Choosing a Futures Broker can be somewhat of a daunting task. Most popular factors I see considered: cost, customer service, experience and knowledge. Going through the process of one’s own due diligence of researching your broker’s firm, trying a futures platform and comparing costs is a process one must take to find a broker that fits him or her.

Being a broker myself, I hear many concerns about cost before I even here about the type of future trading platform one would like to be set up with that fit his or her trading style. Please note cost should not be all when choosing a futures broker. Most reasonable and competitive commission quotes, for example the mini S&P cost less than half a tick. Unless you are trading high volume, less than half a tick should not hurt your account balance per round turn. When you look for “deep discount” commodity brokers, these brokers may provide you with an appealing commission cost but they may lack quality service and or even knowledge of the futures/commodities markets. This happens countless times in the industry; where clients will sacrifice service and knowledge of a broker for fifty cents less in commission because a lower commission cost seems to be more important for a client. Please be aware commission costs are only one ingredient of choosing a broker when trading futures.

If you like this Article, Please share!

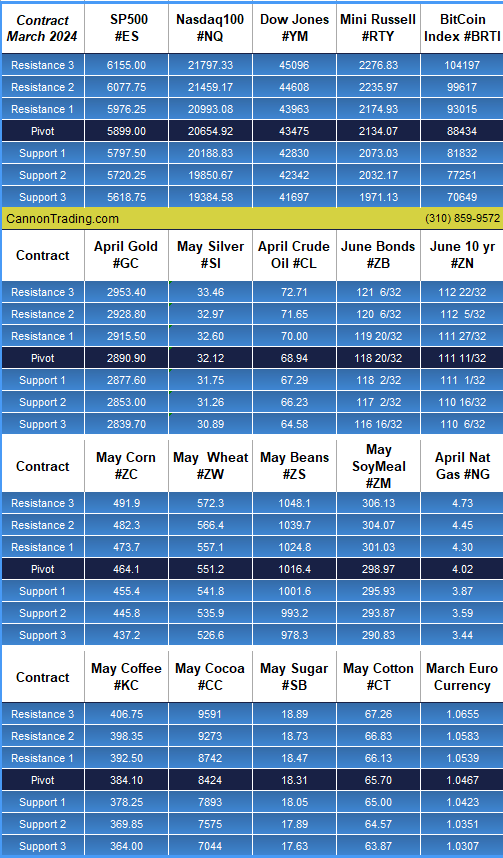

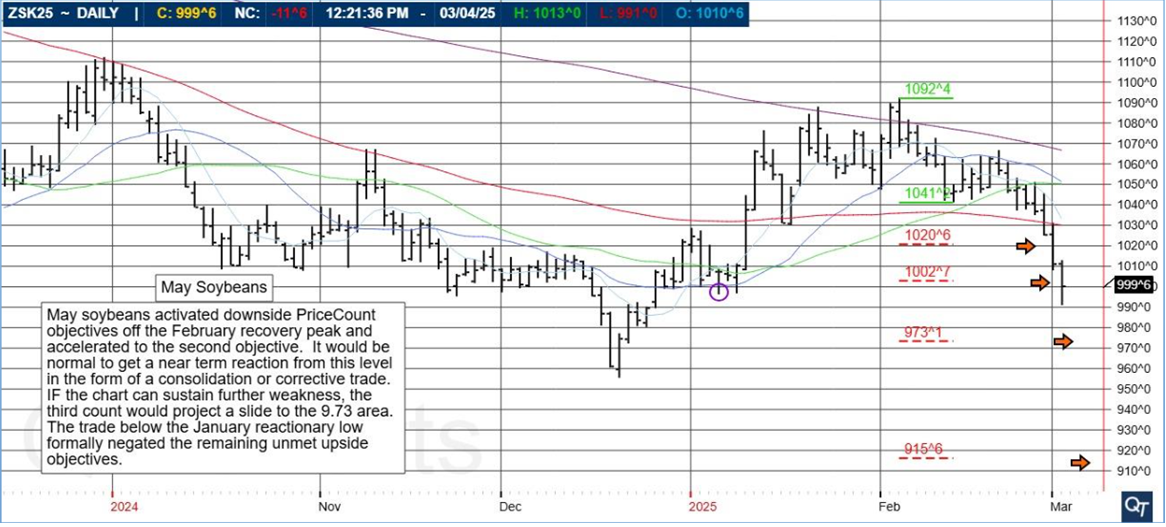

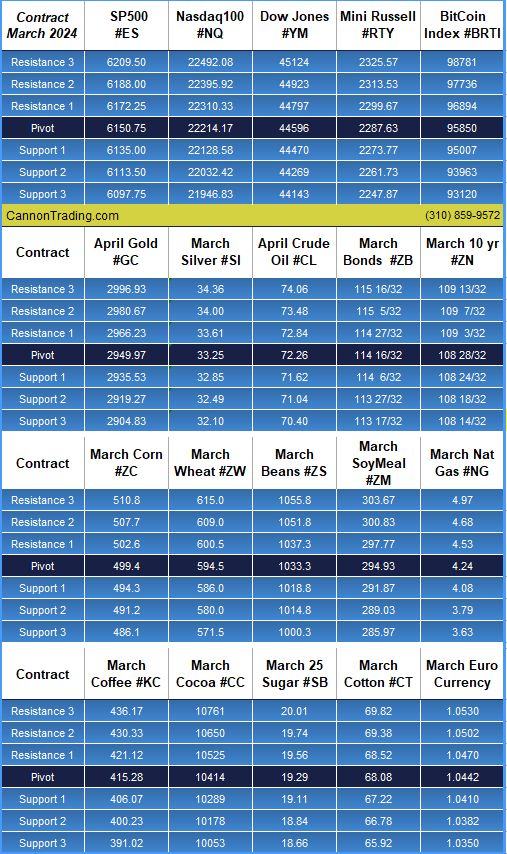

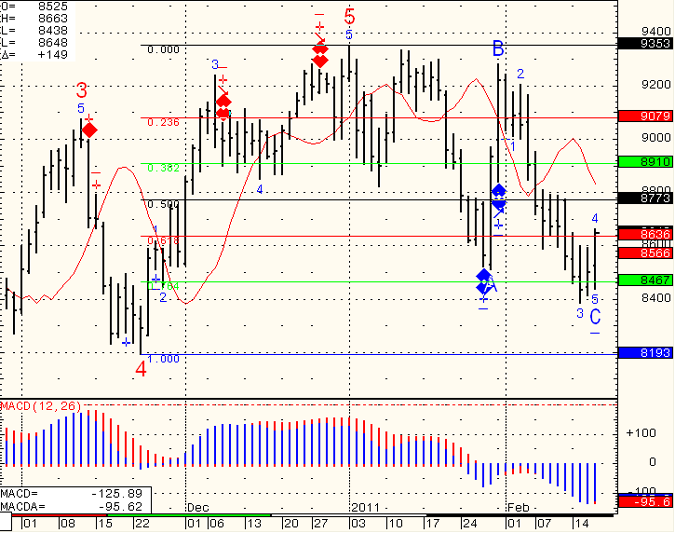

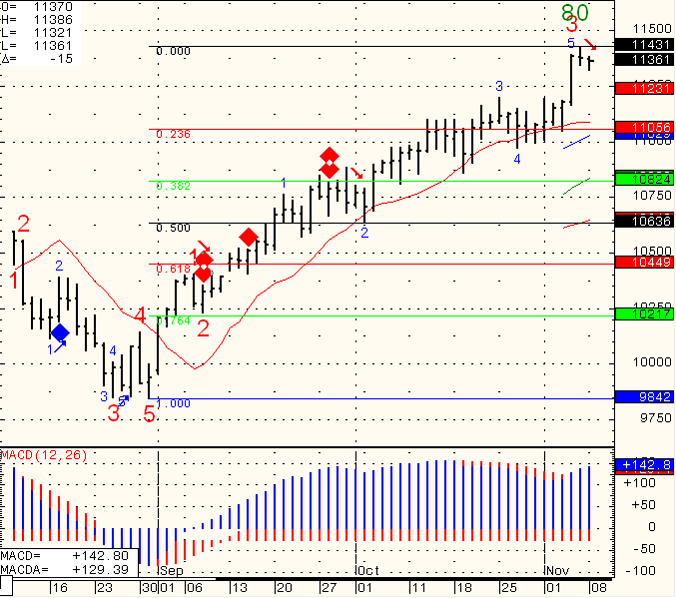

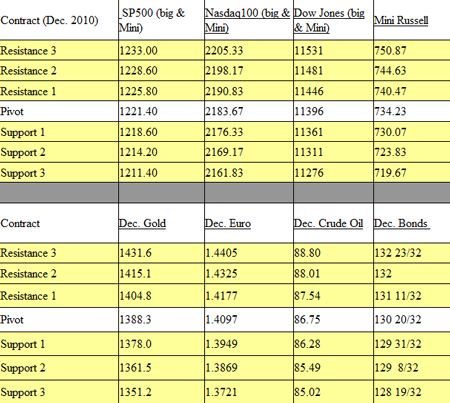

Futures Trading Levels

A more important component, I believe to be than cost when choosing a futures broker is customer service. Always note how long it takes your broker to respond for example to an email you send him or her. Does your broker respond in a timely manner? If your request was urgent did he/she give you the attention that’s required to solve the issue? These are very important factors one must consider when choosing a broker. If you, the client, end up with a commodities broker who is non responsive and not willing to help when the time is needed, there will be no value in you having a broker.

Look for the added values your broker can provide to help increase your success in futures trading, such as experience and knowledge. In my opinion, a great futures broker wants their clients to be successful in futures trading. Never be afraid to use your broker to pick his or her brain about the futures markets you are trading; go over strategies that you are using but may not be working for you. You choose your broker for a reason and your broker’s job is to service your futures account; be able to help you with your trading platform and every so often give his or her opinion of the markets you are trading if it’s asked by the client. In many “deep discount” firms, brokers seem to lack this type of service. I have seen many times where the client is left to figure out the platform themselves and are trading blindly because they lack direction from a licensed broker.

Although I agree that cost is a large component when choosing a broker, always consider the other factors such as customer service, knowledge and experience. Because if a broker lacks those three qualities but can provide you only cost, you may see your account having a shorter life span in the futures markets.

SPECIAL NOTE: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.