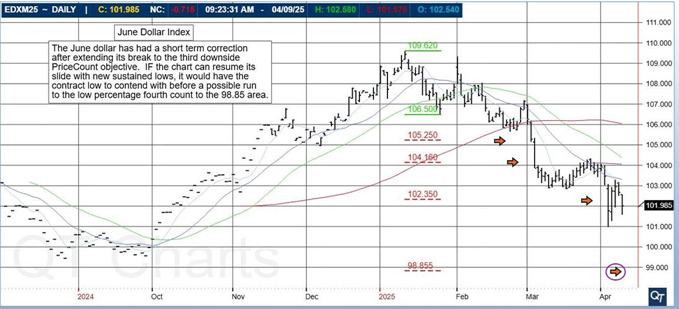

Extreme Volatility + CPI Tomorrow

By Mark O’Brien, Senior Broker

Dow Jones & other indices

As of this typing stock index futures and other futures contracts have experienced single-day range moves not seen in years and after being down, finished up:

→ E-mini Dow Jones: UP +3044 points / 8.4%

→ E-mini S&P 500: UP +480 points / 9.5%

→ E-mini Nasdaq: UP +2038 points / 11.71%

→ Crude Oil: UP +320 points / 5.2%

Volatility is skyrocketing.

This is a completely different environment of extreme trading volatility than what we were trading in 3-4 weeks ago. Markets are evolving and you must adapt your trading to changing market conditions.

This is where you find out what kind of risk taker you are; brash, overbold, unheeding, or prudent, attentive, discriminating. Everyone possesses these traits – and they influence our decision-making differently in different situations.

In trading, if the historical price moves you’re seeing bring out the daredevil in you, plan to watch your trade results all over the place: up and down more than your everyday swings with the odds increasing your account will hit a wall.

Instead, incorporate patience and prudence. Start your trading by setting daily profit targets and daily loss limits and stick to them. Do that for each trade. These days, be aware of LIMIT moves and understand what happens when the market halts at limit levels.

Find daily price limits for CME Group Agricultural, Cryptocurrency, Energy, Equity Index, Interest Rates, and Metals products: click here.

|

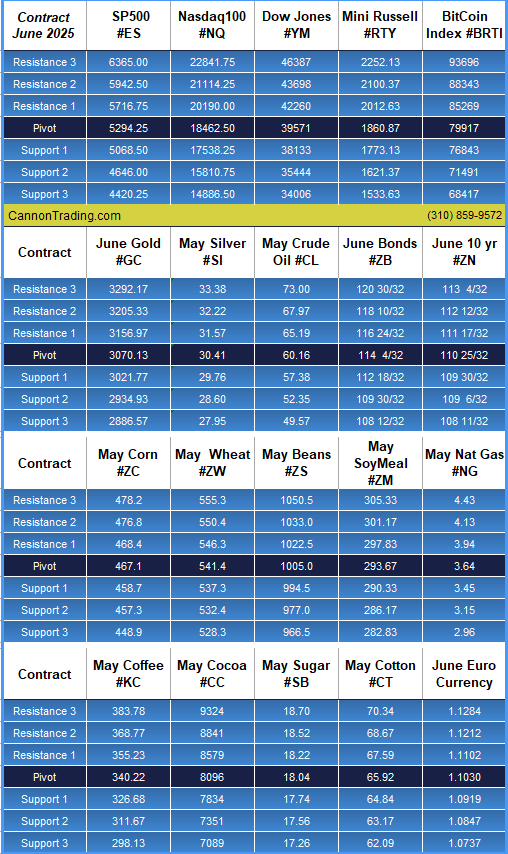

Daily Levels for April 10th, 2025

Want to feature our updated trading levels on your website? Simply paste a small code, and they’ll update automatically every day!

Click here for quick and easy instructions.

Economic Reports

provided by: ForexFactory.com

All times are Eastern Time (New York)

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|