|

- Bitcoin Futures (114)

- Charts & Indicators (308)

- Commodity Brokers (589)

- Commodity Trading (846)

- Corn Futures (64)

- Crude Oil (230)

- Currency Futures (102)

- Day Trading (658)

- Day Trading Webinar (61)

- E-Mini Futures (163)

- Economic Trading (166)

- Energy Futures (127)

- Financial Futures (178)

- Future Trading News (3,162)

- Future Trading Platform (327)

- Futures Broker (665)

- Futures Exchange (347)

- Futures Trading (1,268)

- futures trading education (446)

- Gold Futures (112)

- Grain Futures (101)

- Index Futures (271)

- Indices (233)

- Metal Futures (144)

- Nasdaq (79)

- Natural Gas (40)

- Options Trading (191)

- S&P 500 (145)

- Trading Guide (432)

- Trading Webinar (60)

- Trading Wheat Futures (45)

- Uncategorized (26)

- Weekly Newsletter (224)

Category: Bitcoin Futures

Bitcoin Futures and Nano Bitcoin Futures

In recent years, Bitcoin futures have become an increasingly popular option for investors looking to engage in cryptocurrency markets without directly owning digital assets. Futures contracts are financial instruments that allow traders to speculate on the future price of an asset—in this case, Bitcoin. Through futures contracts, traders can gain exposure to Bitcoin’s price movements without holding any Bitcoin directly. This market offers two main types of futures: standard Bitcoin futures and Nano Bitcoin futures, both of which provide unique advantages to traders.

One reputable brokerage firm, Cannon Trading Company, has stood out for its commitment to high-quality service and excellent customer satisfaction. Established in 1988, Cannon Trading has earned a 5 out of 5-star rating on TrustPilot, making it a trusted platform for investors looking to trade Bitcoin futures and Nano Bitcoin futures. With no market data fees and $25 day trading margins for Nano Bitcoin futures, Cannon Trading offers competitive features for both experienced and new traders.

Bitcoin Futures

Bitcoin is the first and most well-known cryptocurrency, created in 2009 by an unknown person or group under the pseudonym Satoshi Nakamoto. It operates on a decentralized network, where transactions are recorded on a blockchain—a digital ledger that allows for transparency and security without requiring a central authority.

Bitcoin futures are agreements to buy or sell a specific amount of Bitcoin at a predetermined price on a future date. Bitcoin futures trading provides traders with several benefits:

- Leverage: Traders can control larger positions with smaller amounts of capital.

- Hedging: Investors with Bitcoin holdings can hedge against price volatility.

- Profit Opportunities: With Bitcoin futures, traders can speculate on both rising and falling markets, maximizing potential profit opportunities.

Bitcoin futures trading has become a powerful tool for traders who want to gain exposure to cryptocurrency markets without actually holding the asset. This reduces some of the technical and security challenges associated with directly holding Bitcoin, making futures Bitcoin trading an appealing alternative for those wary of managing digital wallets.

What Are Nano Bitcoin Futures?

Nano Bitcoin futures are a smaller, more accessible version of standard Bitcoin futures contracts, catering to traders who may not want to commit to the larger capital requirements associated with standard Bitcoin futures. Nano Bitcoin futures contracts are smaller in size, often representing a fraction of one Bitcoin, enabling traders to start with lower investments. They also allow traders to manage their positions with finer control, ideal for those who wish to practice risk management or diversify their exposure without the high stakes of full Bitcoin contracts.

Nano Bitcoin futures trading has quickly gained popularity for several reasons:

- Low Entry Cost: Traders can start with much less capital.

- Flexibility: Smaller contracts allow for more tailored strategies.

- Lower Fees: Compared to standard contracts, trading futures for nano Bitcoin often incurs lower fees, making it an efficient choice for those looking to trade frequently.

By allowing traders to engage in the futures market on a smaller scale, Nano Bitcoin futures are democratizing access to the crypto markets. Whether for beginners or advanced traders, the flexibility of Nano Bitcoin futures provides a streamlined entry point to cryptocurrency futures trading.

Cannon Trading Company

A Trusted Platform for Bitcoin and Nano Bitcoin Futures Trading

Cannon Trading Company has been a prominent player in the futures market since 1988. Known for its reliability and commitment to customer satisfaction, Cannon Trading has consistently earned high ratings, including a 5-star rating on TrustPilot. Traders choose Cannon Trading for several key reasons:

- Reputation and Experience: With decades in the industry, Cannon Trading has a deep understanding of market dynamics, regulatory requirements, and client needs. The company’s long-standing history builds trust with traders.

- Competitive Fees: Cannon Trading Company offers no market data fees for Nano Bitcoin futures trading, allowing traders to access the market with minimal expenses. This feature is especially attractive for active traders who need to keep overhead costs low.

- Low Margins: The $25 day trading margin for Nano Bitcoin futures allows traders to enter and exit positions without requiring significant capital. This low margin rate makes Cannon Trading accessible to a broader range of clients.

- Top-notch Technology and Platform: Cannon Trading provides cutting-edge trading platforms that facilitate fast and efficient trades. With access to advanced charting tools, real-time market data, and seamless order execution, traders have the resources they need for successful Bitcoin futures trading.

- Stellar Customer Support: Known for exceptional service, Cannon Trading has built a reputation for being client-focused. The firm’s commitment to customer satisfaction is evident from its high TrustPilot rating, reflecting a client base that values transparency, support, and expertise.

Through its competitive offerings and commitment to excellence, Cannon Trading has positioned itself as a premier choice for trading Bitcoin futures and Nano Bitcoin futures.

Why Trade Bitcoin Futures and Nano Bitcoin Futures?

The futures Bitcoin market provides several benefits that appeal to both institutional investors and individual traders. Here’s a deeper look into the benefits of trading Bitcoin futures and trading Nano Bitcoin futures through a trusted brokerage like Cannon Trading Company:

Leverage and Capital Efficiency

One of the biggest appeals of futures trading is leverage. With leverage, traders can control a more substantial position with a relatively small amount of capital. Bitcoin futures typically come with high leverage options, allowing traders to amplify their potential returns. However, leverage can also magnify losses, making risk management essential. Nano Bitcoin futures trading, with lower contract sizes, enables traders to leverage their capital while minimizing risk exposure.

Market Accessibility

The cryptocurrency market is known for its high volatility, which can offer profitable opportunities for traders. Trading futures for Bitcoin and Nano Bitcoin provides a way for traders to enter this market without directly owning Bitcoin. Additionally, since Bitcoin futures contracts are often regulated by financial authorities, they offer a safer environment compared to unregulated crypto exchanges.

Portfolio Diversification and Risk Management

Bitcoin futures trading allows for hedging strategies to protect portfolios from market volatility. If an investor holds Bitcoin and worries about price declines, they can use Bitcoin futures to hedge their exposure. Likewise, Nano Bitcoin futures trading enables smaller-scale investors to hedge against price movements with greater flexibility. Cannon Trading Company’s platforms provide the necessary tools for executing these strategies effectively.

Cost-Effectiveness with Cannon Trading

With no market data fees for Nano Bitcoin futures, Cannon Trading offers a cost-effective trading experience. This fee structure is advantageous for active traders who rely on frequent market data updates. Moreover, the $25 day trading margin makes it possible to maintain positions with minimal upfront costs, providing flexibility for diverse trading strategies.

How to Start Trading Bitcoin Futures and Nano Bitcoin Futures with Cannon Trading Company

To start trading Bitcoin futures or Nano Bitcoin futures with Cannon Trading Company, follow these steps:

- Open an Account: Sign up with Cannon Trading by providing necessary documentation. Account opening is straightforward and supported by responsive customer service.

- Deposit Funds: Fund your account based on your trading goals. For Nano Bitcoin futures trading, the minimum capital requirements are accessible, thanks to low margin requirements.

- Choose Your Platform: Cannon Trading offers access to powerful trading platforms that support real-time data, advanced charting tools, and seamless order execution.

- Place a Trade: Select between standard Bitcoin futures or Nano Bitcoin futures based on your investment strategy. The Nano Bitcoin futures market may suit traders looking for lower-risk options with smaller positions.

- Implement Risk Management Strategies: Futures trading can be highly volatile, so employing strategies like stop-loss orders or setting clear profit targets is crucial.

Bitcoin Futures and Nano Bitcoin Futures Trading Strategies

For those exploring Bitcoin futures trading or Nano Bitcoin futures trading on Cannon Trading’s platform, here are several strategies to consider:

- Scalping: This is a short-term strategy involving quick trades to capitalize on small price movements. The low fees and day trading margins offered by Cannon Trading make it possible to use this strategy effectively with Nano Bitcoin futures.

- Swing Trading: Swing trading involves holding positions over several days or weeks. Traders using this strategy look for trends in Bitcoin’s price and aim to profit from them. The Nano Bitcoin futures market allows for this approach with lower stakes.

- Hedging: As mentioned, Bitcoin futures are ideal for hedging against price declines. Cannon Trading’s accessible Nano Bitcoin futures trading makes it easy for smaller investors to adopt this risk management technique.

Why Choose Cannon Trading for Bitcoin Futures and Nano Bitcoin Futures Trading?

Cannon Trading’s reputation as a top-tier brokerage is supported by its stellar ratings on platforms like TrustPilot. Here’s why Cannon Trading is an ideal choice for futures traders:

- Transparency: The company is committed to transparent pricing and offers no hidden fees, which is essential for long-term client satisfaction.

- Educational Resources: Cannon Trading provides educational materials to help traders understand Bitcoin futures trading and Nano Bitcoin futures trading. With tutorials, market insights, and expert advice, Cannon Trading supports traders at all levels.

- Regulation and Safety: As a U.S.-based broker with years of experience, Cannon Trading adheres to regulatory standards, ensuring a safe trading environment for its clients.

Bitcoin futures and Nano Bitcoin futures present unique opportunities for traders interested in the cryptocurrency market. By partnering with a trusted broker like Cannon Trading Company, investors can leverage the benefits of trading Bitcoin futures with confidence. Established in 1988, Cannon Trading has built a stellar reputation, with a 5-star rating on TrustPilot, offering a safe and cost-effective trading experience.

With no market data fees and $25 day trading margins for Nano Bitcoin futures, Cannon Trading provides an accessible entry point into the Bitcoin futures market for all types of traders. Whether you’re interested in standard Bitcoin futures or the flexibility of Nano Bitcoin futures, Cannon Trading’s advanced platforms and exceptional customer support ensure a trading experience that’s as rewarding as it is professional. Start exploring the world of Bitcoin futures and futures for nano Bitcoin with Cannon Trading today.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

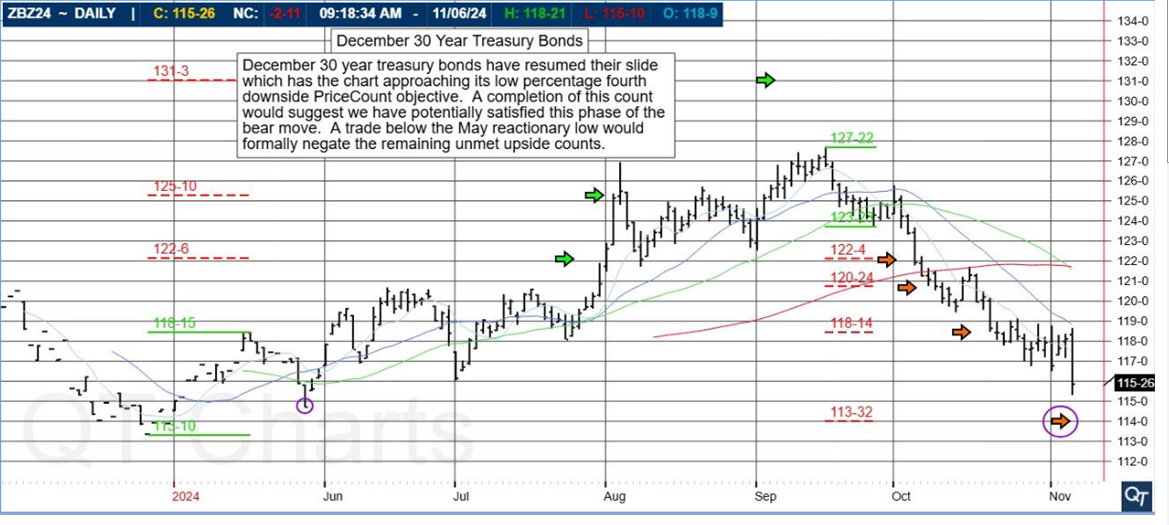

Why Trade Bitcoin Futures? Ask a Broker & 30 Year Treasury Bond Review

|

|

PPI & Retails Sales + Trading Levels for March 14th

Market Overview for the last 2 trading days of the week

By Mark O’Brien

Heads up:

Keep an eye out for the second of this week’s inflation reports: the Bureau of Labor Statistics’ Producer Price Index. The report will be released tomorrow, 7:30 A.M., Central Time.

Energy:

This morning, the Energy Information Agency released its weekly crude oil stocks report and the data was a bullish curveball showing a surprise withdrawal in U.S. crude inventories and a bigger-than-expected drop in U.S. gasoline stocks. April RBOB gasoline futures rose over seven cents as of this typing – a ±$3,000 per contract move – up to ±$2.66 per gallon, close to 6-month highs. Spurring the price increase, Ukrainian drone attacks struck several oil refining facilities in Russia for the second day, damaging its refining capacity

Metals:

In concert with the month-long slump in the U.S. dollar and a lingering expectation the Fed will reduce borrowing costs this June, today gold is chipping away at its ±$20 sell-off Monday and poised to around its prior all-time high close (basis April): $2,188.60/oz. As of this typing, April gold is ±$2,177.00.

Indexes:

All three major stock indexes have sustained trading near their all-time highs this week – after the Personal Consumption & Expenditures Price Index on April 1st (the Fed’s preferred U.S. inflation gauge), February’s non-farm payrolls last Friday and Tuesday’s higher-than-expected CPI reading yesterday. As of this typing, prices are mixed ahead of tomorrow’s release of the Bureau of Labor Statistics’ Producer Price Index.

Softs:

So far, the king of all-time highs this week is not Bitcoin (see below). It’s Cocoa. The May cocoa contract broke above $7,000/ton, nearly $2,000/ton higher over the last month – a ±$20,000 per contract move, including today’s 361-point ($3,6010) move today – with “no top in sight,” stated by The Hightower Report.

Crypto:

March Bitcoin futures are set to close at a new all-time high above 73,000 today. With the Bitcoin ETF now trading, remember that the world’s largest futures and options exchange – the CME Group – offers Bitcoin and Micro Bitcoin futures and options with efficient price discovery in transparent futures markets, prices based on the regulated CME CF Bitcoin Reference Rate (BRR) and easily traded on your supported trading platform. Make it your choice for managing cryptocurrency risk.

Plan your trade and trade your plan

Watch video below on how to rollover from March to June contracts if you are a stock index trader on our E-Futures Platform!

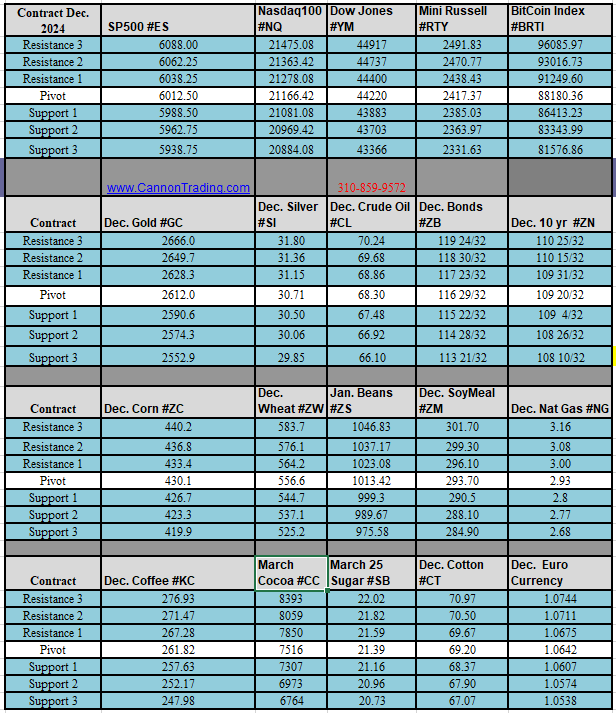

Daily Levels for March 14th, 2024

Improve Your Trading Skills

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

NFP Tomorrow, Bitcoin Futures+ Futures Trading Levels for 03.08.24

NFP Tomorrow.

Non Farm payrolls – market moving report.

I personally like to be out few minutes before the report and look to get back in after the “smoke clears”.

I know some traders who try to play the extremes by placing buy orders on the lower bands and/or sell orders on the upper bands and attach automated brackets to these orders, trying to take advantage of the fast market moves.

Refer back to your journal and keep notes.

Bitcoin Futures on The Chicago Mercantile Exchange

With Bitcoin reaching unprecedented levels, investors are seeking dependable ways to participate. Apart from ETFs and complex offshore entities, the CME Group offers straightforward access to Futures on Bitcoin, Micro Bitcoin, Ether, and Micro Ether futures. Utilize a licensed broker to trade these futures on the esteemed CME Group exchange. Opportunities for engagement range from 1. self-directed trading 2. demo trials 3. opening an account seeking advice from a seasoned broker.

Plan your trade and trade your plan

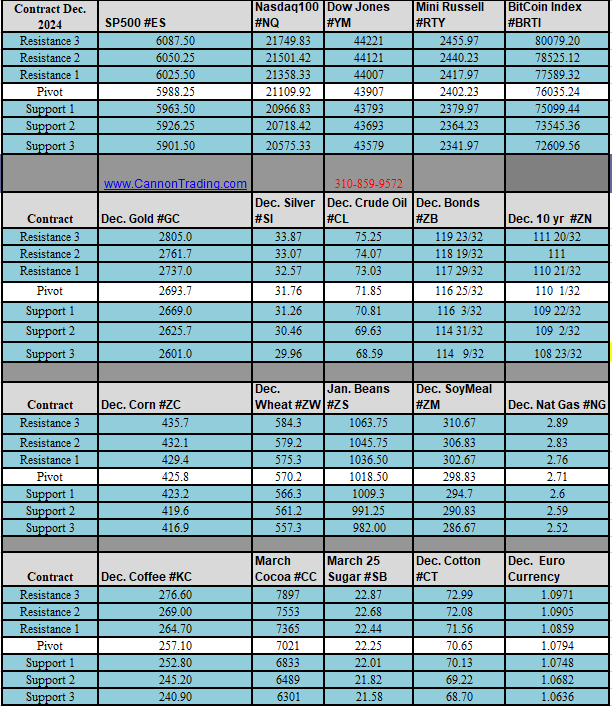

Daily Levels for March 8th, 2024

Improve Your Trading Skills

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Ahead of NFP + Futures Trading Levels for 03.06.2024

Bullet Points, Highlights, Announcements

Heads up:

Keep an eye out for Friday (7:30 A.M., Central Time) for the release of the monthly Non-farm Payrolls report by the Labor Department. It’s widely considered to be one of the most important and influential measures of the U.S. economy.

To review, the Labor Dept.’s Bureau of Labor Statistics surveys about 141,000 businesses and government agencies, representing approximately 486,000 individual work sites. The report excludes farm workers, private household employees, domestic household workers and non-profit organization employees. The report also includes other detailed industry data including the overall unemployment rate as a percentage of the total labor force that is unemployed but actively seeking work, wages, wage growth and average workday hours.

General:

It was truly an historical day yesterday. Both the decades-old 100-oz gold futures contract and the seven-year-old Bitcoin futures contracts traded up to all-time highs. Apart from any of the stock index futures contracts, rarely do we see simultaneous all-time highs for futures contracts. April gold touched $2,150.50 per ounce (and is trading at new all-time highs again today), while the March Bitcoin futures hit 70,195 – before a significant ±10,000-point sell-off in a span of four hours around mid-session.

But wait, there’s more! May cocoa traded up to its own all-time high yesterday as well, hitting $6,660/metric ton intra-day. This is a ±$26,000 move for cocoa in a little more than two months, having closed at $4,048 on Jan. 8.

Three consecutive all-time highs in futures: gold, Bitcoin and cocoa. Oh my!

Energy:

Managing Director and Global Head of Commodity Strategy at Royal Bank of Canada’s Capital Markets Division. That’s quite a title and it’s how Helima Croft’s business card reads. She’s well regarded as a specialist in geopolitics and energy and along with her team of commodity strategists who cover energy and metals are seeing signs of the higher supply/lower demand imbalance in crude oil tipping in the other direction. This is a macro prediction and not forecasting any sort of breakneck move to $100/barrel and it rests in part on the view that the U.S. will be unable to replicate its “blockbuster” output of 2023. It also anticipates OPEC+ will look to press on with its aggressive production cuts having already committed to extending its 2.2 million barrel-a-day production cut through June. The projection also sees the conflict in the Middle East as instilling a risk premium in energy prices that isn’t going away soon and may increase if the region sees a spread of hostilities.

Plan your trade and trade your plan

Daily Levels for March 7th, 2024

Improve Your Trading Skills

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Bitcoin Flirting with All time highs, PCE + Futures Trading Levels for 02.29.24

PCE, Bitcoin and More

By Mark O’Brien, Senior Broker

Heads up:

Keep an eye out tomorrow (7:30 A.M., Central Time) for the release of the Fed’s preferred U.S. inflation gauge: the PCE Personal Consumption & Expenditures Price Index. The consensus is that the January core PCE deflator will ease to 2.8% year-over-year from the 2.9% reading December.

General:

By and large, the outlook for the global economy is improving. In China, the business storm clouds are at least not bucketing down on the county’s overall fiscal house. Report after economic report released in the U.S. continue to validate forecasts of a future “soft landing,” or better – plain ol’ get up and go. To that end, A.I. euphoria dominates the conversation about what’s driving things. Even the disappointment surrounding the Fed’s patience in deciding when interest rates should be lowered hasn’t disturbed the current frame of mind. Keep an eye out for commodities sitting on major lows, such as corn and soybeans. Even with forecasts for a large South American harvest and a stage set for a strong crop year in the U.S., global growth begets global demand and “bargain price” commodities may be ready to mount rallies.

Crypto:

Bitcoin’s value has been on an impressive rise over the past month, and CME Bitcoin futures (“Full-size”-5-Bitcoin contract, 1/50-Micro Bitcoin contract) have lead the way, with the March Micro Bitcoin contract hitting $65,000 during morning trading today, well above the $57,000 range highs posted in Nov. 2021. Open interest for the full-size contract came in at a nominal value of $7.77 billion, which is nearly a third of the market share for all Bitcoin market derivatives – more than Binance ($6.1 billion); more than Bybit ($4.1 billion). These values surpassed past records set in both 2021 and 2017.

At present, the open interest figures for bitcoin futures have reached an all-time high of $24.44 billion as of Feb. 27, 2024.

Energy:

Did you know the U.S. is currently producing around 13.3M barrels of crude per day, which is way more than any country on the globe, including Saudi Arabia at ±8.9M barrels per day (as of Dec. ’23). The output growth has helped tame gas prices and, perhaps more importantly, undermined the influence of OPEC and Russia following the invasion of Ukraine in 2022.

Producers also know that while times are good, demand can come down or eventually plateau, especially with the U.S. currently exporting more oil than nearly every member of OPEC. Remember the 2014-16 downturn, which hammered the industry and was largely driven by a supply glut.

Plan your trade and trade your plan

Daily Levels for February 29th, 2024

Improve Your Trading Skills

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Bitcoin Futures + Levels for 01.12.24

Join our Private Facebook group

Subscribe to our YouTube Channel

Take the Worry out of your Crypto Trading

By Mark O’Brien

Bitcoin futures open interest on the Chicago Mercantile Exchange hit a fresh all-time high this week. Its nominal value reached $5.4 billion as the Jan. futures contract traded within 200 points of $48,000 on Tuesday. The previous all-time high of $4.5 billion was recorded in November 2021 when the front month contract traded to its all-time high above $68,000.

News in the cryptosphere hit a milestone today with the announcement that Bitcoin ETF’s began trading on U.S. exchanges, but should you?

Before you jump on the Bitcoin ETF bandwagon, remember that the world’s largest futures and options exchange – the CME Group – offers you a choice for managing cryptocurrency risk with Bitcoin and Micro Bitcoin futures and options. With efficient price discovery in transparent futures markets, prices based on the regulated CME CF Bitcoin Reference Rate (BRR) and easily traded on your supported trading platform.

Take the worry out of your crypto trading!

A Cannon broker will be able to assist, provide feedback and answer any questions.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

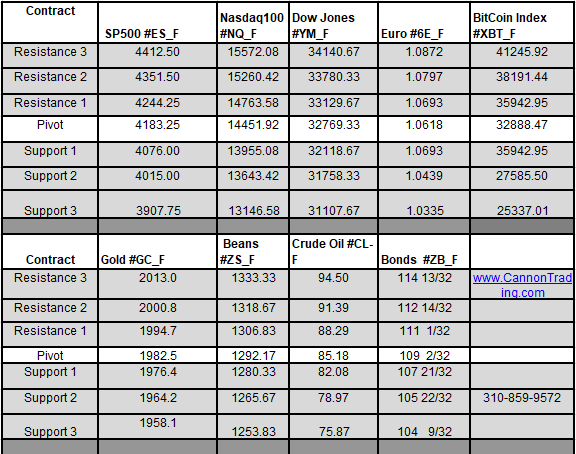

Futures Trading Levels

01-12-2024

Improve Your Trading Skills

Economic Reports,

Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

CPI Tomorrow + Levels for 01.11.24

Join our Private Facebook group

Subscribe to our YouTube Channel

Ahead of CPI and the Rest of the Week:

By Mark O’Brien, Senior Broker

Crypto:

Bitcoin futures open interest on the Chicago Mercantile Exchange hit a fresh all-time high, its nominal value reaching $5.4 billion as the Jan. contract traded within 200 points of $48,000 yesterday. The previous all-time high of $4.5 billion was recorded in November 2021 when the front month contract traded to its all-time high above $68,000.

Energy:

Concerns of slowing demand growth in the energy sector received additional fodder this morning when the Energy Information Agency (EIA) reported a surprise jump in U.S. crude stockpiles and a larger-than-expected jump in storage of both gasoline and distillates. Crude oil (basis Feb.) remains mired in the low $70 per barrel range with a few forays below $70 per barrel over the last month. Despite fears the Israel-Hamas war – now into its third month – could be a catalyst to supply disruption in the Middle East, crude oil is more that $10 per barrel (a $10,000 per contract move) lower since the beginning of the conflict, suggesting traders are more focused on global economic growth (slowing) than geopolitical risk, which seems to be increasing as events related to the war have spread, including attacks on U.S. bases in Iraq, U.S. strikes on Iranian-backed organizations in Syria and Yemen, Israeli attacks in Lebanon on Hezbollah, Yemeni-based Houthi attacks on vessels moving through the Bab al-Mandab Strait at the entrance to the Red Sea from the Gulf of Aden – a route that sees 10-12% of the world’s seagoing freight travel through it.

General:

Tomorrow we’ll be apprised yet again of the inflation situation here in the U.S. with the release of the Bureau of Labor Statistics’ Consumer Price Index Report, which measures the prices paid by consumers for a basket of consumer goods and services (7:30 A.M., Central Time). The reading plays an important role in shaping the Federal Reserve’s outlook on much-anticipated interest rate cuts this year.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

Futures Trading Levels

01-11-2024

Improve Your Trading Skills

Economic Reports,

Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Weekly Newsletter: Bitcoin and Ether Futures + Futures Trading Levels for Oct. 30th

Cannon Futures Weekly Newsletter Issue # 1169

Join our private Facebook group for additional insight into trading and the futures markets!

In this issue:

- Important Notices – FOMC Next Week

- Trading Resource of the Week – Bitcoin and Crypto Currency Futures

- Hot Market of the Week – December Heating Oil

- Broker’s Trading System of the Week – ES Day Trading System

- Trading Levels for Next Week

- Trading Reports for Next Week

-

Important Notices – FOMC Meeting and NFP Next Week!

-

Trading Resource of the Week: Bitcoin & Ether Futures Volume Rises!

-

Hot Market of the Week – December Heating Oil

-

Broker’s Trading System of the Week

|

|

-

Trading Levels for Next Week

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading.

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010