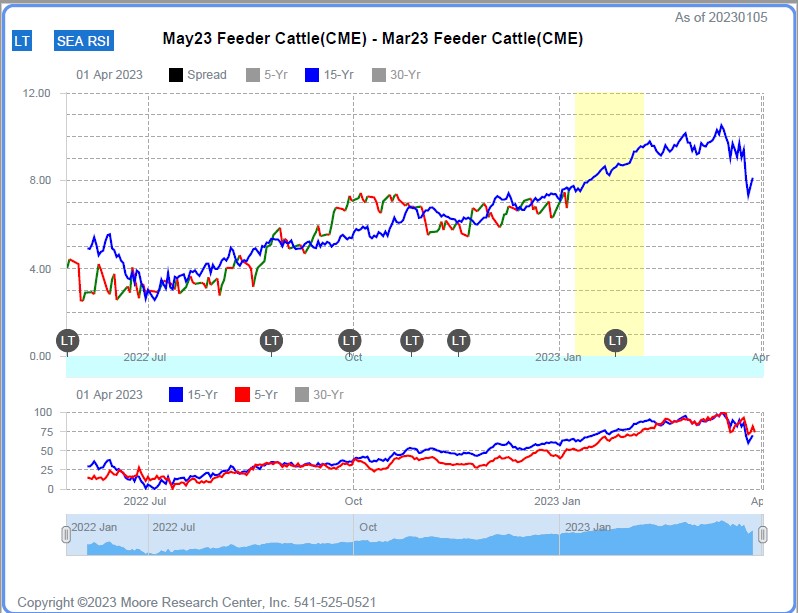

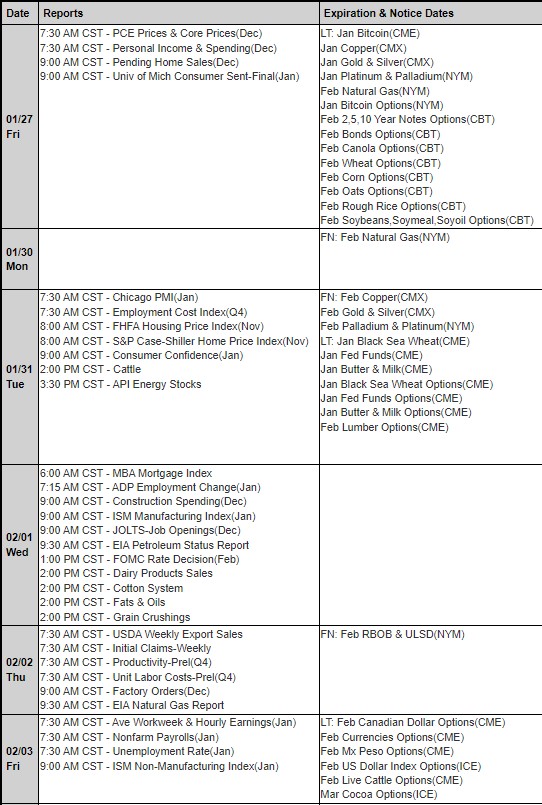

Trading Reports for Next Week

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading