There is life after Mini SP 500…

By Ilan Levy-Mayer, VP

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

The PriceCount study is a tool that can help to project the distance of a move in price. The counts are not intended to be an ‘exact’ science but rather offer a target area for the four objectives which are based off the first leg of a move with each subsequent count having a smaller percentage of being achieved. It is normal for the chart to react by correcting or consolidating at an objective and then either resuming its move or reversing trend. Best utilized in conjunction with other technical tools, PriceCounts offer one more way to analyze charts and help to manage your positions and risk. Learn more at www.qtchartoftheday.com Trading in futures, options, securities, derivatives or OTC products entails significant risks which must be understood prior to trading and may not be appropriate for all investors. Past performance of actual trades or strategies is not necessarily indicative of future results. |

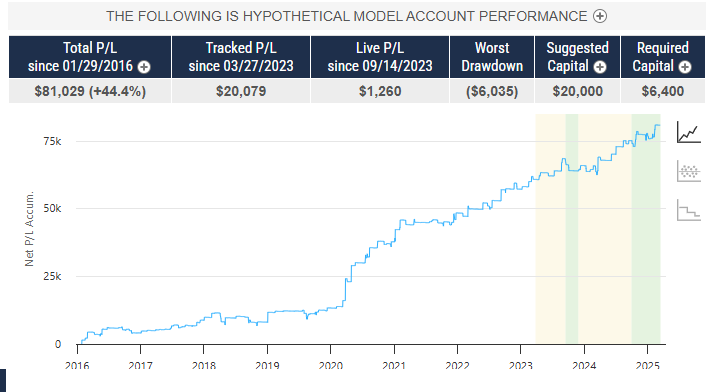

With algorithmic trading systems becoming more prevalent in portfolio diversification, the following system has been selected as the broker’s choice for this month.

PRODUCT

Mini NASDAQ

SYSTEM TYPE

Day Trading

Recommended Cannon Trading Starting Capital

$20,000

COST

USD 85 / monthly

The performance shown above is hypothetical in that the chart represents returns in a model account. The model account rises or falls by the average single contract profit and loss achieved by clients trading actual money pursuant to the listed system’s trading signals on the appropriate dates (client fills), or if no actual client profit or loss available – by the hypothetical single contract profit and loss of trades generated by the system’s trading signals on that day in real time (real‐time) less slippage, or if no real time profit or loss available – by the hypothetical single contract profit and loss of trades generated by running the system logic backwards on back adjusted data. Please read full disclaimer HERE.

|

|

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

____________________________________________________________________

Voted #1 Blog and #1 Brokerage Services on TraderPlanet for 2016!!

____________________________________________________________________

Important notice: For those of you trading any stock index futures contracts, i.e., the E-mini S&P, E-mini NASDAQ, E-mini Dow Jones etc., it is extremely important to remember that we are now rolling over and trading the December contract.

Starting March. 8th, the June 2018 futures contracts will be the front month contracts. It is recommended that all new positions be placed in the June 2018 contract as of March 8th. Volume in the March 2018 contracts will begin to drop off until its expiration on Friday March 15th.

The month code for June is M8

Traders with electronic trading software should make sure that defaults reflect the proper contract as of Friday morning.

Please close any open March Currency positions by the close on Friday the 15th.

Continue reading “Rollover Notice for Stock Index Futures! 3.08.2018”

____________________________________________________________________

Voted #1 Blog and #1 Brokerage Services on TraderPlanet for 2016!!

____________________________________________________________________

Stock index futures seemed a bit more “relaxed” today with lower intra-day volatility and swings but still a pretty large upside moves.

Be careful and make sure you control your emotions, these are not the days for “revenge trading” and “double down” etc…( actually no day is good for that but with this type of volatility, you can get punished very quickly and pretty hard).

Continue reading “Volatile Markets – Be Careful!! 2.13.2018”

____________________________________________________________________

Voted #1 Blog and #1 Brokerage Services on TraderPlanet for 2016!!

____________________________________________________________________

Dryness Extensive Across Southern Plains Wheat Belt

Moisture levels have remained very low across the majority of the hard red wheat belt in the central Plains throughout the winter, with moderate drought now widespread across eastern Colorado into central Oklahoma, and severe to extreme drought located in southern Kansas, Oklahoma, and much of central and northwestern Texas (see map below).

The outlook for the next few weeks shows an upturn in moisture across the northern Plains, with Colorado and Nebraska likely to see some notable improvements in moisture in the form of snowfall. Meanwhile, moisture receipts will likely remain below normal across south central Kansas into west central Oklahoma and northwestern Texas. While moisture needs this time of year are very low for wheat as it remains in dormancy, an upturn in moisture will be critical for these areas once it emerges from dormancy.

However, a drier pattern is expected to continue across the majority of the region in March, which will likely result in some significant stress as spring crop growth resumes. An upturn in rains is possible across the heart of the hard red wheat belt in April, though, which should begin to improve moisture supplies and crop conditions. The rains will be critical to prevent substantial yield reductions for the wheat crop.

By: Don Keeney

Senior Ag Meteorologist

Radiant Solutions Read More with charts and other data at: http://pages.cmegroup.com/index.php/email/emailWebview

Continue reading “Volatile Markets – Be Careful!! Grains Weather Updates…. 2.09.2018”

____________________________________________________________________

Voted #1 Blog and #1 Brokerage Services on TraderPlanet for 2016!!

____________________________________________________________________

With the recent volatility the CME have raised some of the overnight margins for stock index futures.

Most of our clients enjoy $500 daytrading margins for the contracts below, depending on the platform and in rare cases market conditions. Few of the trading platforms will use % of overnight margins and/or if you plan on holding positions more than intraday than note below:

ES was $5,555 –> now $6,105

NQ, $5,720 –> $6,380

YM, $4,620 –> $5,280

RTY, $3,245 –> $3,630

NKD, $4,565 –> $5,280

BE CAREFUL!! THESE ARE NOT “REGULAR OR NORMAL TIMES”

Plan your trade, trade your plan and ALWAYS try to asses the risk/ reward ratio you are about to trade.

Continue reading “CME Raises Margins on Stock Indices 2.08.2018”

Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

1. Market Commentary

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Futures Economic Reports for Friday September 9, 2016

Greetings!

Front month for stock indices is December!!

I looked for some news that may explain the large sell off Friday and almost the same level of bounce today….I saw a few things but must admit none made sense to me, so my clients who are “conspiracy theory believers” may have won this one…..

I saw something about Fed officials speaking today “infused confidence back”, saw another thing that Friday was due to North Korea nuclear tests…yet another explanation spoke about rollover. Another news flash spoke about possibly removing some of the stocks from the financial segment of the SP500, specifically “good performing real estate stocks from the financial/ banking sector…..not to mention the “9/11” effect….and more and more etc. etc…..

My guess is the FED once again too concerned with keeping stock market prices higher than the paying attention to the rest of the economy…..I feel that QE in general and other FED action created artificially higher stock market prices which will one day explode in a violent way. But that is a topic for a whole new discussion.

Bottom line is I have no explanation but here is what the hourly and daily charts look like:

DAILY

Continue reading “Big Volatility in Stock Index Futures Last Two Days – Levels for 09.13.16”

Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

1. Market Commentary

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Futures Economic Reports for Friday September 9, 2016

Greetings!

Rollover is here again….The quarterly event is upon us once more, so read below and adjust!

Rollover Notice for Stock Index Futures

Important notice: For those of you trading any stock index futures contracts, i.e., the E-mini S&P, E-mini NASDAQ, E-mini Dow Jones, the “Big” pit-traded S&P 500, etc., it is extremely important to remember that tomorrow, Thursday, Sept.8th, is rollover day.

Starting Sept. 8th, the December 2016 futures contracts will be the front month contracts. It is recommended that all new positions be placed in the December 2016 contract as of Sept. 8th. Volume in the Sept. contracts will begin to drop off until its expiration on Friday September 16th.

The month code for December is Z6.

Traders with electronic trading software should make sure that defaults reflect the proper contract as of Thursday morning.

Please close any open September Currency positions by the close on Friday the 16th.

Should you have any further question please contact your broker.

Continue reading “Rollover Notice for Stock Index Futures 9.09.2016”

Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

1. Market Commentary

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Futures Economic Reports for Tuesday August 09, 2016

Hello Traders,

Summer trading at its best….8 points range on the Mini SP 500 during the primary session…As a trader, that can be pretty depressing. Few things you can do when stock index futures are “dead”:

In between, feel free to reach out to us here at Cannon with any questions, feedback and comments and let us know how we can help you achieve your goals!

Here is some good reading material for when the market is slow:

https://www.cannontrading.com/community/futures-market-ranking-30-market-events

Continue reading “What should you do when stock index futures are “dead”? 8.09.2016″

Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

1. Market Commentary

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Futures Economic Reports for Thursday March 10, 2016

Hello Traders,

For 2016 I would like to wish all of you discipline and patience in your trading!

Greetings!

I personally will start trading the June mini SP this Friday but most traders will rollover tomorrow:

Rollover Notice for Stock Index Futures

Important notice: For those of you trading any stock index futures contracts, i.e., the E-mini S&P, E-mini NASDAQ, E-mini Dow Jones, the “Big” pit-traded S&P 500, etc., it is extremely important to remember that tomorrow, Thursday, March 10th, at 8:30 am CDT Time is rollover day.

Starting March 10th, the June 2016 futures contracts will be the front month contracts. It is recommended that all new positions be placed in the June 2016 contract as of March 10th. Volume in the March 2016 contracts will begin to drop off until its expiration on Friday March 18th.

The month code for June is M6.

Traders with electronic trading software should make sure that defaults reflect the proper contract as of Thursday morning.

Please close any open March Currency positions by the close on Friday the 11th.

Should you have any further question please contact your broker.

Continue reading “Rollover Notice for Stock Index Futures 3.10.2016”