General:

The big one! It’s that time of the month again: we’re a couple of days from when the Labor Dept. releases its monthly Non-farm payrolls report. It’s widely considered to be one of the most important and influential measures of the U.S. economy and the report is released at 7:30 A.M., Central Time on the first Friday of the month.

Ahead of that, today the ADP National Employment Report showed payrolls increased by 77,000 jobs in February, the smallest gain since July 2024, after rising 186,000 in January. Economists had forecast private employment advancing 140,000.

The ADP report, jointly developed with the Stanford Digital Economy Lab, likely exaggerates the labor market slowdown and has no correlation with the government’s employment report.

Softs:

Arabica coffee futures rose sharply today with the market heading back up towards recent record highs. May ICE coffee rose almost 5% to $4.1855 per lb. intraday. Traders indicated the market showing signs of resuming its upward trend after suffering a sharp setback which took prices from a record high of $4.2995 on Feb. 11 to a low of $3.6630 a week ago – a ±$23,900 per contract correction! The market was keeping a close watch on the weather in top grower Brazil with hot, dry conditions raising some concerns about the upcoming crop.

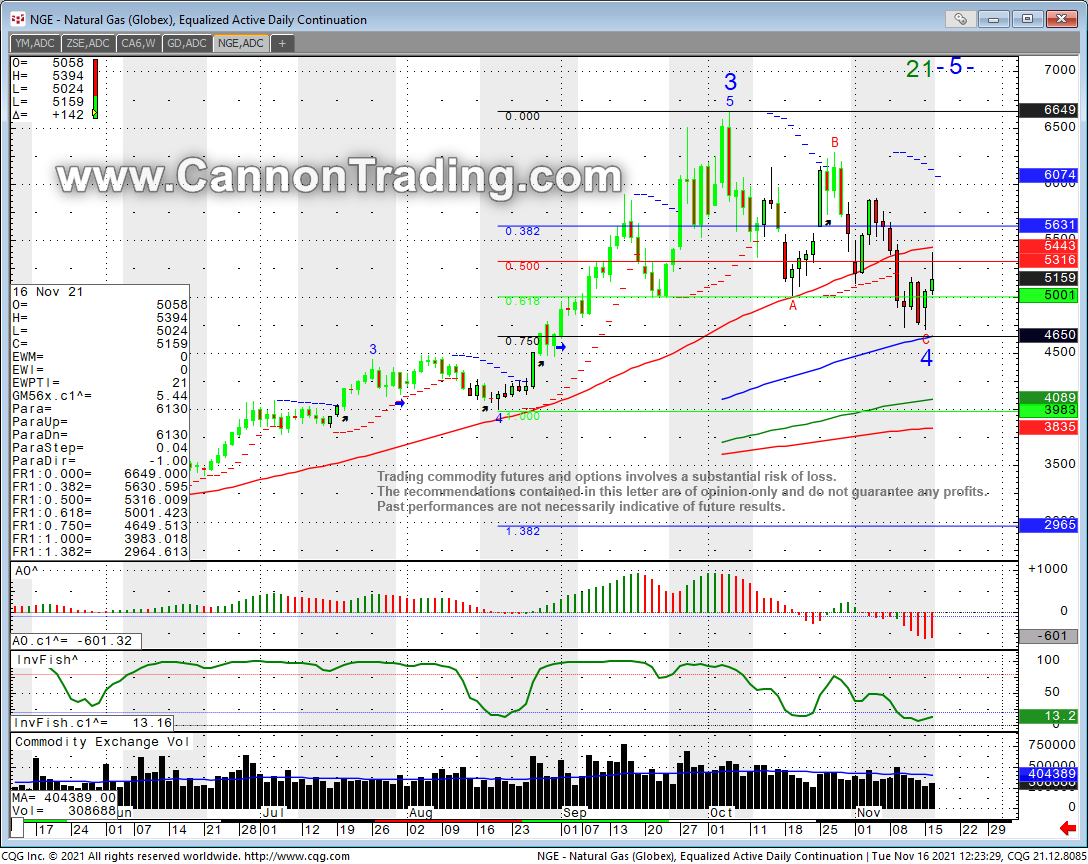

Energy:

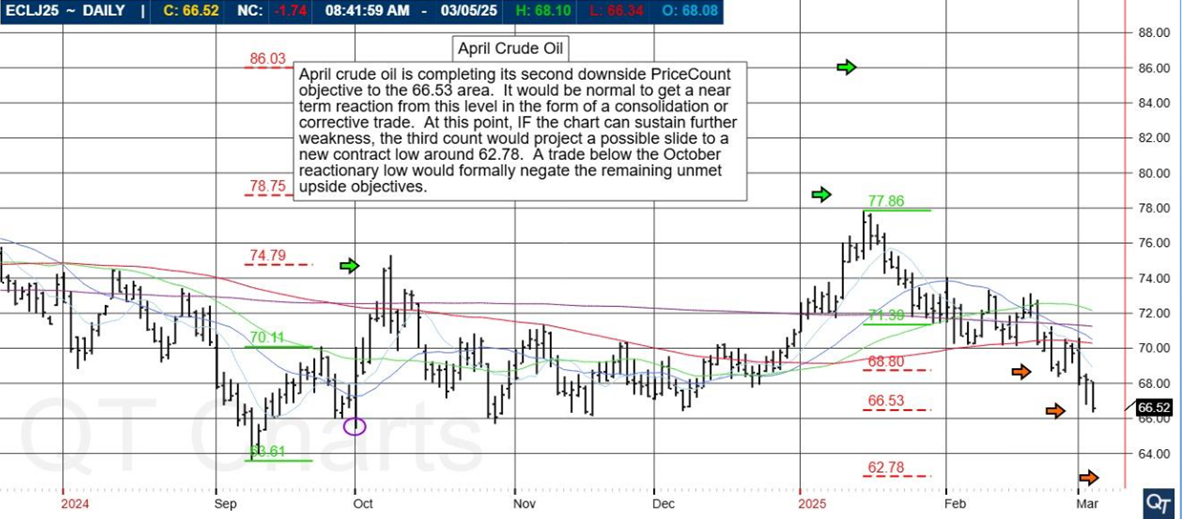

Crude oil futures settled down for the fourth consecutive session today after U.S. crude oil stockpiles posted a larger-than-expected build, adding a further headwind as investors worried about OPEC+ plans to increase output in April and U.S. tariffs on Canada, China and Mexico. April West Texas Intermediate crude (WTI) settled down $1.95, or 2.86%, to $66.31 a barrel, its lowest since November ’24. OPEC+, the Organization of the Petroleum Exporting Countries and allies including Russia, decided on Monday to proceed with a planned April oil output increase of 138,000 barrels per day, its first since 2022.

Metals:

Copper

CME/COMEX copper futures soared today following President Donald Trump’s announced 25% tariffs on copper imports during his Tuesday night speech to Congress. May copper rose ±26 cents/lb. (±5.7% as of this blog post – a $6,500 per contract move – to a $4.825/lb. intraday high. |