Options

Amid geopolitical and macroeconomic movements, Weekly options offer hedging opportunities

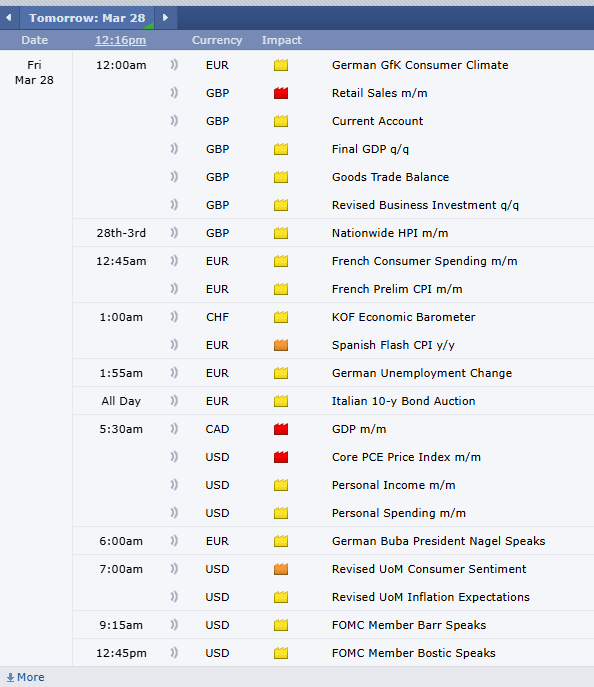

Since his inauguration on January 20, President Donald Trump has regularly made headlines for his international trade policy moves. These fluctuating tariff policies have added volatility to commodity markets, as traders strategize how to navigate uncertainty.

On Monday, March 10, Beijing implemented tariffs on multiple farm products from the U.S. Facing a 15% tariff includes chicken, wheat and corn, while soybeans, pork, beef and fruit face a 10% tariff. China is the largest overseas market for American agricultural products. As policy continues to develop, or stays the same, traders can use Ag Weekly options to insulate their portfolios from uncertainty, now available every day of the trading week. Ag Weekly options hit a record in early March, with 3,730 contracts trading on March 5.

Canada planned to retaliate against President Trump’s 25% tariff on Canadian exports in early March. Ontario was looking to impose a 25% surcharge on energy exports to Michigan, Minnesota and New York. President Trump then moved to increase Canada’s initial metals tariff to 50%, but both countries revoked these additional tariffs. To navigate world events, such as tariffs, traders continue to look to Weekly Energy options. WTI Weekly Energy options ADV in March is up 17.8% compared to February 2025, with an average of 24,222 contracts traded in March to February’s 20,562 contracts.

The Trump administration also placed a 25% tariff on all steel and aluminum imports to the U.S. in early March, which also applies to certain products such as nails, wires and car body and bumper stampings. The steel and aluminum tariffs of President Trump’s first term were subject to a product exclusion application process; this exemption process does not exist for the updated steel and aluminum tariffs. Metals traders can turn to Metals Weekly options to hedge risk that may come with volatility in the markets.

GET DAILY MARKET UPDATES VIA VIDEO – FREE

|