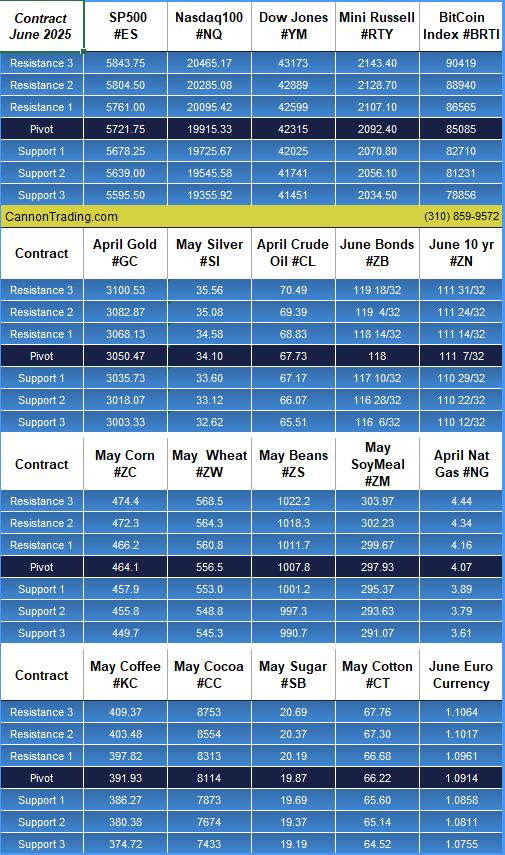

Rollover Week

At-a-Glance Levels

| Instrument |

S2 |

S1 |

Pivot |

R1 |

R2 |

|

|

Gold (GC)

— Feb(#GC) |

4275.13 |

4302.77 |

4343.53 |

4371.174 |

4411.93 |

|

|

Silver (SI)

— Mar. (#SI) |

60.64 |

62.32 |

63.29 |

64.98 |

65.95 |

|

|

Crude Oil (CL)

— Jan (#CL) |

55.38 |

55.91 |

56.76 |

57.29 |

58.14 |

|

|

Mar. Bonds (ZB)

— Mar (#ZB) |

114 10/32 |

114 20/32 |

114 31/32 |

115 9/32 |

115 20/32 |

Rollover

Following the quarterly ritual, it’s time to roll from the December to the March 2026 Index contract. There is a noticeable shift in volume from the Dec. to March. Avoid liquidity traps and begin trading the March 2026 index contracts. Trading the S & P 500? If you are using a CQG Product and your current Symbol is EPZ25 on your DOM, please replace that with the new symbol, EPH26.

December Rollover to March

All other trading platforms are ESZ5 or ESZ25, change to ESH6 or ESH26 depending on the symbology you are using. (MES for the micros across all platforms, need the March symbol as well H) NQ, MNQ, YM, MYM, RTY, M2K for the other main indices.

You do not want to get caught in the cash settlement on Triple Witching Friday.

WEEKLY MARKET UPDATE: Rollover Week – Triple Witching Friday

The Dow Jones, S&P 500 Equal Weight and Russell 2000 all hit fresh all-time highs this week while tech slumped on AI concerns.

Mounting signs that the labor market is softening has led to a relatively accommodative tone out of the FOMC meeting & concerns around Oracle and overspending in general on the AI infrastructure buildout. A Bloomberg news story from earlier today stating that Oracle has pushed back the completion dates for some of the data centers it’s developing for OpenAI to 2028 from 2027.

Oracle subsequently denied the story which is helping tech stocks recover some losses. ORCL credit default swaps were up 10% on Friday to 145 basis points. The backdrop for markets appears to be relatively bullish. Yes, longer term Treasury yields are elevated, but that appears to be driven by higher economic growth expectations. Bullish historical seasonality plus the potential for performance chasing by fund managers also lean in the bull’s favor.

I will be monitoring Bank of Japan (BOJ) meeting on Thursday/Friday which can have an impact on the Yen carry trade. If the BOJ is more hawkish than expected, this could push JGP yields higher which, in turn, likely lifts U.S. Treasury yields, potential for higher volatility.

Understanding JPY Futures Contracts – Japanese Yen futures contracts are agreements to buy or sell a specified amount of JPY at a predetermined price and future date. They are traded against the US Dollar (JPY/USD).

Contract Size (Standard 6J): 12,500,000 JPY.

Contract Size (E-mini J7): 6,250,000 JPY (half the standard size).

Quotation: Prices are quoted in U.S. Dollars per Japanese Yen (e.g., 0.0064 USD per JPY).

Trading Hours: Nearly 24 hours a day on the CME Globex electronic platform, allowing you to react to global news and economic events in real-time.

Settlement: Contracts are cash-settled upon expiration.

FED & YIELDS:

With the Fed lowering rates. Traders are anticipated to be Buying the short end and selling the long end of the yield curve is a classic curve-steepener trade.

Rollover into the new year strong! Don’t get tripped up by Triple Witching Friday!

|